To print this article, all you need is to be registered or login on Mondaq.com.

Poland offers a straightforward and business-friendly

environment for cryptocurrency operations, governed mainly by the

Polish Anti-Money Laundering and Terrorist Financing Law.

Until the Markets in Crypto-Assets (MiCA) Regulation comes into

force on December 30, 2024, businesses wishing to operate in

Poland’s crypto space must comply with existing laws, including

obtaining a Virtual Asset Service Provider (VASP)

license.

Below, we outline the current regulatory framework, benefits of

obtaining a crypto license in Poland, and insights into the

evolving market.

Current Cryptocurrency Licensing Requirements in Poland

To provide crypto-related services in Poland, entities must

register in the Register of Virtual Currency

Activities and obtain a VASP license.

Licensed VASPs can offer services such as:

- Exchange between virtual currencies and fiat money (e.g., EUR

to BTC, BTC to USD), - Exchange between virtual currencies (e.g., BTC to ETH),

- Intermediation in crypto exchange services mentioned

above, - Custody services, including providing crypto wallets (on-ramp,

off-ramp).

VASP Registration Process

- Fast Turnaround: Registration takes just 14

days. - Low Costs: Registration costs PLN 616, plus

minor fees (e.g., PLN 17 for power of attorney duty stamps). - Minimal Paperwork: Requires statements from

board members and beneficial owners.

Why Obtain a VASP License in Poland?

Poland provides a dynamic ecosystem for cryptocurrency

investments, featuring a tech-savvy workforce, growth-oriented

population and competitive registration costs. Here’s why

obtaining a VASP license in Poland is advantageous:

- Legal Operations: Operate legally and gain the

trust of investors and partners. - Market Growth: Tap into Poland’s growing

cryptocurrency market, the largest financial services market in

Central and Eastern Europe (CEE). - Business Expansion: Collaborate with financial

institutions and payment providers. - Future-Ready: under certain conditions VASPs

registered before December 30, 2024, can operate under their VASP

license until transitioning into the new CASP license introduced by

MiCA regulations.

The Growing Crypto Market in Poland

According to the FinTech Foundation Report 2023, Poland’s

FinTech sector is thriving and poised for further expansion.

As of November 2024, there are more than 1,600 entities

actively registered as VASPs. However, not all registered

companies are operational, creating room for new market

entrants.

Transition to CASP License Under MiCA

From December 30, 2024, companies offering crypto services in

the EU must obtain a Crypto Asset Service Provider (CASP)

license. This license ensures compliance with MiCA

regulations and provides passporting rights, allowing businesses to

operate seamlessly across the EU.

Key Differences Between VASP and CASP

Licenses

- VASP License: Currently required for crypto

operations in Poland. - CASP License: Mandatory from 2025, for

services across the EU, with a grace period for existing

VASPs.

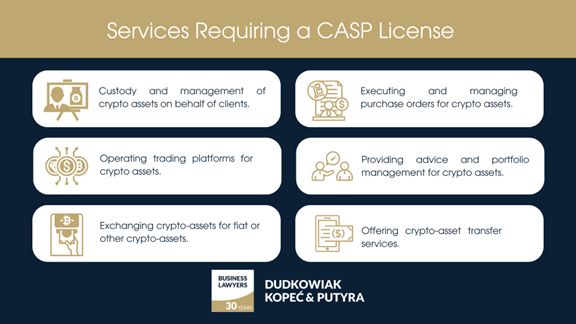

Services Requiring a CASP License

- Custody and management of crypto assets on behalf of

clients. - Operating trading platforms for crypto assets.

- Exchanging crypto-assets for fiat or other crypto-assets.

- Executing and managing purchase orders for crypto assets.

- Providing advice and portfolio management for crypto

assets. - Offering crypto-asset transfer services.

Seizing Opportunities in Poland’s Crypto Market: A

Strategic Call to Action

Poland’s proactive approach to cryptocurrency regulation,

combined with its robust FinTech ecosystem, positions it as an

attractive hub for crypto businesses. Whether you’re planning

to register as a VASP or prepare for MiCA compliance, the

opportunities in Poland’s crypto market are significant.

Act now to secure your VASP license and

establish a foothold in this growing market. With the transition to

CASP license under MiCA on the horizon, early compliance ensures

your business remains competitive and legally compliant.

CRYPTO LICENSE REQUIREMENTS IN POLAND: A COMPREHENSIVE

GUIDE

Poland’s evolving cryptocurrency regulatory framework sets

clear requirements for businesses aiming to

operate as virtual asset service providers (VASPs). Whether

you’re planning to engage in crypto trading, custody services,

or exchange operations, understanding the crypto license

requirements in Poland is essential for ensuring compliance

and maintaining business credibility.

Key Requirements for Obtaining a Crypto License in Poland

To register as a VASP and legally operate in Poland, companies

must meet two primary requirements: the no

criminal record requirement and the professional qualifications

requirement.

1. No Criminal Record Requirement

This requirement applies to both individuals and entities

associated with the business:

For Individuals (e.g., managing persons, beneficial

owners):

- Must not have been legally convicted of intentional crimes,

including: -

- Crimes against state institutions and local governments,

- Document fraud,

- Economic crimes,

- Terrorist financing,

- Intentional fiscal offenses.

For Entities:

- Shareholders, partners, or management members must not have any

criminal convictions related to the offenses outlined above.

2. Professional Qualifications Requirement

Individuals performing activities related to virtual currencies

must demonstrate relevant knowledge or experience. This can be

achieved by:

- Completing a training program or course covering legal and

practical aspects of virtual currency operations, or - Having at least one year of experience in virtual

currency-related activities, supported by relevant

documentation.

Entities fulfilling both requirements are eligible for

entry into the Register of Activities in the Field of Virtual

Currencies.

Post-Registration Obligations for Crypto Businesses in

Poland

After successfully registering as a VASP, companies must adhere

to several post-registration requirements under Polish law.

These include:

1. Money Laundering and Terrorist Financing

Prevention:

- Conducting risk assessments for money laundering and terrorist

financing. - Implementing financial security measures, such as:

-

- Customer identification and verification (KYC).

- Identifying and verifying the ultimate beneficial owner

(UBO). - Assessing business relationships and monitoring them

regularly.

2. Internal Procedures:

- Developing internal policies to counter money laundering and

terrorist financing.

3. Reporting Obligations:

- Notifying Polish authorities of specific / suspicious

transactions. - Cooperating with authorities when suspicious activities are

detected. - Submitting quarterly activity reports to the General Inspector

of Financial Information (GIIF) within 18 days of the end of each

calendar quarter.

Sanctions for Non-Compliance with Crypto Laws in Poland

Failure to comply with post-registration obligations can result

in significant administrative and financial penalties.

These include:

- Public disclosure of the entity’s illegal activities on the

Minister of Finance’s website. - Orders to cease specific activities.

- Removal from the Register of Virtual Currency Activities.

- Prohibition from holding managerial positions for up to one

year. - Financial penalties, which can amount to:

-

- Twice the benefit gained or loss avoided due to the violation,

or - Up to €1,000,000 if the benefit or loss cannot be

determined.

- Twice the benefit gained or loss avoided due to the violation,

Criminal Penalties:

Individuals acting on behalf of the entity which fails to notify

authorities of suspicious activities or provide false information

may face 3 months to 5 years of imprisonment.

Why Compliance Matters for Crypto Businesses in Poland?

Adhering to Polish crypto regulations not only ensures legal

compliance but also boosts credibility with

partners and customers. By fulfilling registration and reporting

requirements, businesses can operate securely in Poland’s

growing cryptocurrency market, fostering trust and

long-term success.

Stay ahead in Poland’s cryptocurrency landscape by ensuring

your business meets all licensing, reporting, and compliance

standards. Non-compliance can lead to severe penalties, so act now

to safeguard your operations.

VASP Frequently Asked Questions

Is cryptocurrency activity legal in Poland?

Yes, cryptocurrency activity, including

transactions and business operations involving virtual assets,

is legal in Poland as long as there is no explicit

prohibition under Polish law. Businesses engaging in

cryptocurrencies must comply with relevant regulatory

requirements.

Is cryptocurrency activity legal in the European

Union?

Yes, cryptocurrency activity is

generally legal across the European Union. This was

confirmed by the Court of Justice of the European Union in its

ruling of October 22, 2015 (C-264/14). Cryptocurrency businesses

operating in the EU must adhere to local and EU-wide

regulations.

Is cryptocurrency business supervised by Polish

financial authorities?

Currently, cryptocurrency businesses are not classified

as part of the financial market under Polish law and are

therefore not subject to direct financial supervision. However, the

authority responsible for maintaining the Register of Virtual

Currencies may inspect VASPs to ensure compliance with registration

requirements. This situation will change along with application of

MiCA regulation.

How long does the crypto registration process in Poland

take?

The registration process typically takes 14

days from the submission of a correctly completed

application, along with all required documents. The Director of the

Tax Administration Chamber in Katowice, under the authority of the

Minister of Finance, handles the registration process.

What are the reasons for a crypto license application to

be denied?

Polish authorities may deny a crypto license

application under several circumstances,

including:

- Incomplete applications that are not corrected within the given

timeframe. - Inconsistent or false information in the application.

- Legally binding decisions prohibiting the applicant from

conducting the proposed business activity.

What can I do if my crypto license application is

denied?

If your application is denied, you can:

1. Request reconsideration of your case by the

Minister of Finance.

2. File an appeal with the competent Regional

Administrative Court for further review.

Are there any specific post-registration obligations for

virtual currency businesses in Poland?

Yes, crypto businesses must comply with

several post-registration obligations,

including:

- Identifying and assessing money laundering and terrorist

financing risks. - Implementing financial security measures such as customer

identification and ongoing monitoring of transactions. - Developing internal policies to combat money laundering and

terrorist financing. - Submitting quarterly reports to the General Inspector of

Financial Information (GIIF). - Cooperating with Polish authorities in cases of suspicious

activities.

Can post-registration obligations be outsourced to third

parties?

Yes, certain obligations, such as financial

security measures and reportings, can be outsourced to

third parties. However, outsourcing does not absolve the

business owner of their legal responsibility for compliance.

What are the penalties for failing to comply with

post-registration obligations?

Non-compliance with post-registration obligations can result in

administrative penalties, including:

- Public disclosure of the violation on the Minister of

Finance’s website. - Orders to cease specific activities.

- Removal from the Register of Virtual Currency Activities.

- A prohibition on holding managerial positions for up to one

year. - Financial penalties of up to €1,000,000 or twice the

financial benefit gained from the violation.

Criminal Liability: Individuals acting on

behalf of non-compliant businesses may face imprisonment ranging

from 3 months to 5 years.

Is a PSD2 license required for cryptocurrency activity

in Poland?

Generally, a PSD2 (authorized payment institution) license

is not required for cryptocurrency activities.

However, if your crypto business includes payment services, you may

need to obtain either an authorized payment institution license

(KIP) or a small payment institution license (MIP), depending on

the scope of services.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.