Ethereum, the second-largest cryptocurrency by market capitalization, faces an increased risk of a short squeeze that could fuel a price rally. Cryptocurrency futures markets are showing signs of extreme leverage, indicating that a significant number of traders are betting that prices will continue to fall.

If the price of Ethereum unexpectedly spikes, these traders will be forced to cover their positions, and the price could rise in a potential short squeeze where short sellers become buyers forced to cover their positions. There is a gender.

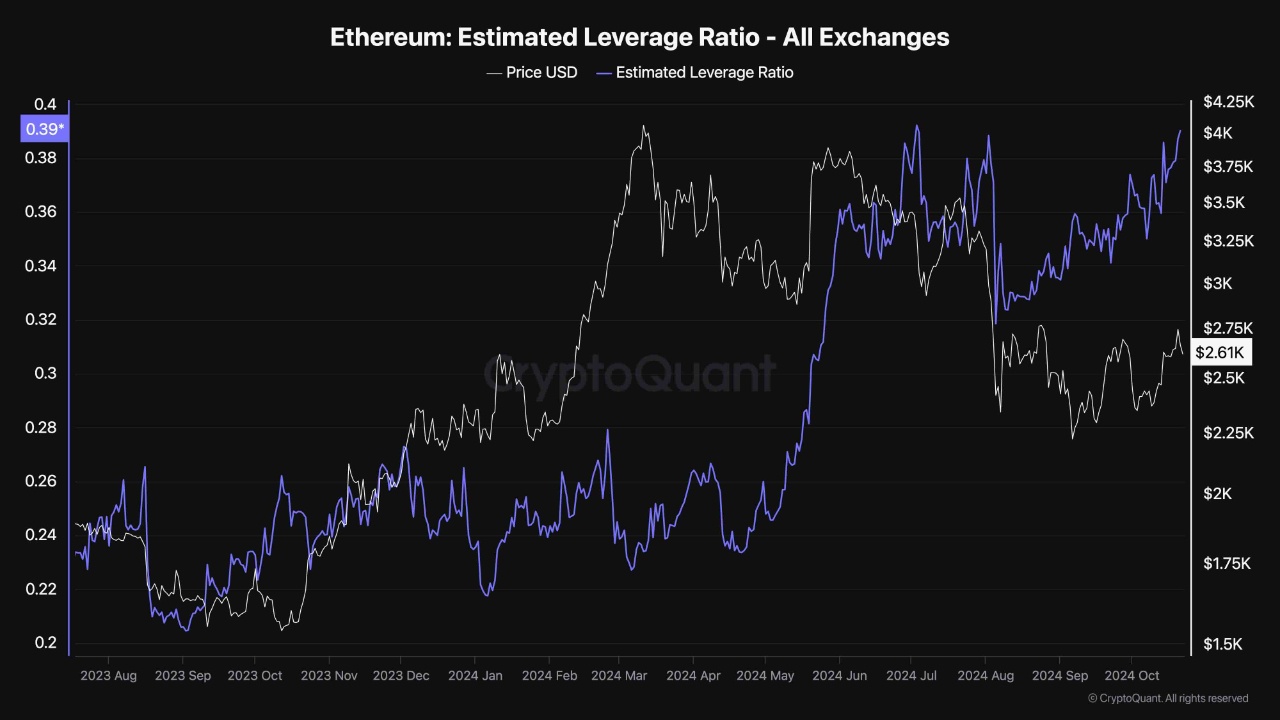

A key metric that measures the level of risk in the futures market is the estimated leverage ratio (ELR), and according to CryptoQuant analyst “ShayanBTC,” this ratio has been steadily rising in recent months, leading to an increase in leveraged positions. It is said to be suggesting. Given Ethereum's recent poor performance compared to Bitcoin, this indicator suggests that many traders are opening highly leveraged short positions.

Analysts noted that the futures market is currently believed to be overheated and leverage is at potentially dangerous levels, making Ethereum vulnerable to a short squeeze.

When such an event occurs, a positive feedback loop is formed and the price can rise further as more traders rush to close their positions. Ethereum’s 100-day moving average is $2,700, a level seen as a significant resistance level for the cryptocurrency.

The analyst noted that if the short squeeze leads to a breakout above this level, the crypto price could continue to rise. As reported, another crypto analyst predicts that Ethereum price could reach a high of $10,000 after breaking out of an uptrend line pattern formed by a symmetrical triangle. did.

Featured image via Pixabay.