- Ethereum has surpassed 5 million active addresses across its mainnet and layer 2 networks.

- Despite this surge in network activity, the price has remained stable, trading at around $2,642.

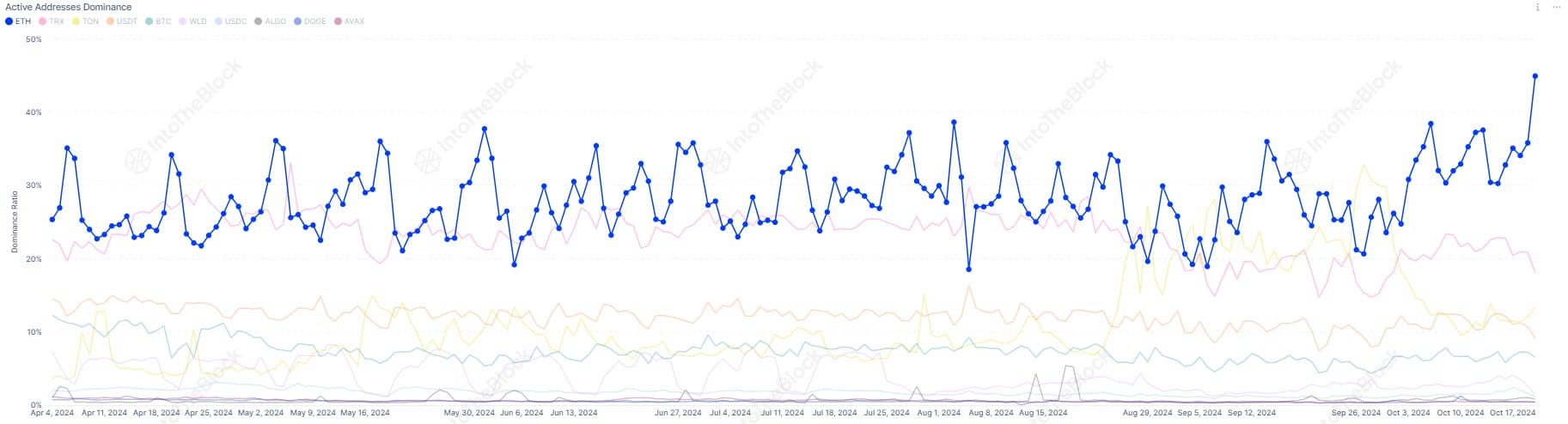

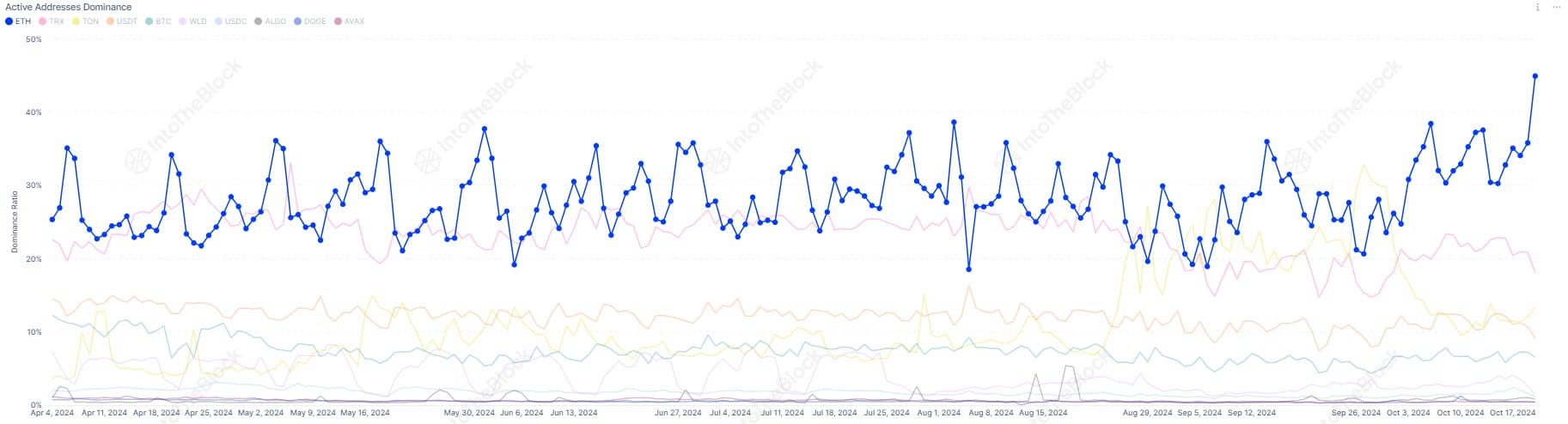

Data shows Ethereum [ETH] leads among Layer 1 (L1) and Layer 2 (L2) platforms in terms of active addresses. As of October 2024, over 5 million active addresses have been recorded across the Ethereum mainnet and its L2 network.

This increase in active addresses is an important indicator of Ethereum’s growing dominance in the blockchain space. However, the key question is whether Ethereum's price has responded to this surge in network activity, or is there a disconnect between its usage and market performance?

Ethereum recognizes the advantage of active addresses

Analyzing Ethereum’s active address chart on IntoTheBlock reveals that Ethereum is outgrowing other networks. Data shows that Ethereum currently occupies a dominant position, with a notable increase in daily active addresses on both its mainnet and layer 2 solutions such as Arbitrum and Optimism.

Source: Into the Block

This surge in activity has pushed Ethereum's share of active addresses to over 40% due to multiple factors. The development and increasing adoption of L2 networks is playing a pivotal role in driving Ethereum's network usage.

Furthermore, the data shows that active addresses have consistently increased throughout 2024, with a significant spike in early October.

Has Ethereum’s price reacted to this network growth?

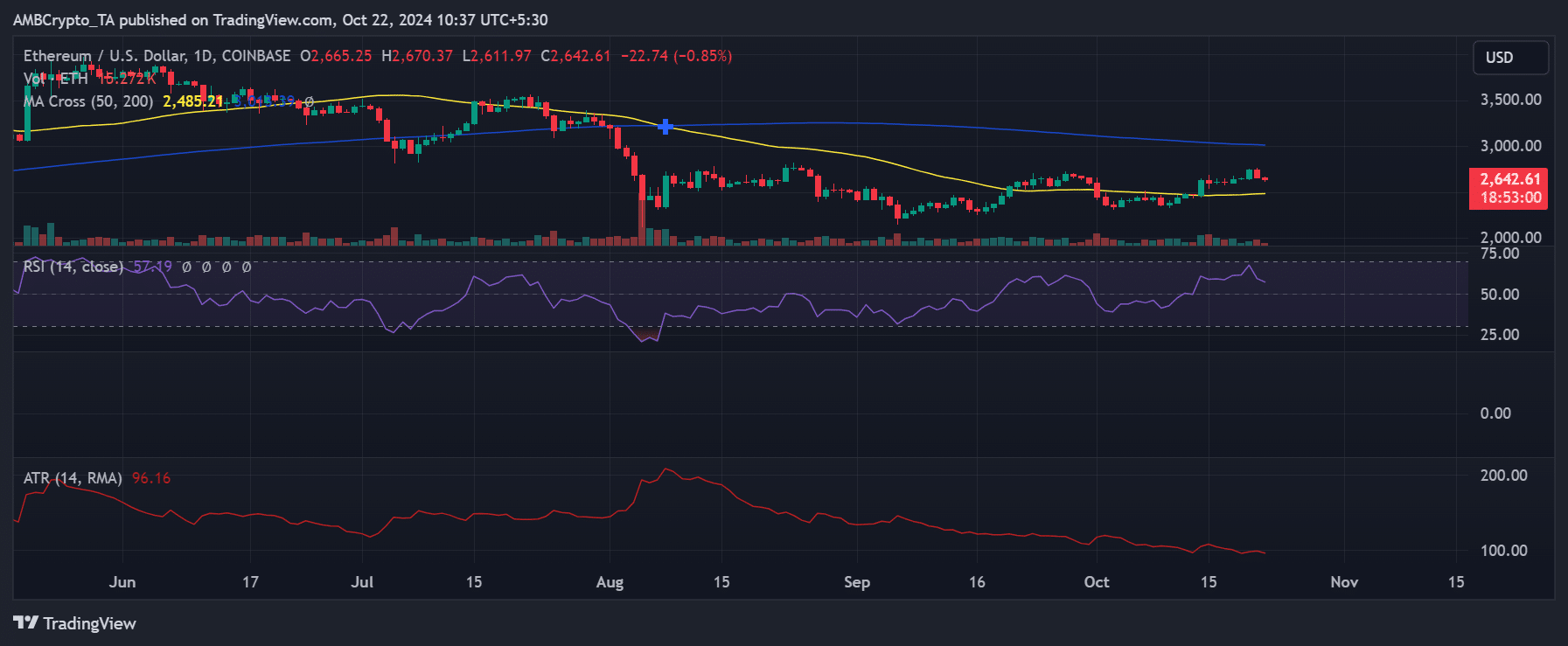

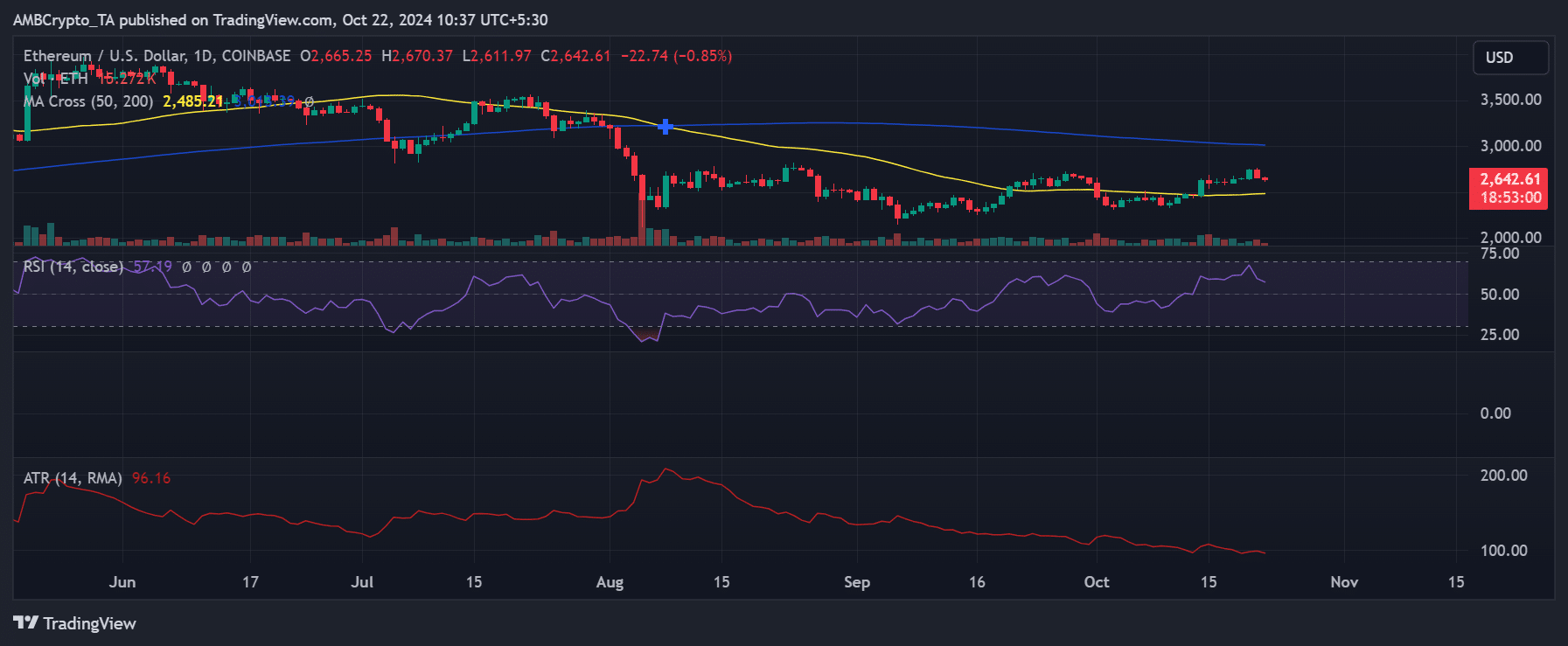

Despite the significant increase in active addresses, Ethereum price fluctuations remain relatively modest. As of October 22, 2024, Ethereum is trading at $2,642, registering a slight decline of 0.85% in the past 24 hours.

The price is fluctuating between $2,600 and $2,670, with support near the 50-day moving average at $2,485.

Source; TradingView

Although the increase in active addresses indicates that ETH is becoming more useful, the price has not yet fully reflected this increase in network activity. The Relative Strength Index (RSI) is currently at 57.19, indicating neutral market momentum with neither overbought nor oversold conditions.

Additionally, the average true range (ATR) of 96.16 indicates a slight increase in volatility, but not enough to suggest a large price move.

These indicators suggest that even though ETH usage is increasing, external market factors and broader investor sentiment are playing a larger role in determining price movements.

ETH price continues to catch up

The increase in active addresses highlights the expansion of Ethereum's ecosystem and growing demand.

With continued adoption of Layer 2 networks and strong staking participation (over 34 million ETH currently staked), if Ethereum can maintain this momentum, the price could catch up with on-chain growth.

Read Ethereum (ETH) price prediction for 2024-25

However, despite these positive signals, ETH price remains cautious. Technical indicators are showing mixed signals, suggesting that while the ETH network is thriving, the market may be waiting for a stronger catalyst to push the price higher.