Ethereum (ETH) offers a buy-on-the-buy opportunity in 2024. Although the buying opportunity may last for many months before it materializes, investors must exercise extreme vigilance to take advantage of the upcoming opportunity.

As we approach the second half of 2024, analysts predict a change in Ethereum's projected price trend. For investors looking ahead to 2025, this could be an attractive buying opportunity.

Ethereum in 2024

In 2024, Ethereum is expected to see price support and various fluctuations. $2,163.33 and the peak resistance level is $3,707.43. The average predicted price for this year is $2,885.98.

However, industry analyst insights suggest that ETH could face a downtrend as it approaches the end of 2024 as it approaches support levels. This expected decline is important because it sets the stage for potential investment opportunities in 2025.

ETH in 2025

As 2025 progresses, Ethereum price is expected to stabilize and hold the 2024 support level at $2,163.33. A gradual rise is expected by the summer of 2025, indicating that we are in a recovery phase.

Interestingly, this chart is generated by one of the most accurate predictive cryptographic algorithms. Although not generated by humans and calculated by AI based on 10 years of historical price data, it is clear to the human eye that this expected price structure is causing a bullish reversal. .

This highlights the importance of considering 2025 as a strategic point for “buy on the edge.”

InvestingHaven forecaster confirms ETH outlook

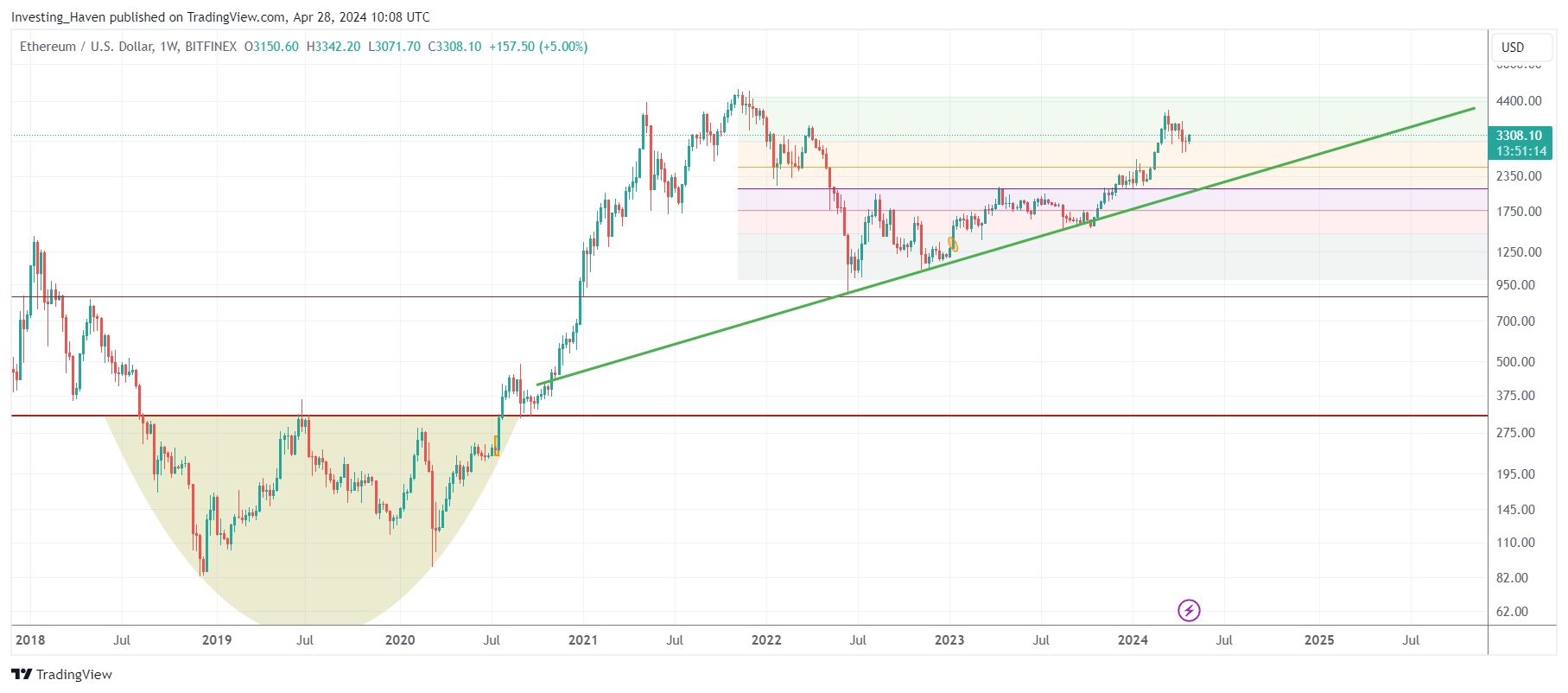

Analysts at InvestingHaven confirmed their buy-on-the-touch prediction and added that the long-term uptrend line on Ethereum’s chart should hold.

If so, the setup on the long-term chart could qualify as a spectacular cup-and-handle formation, which is a very bullish pattern. As a result of this pattern, ETH could significantly exceed its previous ATH in 2025. In fact, an analyst at InvestingHaven predicts that a potential bullish target of ETH $10,000 is achievable in the 2025-2026 period if the cup and handle materialize properly.

ETH – Buy the push?

It is very important for investors to understand the Ethereum price trend in 2024-2025.

The expected decline in the second half of 2024 could be seen as a reaction to market corrections and broader economic factors affecting the crypto landscape. However, the stability of Ethereum prices in the first half of 2025, combined with the bullish influence on the charts, suggests that market sentiment is on track for a recovery.

The concept of “buying on the edge” centers around buying assets when prices are low in the hope that they will later rise in value. For Ethereum, a sharp decline in late 2024 presents such an opportunity, especially when analyzed in conjunction with the stabilization and moderate growth he expects in 2025.

Investors should closely monitor Ethereum’s chart patterns as it approaches support levels and consider whether it is consistent with their risk tolerance and investment schedule.

conclusion

In conclusion, while a sharp decline in late 2024 may seem unfavorable, it could present an epic buying opportunity for those looking to take advantage of the cyclical nature of cryptocurrencies. .

By 2025, a gradual recovery in Ethereum's price could reward those who strategically positioned at these lower price points. The answer to the question “how profitable are buy-on-the-touch opportunities” depends entirely on how ETH behaves around key supports. $2,250how accurate the cup and handle formation will be.

Follow our premium works and receive timely cryptocurrency alerts in 2024 and 2025 >>