7:41 p.m.

7

Takes a few minutes to read ▪

Past bull markets have gone through different phases fueled by capital rotation. Generally, Bitcoin is the leader of a bull market and the favorite in the early stages. Given Ethereum's weak performance compared to Bitcoin, we consider factors that favor capital rotation into Ethereum.

Asset rotation principles

In traditional finance, there are several types of asset rotation. This can include sector rotation (tech, industrial, financial, health, etc.) or asset type rotation (bonds, stocks, commodities, forex, etc.). Capital moves according to conditions and the economy. Rotation can result from profit taking after a big performance and moving to another sector or less valuable type of asset while following economic conditions. This is often seen between cyclical and defensive sectors, for example.

Also, let's look at a very long term example spanning several decades. In the chart below, you can see the cyclical rotation between commodities and the S&P 500 Index.

This type of chart highlights that commodities should perform better than the S&P 500 over the next few years.

The different stages of cryptocurrency

If we look at the cryptocurrency market, we see several phases in terms of rotations between Bitcoin, Ethereum, large caps, and even altcoins. And generally, this comes from a gradual rotation.

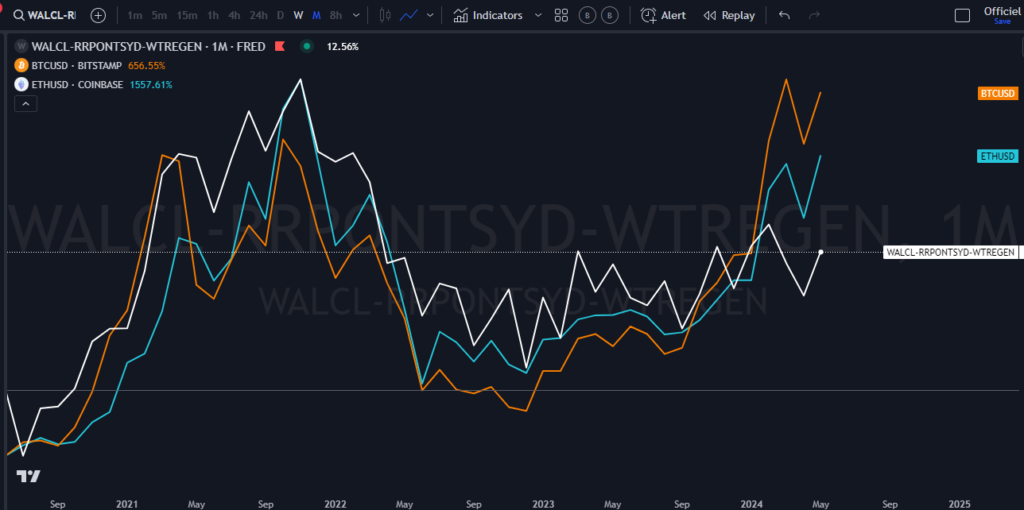

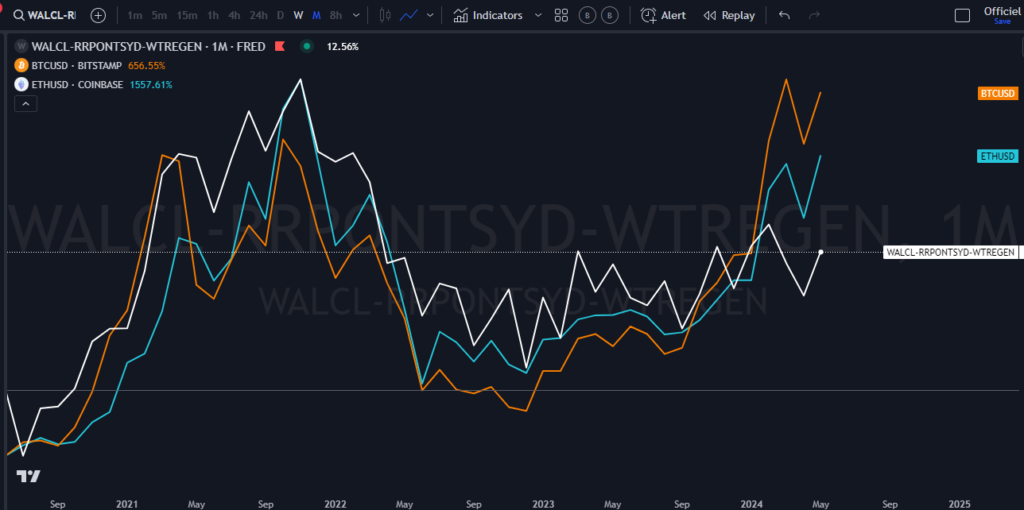

Phase 1: Bitcoin is the leader and store of value in the cryptocurrency market. It is the oldest and most democratized in the cryptocurrency space. The first capital inflows arrive in Bitcoin at the beginning of the bull market. From 2024 onwards, Bitcoin will be available in the form of a spot ETF, which is favorable for stimulating demand. And at the same time, capital inflows increase as demand is stimulated. In phase 1, Bitcoin tends to outperform Ethereum. And phase 2 is approached only when Ethereum starts to approach Bitcoin's performance. You can see this rotation in the example below, highlighting the ETC/BTC ratio.

Phase 2: Ethereum, the second largest cryptocurrency, surpasses Bitcoin, which can be seen in the chart below showing the 2021 bull run.

Phase 3: It’s the turn of the larger currencies (Doge, LTC, XRP, etc.) to surpass Bitcoin.

Phase 4: Altcoin season begins when a large capital rotation occurs, meaning that funds invested in Bitcoin at the beginning of the bull market move to other cryptocurrencies, small and medium capitalization, and even memes. During altcoin season, Bitcoin's dominance decreases. Here is a graph that illustrates this:

To explain this more generally, here is a timeline:

Economic environment and different stages of the cryptocurrency market

The evolution of cryptocurrencies, like the economy, is quite cyclical. That is, there are cycles of growth and cycles of decline. Like any risky asset class, cryptocurrencies evolve in response to favorable and adaptable conditions. Favorable conditions can be defined in several ways. For example, when growth recovers, growth accelerates, creating a favorable environment for cryptocurrencies. Consumer sentiment is positive, encouraging capital inflows. Conversely, when faced with an economic slowdown, this is represented by a bear market for cryptocurrencies. Each cycle, like an economic cycle, often averages one and a half to two years. Thus, if you add up the bull and bear markets, it will be four years, just like the halving.

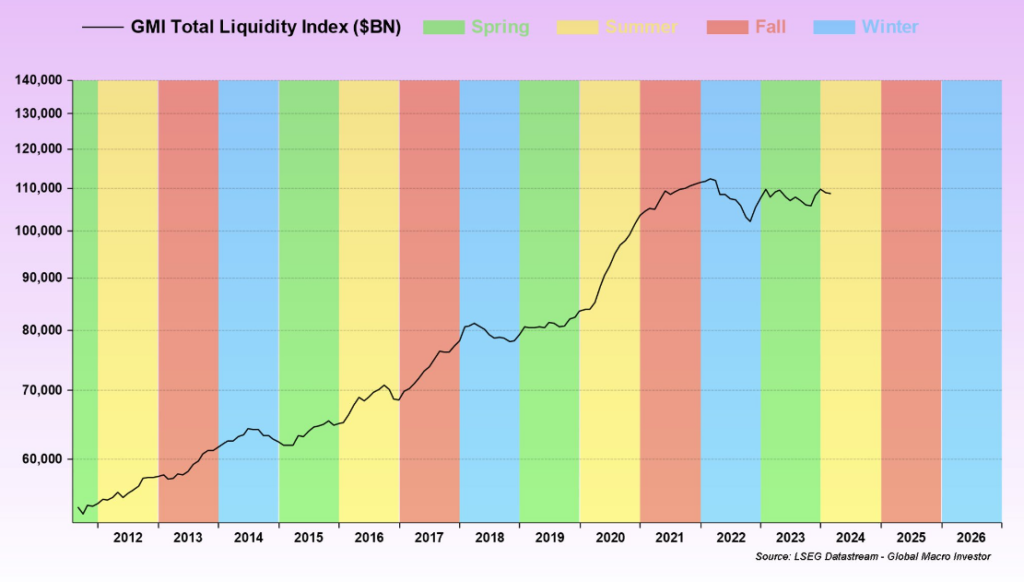

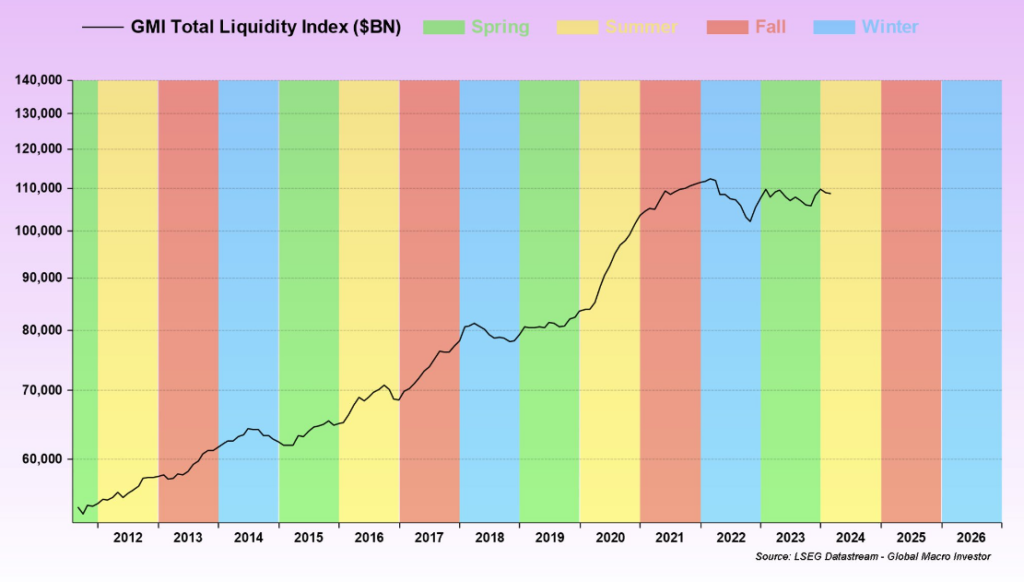

Another positive factor for performance is liquidity. If liquidity is plentiful, cryptocurrencies thrive. For example, the injection of liquidity during the COVID pandemic increased capital in circulation in the market. Financial conditions were very easy. Therefore, more money in circulation to buy the same goods means prices will rise.

Regarding liquidity in the current situation, you can see the graph below which highlights the evolution of liquidity and Bitcoin.

Staying in the same context, i.e. fluidity, we can also see the preferred seasons (summer and fall are best).

Ethereum Delays Explained by Several Factors

As mentioned before, Ethereum often lags behind Bitcoin during the first months of a bull market. This is mainly because capital flows into Bitcoin, the store of value, first. As for Ethereum, it is no longer the only dominant player, with Solana following close behind. This also implies competition. That said, like Bitcoin, Ethereum should benefit from more inflows now that the ETF approval has been formalized. Such products mean that they are more likely to attract new investors, either for tax reasons (introduction of the product into tax-advantaged accounts) or simply because ETFs are an easily accessible product (no need to open multiple brokerage accounts) and inexpensive. This is why approval is a good catalyst for catching up with Bitcoin. Thus, there are several arguments that support Ethereum's outperformance, including favorable conditions, new products available, and the timeline of the phases (see above).

Bitcoin or Ethereum: Which should you choose?

Bitcoin and Ethereum each have different strengths that can help diversify your cryptocurrency portfolio. One feature of Bitcoin is that its supply is limited to 21 million and its production is halved every four years. This makes it a safe haven, especially in countries suffering from hyperinflation. Ethereum also has certain characteristics, such as the fact that it can be used to host other cryptocurrencies and decentralized applications.

The more adoption and democratization that same dynamics go, the more we will be faced with new products because it will be easier and easier to approve them. For example, if there is an ETF that combines Bitcoin and Ethereum, it will be an easy choice. This will open up a lot of possibilities in terms of capital.

Conclusion

We can conclude that the capital rotation system is cyclical and there are several reasons why Ethereum will lead and outperform Bitcoin for the rest of the cycle. One of the big catalysts is the approval of an ETF, just like Bitcoin, which will increase liquidity in the coming months.

Make the most of your Cointribune experience with our “Read to Earn” program. Earn points for every article you read and get access to exclusive rewards. Sign up now and start earning rewards.

Click here to join Read to Earn and turn your crypto passion into rewards!

After working for 7 years in a Canadian bank, I left my duties in the financial markets after 5 years in the portfolio management team as an analyst, etc. However, here I am a democratic media that provides the viewers with financial market information from various aspects such as macro analysis, technical analysis, intermarket analysis, etc.

Disclaimer

The views, thoughts and opinions expressed in this article are those of the author and should not be taken as investment advice. Please conduct your own research before making any investment decisions.