Unlock Editor's Digest for free

FT editor Roula Khalaf has chosen her favorite stories in this weekly newsletter.

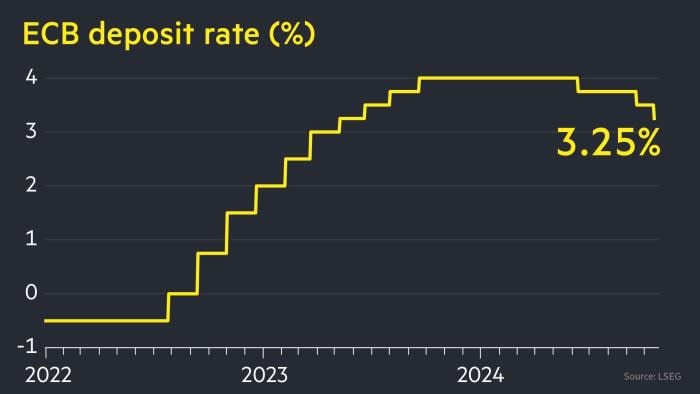

The European Central Bank cut interest rates by a quarter of a percentage point to 3.25%, amid growing confidence that euro zone inflation is finally easing and concerns about lackluster economic growth.

Thursday's action brings euro zone interest rates to their lowest level since May 2023 and follows a similar rate cut at the last ECB Governing Council meeting in early September.

ECB President Christine Lagarde said after the meeting that the process of eliminating inflation is “progressing well” and that all data since the September vote “are in the same direction, that is, downward.”

This suggests that although inflation will rise towards the end of the year, price pressures may be weaker than the central bank expected last month to reach its 2% target by the end of 2025.

Lagarde said the board's support for rate cuts was unanimous and that recent data had “certainly increased our confidence” that the central bank was on track to reach its 2% target.

“Have we broken the neck of inflation? Not yet,” Lagarde said. “Are we about to break its neck? Yes.”

The euro fell slightly after the announcement, trading at $1.083 by mid-afternoon.

The rate cut, which came just five weeks after the previous policy and with few additional economic indicators, “must have made the ECB even more concerned about the euro area's growth prospects and the risk that inflation would fall below target,” said financial institution Macro Global. Director Carsten Brzeski said. ING.

Inflation in the euro zone fell to 1.7% in the year to September, falling below 2% for the first time in more than three years.

The ECB said the inflation outlook was “also influenced by the unexpected downward trend in recent indicators of economic activity”.

A person familiar with the board's discussions told the Financial Times that a “vast majority” of the 26 members of the board believed it had become more likely that growth and inflation would turn out to be lower than expected.

However, despite the disappointing news on growth, Lagarde said rate setters did not consider a euro zone recession to be the most likely scenario. “We're aiming for a soft landing,” she said.

The euro has fallen more than 2% against the dollar over the past month, as expectations grow that the ECB will cut interest rates sooner than the US Federal Reserve.

In September, the Fed lowered its benchmark interest rate for the first time in more than four years, cutting borrowing costs by half a percentage point and hinting at further cuts.

The ECB itself offered little guidance Thursday on the future direction of monetary policy. The meeting reiterated that it was taking a “data-driven, meeting-by-meeting approach” and was “not committing in advance to any particular rate path.”

While policymakers insist they have not yet decided what they will do at their final meeting in 2024, traders say rate cuts in December and January are almost certain.

Overall, swaps market traders expect another 4-5 quarter point rate cut by the middle of next year.

Akshay Singhal, head of short-term rates trading at Citi, said Lagarde's comment that the decision to cut rates was unanimous had “front-loaded” market expectations for a rate cut.

Frédéric Ducrozet, head of macroeconomic research at Pictet Wealth Management, stressed that Lagarde “has not closed the door to successive rate cuts,” but the ECB will have more data at hand in December. I pointed out that I would put it down.

Some argued that October's rate cut could be a “turnaround” towards an early return to lower interest rates. “The ECB continues to emphasize its data dependence, but the path to further deep interest rate cuts in the coming months is clear,” said Ulrike Kastens, an economist at Deutsche Bank's asset manager DWS.

The ECB started cutting interest rates in June and has lowered borrowing costs three times so far. Thursday's decision was made at the Central Bank of Slovenia in Ljubljana.