Microsoft has called on shareholders to vote against a proposal to evaluate its Bitcoin investments, which has a negative impact on the broader crypto industry.

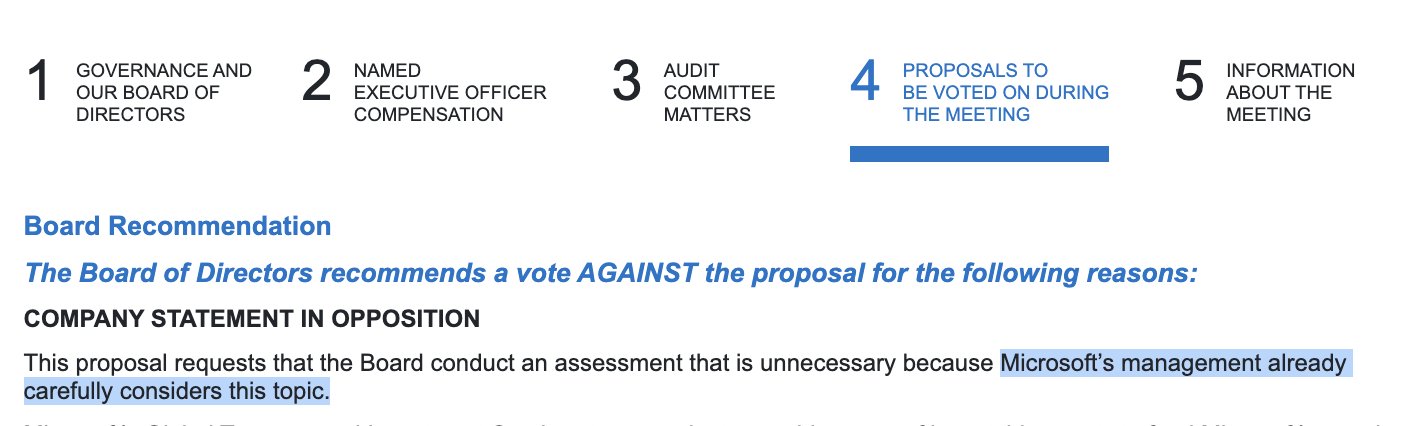

Microsoft will hold its annual shareholder meeting on December 9th, and shareholders will be able to vote on a variety of issues. One of the proposals is titled “Evaluating Bitcoin Investments.” However, the board recommended that shareholders vote against it.

Microsoft has already “carefully considered this issue,” the board claims in a filing with the Securities and Exchange Commission (SEC). “Past evaluations have included Bitcoin and other cryptocurrencies among the options considered, and Microsoft monitors trends and developments related to cryptocurrencies to inform future decisions.” I continue to do so.”

“As the proposal itself points out, volatility should be considered when evaluating cryptocurrency investments for corporate finance applications that require stable and predictable investments to ensure liquidity and operating capital. “Microsoft has strong and appropriate processes in place to manage and diversify its corporate finances for the long-term benefit of its shareholders, and this requested public assessment is unwarranted.” Ta.

The filing states that the National Center for Public Policy Research should consider Bitcoin at this year's annual shareholder meeting, as Microsoft strongly encourages companies to allocate at least 1% of their total assets to Bitcoin. It is stated that he plans to make a claim. The group described the leading cryptocurrencies as “a good hedge against inflation, if not the best.”

Microsoft is already leveraging Bitcoin technology through the open-source Decentralized Identifier Network (ION), which runs on the Bitcoin blockchain. The system uses decentralized digital credentials, such as driver's licenses and diplomas, that users can use for online identification. These “decentralized digital credentials” ensure users are in control of their data.

Urging shareholders to vote against Bitcoin investments led to ridicule from the broader crypto community.

“It's like Blockbuster discreetly dismissing Netflix,” said one harsh commenter on X in response to the news.

“I want Microsoft executives to think about how stupid they are,” said another person.

I want Microsoft executives to think about how stupid they are.

— Angarlo (@angarlo7) October 24, 2024

Just like how Blockbuster prudently dismissed Netflix.

— lastcoinstanding.substack.com (@LastCoinStandng) October 24, 2024

One commenter suggested selling Microsoft stock and converting the funds directly into Bitcoin. “The other shoe is going down. Maybe I should sell all my Microsoft stock and use the proceeds to put all my effort into Bitcoin?? As long as Bill is at Microsoft and on the board, there will be Attitude is going to really tip things over.'' “Enough of his genocide and Epstein Island vibe.'' a commenter said.

The other shoe goes down. Should I sell all of my Microsoft stock? Use the proceeds to go all-in on Bitcoin?? As long as Bill is at Microsoft and on the board, that kind of attitude will tilt things pretty far… his genocide. And the atmosphere of Epstein Island is over…

— Weed (@St30221Richland) October 25, 2024

“Even a fool would know that the right decision is to vote “yes,'' put all the “pipes'' in place, and exchange even 1% of the Treasury for Bitcoin. Optionally, you will be free to increase or change this percentage immediately. This is just a basic fiduciary responsibility,” said another.

Even a fool would know that the right decision is to vote “yes”, get all the “pipes” in place, and convert even 1% of the Treasury into Bitcoin.

This gives you the freedom to immediately increase or change this percentage as a future option.

This is just basic fiduciary responsibility. 🤷♂️

— lastcoinstanding.substack.com (@LastCoinStandng) October 24, 2024

If Microsoft invests in Bitcoin, it will become one of the few U.S.-listed companies, along with MicroStrategy and others, to hold Bitcoin as reserves.

Microsoft stock has soared 14.52% year to date in 2024, while MicroStrategy stock has soared 244%. MicroStrategy's current holdings are 252,220 BTC, worth approximately $15.8 billion.

The company has consistently been at the forefront of institutional investor adoption of Bitcoin, having invested heavily in the cryptocurrency since late 2020. This latest acquisition further solidifies MicroStrategy's position as one of the largest corporate holders of Bitcoin.

MicroStrategy continues to accumulate Bitcoin

MicroStrategy, a leading business intelligence company, has once again expanded its Bitcoin holdings. This latest acquisition underscores MicroStrategy's continued belief in Bitcoin as a digital asset and commitment to increasing its value over the long term.