- Ethereum could soon fall into the $3,000 psychological support zone

- The indicator showed a strong buy signal, but there's more that investors need to consider

Recently, Ethereum [ETH] Behind the scenes, we can see bearish sentiment growing stronger.In fact, in his Santiment post on X (formerly Twitter), both Bitcoins [BTC] And in Ethereum, there was an increase in bearish posts ahead of the halving.

Negative social media engagement turned positive on April 18th, with BTC rebounding to $64.1,000 and ETH to $3,094. AMBCrypto analyzed other indicators to understand whether investors should buy ETH now.

Lower gas prices could be a disguised threat

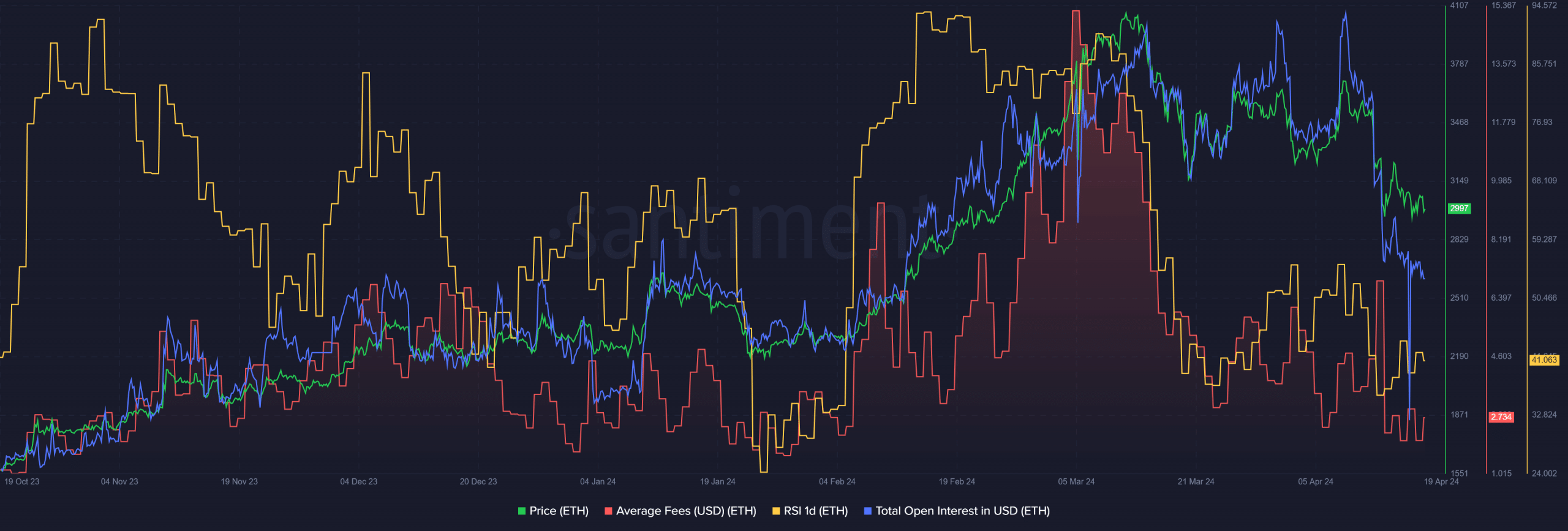

Source: Santiment

AMBCrypto noted that Ethereum’s open interest has decreased dramatically over the past 10 days. From a peak of $7 billion on April 9th (Ethereum price: $3,638), it has fallen to $4.6 billion (Ethereum price: $2,997) at the time of writing.

The sharp drop in OI meant speculators were afraid to go long and lacked bullish belief. I conveyed my weak feelings. The daily RSI has also been below neutral 50 for most of the period since March 18th. This suggests that momentum has continued in favor of sellers over the past month.

Average rates on the network are also decreasing. He highlighted in his recent AMBCrypto report that while this is a positive for users, it also points to a decline in demand for transactions on the blockchain.

Address purchase opportunities

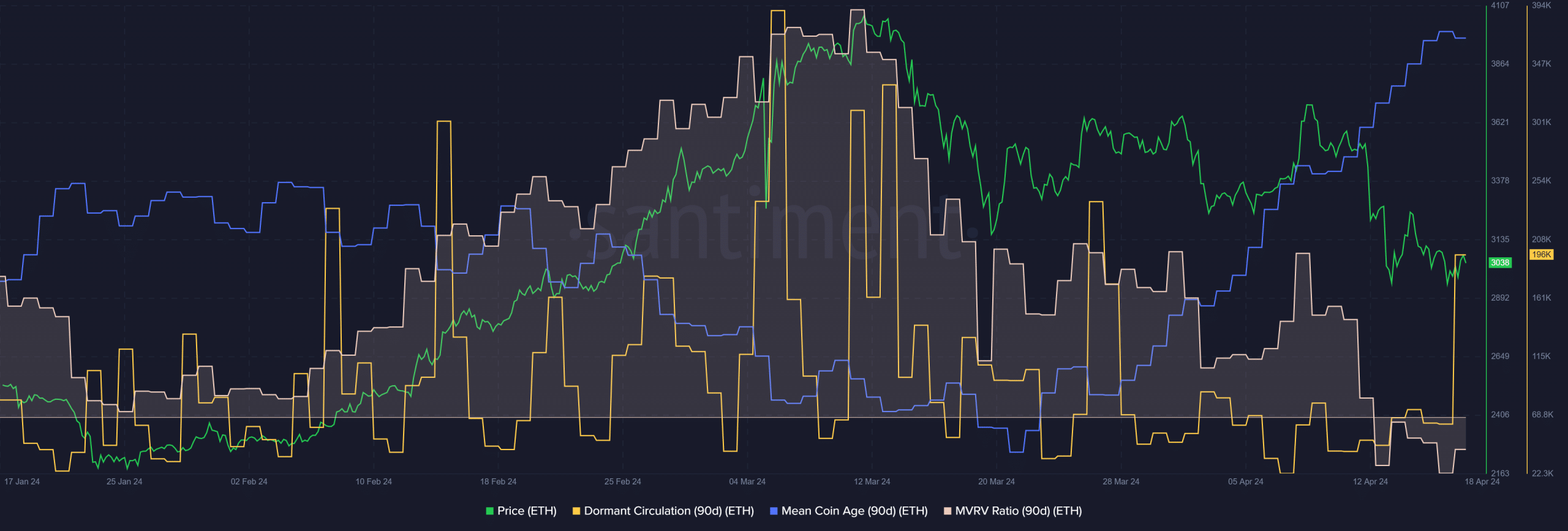

Source: Santiment

The $3,000 psychological support zone would have been a great buying opportunity a month ago. It may yet be proven. At the time of writing, the 90-day MVRV ratio was below zero, indicating that the asset was undervalued and holders were incurring losses.

However, the average age of the coins has been trending steadily upward over the past three weeks. Together they signaled investors to buy Ethereum.

Is your portfolio green? Check out the Ethereum Profit Calculator

Still, dormant circulation spiked significantly on April 18th. This highlights a sharp movement in the token and could foretell a wave of selling. Furthermore, at the time of this writing, Bitcoin was barely clinging to the $61,000 support zone.

Patience and caution can be very beneficial to investors. Further declines remain likely. Considering the recent overheating of the market, it is likely that the price will decline for another month or two after the halving.