- Ethereum ETF outflows have weakened demand for ETH, signaling low investor interest.

- Open interest fell sharply, but top traders took long positions, suggesting a shift may be coming.

Ethereum [ETH] Despite growing hopes that ETFs would drive demand, there have been recent outflows from ETFs.

Many analysts have observed this and some believe this is the reason ETH is experiencing weakness.

Wu Blockchain reported that net outflows into the Ethereum Spot ETF peaked at $15.114 million on September 17.

Next, looking at the data for Ethereum ETFs, we can see that most ETFs did not record positive flows throughout the week. Outflows were dominant throughout the week.

The exodus of Ethereum ETFs may have had a significant impact on ETH’s recent performance, as the latter coincided with a cooling in sentiment and, as a result, a drop in network activity.

Investor excitement is also evident in ETH’s latest price movements: Bitcoin has risen by over 14% from its current monthly low, while ETH has only risen by around 7.7%.

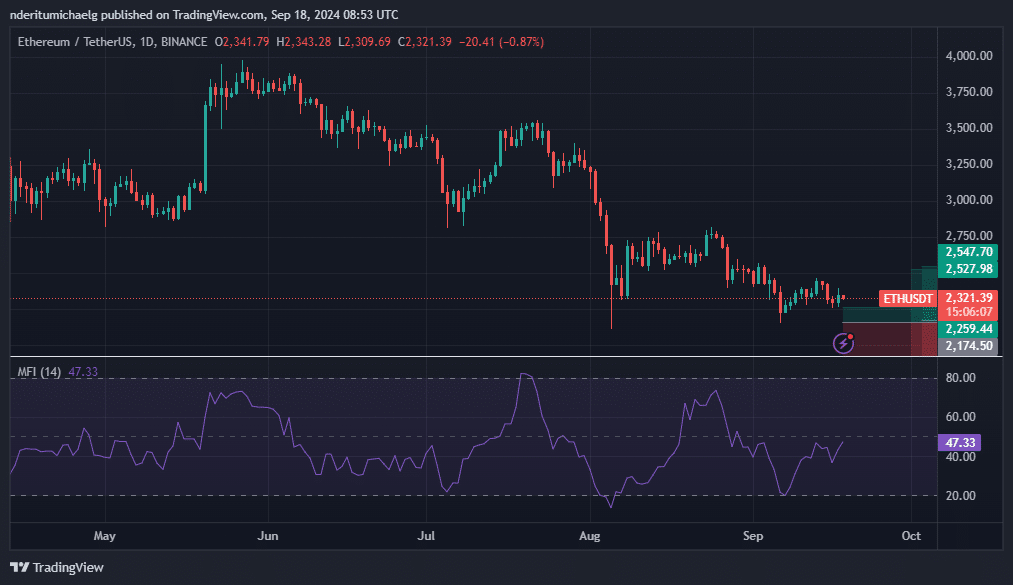

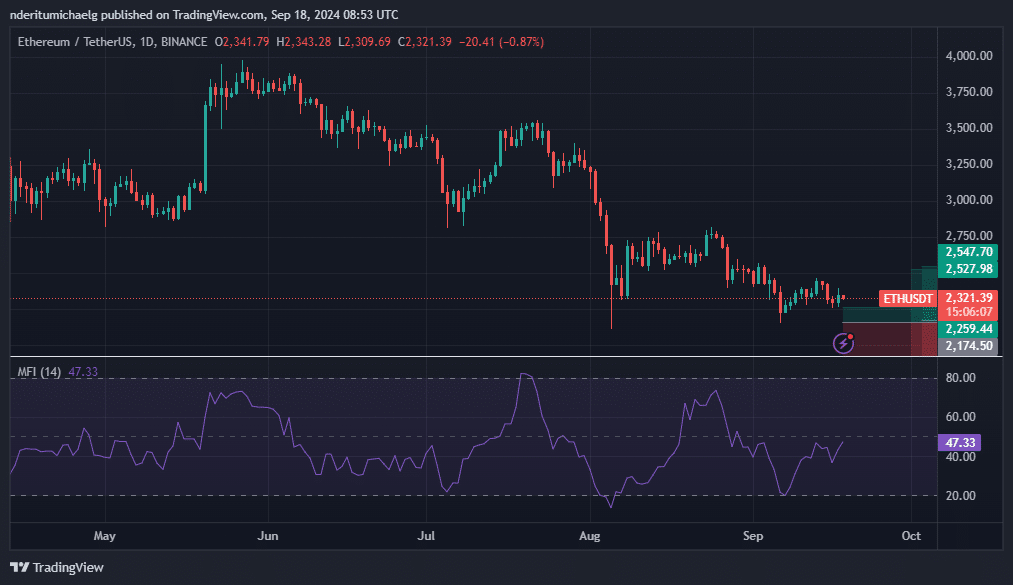

This highlighted the declining demand for ETH, with the cryptocurrency trading at $2,321 at the time of writing.

Source: TradingView

ETH’s RSI is struggling to rise above the 50% level, confirming low bullish momentum. Nonetheless, the MFI indicates that there is still some liquidity flowing into the coin, albeit in small amounts.

Can ETH make a strong comeback?

A strong rally is not entirely impossible: ETH’s current woes are the result of a confluence of factors, including ETF outflows and a decline in on-chain activity.

However, a shift in these factors could see a return of robust demand, especially if Ethereum ETFs start seeing healthy inflows.

ETH’s current price level can also be considered a healthy area, however, it is currently full of uncertainty, which is also affecting its performance in the derivatives space.

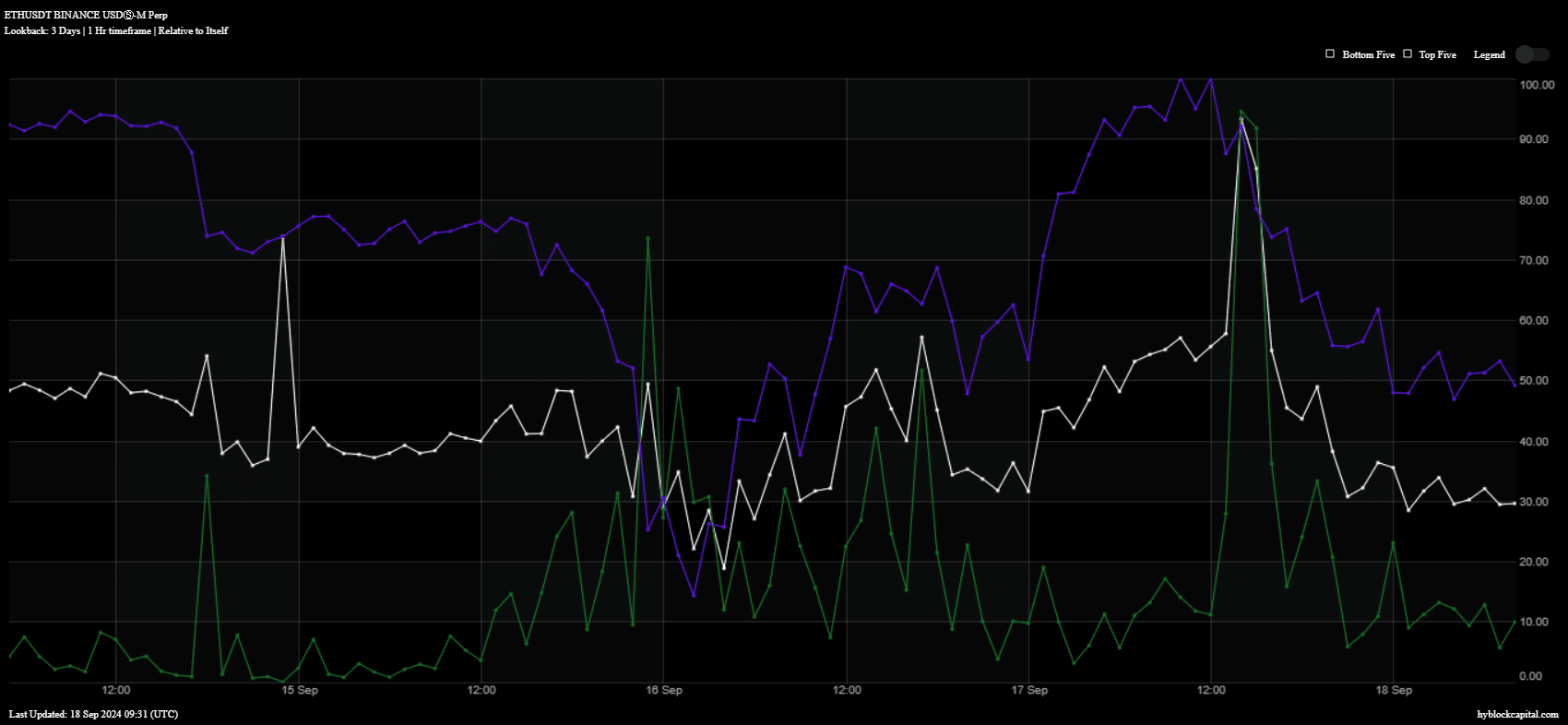

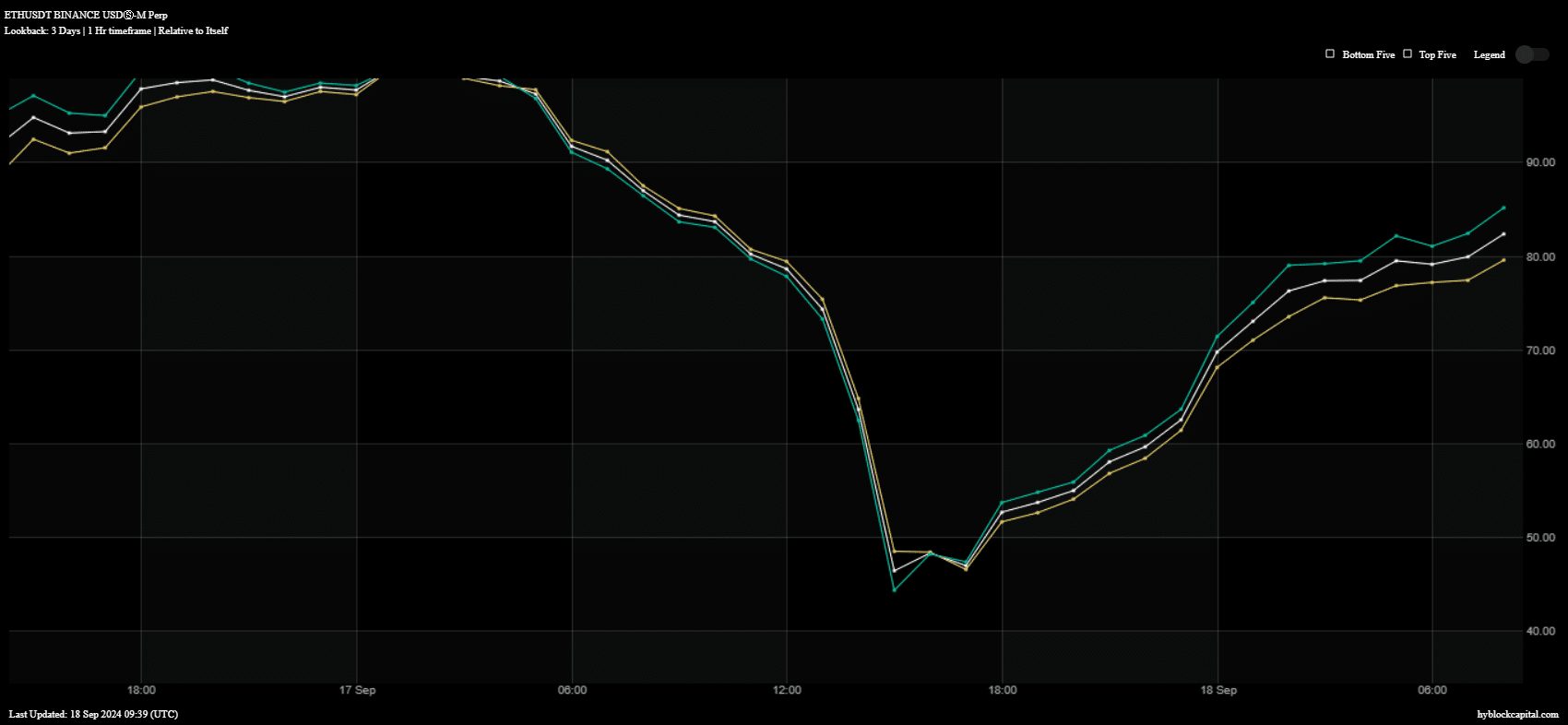

For example, the level of open interest (blue) has plummeted in the past 24 hours. We have also observed a decline in buying volume (green) over the same period.

Source: Highblock Capital

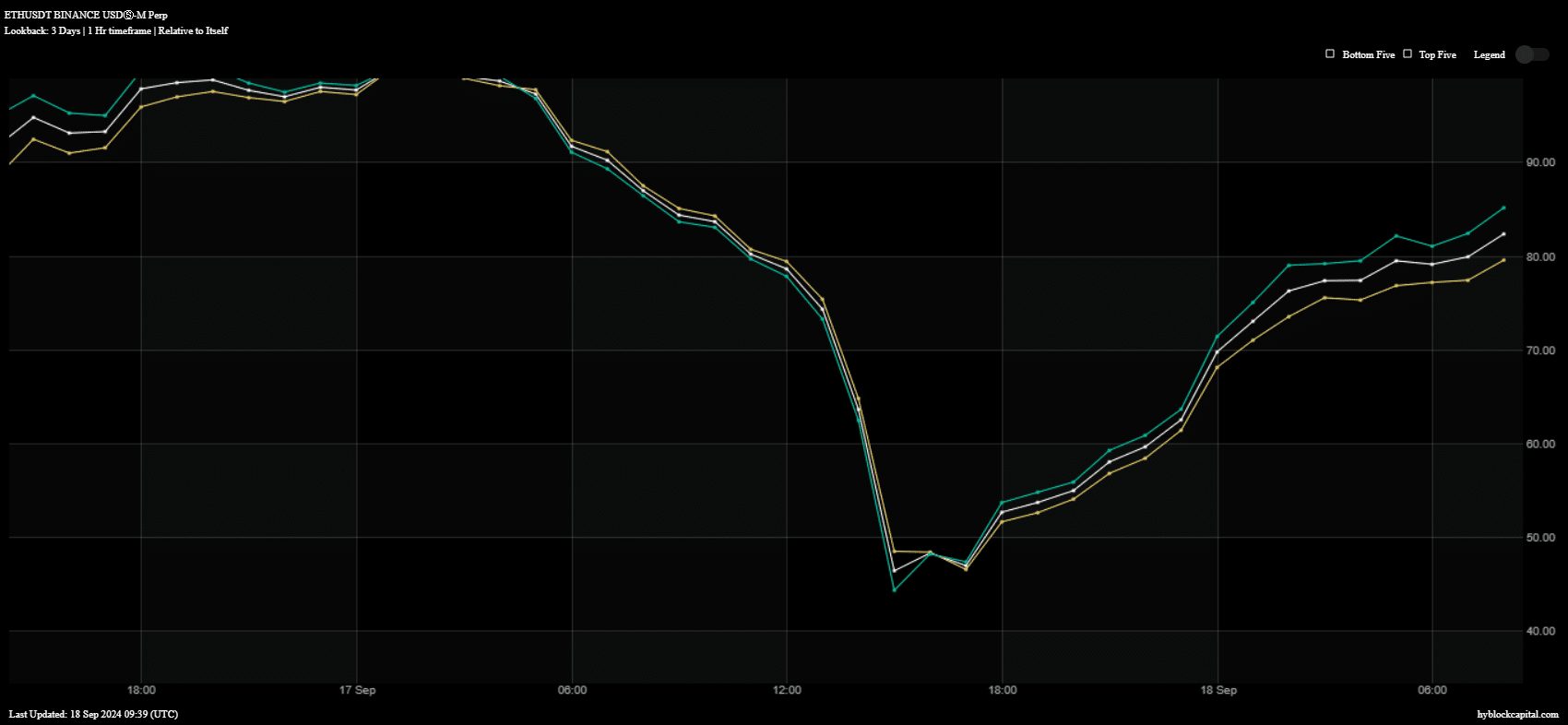

There were also indications that these results in ETH’s performance could also be linked to whale manipulation: the number of longs among top traders decreased during Tuesday’s trading session.

However, it rebounded again, suggesting that top traders are back in bullish mood.

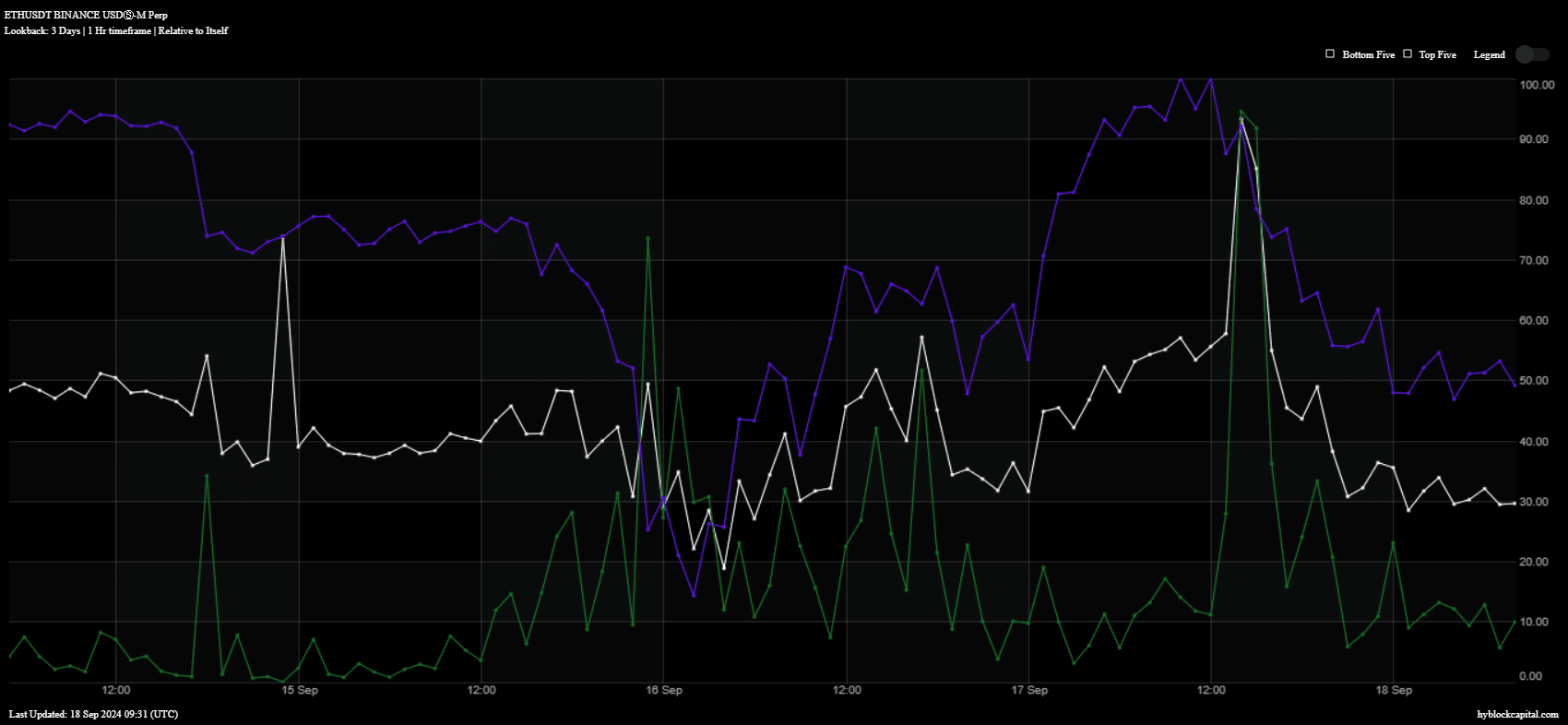

Source: Highblock Capital

Ethereum [ETH] Price forecast 2024-2025

ETH longs among top addresses (green) and global longs (yellow) have rebounded significantly over the past 24 hours, suggesting that ETH bulls may gain momentum heading into the weekend.

However, this depends on whether ETH can aggregate enough demand and momentum to put the price back on an upward trajectory.