Ethereum transaction fees are currently the lowest since October 2023, according to on-chain data. Here's what this means for cryptocurrencies.

Ethereum transfer fees recently fell to a low of $1.12

According to data from an on-chain analytics company Santimento, the average fees on the Ethereum network have recently fallen to low levels. Fee here refers, of course, to the amount that every sender must attach to a transaction as compensation for processing the move through the blockchain.

The fees investors need to pay to expedite the transfer will depend on the network conditions at the time. During periods of high activity, there can be intense competition to process transactions quickly, so users in a hurry may have to pay higher fees to keep up with this traffic. .

Therefore, average fares tend to be higher during busy times. Similarly, during periods of low activity, users only have to pay a lower amount. Due to this relationship, the average price can tell us about the current demand for usage of the Ethereum network among users.

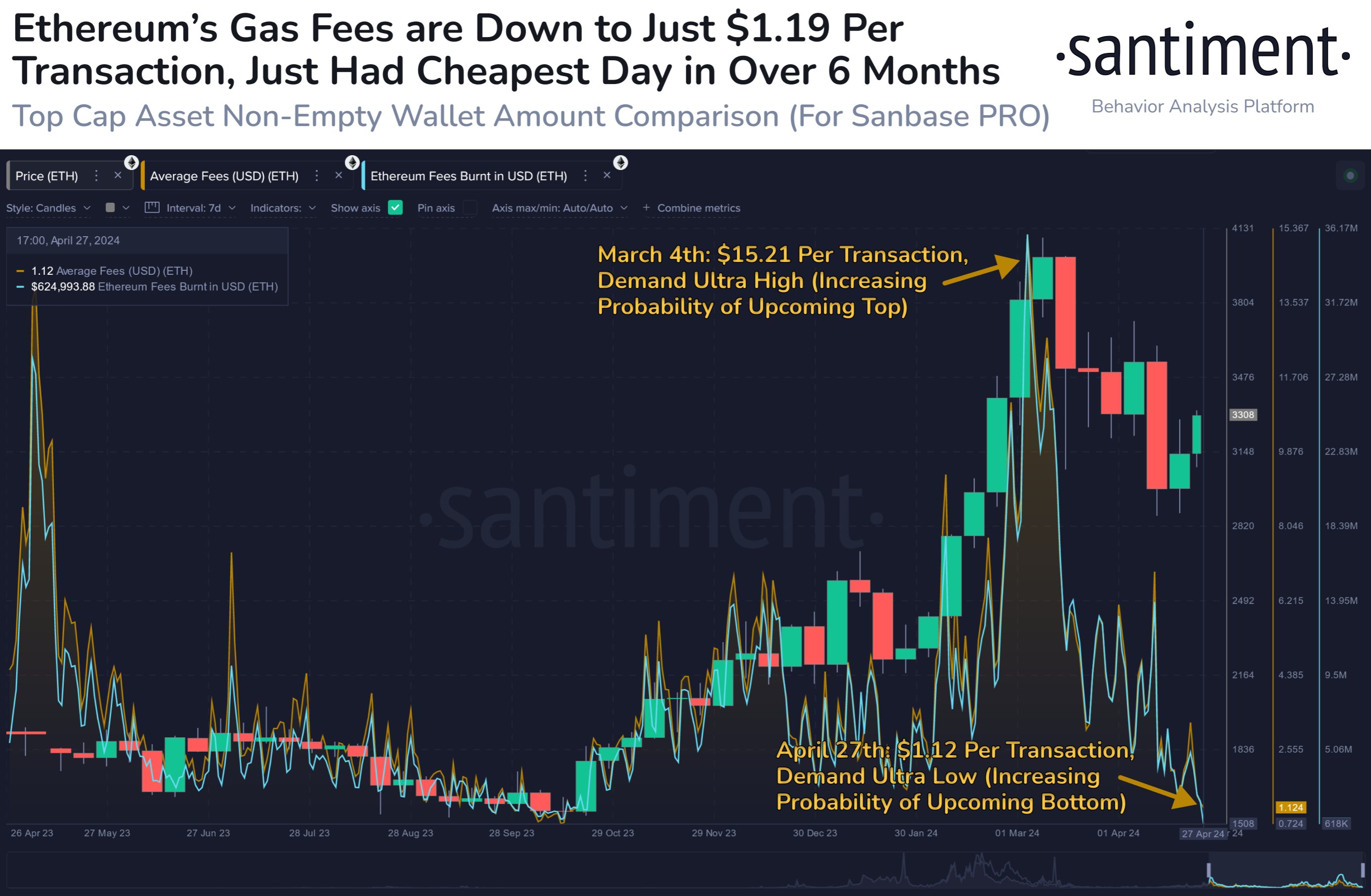

The chart below shows how the average fees on the Ethereum blockchain have changed over the past year.

The value of the metric seems to have been going down in recent days | Source: Santiment on X

As shown in the graph, Ethereum's average fees have skyrocketed with this year's rally, reaching a high of $15.21 last month. Interestingly, this peak in fees occurred near the peak of the price of the asset itself.

“Traders have historically oscillated between sentimental cycles of feeling like cryptocurrencies are 'going to the moon' and feeling like they're 'done,' and this can be observed through trading fees,” the analysis firm said. points out.

Historically, markets tend to move against most expectations, so prices tend to hit a ceiling during periods of high fees when FOMO begins. Therefore, the pattern seen last month is consistent with what has been observed in the past.

From the chart, we can see that Ethereum fees are observing a drawdown along with the price following this high. Recently, the indicator has continued this cooldown, currently dropping to a low of just $1.12.

This is the network's lowest price since last October. Just as high fees can create a ceiling, low demand can create a bottom in cryptocurrencies.

“The market has largely reversed over the past six weeks, and the lack of demand and strain on the network could lead to a turnaround for ETH and related altcoins sooner than many expected,” Santiment said. explains.

ETH price

Ethereum rallied to a high of $3,350 yesterday, but has now fallen to just $3,170, and it appears the asset has already recouped this surge.

Looks like the price of the coin has gone through a rollercoaster over the past couple of days | Source: ETHUSD on TradingView

Featured image of Kanchanara on Unsplash.com, Santiment.net, Charts on TradingView.com