Today we will get the latest PMI. US PMI is important, but at least it doesn't determine yields.

The lower Eurozone PMI forecast has strengthened the idea that the ECB will cut rates further in December. Interestingly, Gilts rose 6 points after Britain's Finmin Reeves suggested that she could borrow more for infrastructure, and the market believed her. The winning points have been reduced to 3 points, but there is still more left. This idea also suggests that the central bank will slow down its rate cuts. Reuters said: “This helped premium investor demand for holding UK 10-year bonds against Germany rise to 198 basis points on Thursday, up from a 14-month high of 201 basis points hit earlier this month. It was slightly lower.”

Regarding the Yen: USD/JPY reversed downwards from yesterday's high of 153.18 to today's all-time low of 151.77. This is why we have Rule 4. This push stemmed from overbought conditions, but was also helped by the finance minister's comments. The finance minister said Treasury officials were “monitoring exchange rate movements with increased vigilance.” This is hardly reported, meaning it's little more than a whisper as threats of intervention go, but traders certainly heard it.

Bank of Japan Governor Ueda said last night that it would “still take some time” to reach the 2% inflation target and that interest rate hikes would be “cautious and gradual”. As is usual for central bankers, he also warned of the cost of moving too slowly, which would (likely) mean further depreciation of the yen. Elections will be held this weekend, and the next Bank of Japan meeting is on October 31st.

Mizuho's chief strategist told Reuters: “The Ishiba administration will need to prevent a rapid appreciation of the dollar/yen, but I don't think either the MOF or the Cabinet actually want to intervene.” Ta. He will soon take a test with a score of 160.

forecast

The dollar has rebounded particularly against the yen, but not so much against the pound. A landslide may start with just one or two rocks, but this is (so far) a very small movement. Even if the dollar is overbought, we don't expect a landslide. That's because we don't think there will be any respite in strong yields until after the election. Keep the faith.

Trivia: On the front page of the FT newspaper, there is an article that shows the economic ignorance of American voters. “In the last monthly poll from the FT and the University of Michigan's Ross School of Business, 44 percent of registered voters said they had more confidence in Trump on the economic response, compared to 43 percent for Harris.

“These results, coming less than two weeks before the election, mark the first time that Mr. Trump leads Ms. Harris on this issue in the FT-Michigan Ross poll.

“The poll also found that Mr. Trump has widened his lead among voters in terms of which candidate would be better off financially, with 45% choosing the former Republican president; Democratic Vice President Harris had 37%, an improvement of 5 points from the previous month.

A publication called Project Syndicate has some excellent, well-thought-out, and well-written opinion pieces, although usually quite verbose. They always have great headlines that catch the eye. This time it's “BRICS is not a problem yet.” Here's the subheading: “The annual BRICS summit is an ideal opportunity for political leaders like Vladimir Putin to promote a vision of a world not led by the United States. It is also confirmed year after year that it has no real purpose beyond producing.

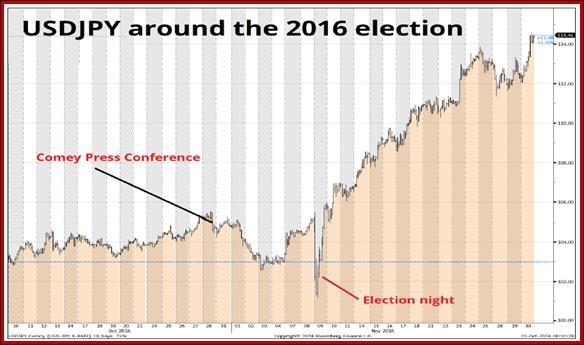

US politics: Brent Donnelly, author of The Art of Currency Trading, retells the dollar story from Trump's 2016 election victory (https://www.spectramarkets.com/amfx/a-fun -story-from-2016/).

There's a lesson here. Despite Comey's setback, Clinton led in every poll. The dollar was trending upward. In the hours that followed, it became clear that Trump was winning state-by-state electoral votes. The dollar has plummeted.

But the next day, the dollar strengthened due to the new high-risk environment. This is what is often referred to as the foreign exchange market's often perverse reaction to events that “should” go in a different direction. Rising risk, rising dollar, even if the rising risk is due to something in the US. See Donnelly's chart. I'm sure the same thing will happen again.

What happens if Harris wins? Given that the Harris plan would increase the budget deficit less, bond yields should fall with the dollar. This is some kind of relief rally.

US Politics 2: Critic Carville has published an op-ed in the NYT on why Harris will win despite the polls. First, Trump and the Republican Party are losers. They lost in 2018, 2020 and 2022. Second, Ms. Harris has more money, and money matters in American politics. In part, that's because money pays for TV ads.

Third, the age-old desire not to make the same mistake twice. Most people are kind-hearted and reasonable, Carville said. They see Trump as malignant. They prefer hope and positivity to frustration and negative thinking.

US Politics 3: The site Electoral Count shows Harris leading by 271 votes to Trump by 246. Counting the battleground states, Harris won 60 electoral votes in Michigan, Pennsylvania, Wisconsin, Minnesota and Nevada. Trump won 43 points in North Carolina, Georgia and Arizona. Harris needs 270 points to win, giving him a one-point lead. Note that given what happened in 2020, there's less certainty about Georgia for Trump. This might be worth keeping an eye on over the next two weeks.

This is an excerpt from “The Rockefeller Morning Briefing.” This is much larger (about 10 pages). This briefing has been published daily for over 25 years and reflects our seasoned analysis and insights. This report provides in-depth background and is not intended to be a guide to Forex trading. Rockefeller produces other reports (spot and futures) for trading purposes.

Get a 2-week trial of the complete report and trader's advice for just $3.95. click here!