- Since Dencun, Ethereum daily fees have fallen by a quarter.

- Lower fees have alleviated deflationary pressure on Ether.

Recently enabled Dencun upgrade created Ethereum [ETH] Scaling solutions are much more affordable and can reduce transaction fees by as much as 90% in some cases.

However, while much of the hype centered around cost benefits, commonly referred to as Layer 2 (L2), the base layer also appeared to benefit from significant technological changes.

Ethereum’s daily fee income drops significantly

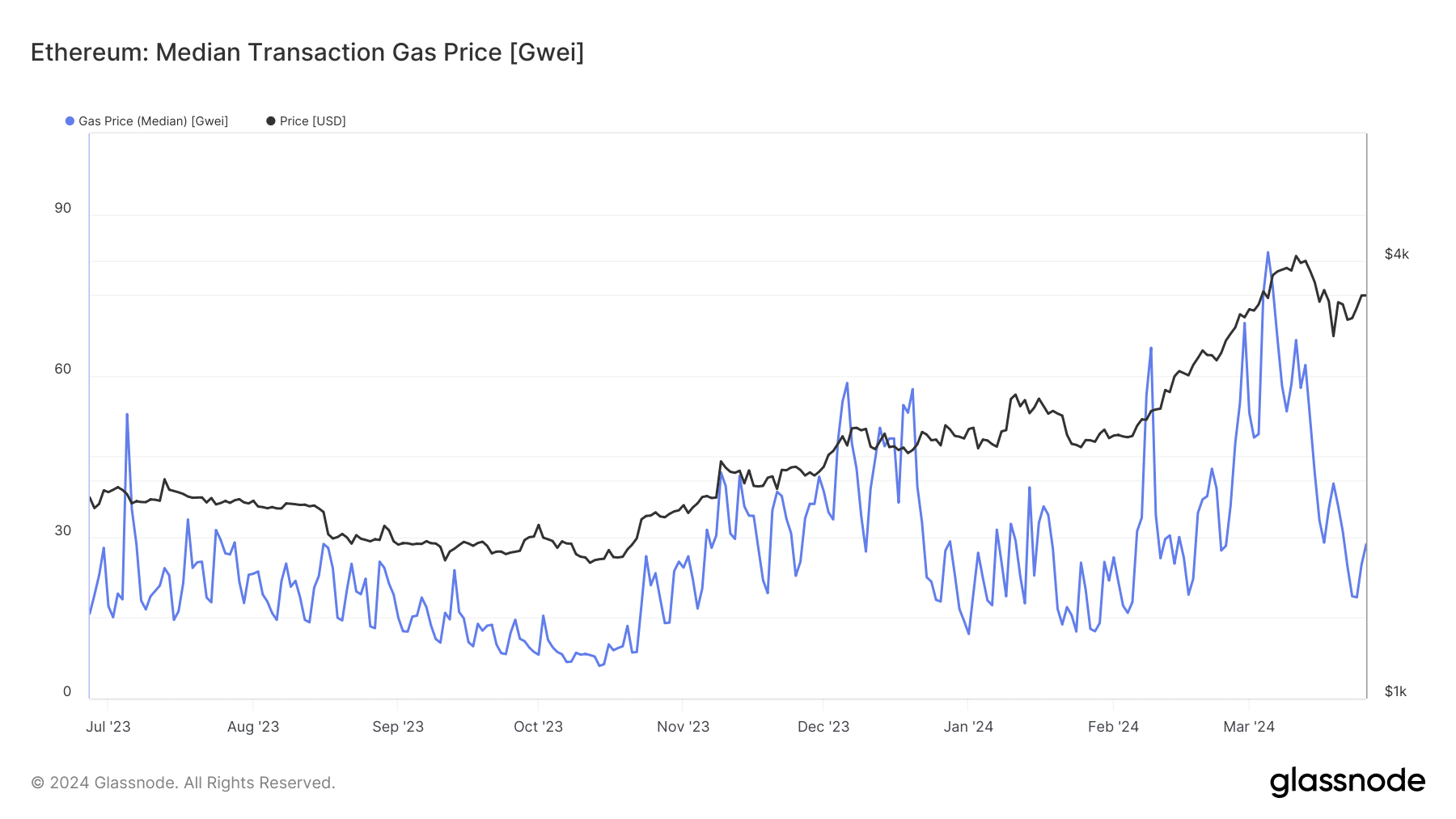

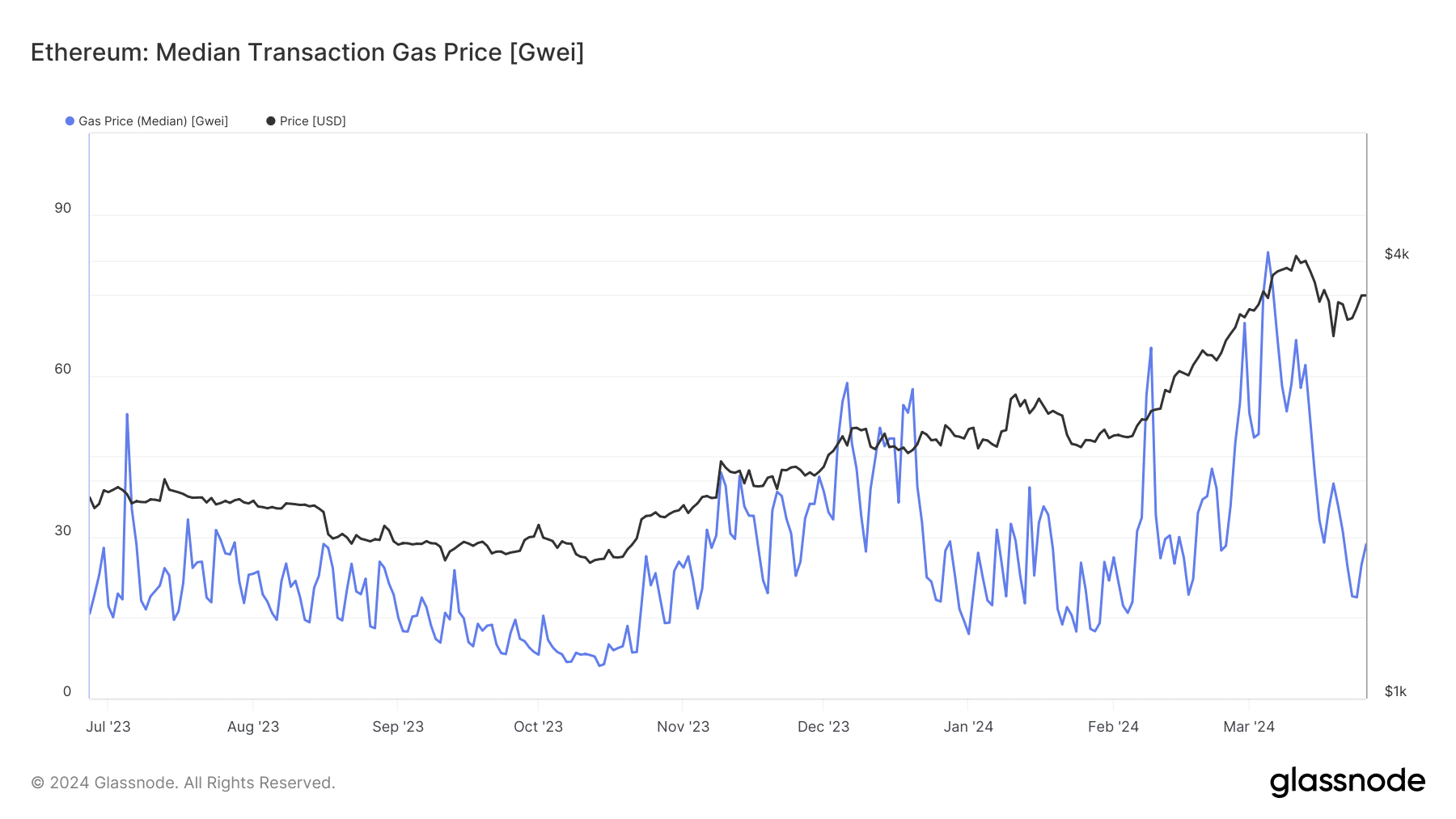

According to X (former Twitter) user David Alexander II, mainnet gas prices have fallen sharply since Dencun's execution on March 14, and the number of daily transactions has remained roughly the same.

Notably, prior to Dencun, Ethereum processed an average of 1.23 million transactions per day and collected an average of approximately $28.7 million in fees per day.

Now, the number of transactions is the same, but the fees have dropped to $7.7 million.

Source: Nansen

AMBCrypto investigated further using data from Glassnode and found that the average fees paid per Ethereum transaction have dropped significantly over the past two weeks.

Source: Glassnode

Faded meme coin mania is also criticized

While Dencun may have indirectly contributed to lower Ethereum fees, it is important to note that one of the main reasons for the downturn is the decline in memecoin enthusiasm, as previously reported by AMBCrypto. It was important.

Fees remained high in early March, when Ethereum-based meme tokens like Pepe emerged. [PEPE] and Shiba Inu [SHIB] The value soared.

However, as the month progressed, traders began to focus on Solana. [SOL] Seeking higher profits from the swarm of meme coins issued through pre-sales.

Is your portfolio green? Check out our ETH Profit Calculator

ETH deflation rate slows down

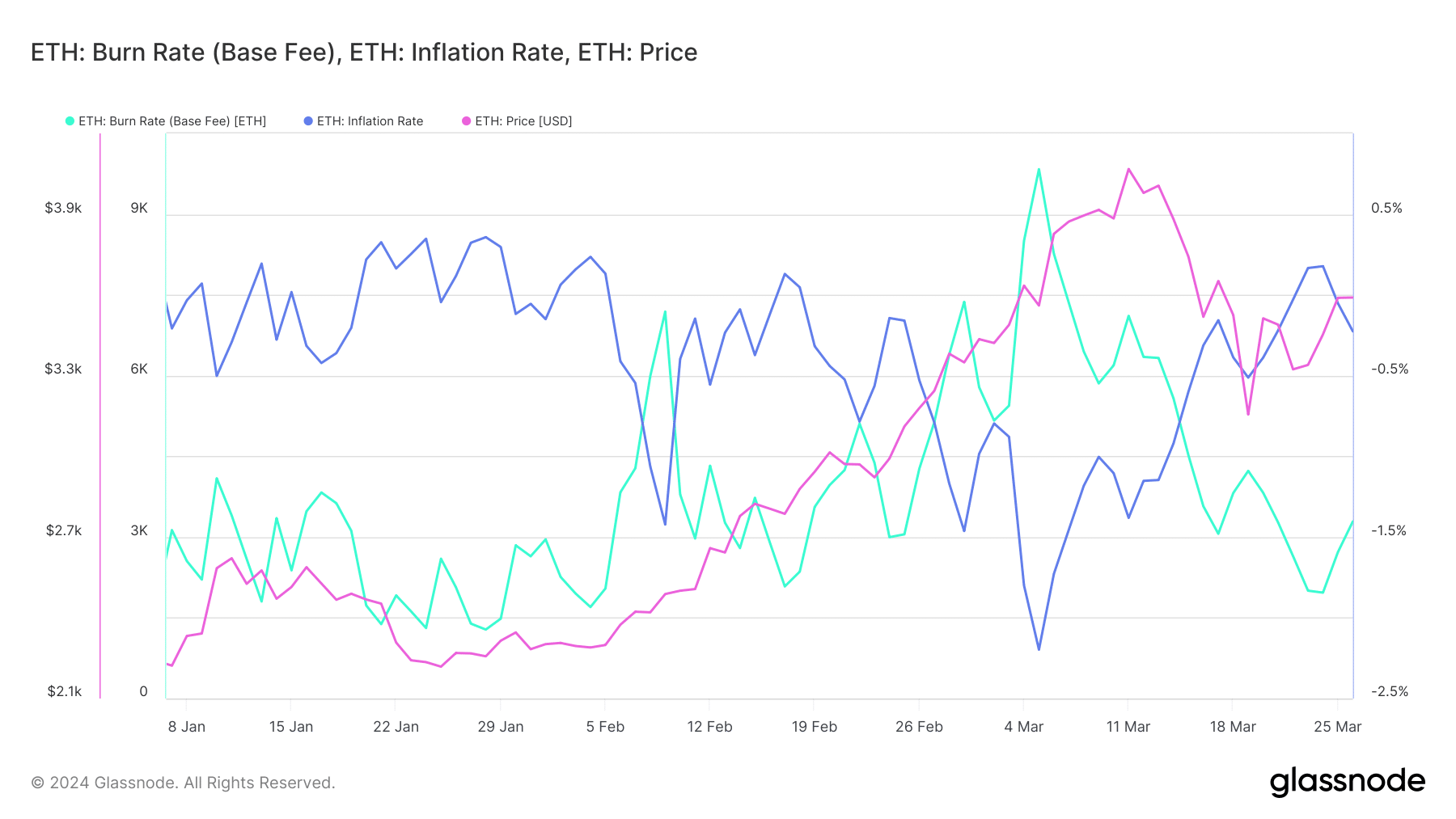

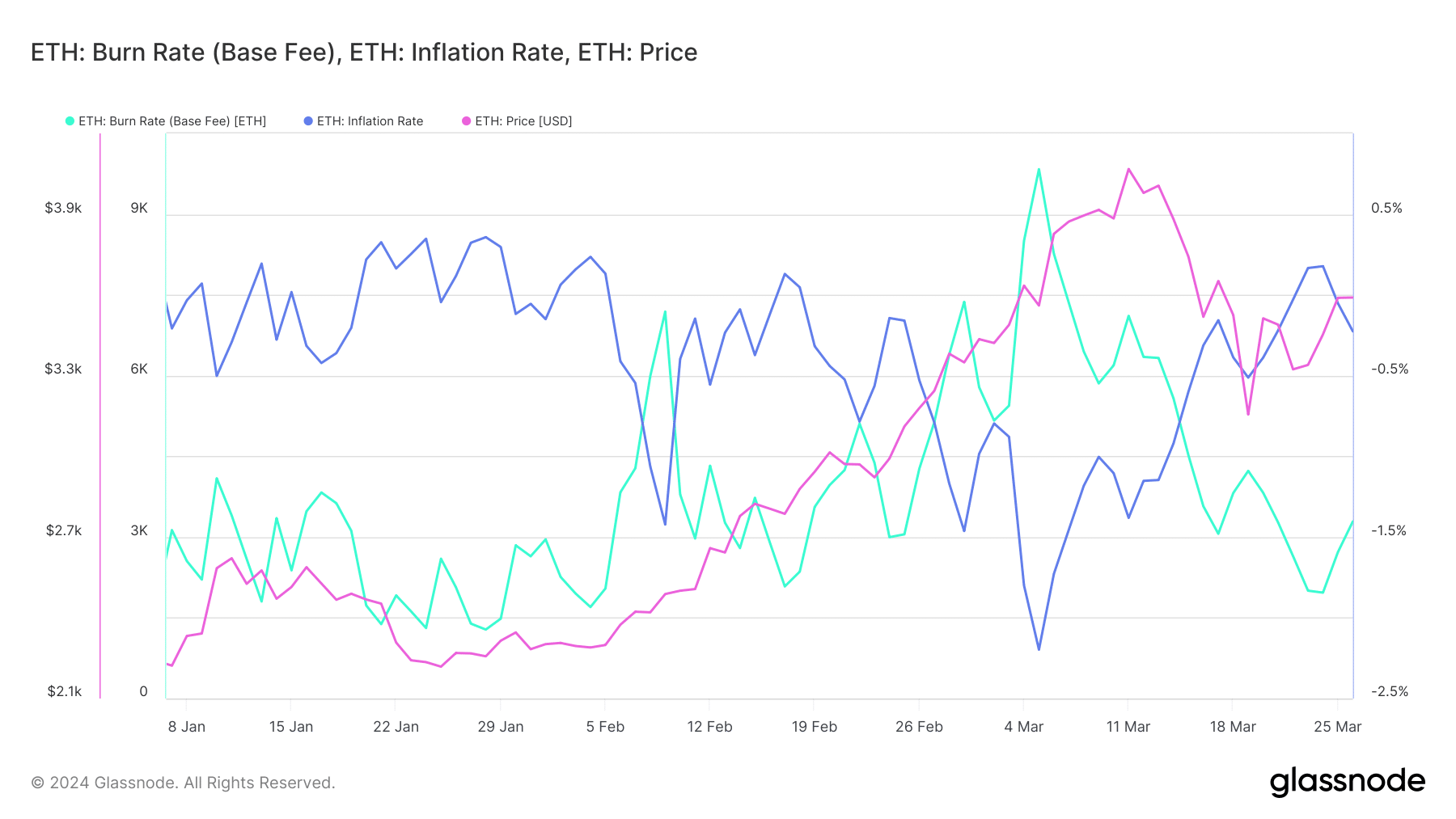

As Ethereum mainnet fees have decreased, the rate at which the supply of ETH coins is being exhausted has slowed down.

Please note that a set amount of ETH will be burned for each transaction. This corresponds to the minimum amount required for a transaction to be considered valid, i.e. the base fee.

As is clear, the burn rate has fallen sharply in recent weeks, pushing up the inflation rate. The reduction in deflationary pressure likely played a role in the 12% decline in ETH since Denkun.

Source: Glassnode