Venture capitalist Arthur Chong believes the decentralized finance (DeFi) sector is in the midst of a “renaissance.”

The CEO of DeFiance Capital told his 177,800 followers on social media platform X that both internal infrastructure improvements and external macroeconomic developments are driving DeFi's resurgence.

“With changes in global interest rates, risk assets such as cryptocurrencies, including DeFi, are becoming more attractive for investors seeking higher returns.

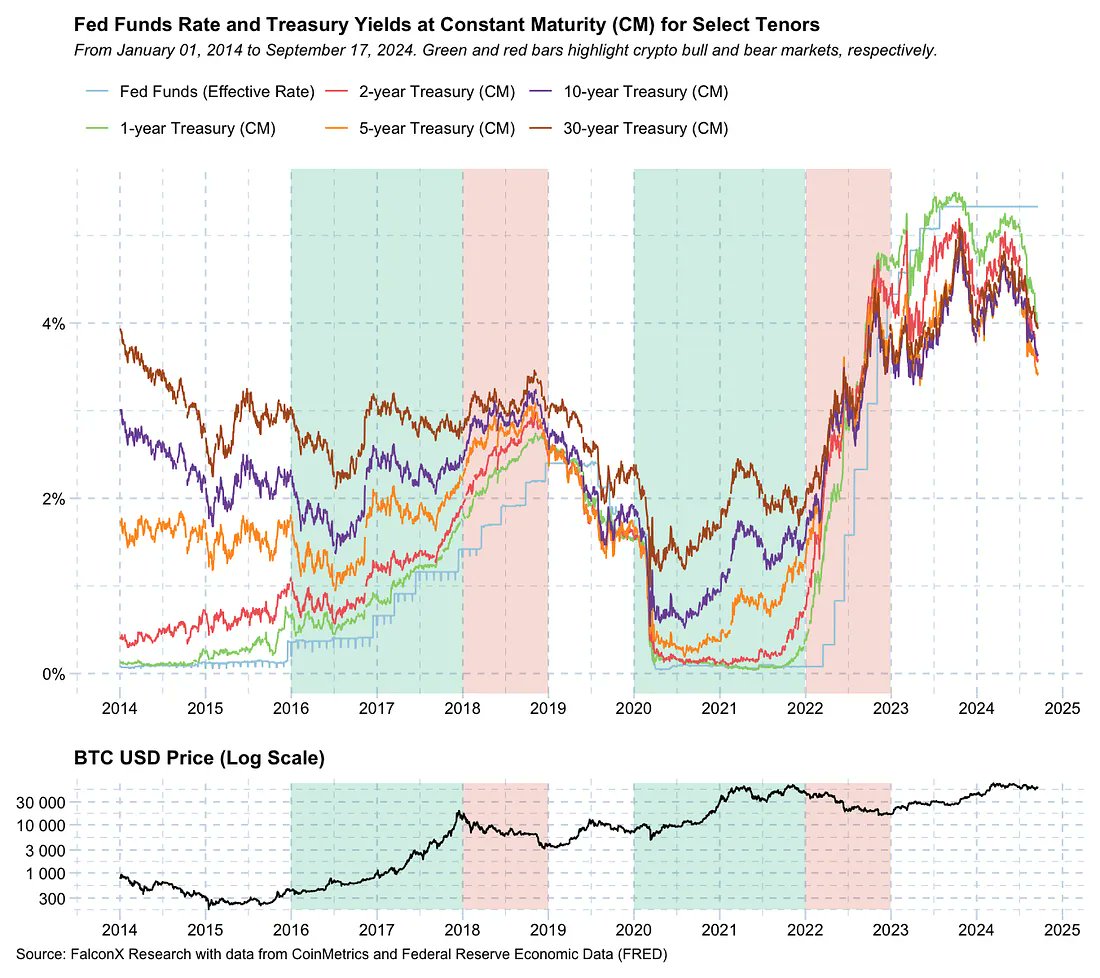

The Federal Reserve's 50 basis point interest rate cut in September sets the stage for a period of low interest rates similar to the environment that fueled the crypto bull markets of 2017 and 2020, as shown in the chart below. I was there. . Bull markets in Bitcoin (and cryptocurrencies) are highlighted in green during historically low interest rate regimes, while bear markets are typically highlighted in red when interest rates are skyrocketing. ”

Specifically, Cheong said DeFi benefits from lower interest rates, as Treasury bills and traditional savings accounts have lower returns. According to the venture capitalist, this will encourage more investors to turn to DeFi protocols in search of higher yields.

DeFiance Capital's CEO said lower funding costs could encourage DeFi users to take out loans, drive DeFi users into the sector's ecosystem and drive increased activity. It is also pointed out that

“While interest rates may not fall to the near-zero levels seen in past cycles, the opportunity cost of leveraging DeFi will fall significantly. Interest rate differentials may be amplified through leverage. Given that, even a modest drop in interest rates is enough to make a big difference.

Furthermore, we expect the new interest rate cycle to be a major driver for stablecoin growth, given that it will significantly lower the cost of capital for yield-seeking TradFi funds to migrate to DeFi. ”

Never miss a beat – Subscribe to get email alerts delivered straight to your inbox

Check price action

follow me ×Facebook and Telegram

Surf the Daily Hoddle Mix

Disclaimer: The opinions expressed on The Daily Hodl do not constitute investment advice. Investors should perform due diligence before making high-risk investments in Bitcoin, cryptocurrencies, or digital assets. Please note that transfers and transactions are made at your own risk and you are responsible for any losses you may incur. The Daily Hodl does not recommend buying or selling any cryptocurrencies or digital assets. The Daily Hodl is also not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: Mid Journey