Dogecoin has maintained its price movement over the past 24 hours, with price data reflecting a 14.5% decline in the 7-day time frame. However, the price drop has done little to dampen the general sentiment surrounding Dogecoin, especially in the long term. As part of the lingering optimism surrounding the memecoin, data highlighted by crypto analyst Ali Martinez shows surprisingly bullish sentiment among Dogecoin enthusiasts on cryptocurrency exchange Binance. It's clear.

The majority of Binance traders are betting on Dogecoin price rising

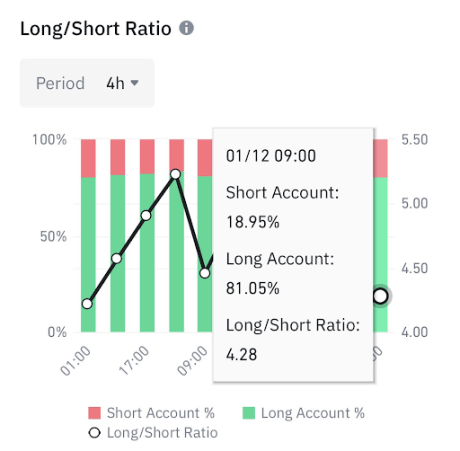

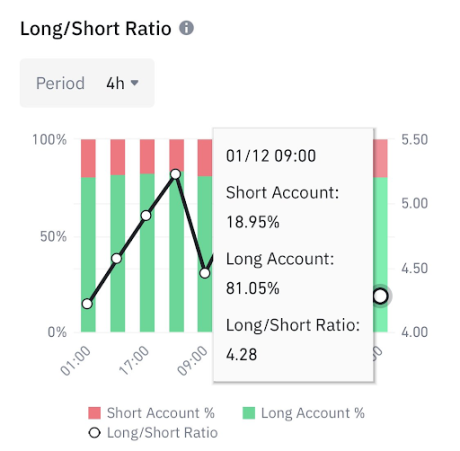

The majority of Dogecoin traders remain bullish despite the recent decline in Dogecoin’s price from just below $0.4 since January 7th. This bullish stance is highlighted by crypto analyst Ali Martinez through his trading positions on crypto exchange Binance. At the time, the long/short ratio showed that about 81.05% of all traders with Dogecoin positions on Binance were betting on the price rising.

This bullish stance is further highlighted by Binance’s DOGEUSD_PERP ratio, which reveals that 90.43% of perpetual contract accounts are in long positions, according to Coinglass data. Perpetual contracts with no set expiry or settlement date reflect the trader's expectations for an indefinite period. This imbalance against long positions suggests that the majority of Dogecoin traders remain confident in the memecoin's long-term growth potential, especially with an eye on another massive bull market in 2025. I'm doing it.

Interestingly, on-chain data shows that Dogecoin whales are also taking advantage of the price drop to accumulate more DOGE tokens. This accumulation trend caused whale addresses holding between 10 million and 100 million DOGE tokens to increase their overall holdings by approximately 470 million tokens within 48 hours.

DOGE needs to maintain above $0.3

As of this writing, Dogecoin is trading at $0.33, down 3.35% in the past 24 hours. This decline is part of a broader trend of lackluster price performance over the past 30 days, during which Dogecoin has struggled to consistently break above the $0.40 mark. The most recent example is when this price level acted as a key resistance level during Dogecoin's short-term price spike in the first few days of January 2025.

The focus of Dogecoin traders and investors has now shifted from breaking the $0.40 resistance level to defending the $0.30 support zone, which is becoming increasingly important in maintaining the memecoin’s long-term bullish narrative. It has become. To maintain bullish momentum, Dogecoin needs to hold firmly above this support level. This is because a breakdown can signal the beginning of a deeper correction.

If it manages to sustain above the $0.3 mark, the bullish trajectory is still maintained and Dogecoin could easily move higher at any time. However, if the $0.30 support cannot be sustained, further correction towards the $0.25 mark is likely. Such a scenario would not only weaken the technical outlook, but also weaken real returns even if the overall crypto market begins to recover.