Friday, June 14, 2024 5:57 AM

every day, Coin Rules Stay up to date on the current state of the digital asset market with Blockbeat's news, analysis, opinion and commentary on blockchain and digital assets..

The Federal Reserve's policy committee, commonly known as the Federal Open Market Committee (FOMC), decided to keep interest rates unchanged in a long-awaited move at its recent meeting. The decision comes amid ongoing concerns about inflation, although the latest figures show signs of easing. As a result, markets, including cryptocurrencies, are bracing for change.

The FOMC plays a key role in formulating US monetary policy. It meets regularly to decide on interest rates with the aim of balancing job growth with price stability. At its most recent meeting on June 12, 2024, the committee left the target interest rate unchanged at 5.25%-5.50%. This decision was expected but was made taking into account inflation trends. Recent data shows that inflation has risen by 3.3% over the past year, with a slight increase of 0.2% in May. This was enough to calm the market and raise expectations of an expected rate cut later this year.

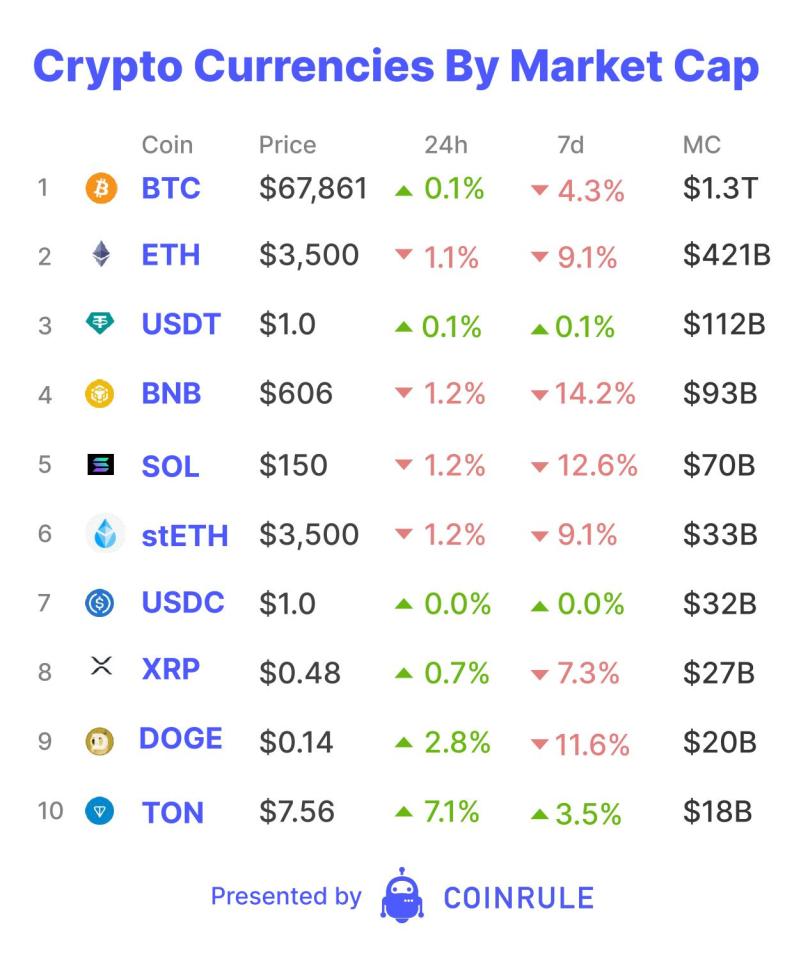

Cryptocurrencies have had an uneasy relationship with the Fed's policies. When the Fed began aggressively raising interest rates in 2022 to curb inflation, the cryptocurrency market experienced a severe downturn. Rising interest rates lead to higher borrowing costs, which has led investors to pull out of risky assets such as Bitcoin and Ethereum. However, the recent pause in interest rate hikes has provided a breather. After the latest CPI report, which suggested inflation was subsiding, Bitcoin and Ethereum both surged by about 4%, with Bitcoin briefly reaching the $70,000 mark before falling slightly. Traditional markets also reacted to the event, with the S&P 500 and Nasdaq Composite Indexes rising by about 1% and 2%, respectively, following the announcement.

Going forward, the cryptocurrency market is at a critical juncture. The Fed's steady control of interest rates suggests a period of potential volatility. The CPI figures suggest easing inflation, and there is speculation that interest rates will be cut in the near future. This could lead to volatility in cryptocurrency prices. Interestingly, most of the recent price declines in cryptocurrencies have already taken away downward liquidity, meaning that downward pressure on prices is easing. This could shift the focus to the upside, and if volatility begins, the market could rise further.

However, despite these short-term possibilities, the medium-term outlook for cryptocurrencies is uncertain. The market may continue to trade sideways, waiting for a new catalyst to determine its direction. An Ethereum ETF is one candidate to keep in mind as a catalyst for a significant upswing. The acceptance of this asset could see billions of dollars flowing into the Ethereum blockchain. This would not be a game changer only for ETH, but could also be an opportunity for altcoins to see a significant upswing.

Ultimately, the Fed's current stance provides temporary calm but leaves room for more volatility to come. As the Fed balances inflation control and economic growth, crypto investors need to remain vigilant and prepare for markets to swing in either direction, influenced by traditional monetary policy and the unique dynamics of digital assets.