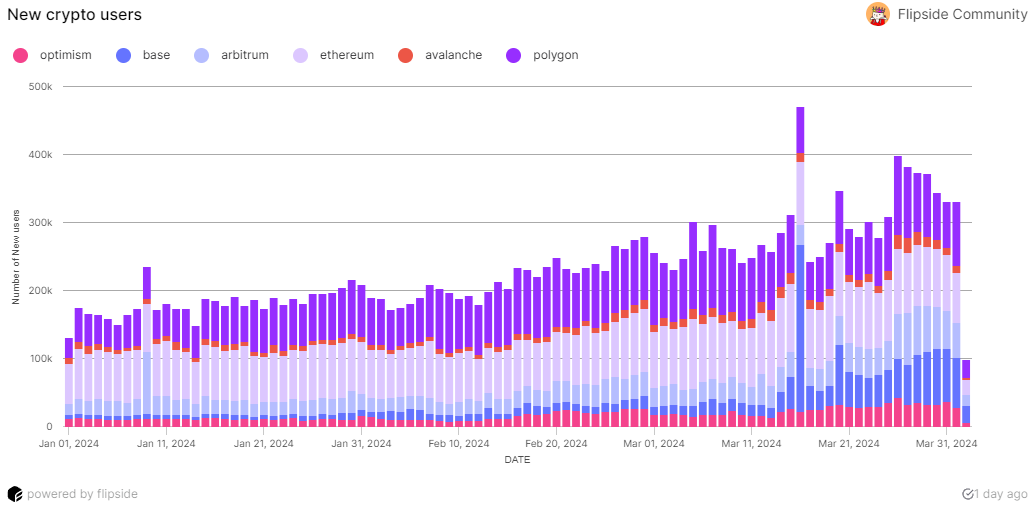

Ethereum and Polygon lead against new Ethereum Virtual Machine (EVM) chains in new user acquisition and transaction volume growth, as revealed in Flipside’s “New EVM Users: Q1 Snapshot” report is maintained.

As of March 27, Ethereum had 13.4 million new users and Polygon had 12.3 million new users, accounting for approximately 70% of the total number of new EVM users this year. In contrast, Arbitrum has added 4.7 million users since the beginning of his 2024 year.

While Ethereum’s mainnet maintains its historical dominance, layer 2 protocols are processing more data. Decentralized finance (defi) continues to be a key attraction for new users, with Ethereum leading the way in Q1 trading volume with $12 billion.

Additionally, the upward trend in DeFi activity contrasts with the intermittent and volatile fluctuations of the previous year, indicating growing interest and participation in DeFi among newcomers to the blockchain space.

Arbitrum ranks second on the list with $9.5 billion in profits since the beginning of 2024. The Flipside report attributes this milestone to increased new user activity in Arbitrum's defi space. In contrast, Polygon's high new user count is due to increased non-fungible token (NFT) activity.

With a record 243,000 new users as of March 16, Base has grown its new user base by nearly 8x since January, thanks to Coinbase's efforts to simplify cryptocurrencies for beginners. It is increasing to

“While Base still lags far behind the major EVM chains in terms of overall new user numbers, it has nevertheless seen impressive growth, especially since the chain's activity declined in the last few months of 2023. ”, the report states.

The report notes that this spike coincides with Bitcoin hitting a new all-time high, and marks the highest daily new user count of any EVM chain this year. are doing.

As a sign of diversity, a significant portion of newly registered users are working with various decentralized applications (dApps) on Ethereum. However, the analysis found that Ethereum has the least even distribution of app adoption among his six chains analyzed.

“This difference applies to Base, where the difference in the number of new users between the first and second app on the chain was only 16.9%, compared to ~300% for Ethereum.”

“The fact that Base is relatively new may have reduced the early protocol's first-mover advantage and resulting network effects, preventing user integration into a single app.”

Token swap and bridging apps are the most common entry points for new users on the EVM chain, with Uniswap and Orbiter Finance leading the way with Ethereum and Base, respectively.

NFT trading activity across the EVM chain painted a turbulent picture, as revealed by additional insights in the Flipside report.

While new user NFT trading on Ethereum and Base has steadily increased, Polygon has seen a significant decline from its initial peak. This fluctuation highlights the volatile nature of interest in NFTs and suggests that NFTs may not continue to dominate the market narrative in the next cycle as they have in the past.

Additionally, the report also highlighted the role of specific applications in directing user activity on various chains. For example, many new optimistic users were seduced by Worldcoin (WLD). This indicates long-term community interest in a particular project.

“This notable statistic, along with the observed lower DeFi and NFT trading volumes on Optimism compared to other chains, suggests that there is potential during Optimism’s ecosystem evolution compared to other EVM chains. This may reflect a discrepancy.”