Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has seen turbulent market performance in recent weeks. Despite the bearish sentiment and network decline, Ethereum price is showing signs of recovery. Currently, the live price of Ethereum is $2,916.04 with a 24-hour trading volume of $6,041,178,931. The cryptocurrency experienced a slight increase of 0.49% in the past 24 hours and maintains its position as an important player in the digital asset space.

ETH/USD 24-hour price chart (Source: CoinMarketCap)

Speculative divergence and short-term holder concerns

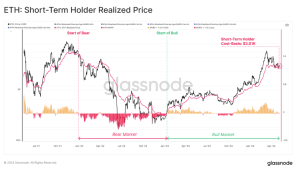

A recent newsletter from analytics firm Glassnode highlighted Ethereum’s underperformance compared to Bitcoin in the current market cycle. Following the halving of Bitcoin's block subsidy in April, the prices of both BTC and ETH fell.

but, ethereum The correction was significantly shallower than Bitcoin's correction, indicating some market resilience. Nevertheless, Ethereum’s deepest drawdown this cycle reached -44%, which is significantly higher than Bitcoin’s -21%.

Short-term holders (STH) who hold ETH for 155 days or less are particularly at risk. Their total cost basis is at around $3,000 level, so further price declines could push these investors into losses. Analysis of Glassnode’s Market Value vs. Realized Value (MVRV) indicator suggests that if Ethereum experiences further downward volatility, these investors may panic and sell their holdings.

Inflation trends after Dencun upgrade

Recent Denkun upgrade has brought about a change in Ethereum’s supply dynamics, ending its deflationary trend. According to CryptoQuant data, from March 12th to May 7th, the total supply of Ether increased from 120 million to 120.1 million.

This inflationary trend appeared because the amount of Ether burned decreased due to the reduction in transaction fees after the upgrade. Despite this change, Ethereum's fundamental value remains strong, especially its usefulness for decentralized applications (DApps).

Long-term holder behavior and market psychology

Long Term Holder (LTH) Ethereum I take a more patient approach. According to Glassnode, these investors typically hold their stocks for more than six months and are in no rush to sell, despite the positions being profitable. This move is in contrast to previous market cycles that saw increased selling when LTH hit new all-time highs. Their current reluctance to sell suggests confidence in Ethereum's long-term potential.

Market sentiment remains cautious due to US regulatory developments, particularly regarding the approval of Spot Ether exchange traded funds (ETFs). However, as reported by Glassnode, the increase in new Ethereum addresses indicates increased interest in the Ethereum ecosystem and a potential influx of new investments.

ETH derivative data analysis

Additionally, options open interest increased slightly by 1.63% to $6.38 billion. This increase indicates that while trading volume is down, there are more options contracts outstanding, meaning traders are holding positions longer or preparing for future market movements. It suggests that

However, the total trading volume of Ethereum derivatives has decreased significantly by 44.97% and now stands at $12.38 billion, according to Coinglass. This sharp decline indicates a decline in trading activity and perhaps less investor engagement or market speculation.

Analyst views on the future of Ethereum

A prominent cryptocurrency analyst gives his opinion on Ethereum price trends. Analyst Michael Van de Poppe predicts a significant market reversal for ETH in the coming weeks, which has garnered a lot of attention within the crypto community. Similarly, experienced market analyst Peter Brandt analyzed Ethereum's price chart and found that although the pattern is too thin to be considered a flag, a possible channel pattern could cause the price to move in either direction. It suggests that it is suggestive of sex.

This is a very likely scenario #Ethereuma delay/rejection of less than two weeks would be a major reversal moment for . $ETH And the market. pic.twitter.com/kBir6ghcJD

— Michael van de Poppe (@CryptoMichNL) May 10, 2024

Despite widespread skepticism in the market, there are signs of a potential recovery for Ethereum. The Relative Strength Index (RSI) on the 4-hour chart indicates a short-term upside potential. As Ethereum continues to navigate these difficult market conditions, the broader cryptocurrency community continues to watch and anticipate significant changes that could reshape the digital asset landscape.