Recently, significant transfers of Ethereum (ETH) to virtual currency exchanges have been attracting market attention. The move has fueled speculation about possible profit-taking, portfolio rebalancing or market speculation.

These moves coincide with the U.S. Securities and Exchange Commission (SEC) nearing a decision on the VanEk Ethereum exchange-traded fund (ETF), raising expectations within the industry.

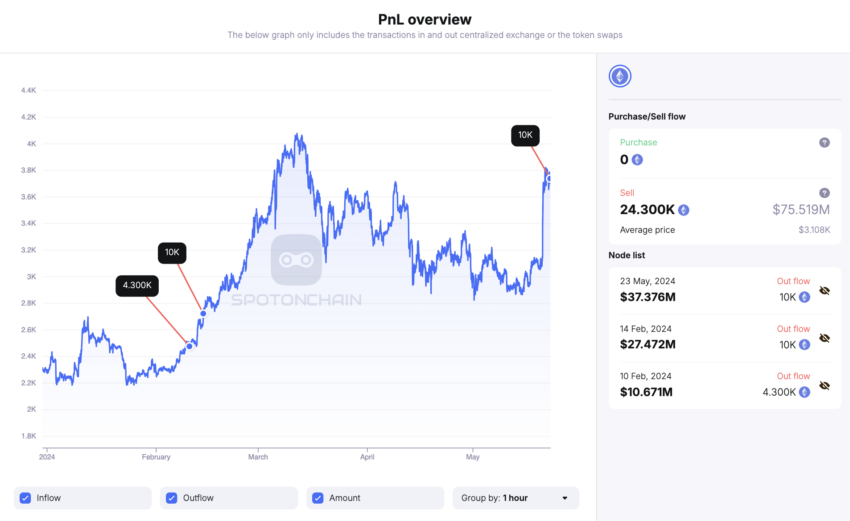

Investor transfers ETH to exchange

Jeffrey Wilk, one of the founders of Ethereum, has transferred 10,000 ETH, worth approximately $37.38 million, to the cryptocurrency exchange Kraken. The motivation behind such a significant transfer is unclear, but we can derive some hypotheses from it.

- Take profit: Wilk may be selling tokens for profit. This could be because you achieved your desired return on investment or because you anticipated a potential decline in the market.

- Portfolio rebalancingWilke may be rebalancing his portfolio by selling some tokens and buying others. This could be based on market conditions, project developments, or a change in his investment strategy.

- Market Speculation: Wilk may be speculating on short-term price movements or taking advantage of arbitrage opportunities between different crypto exchanges.

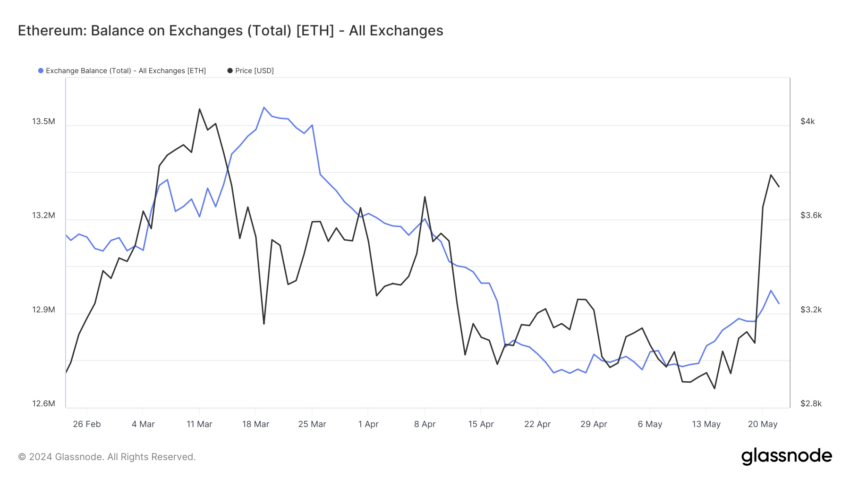

Wilke appears not to be the only one looking to lock in profits, reshuffle his portfolio, or simply speculate on the market: A look at Ethereum balances on exchanges shows a surge in the number of tokens available for sale.

- Exchange balance: This refers to the total amount of Ethereum stored in the cryptocurrency exchange's wallet.

Over the past two weeks, more than 242,000 ETH has moved into the cryptocurrency exchange's wallet. This indicates an increase in trading activity on the exchange, which may contribute to price fluctuations.

Ethereum ETF Approval Imminent

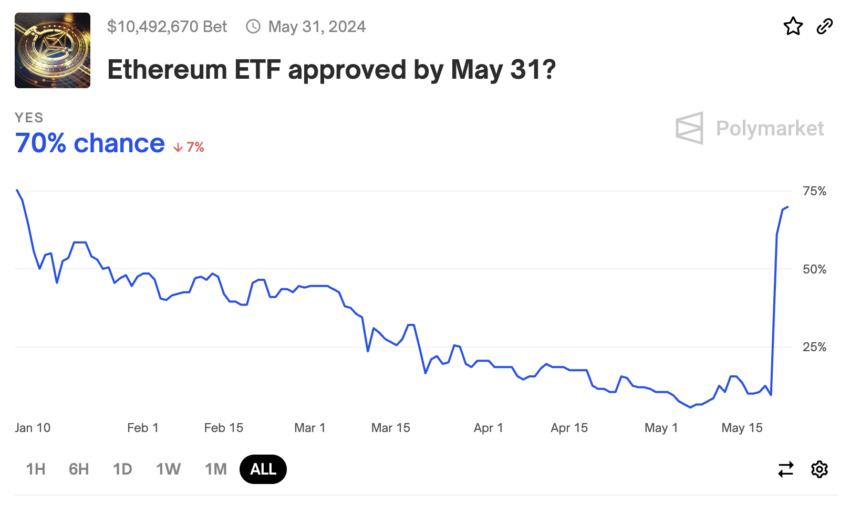

The timing of these moves is notable as it coincides with today's SEC final ruling regarding the Vaneck Ethereum ETF. Interestingly, on May 20, the SEC asked Nasdaq, CBOE and NYSE to narrow their listing applications for the Spot Ethereum ETF, signaling that these applications may be approved.

Following this regulatory development, Bloomberg Intelligence ETF analysts Eric Balchunas and James Seifert said the chances of approval have increased significantly, from just 25% to a respectable 75%.

“We heard rumors this afternoon that the SEC could make a 180-degree turn on this increasingly political issue, and now everyone is panicking. But again, for example, filing Until we receive further information, including updated documentation, we will keep the cap at 75%,” Balciunas wrote.

Read more: Ethereum ETF Explained: What is an ETF and How Does It Work?

Similarly, Polymarkets, a decentralized prediction market platform that allows users to bet on world events, has seen a significant increase in confirmation probability, increasing from 10% to 70% in the past 72 hours.

Warning signals for traders

While industry leaders like Anthony Pompliano see the approval of an Ethereum ETF as an “industry-wide acknowledgement” and “the last dam to be torn down,” traders should exercise caution: the increase in ETH deposits into crypto exchange wallets signals a possible surge in selling pressure and profit-taking.

Meanwhile, the Tom DeMark (TD) Sequential indicator shows a sell signal on the Ethereum daily chart.

- TD Sequential Indicator: This is a technical analysis tool used to identify potential market trend exhaustion points and upcoming price reversals.

- Setup Phase: This means counting 9 consecutive price bars, each bar ending higher (for an uptrend) or lower (for a downtrend) than the bar 4 periods ago. To do.

- countdown phase: Following the setup phase, a countdown is started and a series of 13 additional price bars closes lower (in case of a downtrend) or higher (in case of an uptrend) than the two previous closing price bars. will be counted.

The current nine green candles on the daily chart suggest that a sudden surge in selling pressure could cause Ethereum to reverse in one to four daily candles, or begin a new downward countdown phase before the uptrend resumes.

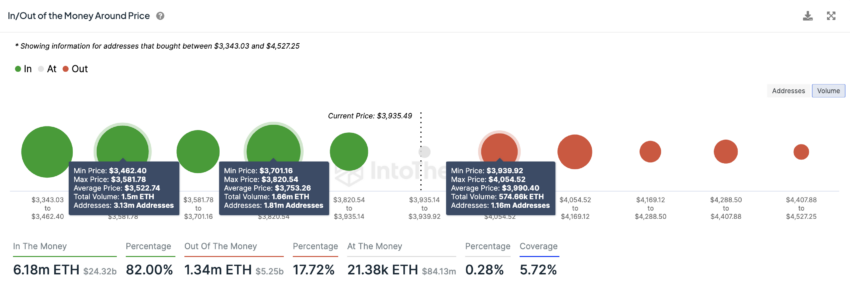

Despite bearish signals from an on-chain and technical perspective, the In/Out of Money Around Price (IOMAP) indicator remains above a key support area that could hold Ethereum in case of a correction. It suggests that there is.

- IO map: This indicator helps to analyze and visualize the distribution of holders' positions relative to the current price. This helps to understand potential support and resistance levels based on the number of addresses holding a particular cryptocurrency at different price levels.

- In the Money: Refers to an address that acquired a cryptocurrency at a price lower than the current market price, indicating a potential support level as the holder is likely to sell it at a profit.

- I do not have any money: Refers to an address that acquired cryptocurrencies at a price higher than the current market price. Indicates a potential resistance level if the holder wants to break even or minimize losses.

Based on IOMAP, over 1.81 million addresses purchased approximately 1.66 million ETH between $3,820 and $3,700. This demand zone could cap Ethereum’s price amid increasing selling pressure. However, if it fails to hold, the next key support area would be between $3,580 and $3,462, with 3.13 million addresses purchasing over 1.5 million ETH.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Meanwhile, the most important resistance barrier for Ethereum is between $3,940 and $4,054, where over 1.16 million addresses previously purchased around 574,660 ETH.

The bearish outlook will be invalidated if Ethereum overcomes this hurdle and secures a daily close above $4,170, which could trigger a new upward countdown phase towards $5,000.

Summary and conclusion

Ethereum co-founder Jeffrey Wilke's recent transfer of 10,000 ETH to Kraken is a sign of broader market activity as investors move large amounts of ETH to exchanges. This trend coincides with increased trading activity, suggesting profit-taking, portfolio rebalancing and possible market speculation by Ethereum holders. ETH balances on exchanges are surging, suggesting increased market volatility may be on the way.

This market move comes at a critical time as the SEC is close to making a final decision on Vaneck's Ethereum ETF, with analysts noting that the chances of approval have increased significantly from 25% to 75%. Such regulatory developments are seen as a positive signal for the broader cryptocurrency market and could pave the way for further institutional investment.

Read more: How to buy Ethereum (ETH) and everything you need to know

The IOMAP indicator shows a strong support level for Ethereum, even though technical indicators suggest a possible short-term bearish trend. This suggests that although there may be a short-term correction, the underlying demand for Ethereum remains strong. Long-term holders appear to be confidently continuing to accumulate ETH, which bodes well for future price stability and growth.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although BeInCrypto strives to produce accurate and unbiased reporting, market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.