The rise in CPI raised concerns about interest rate hikes, causing Ethereum to fall by 3%. Market uncertainty has led to ETF outflows as investors seek alternatives. ETH price could rise by 12 percent after hitting major support.

Ethereum falls 3% on CPI data release

Ethereum fell by 3% following the news of the release of Consumer Price Index data that showed the inflation rate was 2.4%, an increase of 0.1% year-on-year. A slight rise in inflation spooked investors, who were worried about raising interest rates to cool an already bearish crypto market.

Ethereum quickly reacted and began to fall against the $2,300 level as investors began selling. Ether’s struggle to regain bullish momentum is further clouded by the outlook for market-wide uncertainty, including further inflation data.

– Advertisement –

Bitcoin and Ethereum ETFs See Significant Outflows as Market Uncertainty Continues

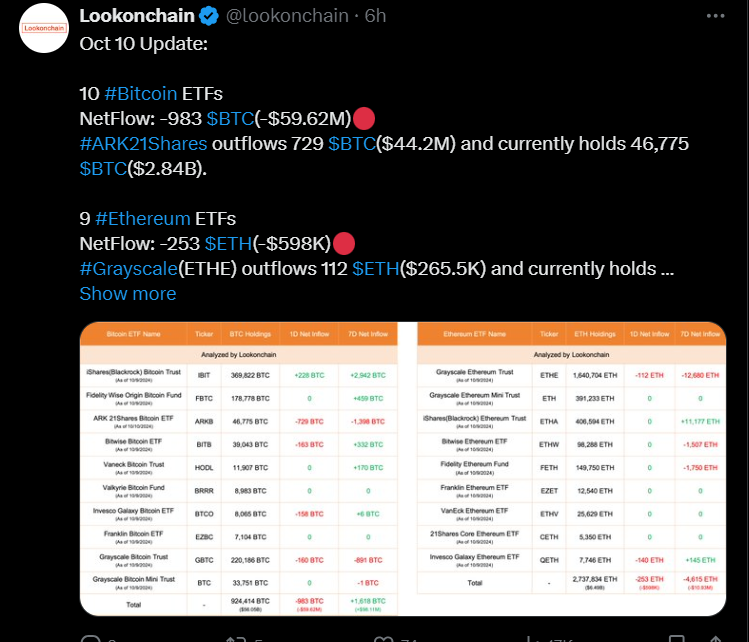

The latest data from Lookonchain reveals negative net flows in both the Bitcoin and Ethereum ETFs, suggesting that selling pressure continues. Bitcoin ETFs experienced significant net outflows of 983 BTC (valued at $59.62 million), with ARK21Shares alone accounting for 729 BTC of this outflow.

The continued outflow of funds indicates investors' cautious sentiment amid uncertain market conditions. The larger story is also impacting ETH price.

The Ethereum ETF also experienced negative net flows, with a total of 253 ETH (equivalent to approximately $598,000) outflowing.

Grayscale Ethereum Trust recorded the largest outflow, with 112 ETH worth $265,000 leaked. These outflows signal a sustained selling trend in the Ethereum ETF, reflecting broader market volatility and investor relocation.

Ethereum faces further decline under market pressure

Ethereum is struggling with continued selling pressure that intensified after the release of CPI data. ETH price is currently trading at the $2,363 mark and testing the key support level at $2,350.

A break above the $2,420 level and the diagonal trendline could increase the chances of a 12% surge. In this scenario, Ethereum could aim for the $2,720 resistance level, a target supported by historical price movements.

The RSI is at 45, indicating a gradual transition from an oversold situation, but is still below the neutral 50 level, and while selling pressure has eased, the bullish momentum remains tentative. It suggests that it remains the same.

ETH price is testing an important support level at $2,350, where a successful rebound could signal a strong recovery coupled with rising RSI. If the RSI rises above 50, it will confirm an increase in buying intent.