- Ethereum showed a bullish market structure on the 1-day chart.

- But at the time this article was published, buyers had won the battle for control.

Ethereum [ETH] After the recent retracement from $4.1,000, we witnessed Coinbase premium turn negative.

The complexities surrounding Ethereum ETFs may explain why U.S. investors became less bullish on the asset in March.

Another report from AMBCrypto highlighted that long-term holders of ETH are not selling their tokens. Technical analysis also shows a bullish outlook.

Now that I think about it, the retest was perfect.

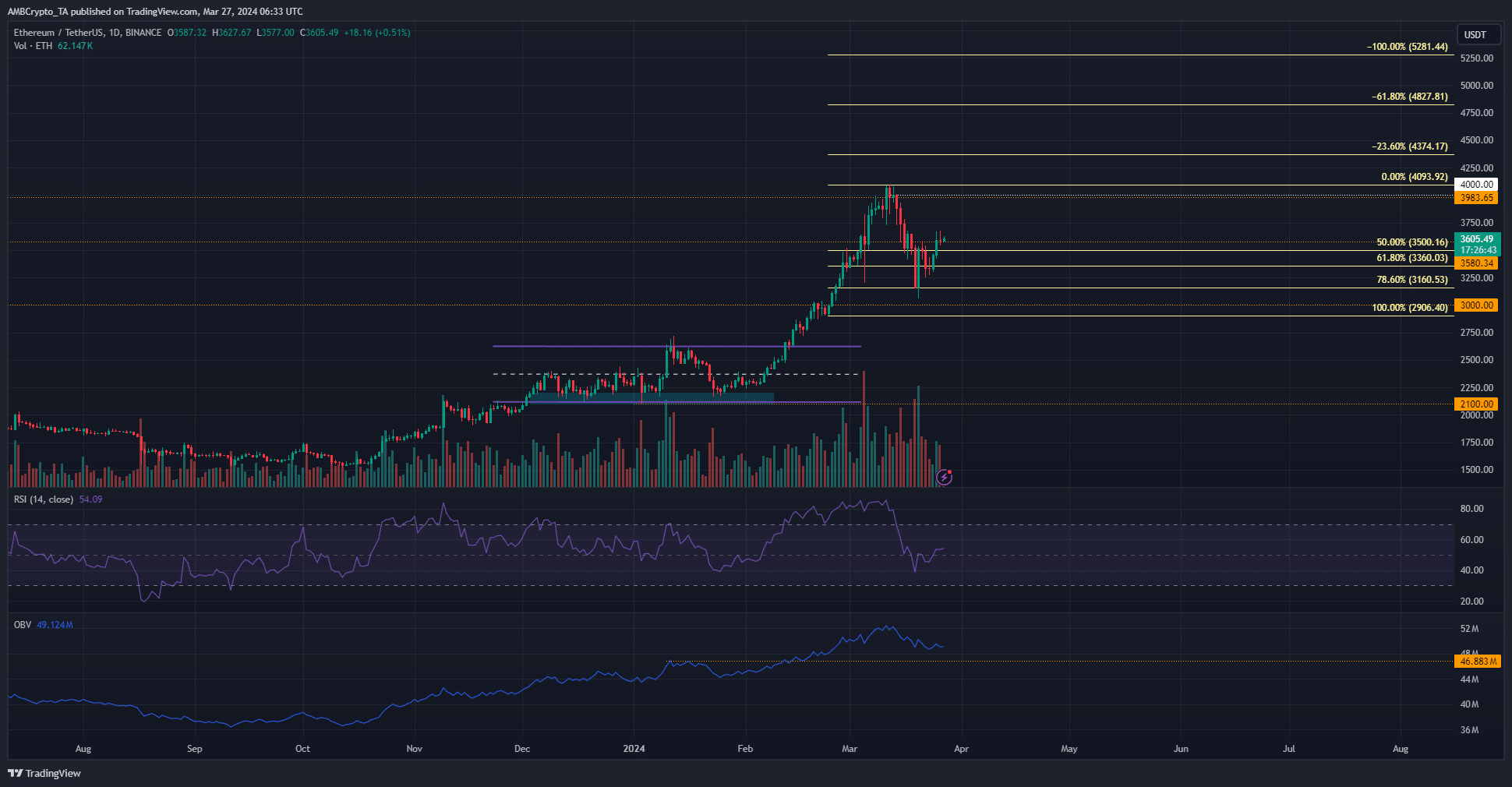

Source: ETH/USDT on TradingView

Ethereum’s daily chart formed a swing low on March 20th at $3,056. Despite the significant retracement, market structure remained bullish on the daily time frame.

The only RSI below 50 was 54 at the time of writing.

This showed that although the bears briefly maintained control, the bulls are once again vying for control. On the other hand, OBV did not test the mid-February resistance as support.

Therefore, buying pressure remained strong in the long term.

Sales volumes were large in March, but not enough to overwhelm buyers. The Fibonacci retracement level (light yellow) showed that $3160 is an important support level.

Price rebounded from this level without closing any daily candles below this level.

Additionally, the resistance at $3,580 was on the verge of being broken. The evidence at hand suggests that additional benefits are likely.

Discussion of ETH exceeding $4000

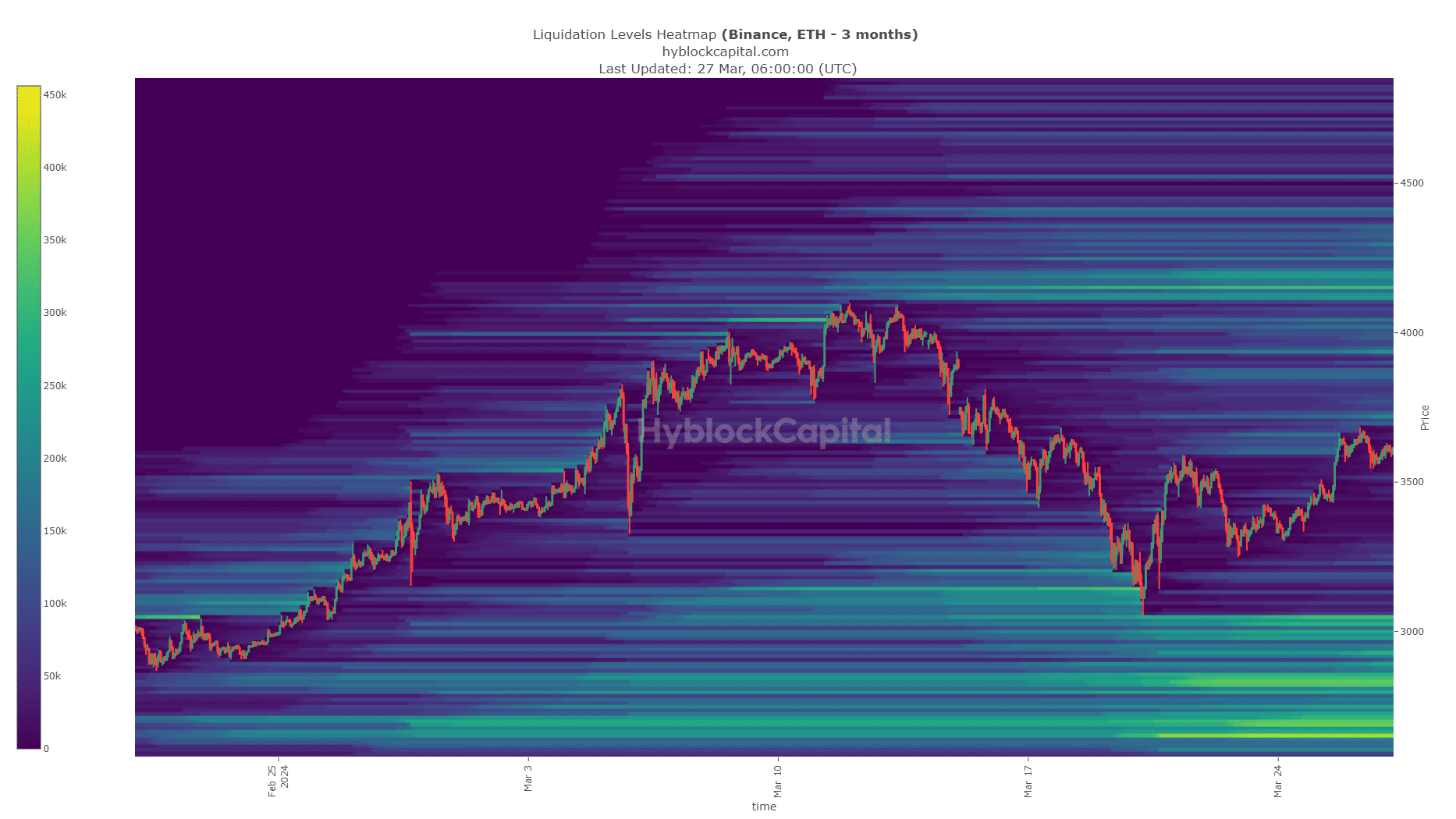

Source: High Block

The move to $3,000 eliminated an estimated $8 billion in liquidation levels. Any further loss could have resulted in even bigger losses for the bulls, but the price reversed and started rising.

Realistic or not, the market cap of ETH converted to BTC is as follows

In the north, $3,940 and $4,150 were the next areas to look at. Numerous liquidation levels are concentrated around them.

ETH could decide to gather this liquidity and reverse or breakout depending on the sentiment surrounding both Ethereum and Bitcoin [BTC].

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.