- Ethereum’s on-chain indicators showed bullish signs on the charts

- However, key technical indicators suggested that the coin's price could fall further.

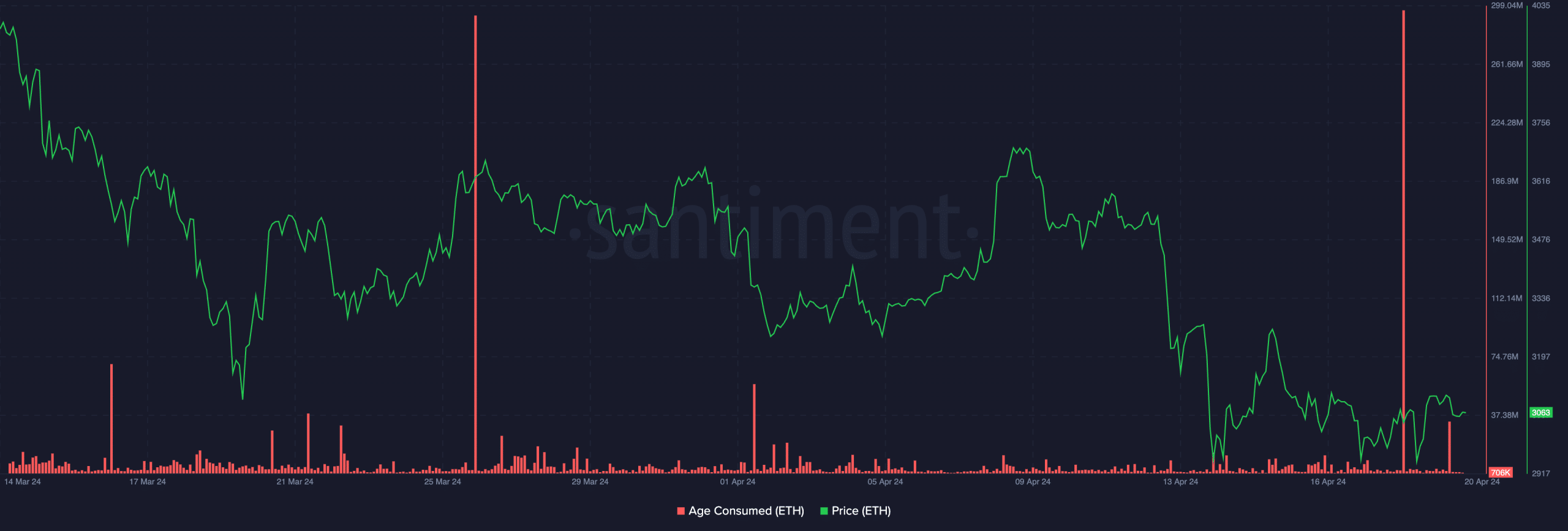

ethereum [ETH] The consumption age index rose to a one-month high on April 18th. Following this rise, the altcoin's value also rose slightly, suggesting it may have reached a local bottom. Santimento's data.

Source: Santiment

Is the bottom included or not?

To assess whether the price has entered the bottom, it is important to evaluate the consumption age indicator for ETH. This indicator tracks the movement of idle coins that have been held for a long period of time. This is considered a good marker of regional tops and bottoms, as long-term holders move their dormant coins very little. Therefore, whenever this happens, there is often a significant change in market trends.

Whenever this metric spikes, it indicates that a significant number of previously held idle tokens are starting to change hands. This suggests that the behavior of long-term holders is changing significantly.

On the other hand, when the consumption age of an asset decreases, it means that coins that have been held for a long time remain in the wallet address without being traded.

In fact, Ethereum's consumption age rose to a high of 1.6 million on April 18, according to Santiment. After this, the price of ETH briefly fell below $3,000, but quickly rebounded and was trading at $3,059 at the time of writing.

Since April 18th, the value of cryptocurrencies has increased by 3%, according to coin market cap.

Why you need to be careful

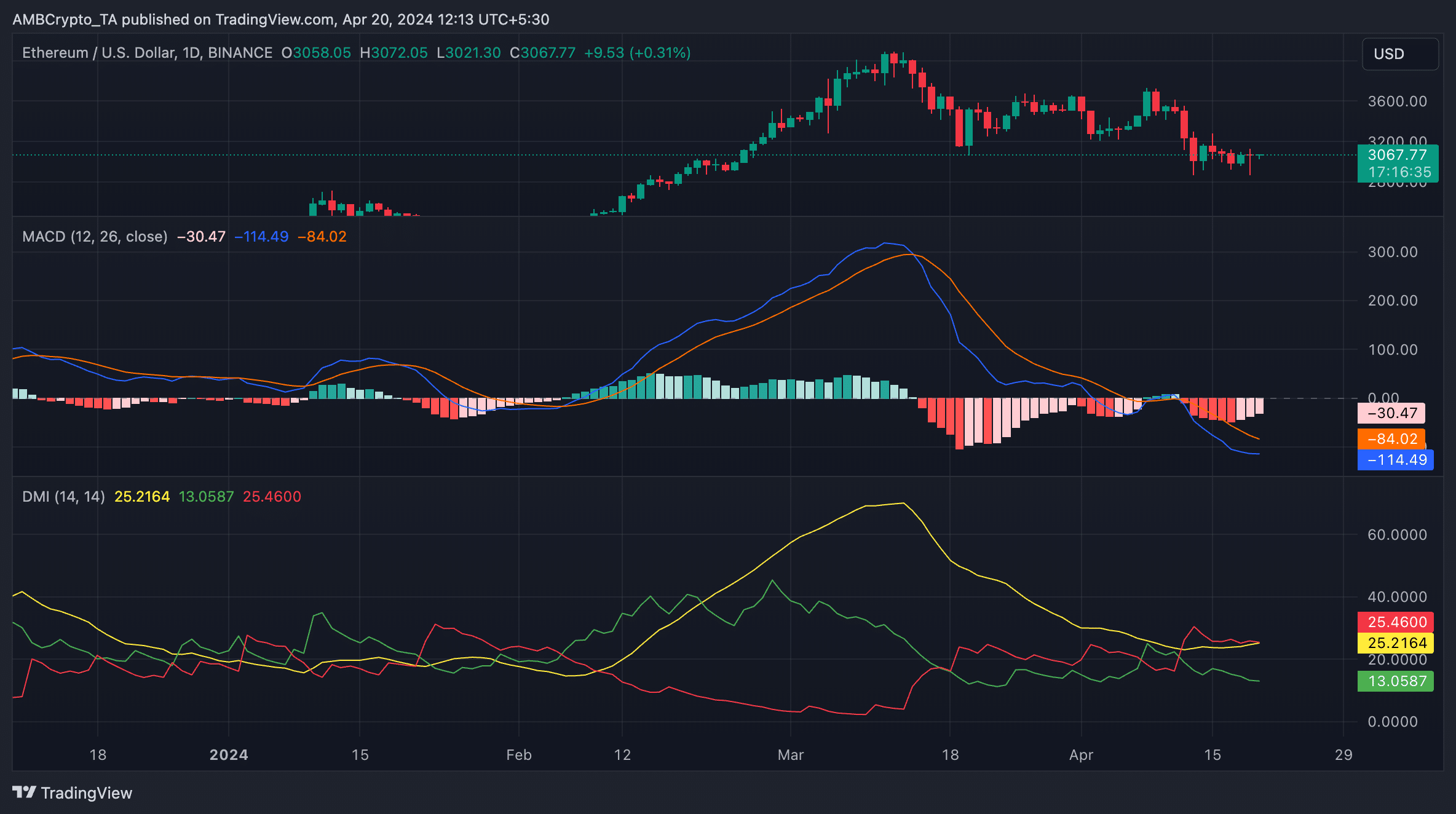

Although ETH’s consumption age suggested a possible uptrend, an assessment of the coin’s price movements on the 1-day chart revealed that the short-term outlook remains significantly bearish.

It highlights that bearish forces are outweighing bullish activity in the ETH market, with its positive directional index (green) settling below the negative index (red).

Is your portfolio green? Check out the Ethereum Profit Calculator

When these lines of the Asset Directivity Index (DMI) are arranged like this, it indicates that the market trend is bearish and the price is under heavy pressure from sellers.

Additionally, measurements of the Moving Average Convergence/Divergence (MACD) indicator in the ETH market confirmed that the MACD line has fallen below the signal line and the zero line, confirming that the bearish trend is prevailing.

Source: ETH/USDT on TradingView

When these lines are positioned this way, it indicates a strong bearish trend in the market and confirms the possibility of further declines in asset prices.

Market participants often take this as a signal to exit long positions and take short positions. Simply put, this may be a difficult time to navigate the Ethereum market.