- If Ethereum falls below $3,050, the market structure may turn bearish.

- Momentum and selling pressure are steadily increasing, potentially forcing further losses.

Over the past 24 hours, we have seen a wave of strong selling pressure.Bitcoin [BTC] and Ethereum [ETH] have each pointed to a loss of 7-8%, and further significant declines are expected. The $3.5,000 level was an important short-term support for ETH.

crypto analyst Ali Martinez He noted that bear pennant formation is underway. If that happens, it could drop to $2.8 million. Will the Bears make this prediction come true?

Bear Pennant vs. Demand Zone – Who Will Win This Round?

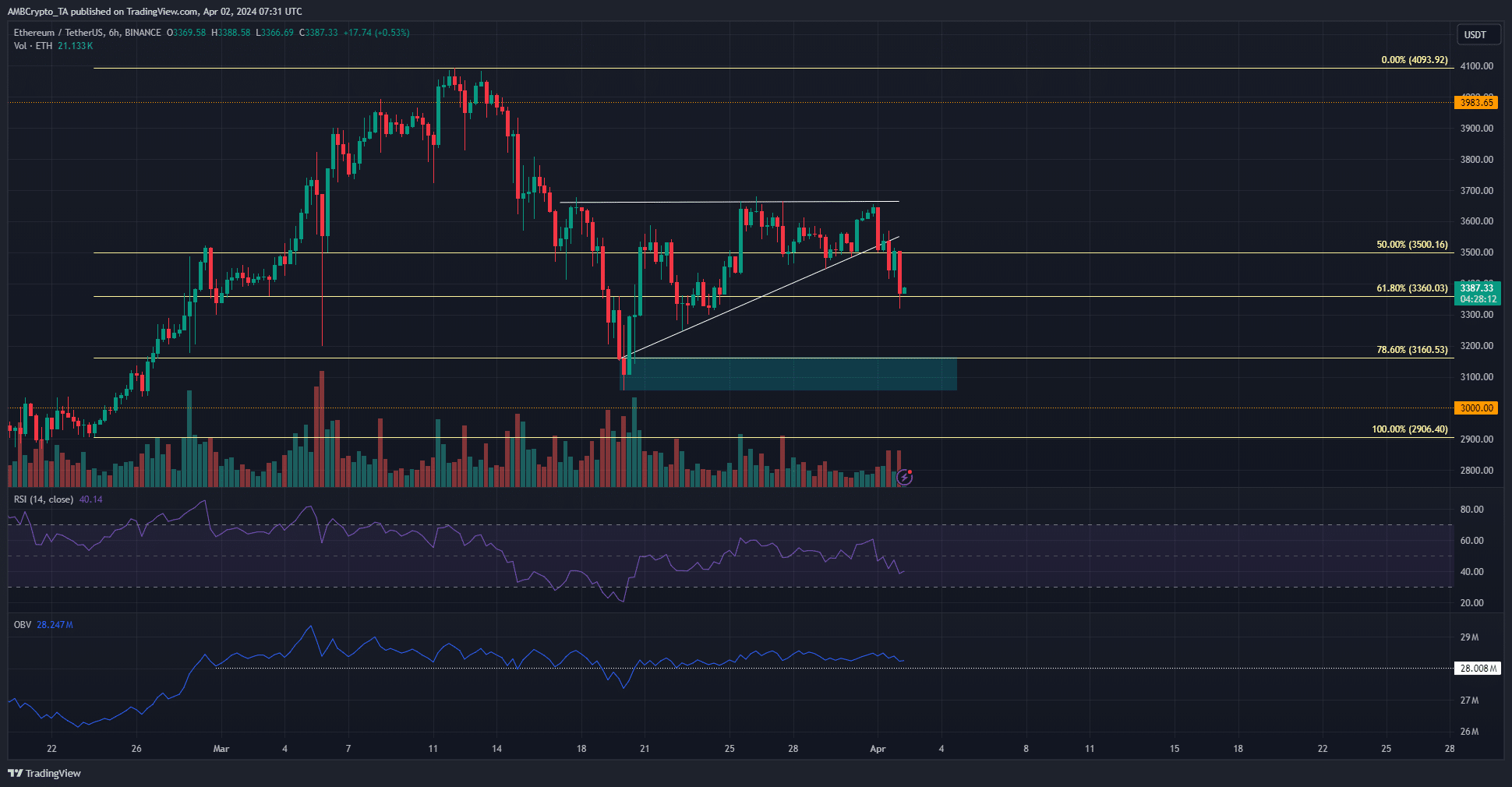

Source: ETH/USDT on TradingView

AMBCrypto highlighted the pennant formation in white. Based on the length of the flagpole, a drop to $2.6,000 could begin. $28,000 to $29,000 was the region that consolidated in February before ETH surpassed $3,000.

Therefore, it can serve as an aid during descent and repel bears. The $3.1,000 region was also a bullish order block on the lower time frame that saw a big reaction from the price earlier this month.

Trading volumes have decreased over the past two weeks as Ethereum formed a bearish pattern. A break below the uptrend line confirms that the pattern is developing. A break below $3,056 will result in a bearish reversal in market structure on the 12-hour chart.

Ethereum was undervalued, should you rush to buy now?

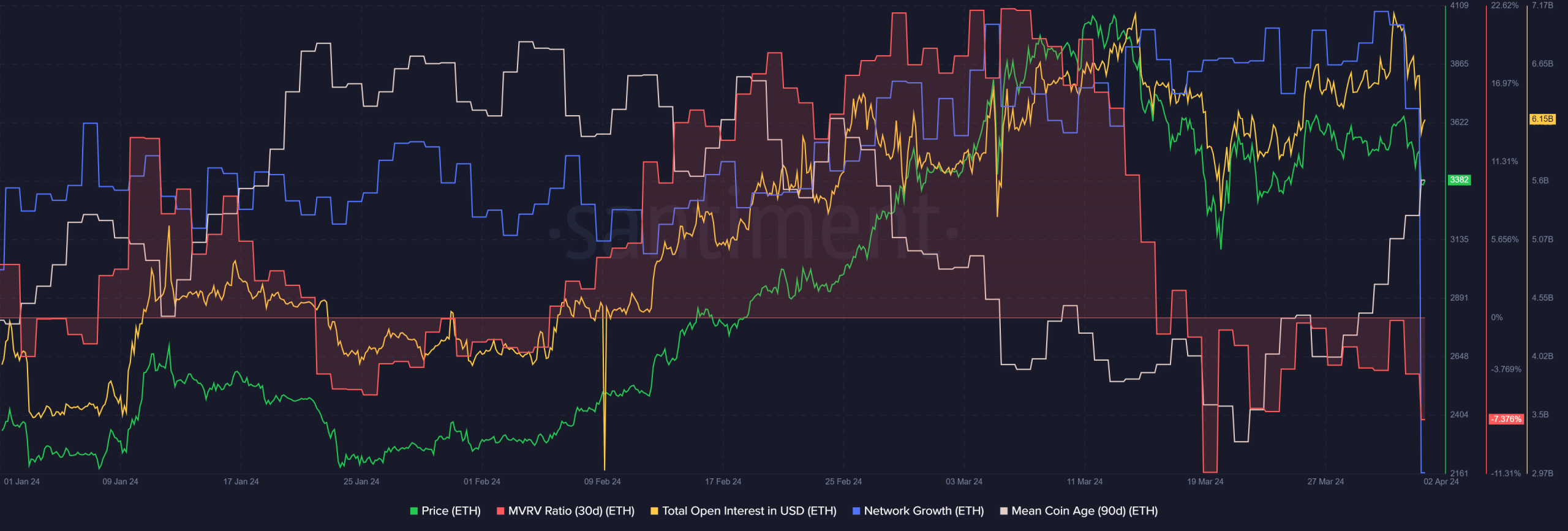

Source: Santiment

AMBCrypto’s analysis of some of Ethereum’s on-chain metrics has positive results for investors. The 30-day MVRV ratio has been below zero since March 18, indicating that the asset is undervalued.

However, the average age of coins, which had been on the decline since February 9, has started to trend up.

Overall, it was a strong buy signal. However, this signal is not short-term. Risk management should also be developed based on technical analysis, and at the time of this article, the bears have the advantage.

Is your portfolio green? Check out the Ethereum Profit Calculator

Comparing the network growth between March and January, we found that the number of new addresses created on the network increased.

Total open interest fell along with the price, indicating short-term bearish sentiment. However, the evidence at hand shows that a drop to $310,000 or even $2,6000 still presents a buying opportunity for long-term holders.