- The price of Ethereum has risen by more than 25% over the past seven days.

- Most indicators pointed to a price correction in the short term.

Ethereum [ETH] Last week saw a significant increase as the price climbed well above $3,700.

As the token's price continues to gain bullish momentum and shows signs of high accumulation, whales have been behaving in an interesting way.

Ethereum Whales Are Stockpiling

CoinMarketCap data Last week, it became evident that ETH experienced some days of fairly low volatility. On May 21, that all changed as ETH turned bullish. The token’s price has risen by more than 25% in the past seven days.

At the time of this writing, ETH was trading at $3,789.10 and had a market cap of over $455 billion.

Apart from the price, the number of ETH transactions also increased.

Recent Tweet According to IntoTheBlock, the number of ETH transactions above $100,000 has surged, hitting its highest level since late March, with many of the transactions being conducted by whales.

The tweet also noted that ETH addresses holding more than 0.1% of the supply saw their highest daily accumulations in over a month, suggesting whales are buying ETH.

AMBCrypto then checked Ethereum's on-chain indicators to see if buying sentiment was prevailing across the market.

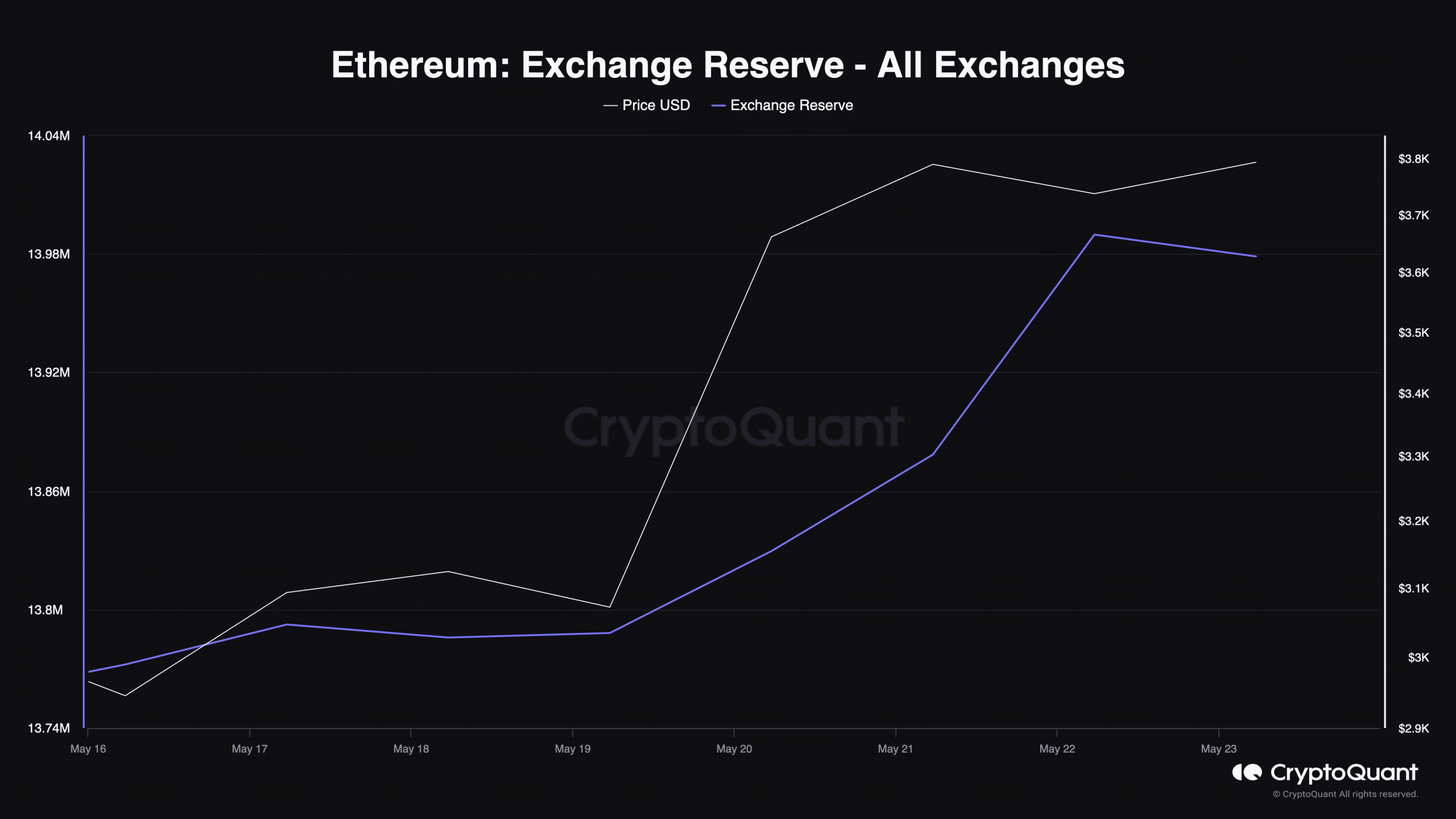

Source: CryptoQuant

After the spike on May 22nd, we noticed that ETH exchange reserves started to decrease.

according to CryptoquantETH net deposits on exchanges were lower compared to the past seven-day average, further supporting the fact that buying pressure was high.

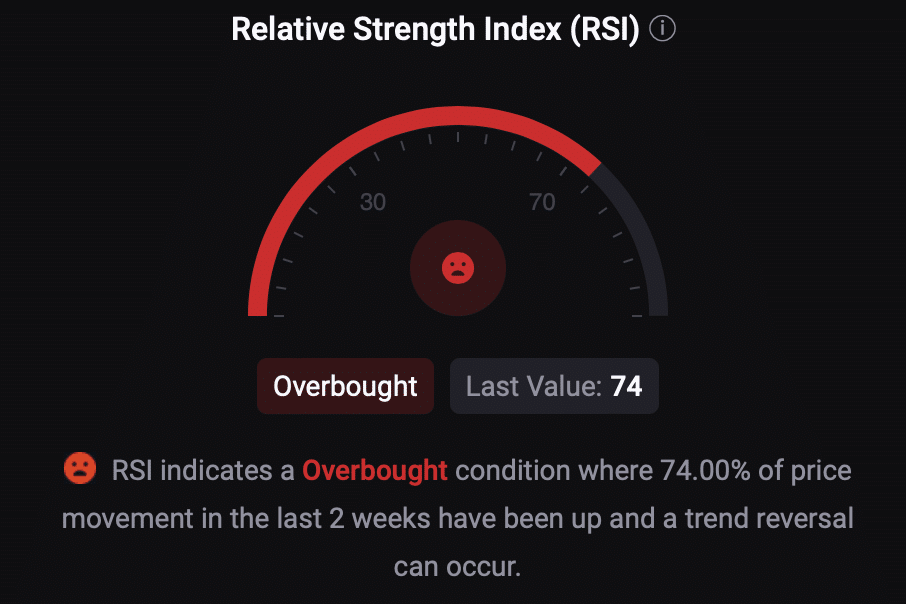

However, the accumulation phase may soon come to an end as ETH’s Relative Strength Index (RSI) enters the overbought zone.

This could prompt investors to sell, resulting in a decline in the token price in the coming days.

Source: CryptoQuant

Is a price correction inevitable?

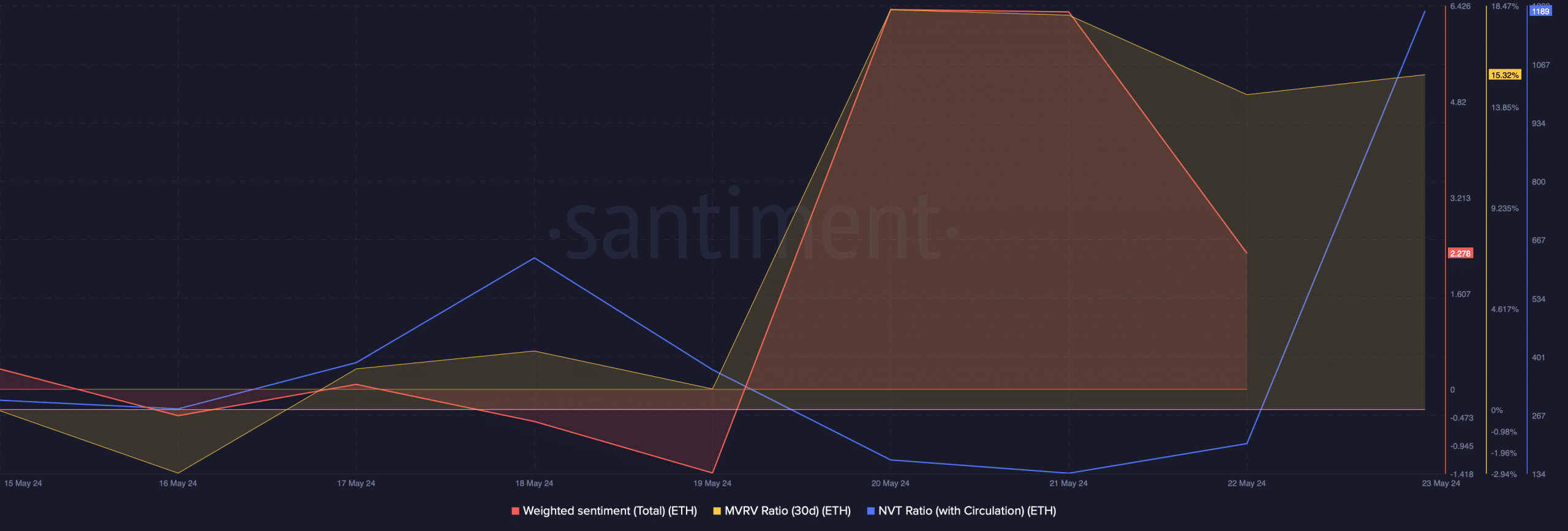

AMBCrypto then analyzed Santiment’s data to understand whether the token is waiting for a price drop.

ETH weighted sentiment has declined over the past few hours, indicating less bullish sentiment towards the token. The NVT ratio has also increased significantly.

When this indicator rises, it means the asset is overvalued, increasing the chances of its price falling.

Nevertheless, the MVRV ratio remained bullish as it had a value of over 15% at the time of writing.

Source: Santiment

Is your portfolio green? ETH Profit Calculator

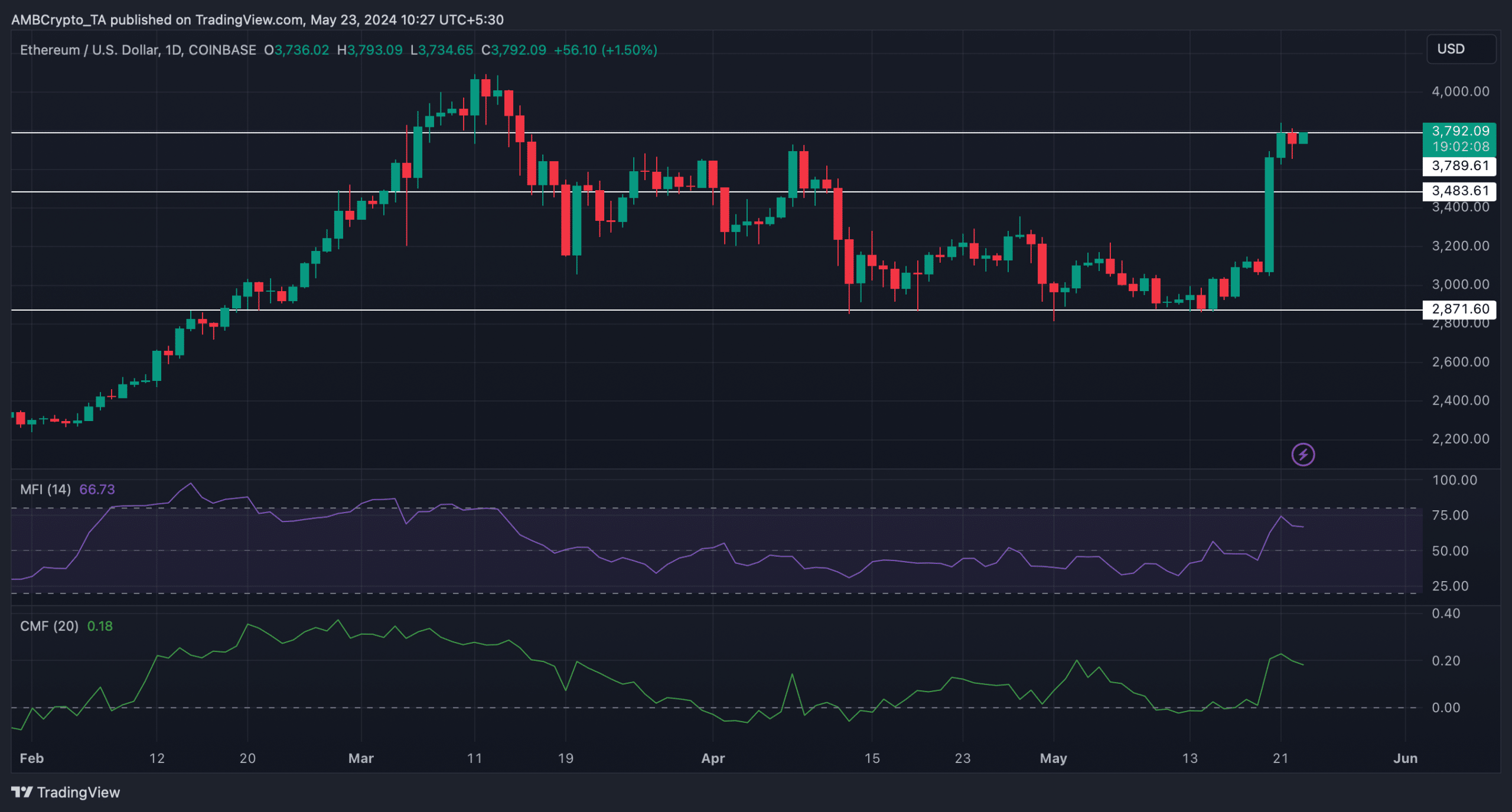

Like most indicators, several market indicators also showed bearish trends. For example, the Money Flow Index (MFI) has fallen. Chaikin Money Flow (CMF) shows a similar trend, suggesting a price correction.

As ETH approaches, investors may witness a drop to $3.4 million. On the contrary, to sustain the full upside, ETH would need to flip the $3.79 million resistance to support.

Source: TradingView