Ethereum price today: $2,440

- Ethereum price has regained the $2,395 support level, but is likely to be rejected near the $2,490 resistance.

- The launch of Unichain could increase inflationary pressure on Ethereum.

- Uniswap accounts for the majority of Ethereum's total revenue and ETH spent.

Ethereum (ETH) regained the $2,395 support level on Friday and is attempting a move towards the $2,490 resistance. Once Uniswap's Unichain goes live, top altcoins could face inflationary pressures in the coming months, as the decentralized finance protocol contributes significantly to Ethereum's earnings and daily ETH burn.

Ethereum’s “super healthy money” story could be at further risk with the launch of Unichain

Ethereum-based decentralized exchange Uniswap on Thursday announced the launch of its layer-2 network Unichain. Uniswap Labs said in an X post that the new L2 will reduce block times, make transactions cheaper, and improve access to cross-chain liquidity.

Despite the positive news for UNI holders, several Ethereum community members believe that Unichain’s launch could parasitize the main chain and cause further damage to ETH’s “ultrasonic money” story. expressed concern.

Since the Dencun upgrade in March that introduced blob space, L2 has made transactions cheaper at the expense of main chain revenue. According to DefiLlama data, since the March upgrade, L1’s weekly revenue has plunged 300% from 35.07,000 ETH to 8,69,000 ETH. As a result, fees captured and total burned ETH in L1 plummeted. The ETH burn mechanism introduced in the London hard fork was a process that ensured that its supply maintained a deflationary trend.

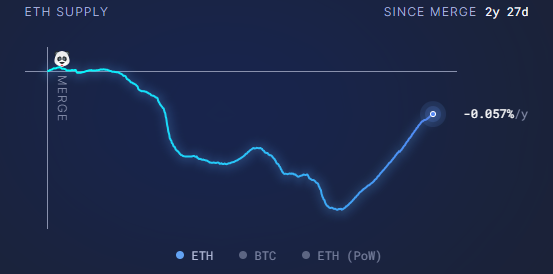

However, according to Ultrasound.money data, the ETH supply is on the rise, with over 300,000 ETH added since the upgrade at an annual inflation rate of 0.7%.

Increase in ETH supply (Source: Ultrasound.money)

This is already a concern for most users, but once Unichain goes live, ETH fee collection and supply inflation may worsen in the coming months.

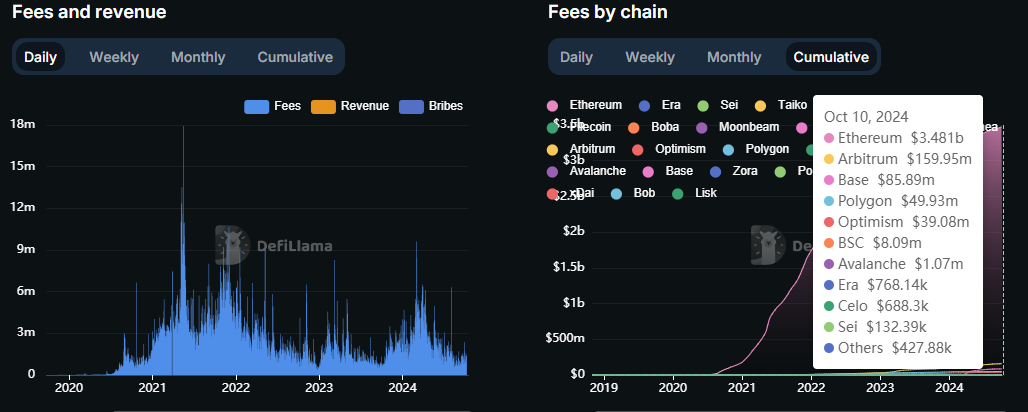

According to data from DefiLlama, Uniswap currently accounts for the majority of L1 revenue, with more than 90% of cumulative fees coming from payments on the main Ethereum chain. Losing such a major revenue source to the L2 world could hinder revenue growth.

Uniswap cumulative fees across the chain (Source: DefiLlama)

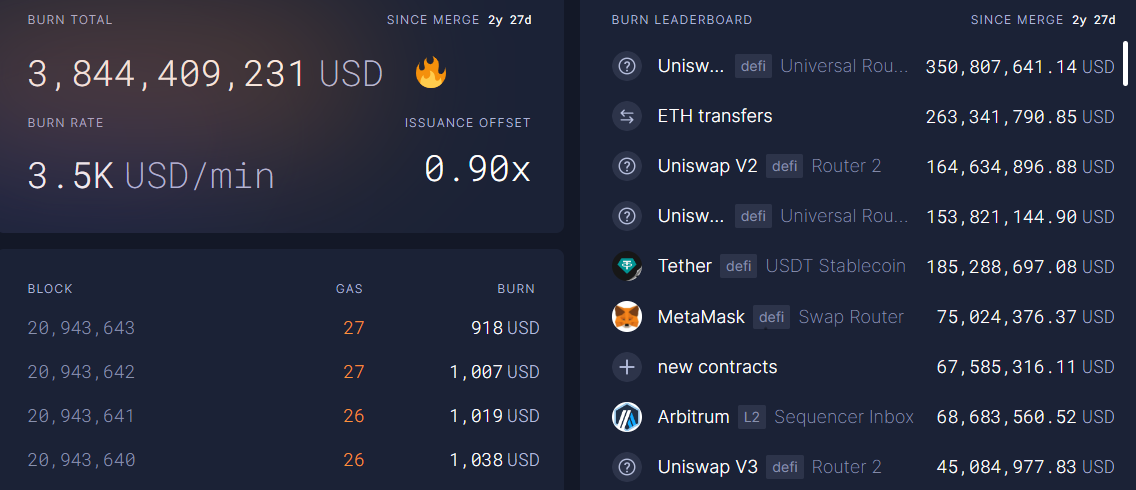

Second, Uniswap, Uniswap V2, and Uniswap V3 are in the top 10 of the ETH Burn leaderboard, which means they are contributing significantly to reducing the ETH supply. Most of the transactions that cause Uniswap's extremely high burn rate are likely to migrate to Unichain at launch, which could accelerate ETH supply growth and increase inflationary pressures, weighing on the price. there is.

ETH Burn Leaderboard (Source: Ultrasound.money)

Meanwhile, the Ethereum ETF recorded net inflows of $10.1 million on Thursday despite the price drop, according to data from Pharside Investors, while BlackRock's ETHA recorded $17.8 million in inflows, while Fidelity FETH and Bitwise ETHW recorded outflows of $3.5 million and $4.2 million, respectively.

Ethereum Price Prediction: ETH could be rejected near $2,490 resistance

Ethereum was trading around $2,440 on Friday, up more than 2% on the day. In the past 24 hours, ETH saw $34.28 million in liquidations, with long-term and short-term liquidations accounting for $19.34 million and $14.95 million, respectively.

Ethereum recovered the $2,395 level in the Asian session and is attempting a move towards the $2,490 resistance. ETH could see a rejection near this resistance level as it is level with the 50-day simple moving average (SMA) that has been limiting the price for the past nine days.

ETH/USDT daily chart

A possible rejection at $2,490 could send ETH back again to find support at $2,395.

Relative Strength Index (RSI), Stochastic Oscillator (Stoch), and Awesome Oscillator (AO) momentum indicators are below neutral levels of 50, 50, and 0, respectively, indicating a prevailing bearish bias in the market. I am.

If the daily candlestick closes below $2,200 and breaks through the key downtrend line that has been in place since May 27th, the theory will be invalidated and a major correction in ETH will be triggered.