- The price of UNI skyrocketed after the protocol revealed plans to introduce the ERC-7683 standard.

- Open interest reached a monthly high and activity spiked, potentially sending the token as high as $12.

Uniswap [UNI] It made an unexpected move in the past 24 hours, rising 18.98% to $9.30.

For many participants, this surge may be related to the news that the US SEC is becoming more likely to approve Ethereum. [ETH] The price of ETH has skyrocketed due to the increase in spot ETFs.

That was a factor, but it wasn't the only reason. According to AMBCrypto research, large-scale developments and other on-chain events were essential to UNI's rise.

Labs have new standards

On May 20th, Uniswap Labs revealed that it is introducing a new token standard called ERC-7683. For context, ERC stands for Ethereum Request for Comment.

It is a standard for creating and issuing smart contracts on the Ethereum blockchain.

According to Uniswap Labs, this standard, if implemented, will resolve fragmentation on the network and improve cross-chain interactions. The proposal read as follows:

“By implementing standards, cross-chain intent systems can interoperate and share infrastructure such as order distribution services and filler networks.”

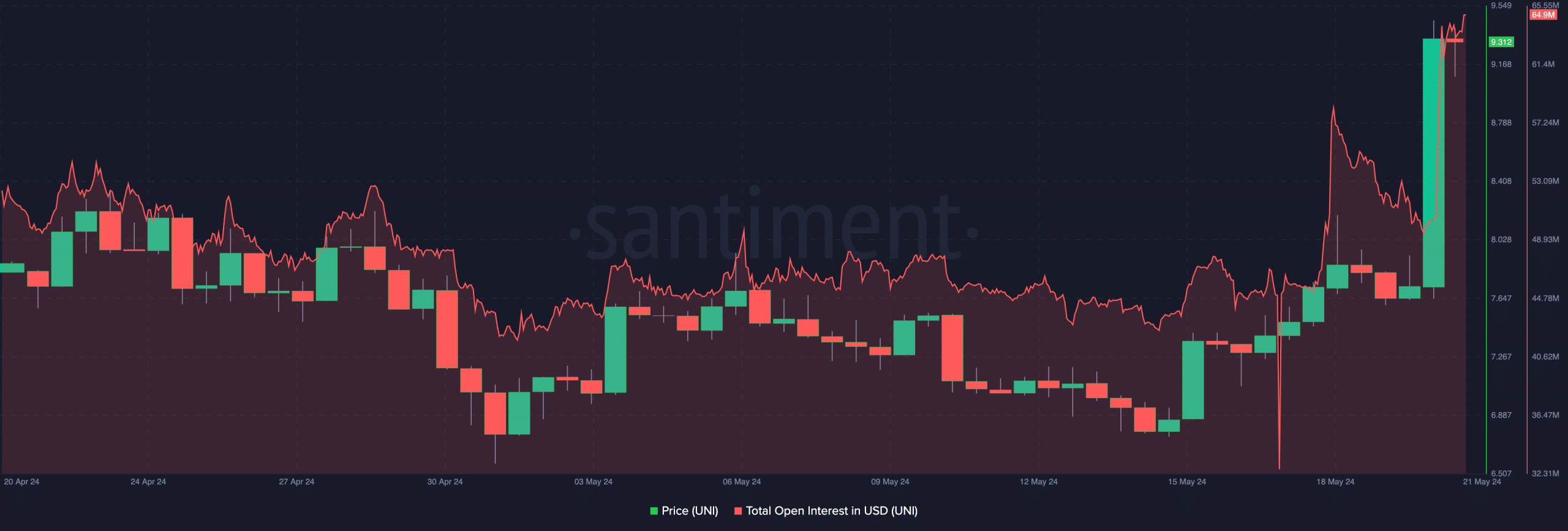

Immediately after the announcement, UNI's open interest (OI) increased. His OI at the time of writing was $64.9 million. This was a value the metric had not reached in over a month.

Source: Santiment

An increase in OI indicates that more money is flowing into the market. On the other hand, a decrease in OI indicates an outflow of liquidity and a decrease in net positions.

Activity Rises, UNI Set For Further Price Rise

When viewed alongside price, OI indicates that buyers in the market are aggressive. If this value continues to rise, the price of UNI could rise as well.

Additionally, predictions that the token could rise above its March highs could come true. But apart from OI, there were other changes on the network that were driving the hike.

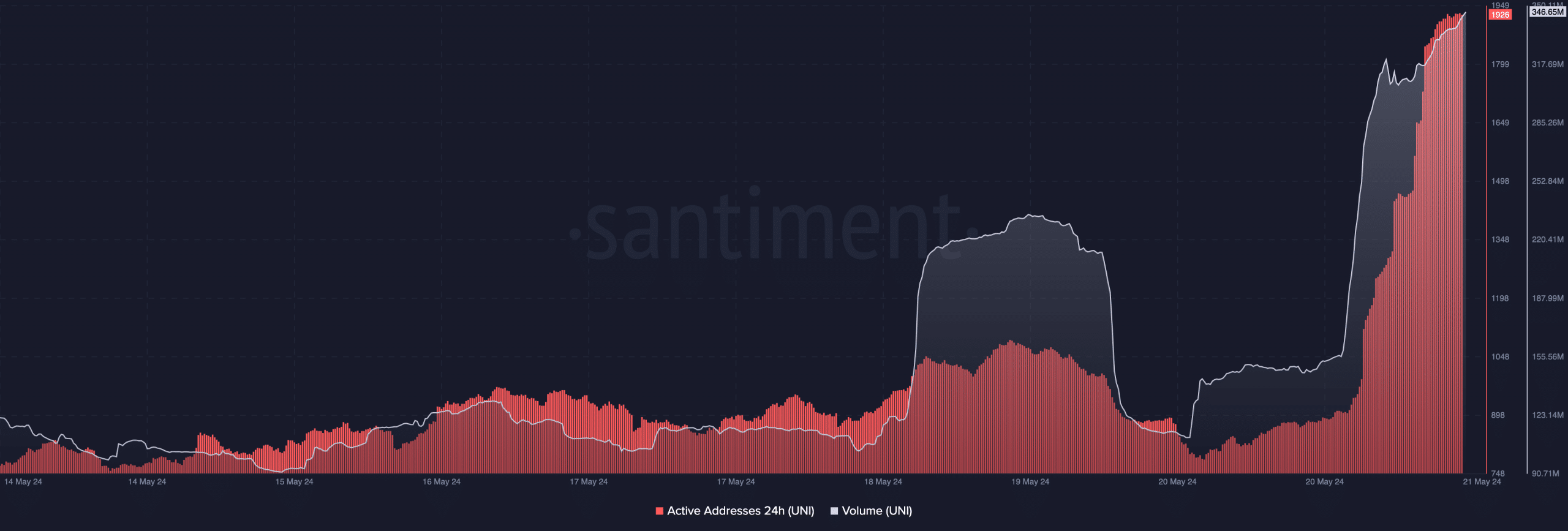

One was a 24-hour active address. Whenever active addresses increase, it means a large number of users are interacting with the blockchain.

When the metric drops, it means that the number of unique addresses visiting the network is decreasing.For UNI, on-chain data from Santiment showed that active addresses rose to a weekly high of 1,926.

This sharp rise indicates growing confidence among holders. In most cases, this leads to an increase in buying activity and is undoubtedly one of the reasons why the price of UNI has increased northward.

Source: Santiment

Whether it's realistic or not, the market capitalization of UNI in ETH terms is as follows:

Additionally, AMBCrypto received confirmation of increased interest from volume. At the time of writing, UNI's trading volume was $346.65 million.

If this number increases as the price of the token increases, UNI could reach higher values. Given this momentum, the price of the cryptocurrency could reach $12 to $15 in the short term.

![Ethereum is not the only reason for Uniswap [UNI] Pump up 18% in 24 hours](https://decentralizedrebel.com/wp-content/uploads/2024/05/uni-token-and-ethereum-news-1000x600.webp.webp)