Published as part of the ECB Economic Bulletin, issue 8/2022.

On January 1, 2023, Croatia adopted the euro, becoming the 20th member state of the euro area. The assessment contained in the European Commission and European Central Bank's 2022 Convergence Report paves the way for the first eurozone expansion since Lithuania joined in 2015.[1] On July 12, 2022, the Council of the European Union formally approved Croatia's membership in the euro area and determined the exchange rate of the Croatian kuna at 7.53450 per euro.[2] This was the central rate for the kuna during the country's participation in the Exchange Rate Mechanism (ERM II).[3]

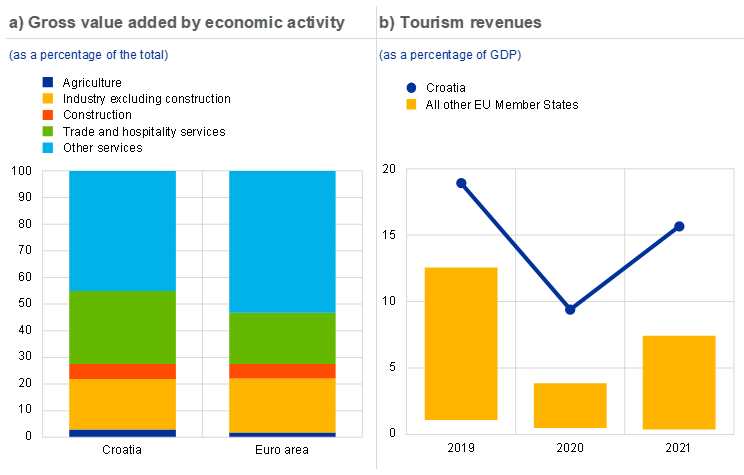

Croatia is a small economy and is well integrated with the eurozone through trade and financial links. It has a population of approximately 4 million people, and its GDP accounts for approximately 0.5% of the euro area GDP. The composition of gross value added in Croatia is similar to that of the euro area as a whole, with industry (including construction) and services accounting for approximately 25% and 72%, respectively (Exhibit A, panel a). Tourism accounts for the majority of Croatia's service sector, accounting for approximately 19% of GDP in 2019. This share declined significantly in 2020 due to the coronavirus pandemic, but increased again in 2021 and 2022. EU member states (Figure A, panel b). Tourism has significant spillover effects on other sectors of the economy.

Chart A

Structure of the Croatian economy

Sources: Eurostat, ECB and author calculations.

Note: Panel a) is based on gross value added at current prices in Q2 2022. “Trade and hospitality services” includes trade, transportation, accommodation and food service activities. Panel b) is based on travel credits in the balance of payments statistics and measures non-resident spending on goods and services when visiting a country. Yellow bars show the range of minimum and maximum values for all other EU member states.

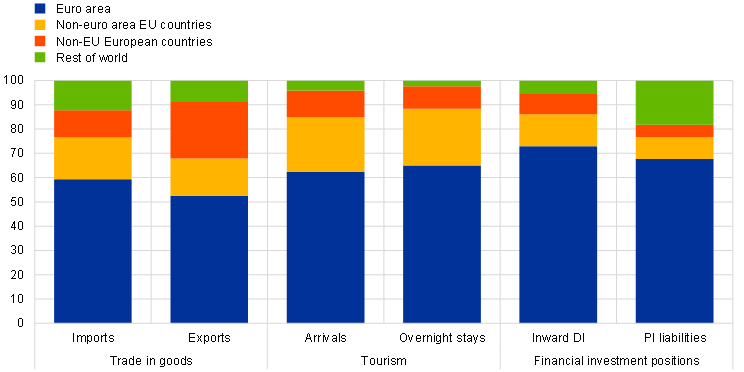

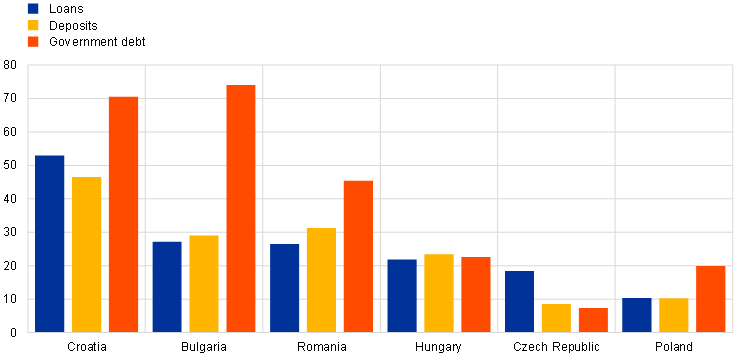

The eurozone is Croatia's main trading and financial partner (Figure B). Furthermore, banks owned by financial institutions based in other euro area countries play a dominant role in the Croatian banking system. Before the formal introduction of the euro, the Croatian economy was also characterized by a high degree of euroization. A significant portion of public and private debt was issued in euros, reflecting the currency composition of household savings and non-financial business liquid assets (Exhibit C).[4] Overall, the business cycle of the Croatian economy was highly synchronized with that of the euro area over the decade leading up to the introduction of the euro.

Chart B

Trade and financial links between Croatia and the euro area

(as a percentage of the total)

Sources: Croatian Statistical Institute, International Monetary Fund (CDIS and CPIS), and authors' calculations.

Note: “DI” stands for Direct Investment and “PI” stands for Portfolio Investment. “CDIS” refers to the Coordinated Direct Investment Survey and “CPIS” refers to the Coordinated Portfolio Investment Study. Data refers to 2021 for goods trade, tourism and PI debt. See 2020 for DI position data. Domestic tourists are not considered for tourist arrival and accommodation. The share of PI debt was calculated using mirror data of bilateral assets with Croatia.

Chart C

Proportion of euro-denominated loans, deposits and government debt

(as a percentage of the total)

Source: ECB and author calculations.

Note: Data refers to outstanding loans and deposits of non-monetary financial institutions excluding general governments as of the end of August 2022, and general government debt outstanding as of the end of 2021.

The Croatian economy is expected to benefit from the elimination of currency risks and lower transaction and borrowing costs. Given that Croatia is already deeply integrated into the euro area, and assuming it continues to pursue sound fiscal, structural and monetary policies, we expect it to benefit from euro adoption. The advantages include: (i) the elimination of exchange rate risks against the euro, which has recently been one of the main causes of fragility in the Croatian economy; (ii) a positive impact on foreign trade (including tourism) and investment through lower transaction costs and increased price transparency and comparability;[5] (iii) Firmly entrenched inflation expectations, along with lower regulatory costs and exchange rate risks, lower borrowing costs for the economy. The costs and risks associated with euro adoption are expected to be relatively small and mainly temporary, including switching costs and the risk of unreasonable price increases (against which the Croatian authorities have taken some measures). expected to be. Considering that Croatia's economic and financial integration with the euro area is already at a high level and the HRK/EUR exchange rate has been stable so far, adjusting the exchange rate as a macroeconomic policy tool in the event of an asymmetric shock The cost of losing the ability to do so is likely to be high. Low things. However, in order to limit the realization of such costs, the Croatian authorities need to implement sound economic and fiscal policies, respecting the inevitable constraints associated with a common currency and single monetary policy.

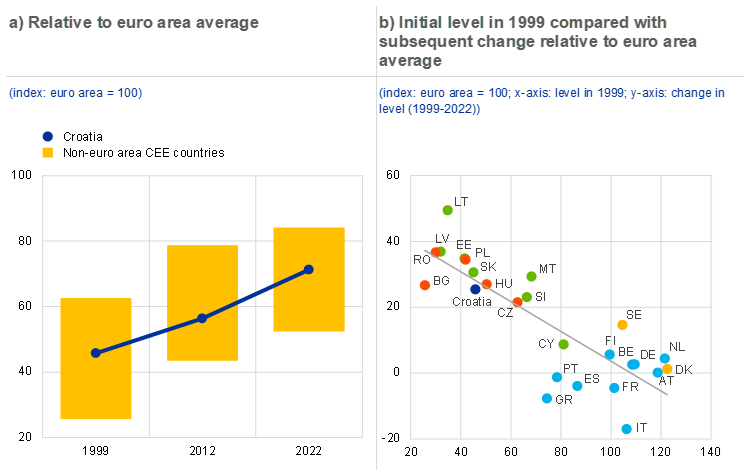

After joining the EU in 2013, Croatia has made significant progress in addressing macroeconomic imbalances and achieving convergence with the euro area. The macroeconomic imbalances that emerged during the long recession from 2009 to 2014 have been gradually corrected. These are associated with high levels of external, private, and government debt at low potential growth rates. The subsequent economic recovery and credible policy measures, including a sound fiscal stance and reforms to the labor market and business environment, have steadily reduced these vulnerabilities. At the same time, Croatia has significantly achieved substantial convergence with the euro area. GDP per capita rose from around 55% of the euro area average in 2012 (just before EU accession) to just over 70% in 2022 (Chart D, Panel a). Croatia's real growth performance followed the typical catch-up process observed in countries that adopted the euro after 2002 and other non-euro area countries (Exhibit D, panel b). Furthermore, in 2020, the Close Cooperation Framework entered into force, providing a gateway for non-euro area countries to the Banking Union, achieving convergence in banking supervision.[6] This framework ensured the application of uniform supervisory standards and contributed to safeguarding financial stability and facilitating the process of financial integration.

Chart D

real GDP per capita

Source: European Commission (AMECO database) and authors' calculations.

Note: Based on real GDP per capita based on purchasing power standards (PPS). For more information, see Diaz del Hoyo, JL, Dorrucci, E., Heinz, FF, Muzikarova, S., box 2, “Real convergence of the euro area: long-term prospects”. Sometimes paper series, No 203, ECB, December 2017. Data for 2022 is taken from the European Commission's Economic Forecast for Autumn 2022. “CEE” stands for “Central and Eastern Europe”. In panel a), the yellow bars show the range of minimum and maximum values across non-euro area CEE countries (Bulgaria, Czech Republic, Hungary, Poland, and Romania). The red dots in panel b) indicate non-euro area CEE countries (Bulgaria, Czech Republic, Hungary, Poland, Romania). Yellow dots indicate Denmark and Sweden. Green dots indicate countries that have joined the euro area since 2002 (Cyprus, Malta, Slovenia, Slovakia, Latvia, Lithuania, and Estonia). Light blue dots indicate countries that joined the euro area before 2002 (Belgium, Germany, Greece, Spain, France, Italy, Netherlands, Austria, Portugal, and Finland). Ireland was excluded because an unusual GDP revision in 2015 did not reflect an increase in actual economic activity. Luxembourg is excluded because the large number of cross-border workers distorts the calculation of GDP per capita.

Croatia's economy recovered strongly from the significant drop in production in 2020 and remained resilient to the economic impact of Russia's invasion of Ukraine. Reflecting Croatia's high dependence on tourism, the pandemic has dealt a severe blow to the economy, with real GDP contracting by 8.6% in 2020. Although policy support helped cushion the economic impact of the crisis, the economic downturn temporarily reversed previous progress. By correcting pre-pandemic macroeconomic imbalances. Progress accelerated again in 2021, with the economy recording double-digit growth (13.1%) on the back of a strong tourist season and solid consumer spending and investment movements. Croatia's economy continued to be the fastest growing among EU member states in 2022, due to the continued strong performance of the tourism sector and relatively limited direct trade and financial exposure with Russia.[7] As a result of rising energy and food prices, consumer price inflation rose further in 2022, significantly exceeding euro area inflation. Fiscal measures, such as lowering the value-added tax rate and price ceilings on gas, electricity and basic foodstuffs, lowering fuel excise taxes and freezing margins on petroleum products, helped temporarily ease inflationary pressures. Overall, the multiple shocks arising from the COVID-19 crisis and the war in Ukraine had a limited impact on Croatia's ability to meet the convergence criteria for euro adoption. Nevertheless, there are concerns about the sustainability of the end to inflation, for example if fiscal measures to support aggregate demand accelerate inflation further.

It is important for Croatia to ensure the sustainability of economic convergence in order to fully enjoy the benefits of the euro and to enable the coordination mechanisms to function efficiently within the expanded currency area. Economic policies should be directed towards supporting growth potential and resilience to prevent the emergence of macroeconomic imbalances. Croatia's economic growth potential still appears subdued as a catch-up economy. In this context, it is necessary to implement structural policies aimed at increasing potential growth rates and strengthening the competitiveness and resilience of the economy. Improving the quality and efficiency of the institutional and business environment, administrative and judicial systems, and modernizing the country's infrastructure could be prioritized. Overall, policies should focus on supporting innovation and investment in new technologies, with a view to broadening the sources of economic growth beyond tourism. Increasing labor productivity requires (i) reducing mismatches in the labor market, (ii) increasing the quantity and quality of labor supply, (iii) raising low labor participation rates, and (iv) aligning the education system with the needs of the economy. Match. To ensure the successful completion of the reform agenda, the efficient absorption of the EU funds allocated to the country will also be of paramount importance.[8]