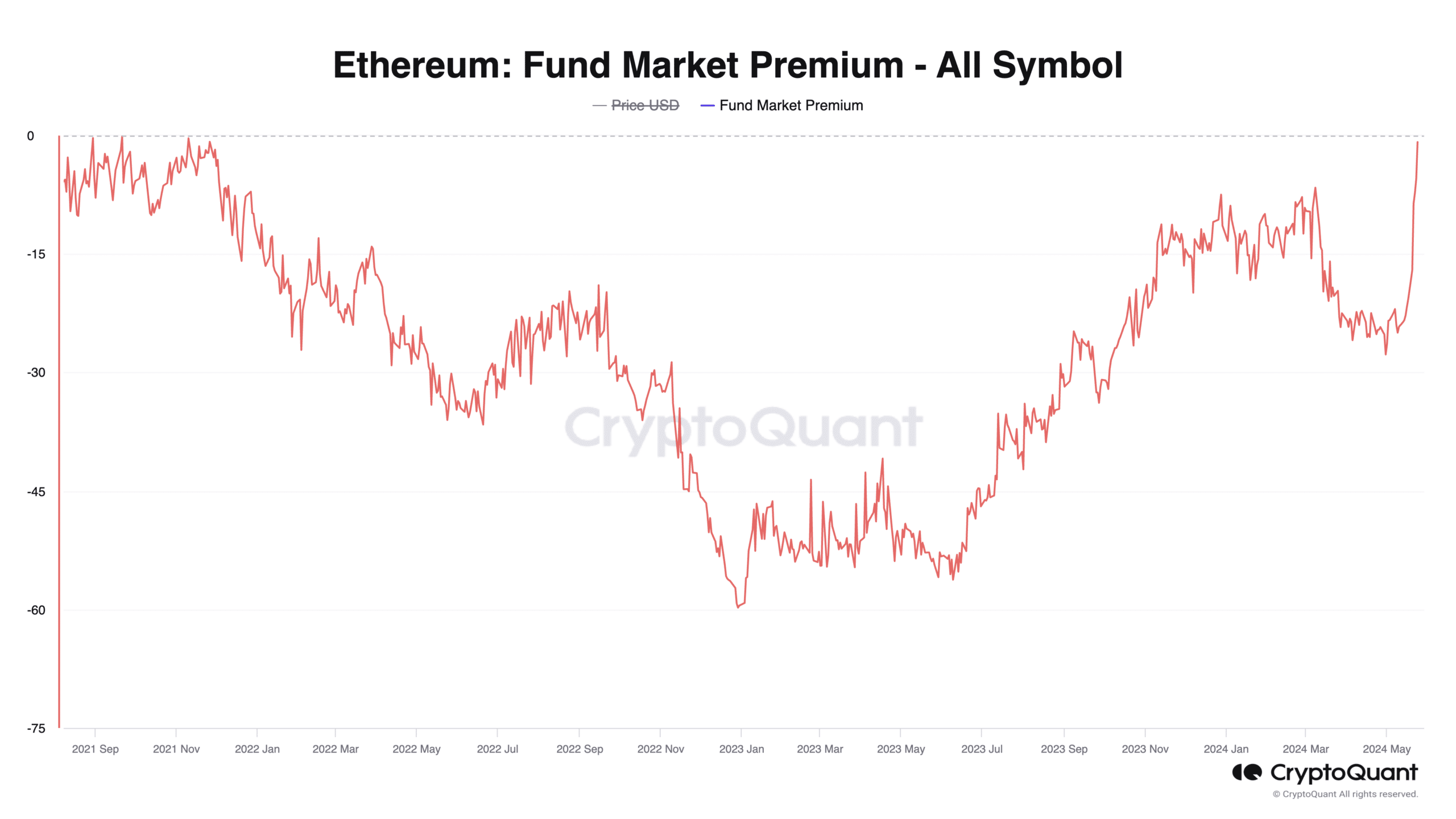

- ETH fund market premium hits highest level since November 2021.

- As buyer fatigue sets in, the coin's value may temporarily decline.

Ethereum [ETH] Fund market premiums rose to their highest in three years. CryptoQuant data.

The index has been on an upward trend since early May, with most of the increase coming after the Securities and Exchange Commission (SEC) announcement. approved On May 23, there were eight applications for ETH spot exchange-traded funds (ETFs).

The fund market premium for ETH measures the difference between the price of the coin on the spot market and the price of an Ethereum-based fund or trust.

A spike in this indicator indicates increased demand for ETH in investment funds.

This means that investors are willing to pay a premium to gain exposure to Ethereum through an investment fund, rather than buying it at market price in the spot market.

At the time of writing, ETH’s fund market premium was -0.81.

According to data from CryptoQuant, the last time this high was reached was on November 10, 2021. A few days later, on November 16, the altcoin hit an all-time high of $4,891.

Source: CryptoQuant

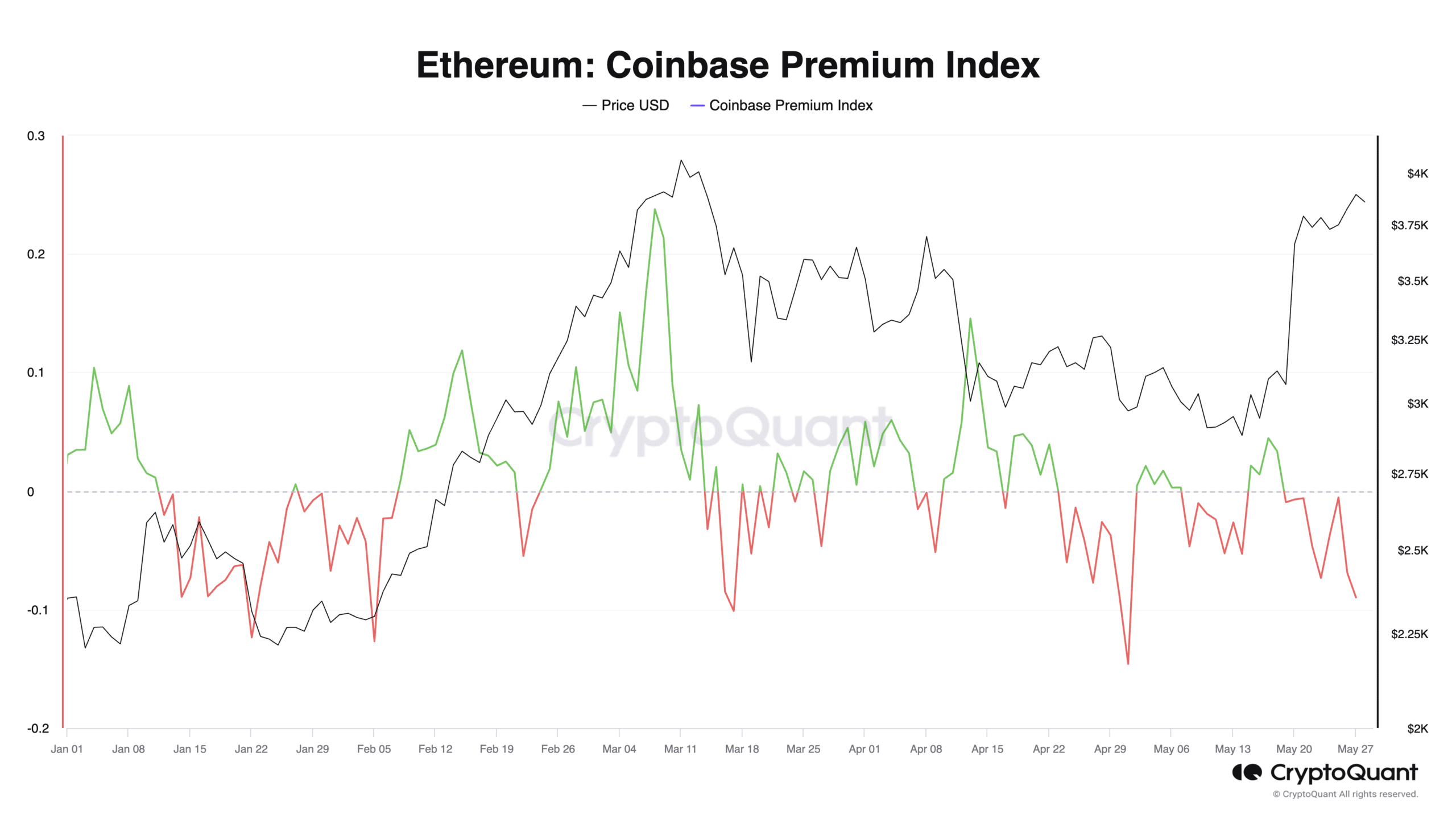

Coinbase takes a hit

The decline in the Coinbase Premium Index (CPI) also reflects the preference of American investors to gain exposure to ETH through investment funds.

The coin's CPI, which tracks the price difference between Coinbase and Binance, has again fallen into negative territory, suggesting a decline in trading activity on U.S.-based exchanges.

At the time of writing, ETH’s CPI was -0.08.

Source: CryptoQuant

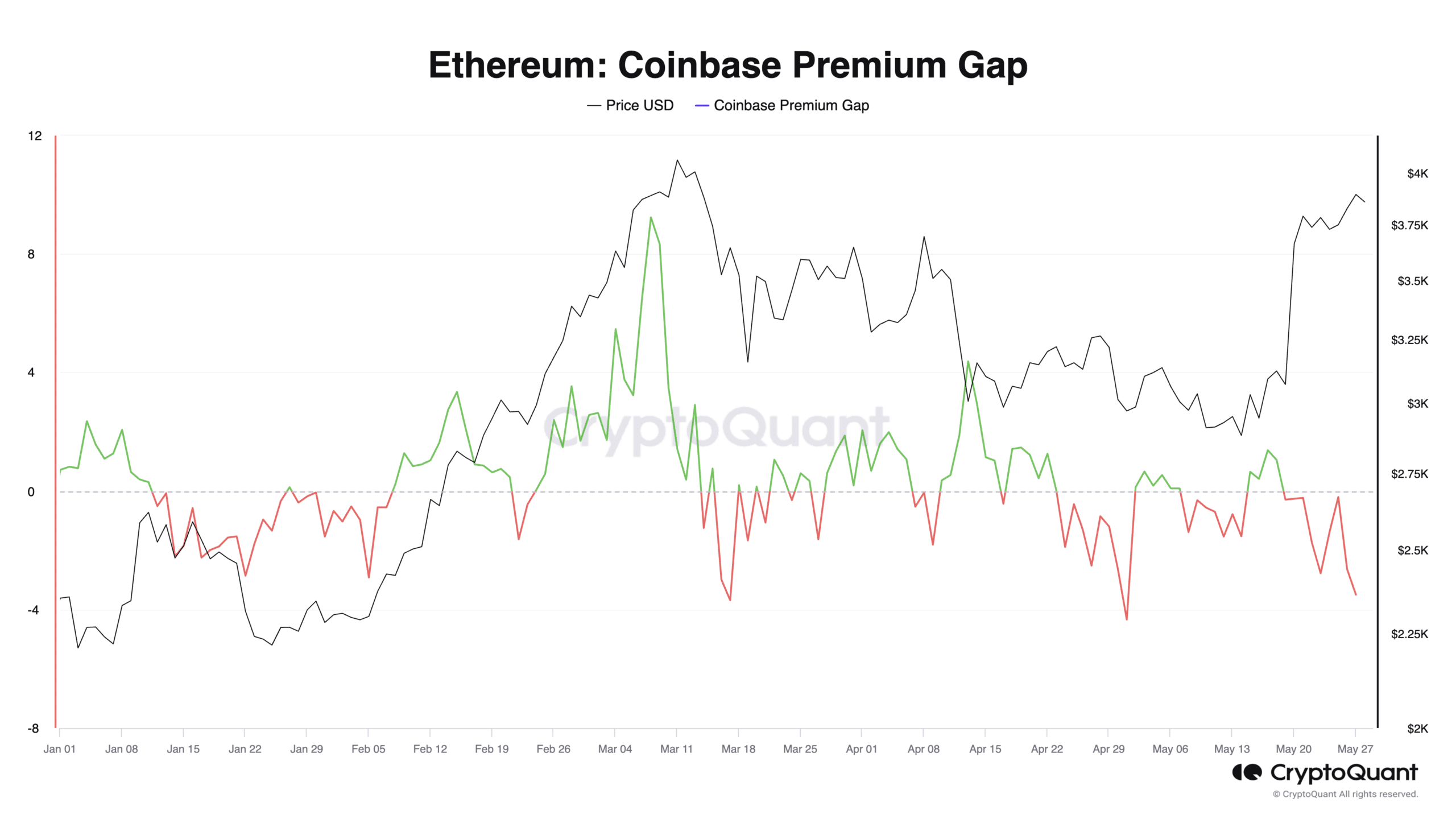

Confirming this trend, the Coinbase Premium Gap (CPG) value for ETH was also negative at the time of writing.

A negative CPG indicates that the altcoin is trading at a lower price on Coinbase compared to other major exchanges.

Source: CryptoQuant

There could be many reasons for this, ranging from market imbalances to liquidity issues, but in this case it was caused by increased attention on ETH-based investment products.

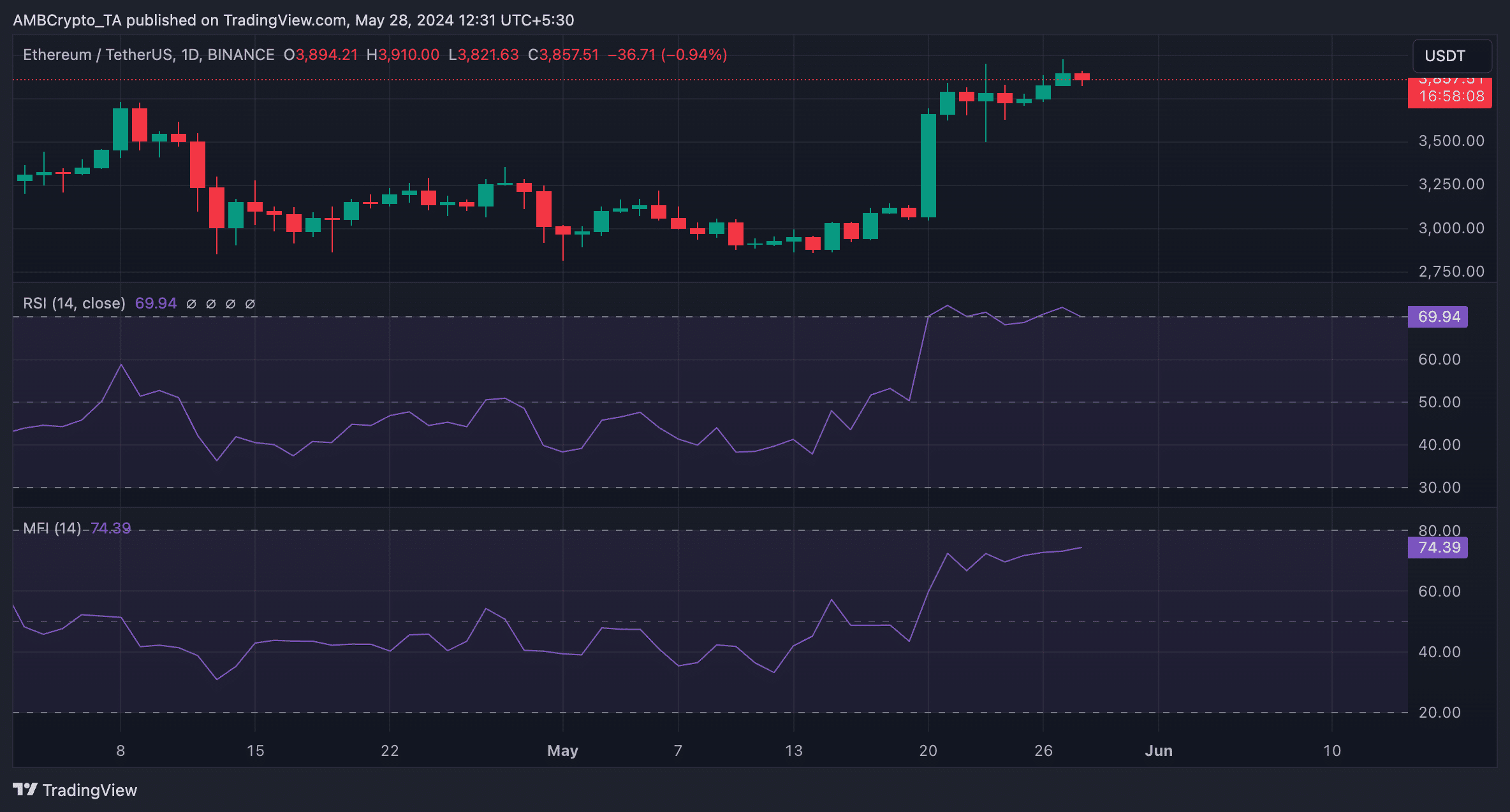

ETH Will Experience Some Pullback

according to CoinMarketCap According to the data, ETH was trading at $3,859 at press time.

ETH accumulation has increased significantly in recent days, as shown by rising key momentum indicators.

Is Your Portfolio Green? Check out our ETH Profit Calculator

At the time of writing, ETH’s Relative Strength Index (RSI) was at 70.17 and the Money Flow Index (MFI) was at 74.41.

ETH/USDT chart. Source: TradingView

Importantly, at these values, buyer fatigue may begin to set in as the market heats up, thus a potential minor price correction could be on the way.