- Indicators suggested that Ethereum is undervalued.

- Market indicators showed mixed signals regarding the upcoming bull market rally.

Ethereum [ETH] On May 6th, the price was back on track, once again exceeding $3.1 million. The token broke above psychological resistance but also consolidated within a bullish pattern.

If this pattern breaks out, ETH could reach new highs in the coming weeks.

Ethereum price prediction

Last week was not in the best interest of investors, as the price of the king of altcoins plummeted to $2.8 million. However, the token gained bullish momentum on May 1st as the price rose steadily.

according to coin market cap, the price of ETH has increased by more than 1.55% in the past 24 hours. At the time of writing, it is trading at $3,144.11, with a market capitalization of over $377 billion.

Meanwhile, popular crypto analyst World of Charts recently posted a tweet highlighting a falling edge pattern on the ETH chart.

Tokens began to be integrated into patterns from early March. According to Tweetthe correction phase for ETH ended as it was heading towards the upper trend line of the descending wedge.

A successful breakout from the descending wedge pattern could push prices up by 45% to 50% in the coming weeks. Predicting the price of Ethereum, if a bull market occurs, it could surpass the March high.

Is Ethereum ready for a rally?

AMBCrypto then analyzed Ethereum’s on-chain indicators to see if they support a potential breakout.

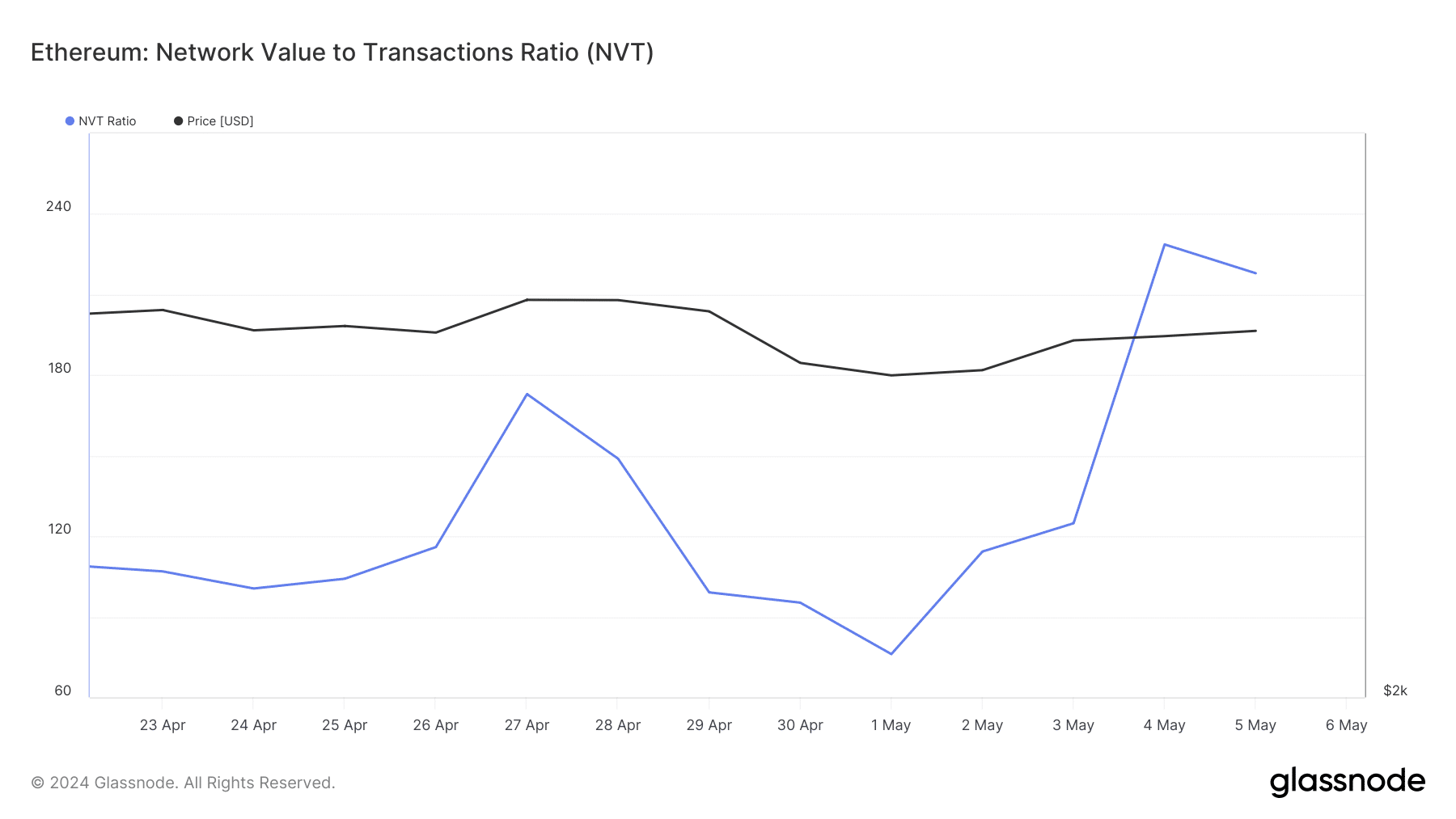

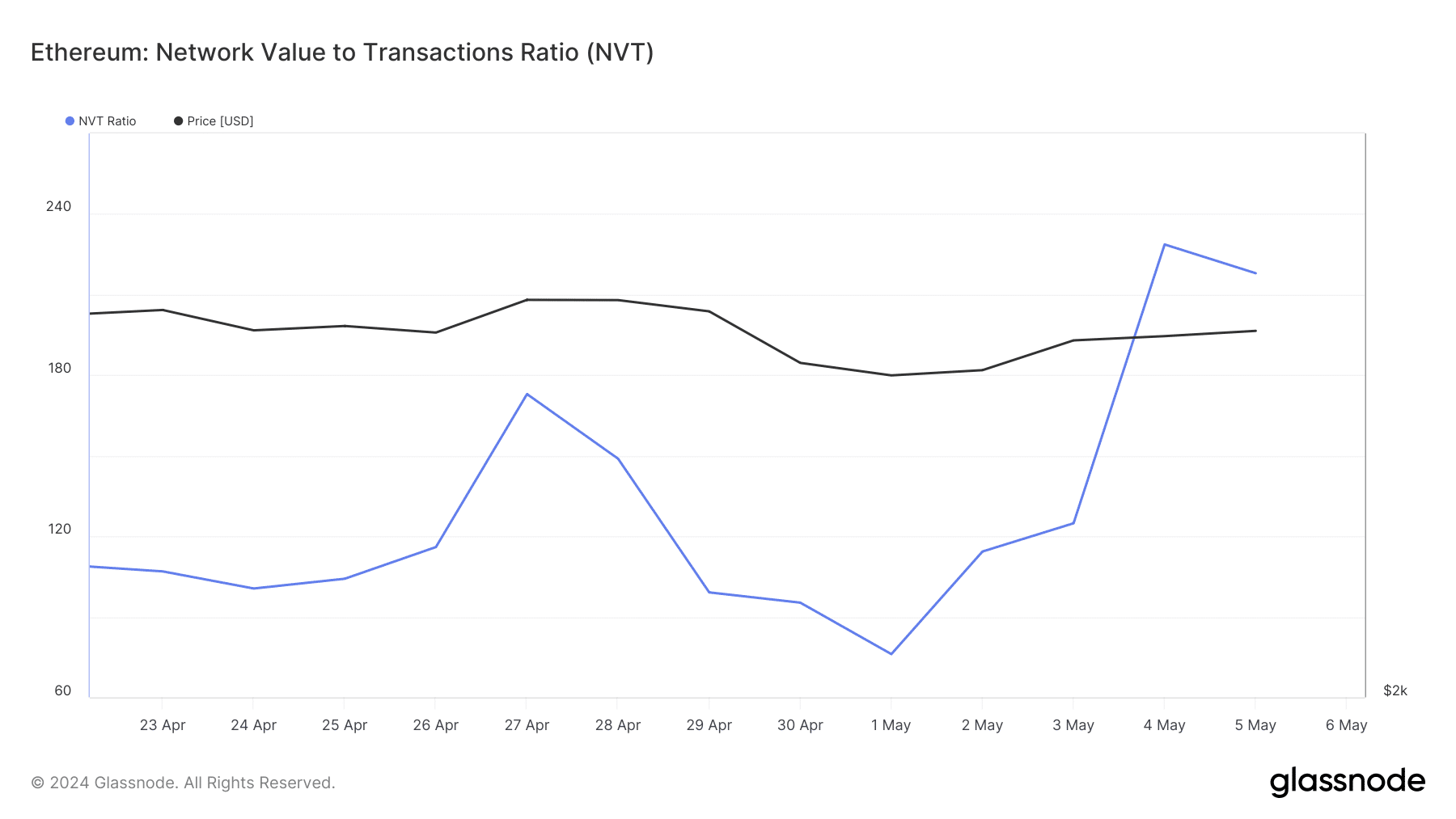

Notably, ETH's network-to-value (NVT) ratio spiked and then recorded a decline. A decline in the indicator means that the asset is undervalued.

Source: Glassnode

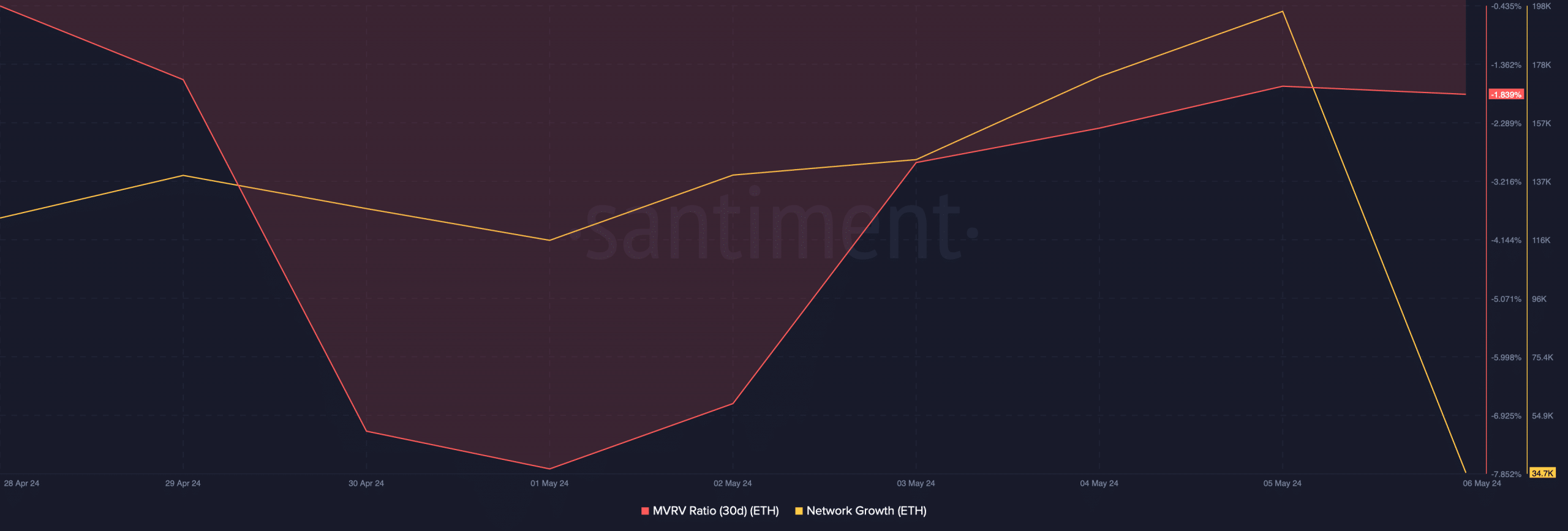

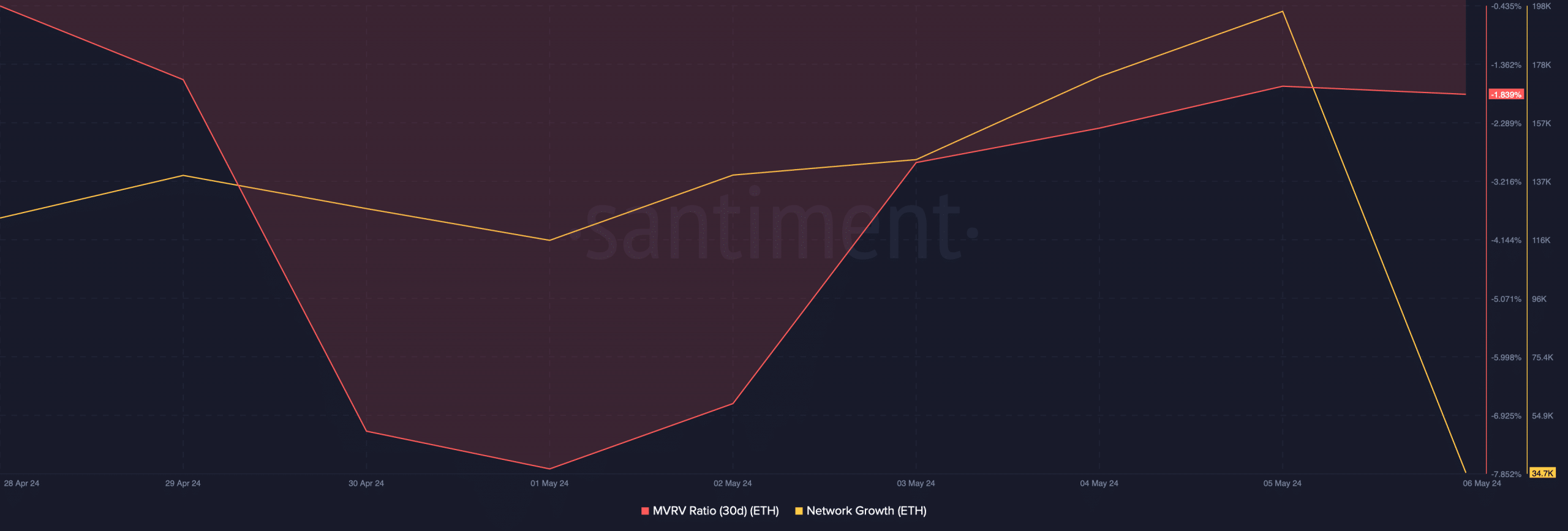

Our analysis of Santimento's data points to several other bullish indicators. For example, ETH's MVRV ratio improved last week. Network growth was also significant.

This means that more new addresses have been created to transfer tokens, reflecting high activity.

Source: Santiment

However, Lookonchain’s latest Tweet I turned to sell. According to the tweet, Whale sold 7,000 ETH, worth more than $22 million at the time of writing. AMBC Crypto Converter.

This seemed bearish, suggesting that whales were expecting prices to fall.

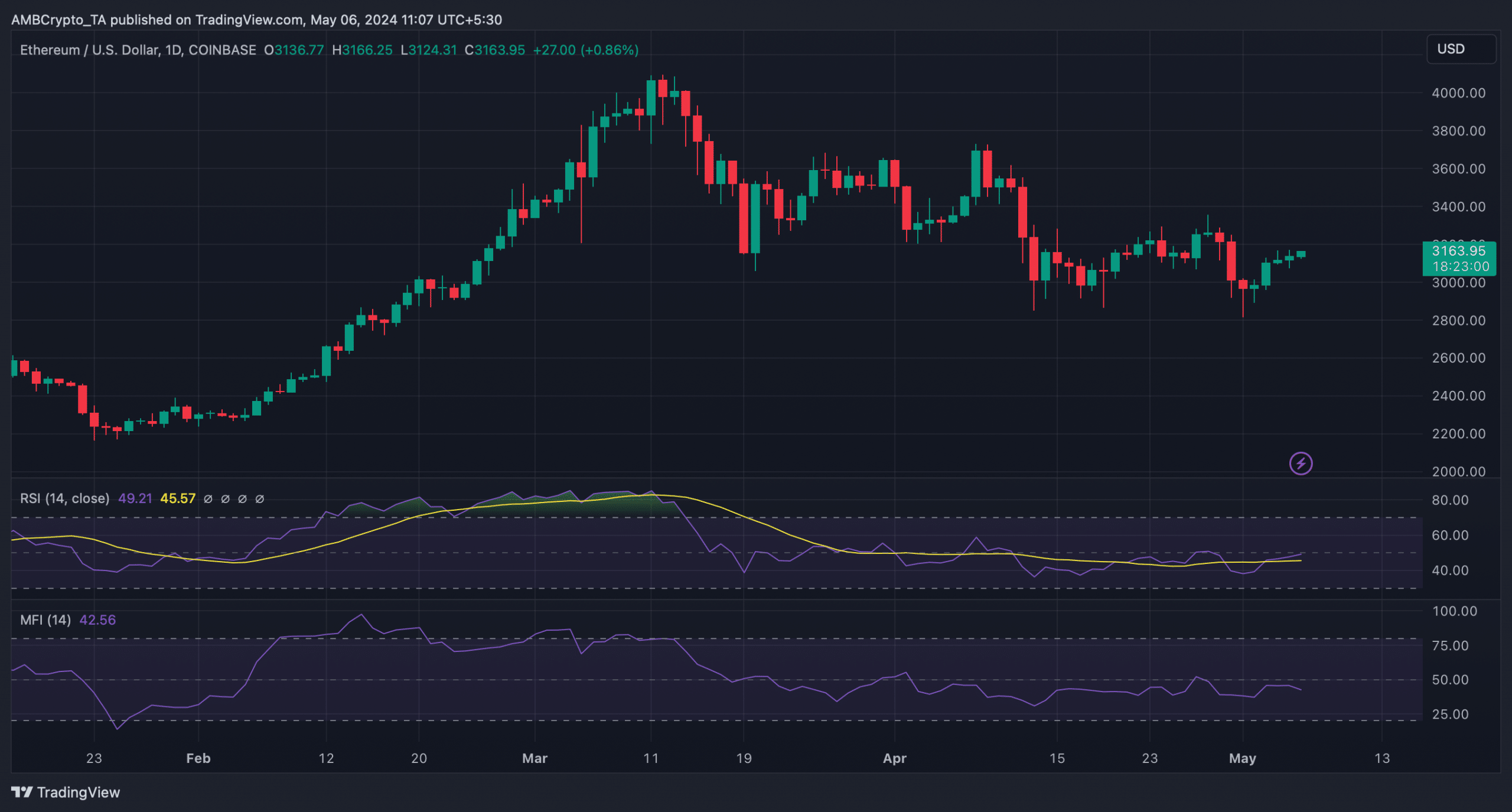

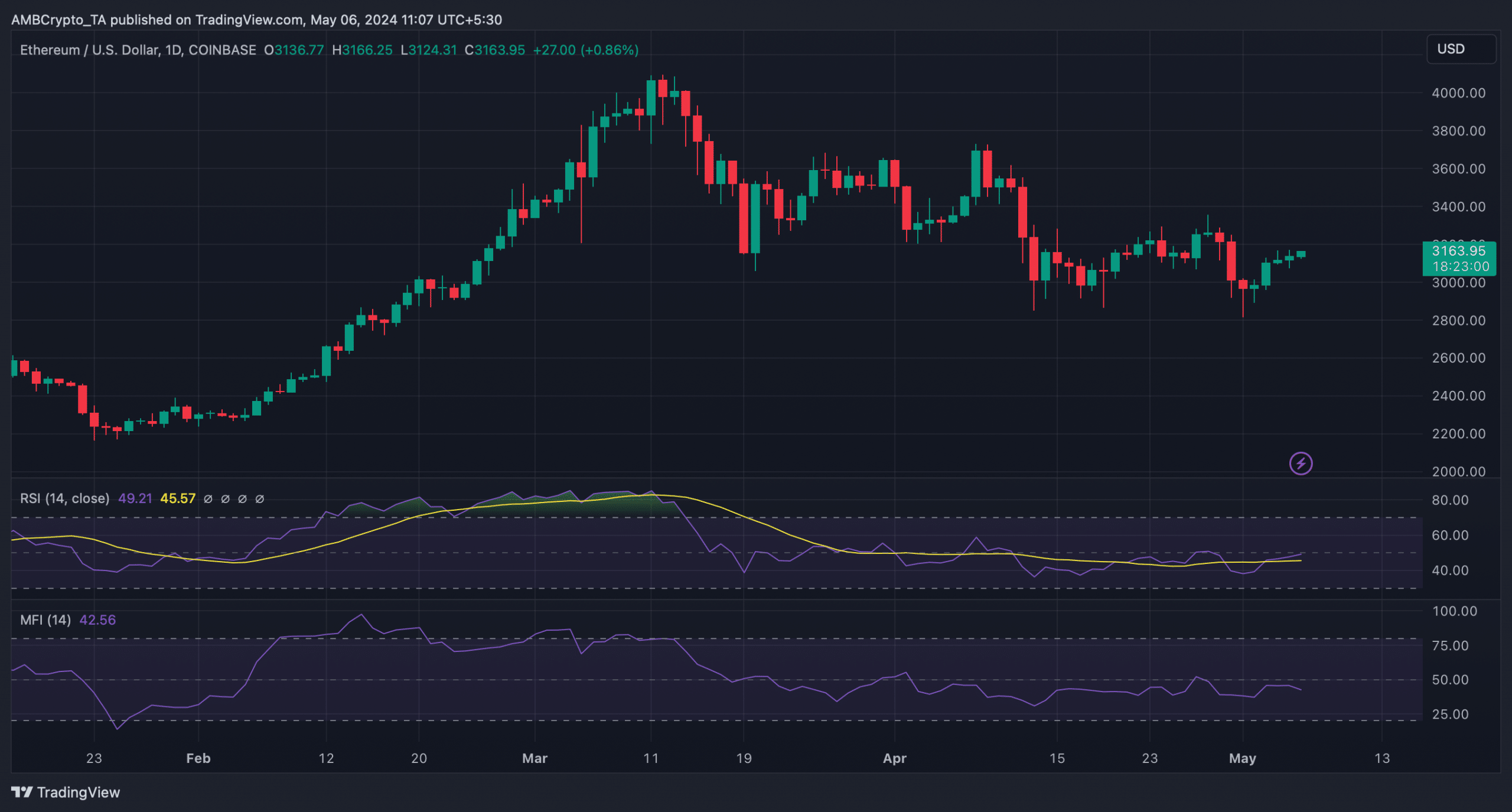

AMBCrypto then analyzed the daily chart of ETH to better understand if a breakout above the descending wedge pattern is possible.

read ethereum [ETH] price prediction 2024-25

According to our analysis, ETH’s Relative Strength Index (RSI) registered an increase, with its value at 49.7, suggesting that the price is likely to rise.

Nevertheless, the Money Flow Index (MFI) remained below the neutral mark of 50, supporting the bears.

Source: TradingView