- As the election cycle draws to a close, Ethereum could become more liquid.

- However, various factors cast doubt on the possibility of that rebound.

With just a week left until the election, crypto markets are poised to become more liquid and a potential catalyst for Ethereum [ETH] To get out of the doldrums. This could indicate a promising buying opportunity as ETH is sitting on a favorable greed index.

But uncertainty clouds the rebound. If the previous pattern repeats, Solana could capitalize on the Bitcoin market peak again. As recently, BTC has seen strong daily gains for four days despite a pullback, which could limit the prospects for ETH's recovery.

As a result, if market conditions are favorable, this weekend could be crucial and set the stage for ETH to move towards the $3,000 mark.

Ethereum’s core metrics face pressure

This cycle has been particularly difficult for Ethereum. Despite a 40% increase in daily active addresses. main net and Layer 2 networks, ETH price has not kept up, slumping nearly 7% after closing at $2.7,000 just a week ago.

Compounding these problems is the fact that Ethereum's network fees have reached record lows, lagging behind competitors such as Solana. This creates further challenges for Ethereum. Prices this low can raise concerns about network security.

Overall, a combination of factors has prevented ETH from capitalizing on Bitcoin's peak. Investors are increasingly uncertain about the future of Ethereum and see great potential in other blockchains.

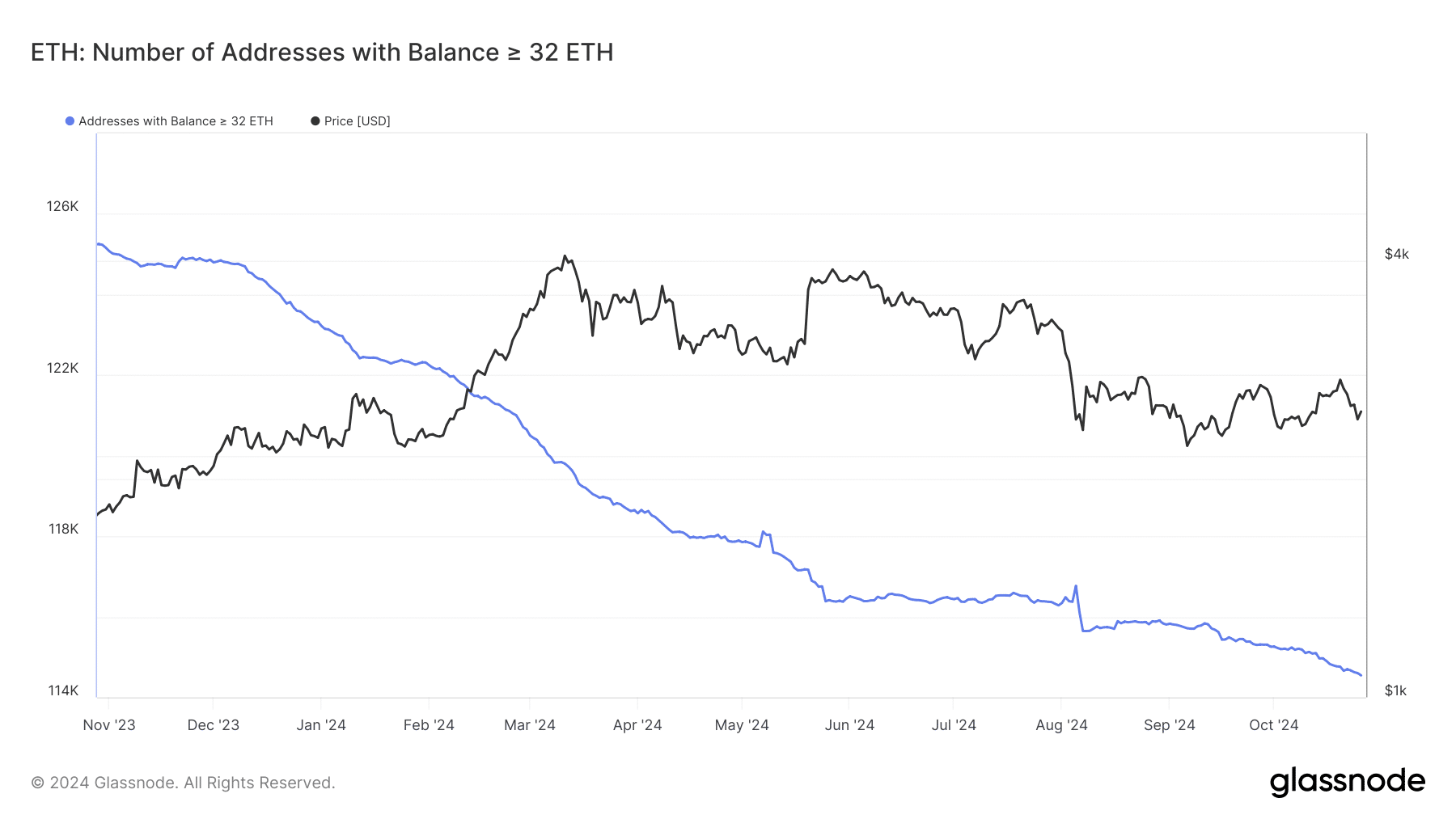

Source: Glassnode

Source: Glassnode

In addition to these challenges, the number of validators on the Ethereum network has decreased significantly and staking wallets are at their lowest in a year. The proof-of-stake (PoS) consensus mechanism requires a minimum of 32 ETH to stake, but this reduction in validators raises concerns about the overall health of the network.

Delays in transaction validation can cause network congestion and drive users away. This cycle will see a noticeable shift from ETH to SOL, with Solana's high throughput allowing for faster transaction speeds and lower fees.

This trend highlights Ethereum's struggle to maintain its user base.

Electoral fluidity alone is not enough

If the network does not address these challenges, the election buzz could only bring ETH short-term gains and lack the power needed for a true breakout.

Ethereum needs to reinvigorate its market power, which declined significantly in the last market cycle and is currently at just 13%, its lowest level against Bitcoin since April 2021. There is.

A high Bitcoin dominance usually signals the start of an altcoin season, but if this trend does not reverse, ETH may struggle to regain its leading position in the market.

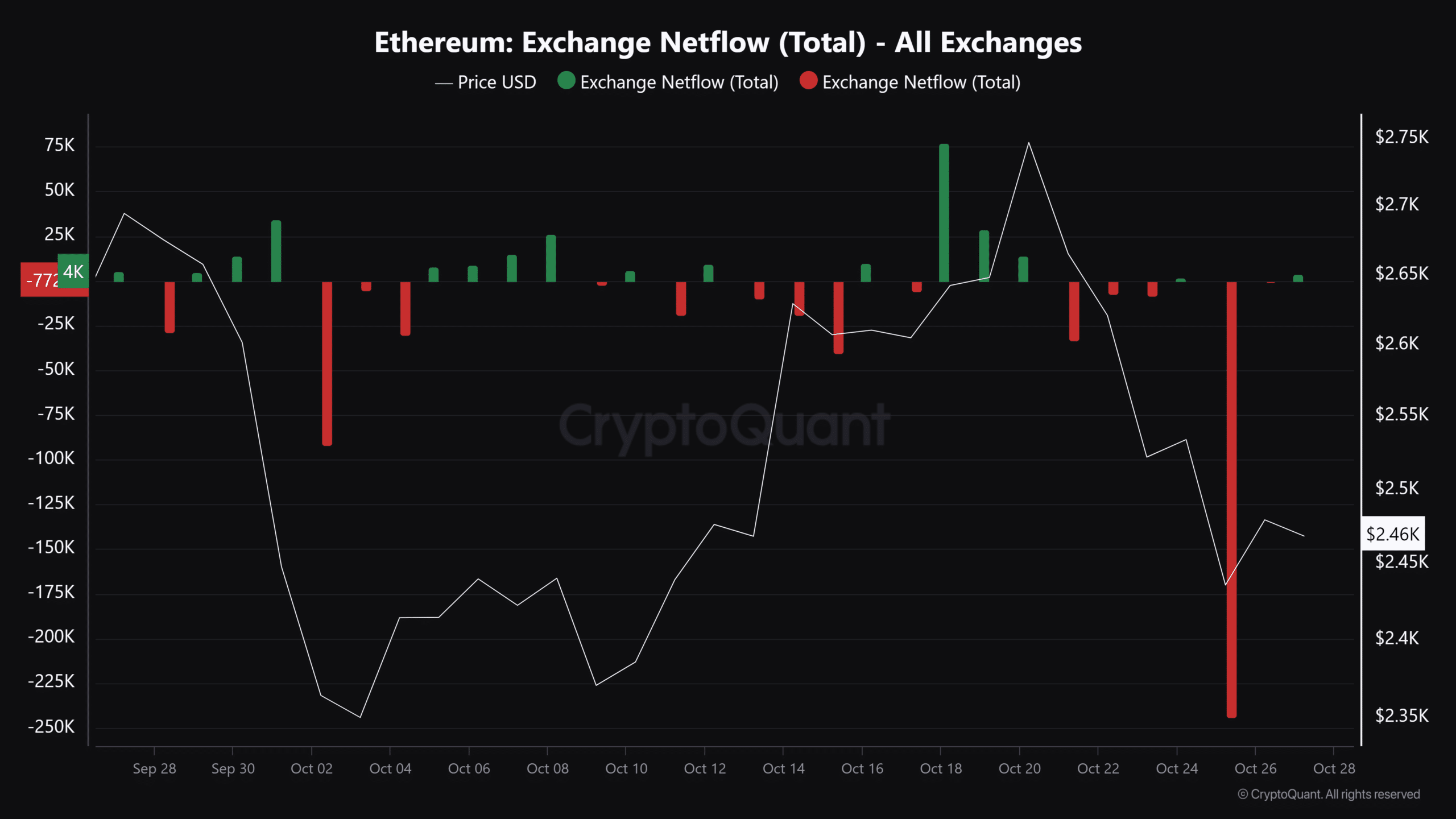

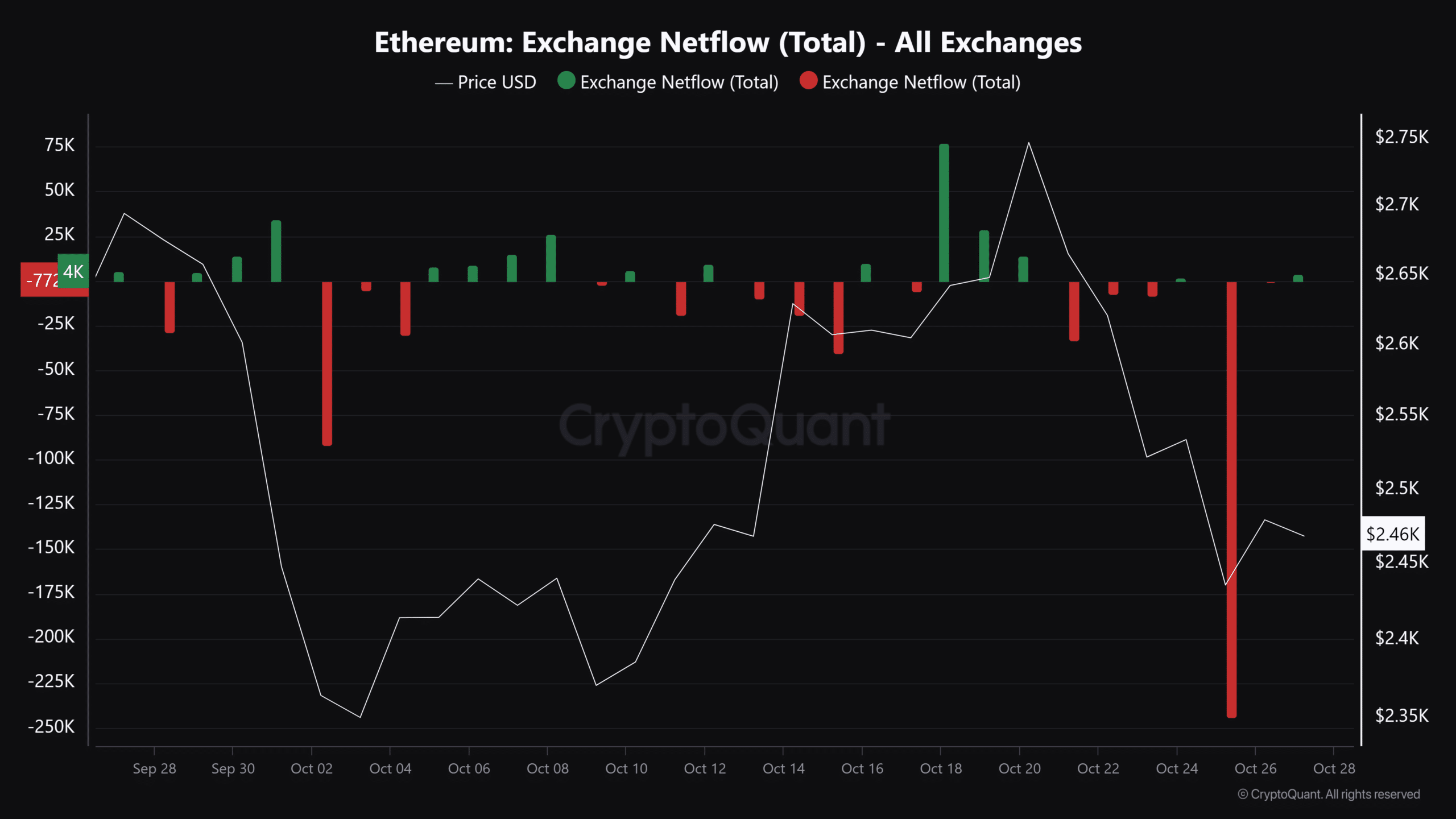

Source: CryptoQuant

Interestingly, just two days ago a spike in ETH outflows occurred, with 244,000 ETH withdrawn from the exchange. This suggests that investors perceive the current price as a push and could help the bulls hold the $2.4,000 support line.

However, there was no effect on prices.

read ethereum [ETH] Price prediction for 2024-2025

That said, there is a good chance that ETH will rise in the short term as the election draws to a close. This could reverse the current trend and help the bulls contain bearish pressure.

However, unless Ethereum can maintain network health, the prospects for Ethereum to emerge from the doldrums remain limited. If these issues are not addressed, there is a significant risk that the current underperformance will become a permanent trend and jeopardize ETH's market position.