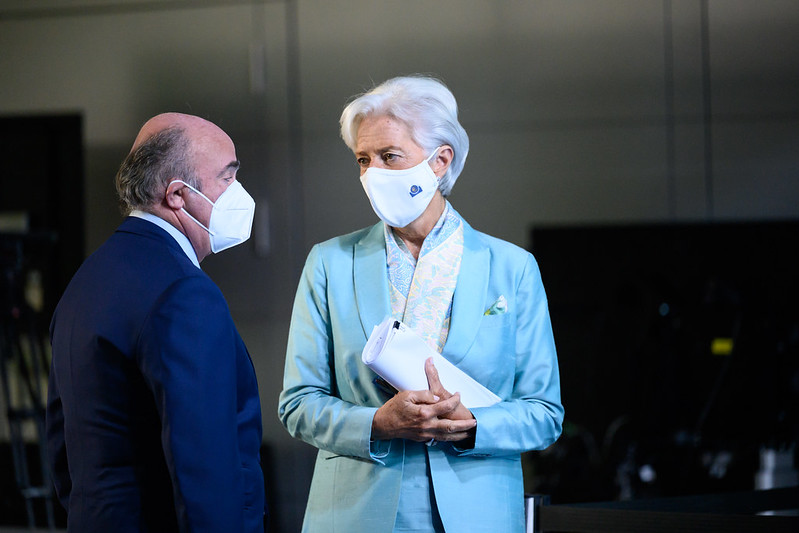

European Central Bank President Luis de Guindos expressed confidence that interest rates would fall further, but probably more slowly than expected.

Speaking at the livestreamed MNI Connect event in London, the ECB vice president said it was unclear how many times interest rates would be cut by 2024.

But in the longer term time frame, looking out to the end of 2025, the direction is clear, he added.

De Guindos likened it to walking through a dark room, explaining that you need to move slowly and carefully.

He expressed confidence in the ECB's baseline forecast, but said it was simply a matter of there being risks that could throw it off.

In particular, he pointed to risks arising from geopolitics, which financial markets can sometimes struggle to gauge.

Additionally, there were financial stability risks associated with high market valuations and political risks, including the path of US fiscal policy following the November presidential election.

In any case, he expects inflation to remain stable over the next five to six months and said the movement will be “mixed.”

This is a result of, among other things, the influence of significant base effects.

Still, policymakers said they were highly confident that inflation would return to their target in the second half of 2025.

He also judged that inflation expectations in the euro area are indeed stable at around 2.0% at present.