Bitcoin's bullrun is about to be supercharged, but this time it is not Michael Saylor. When CME launches Bitcoin BFF at a major Bitcoin Bull Lankataist event, Bitcoin Friday is coming.

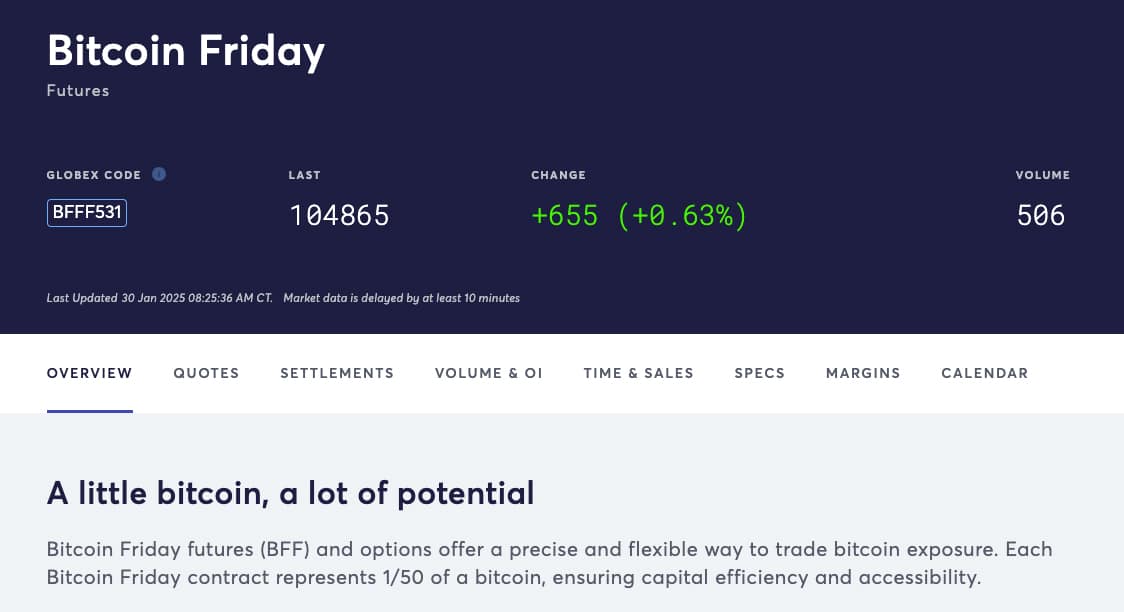

As recently reported, the Chicago Marcantile Exchange (CME) group will introduce options on Bitcoin Friday Futures (BFF) on February 24, 2025, and requires approval.

This enhances the accuracy of managing short -term bitcoin prices. }

price

24 hours volume

?

->

Price 7D

risk. The new BFF option is the extension of the successful BFF release of CME. This is a bullish news of bitcoin and cipher in general.

The price of bitcoin is extremely bullish: How to make CME BFF worsen the possibility of Blurran

The CME BFF contract, which debuted last September, became one of the most successful CME groups.

Since then, more than 775,000 contracts have been traded and are very popular among investors. The size of these contracts is small, one -50th of bitcoin, with a daily expiration from Monday to Friday.

Giovanni Vicioso, the CME Group's global head, has emphasized the accuracy of these new options to traders.

By introducing these options, the Bitcoin of the microsized and the .cwp-coin-chart SVG pass {strokewid: 0.65! Along with important things, it complements existing products in the CME group, including physically deposited bitcoin and ether options. }

price

24 hours volume

?

->

Price 7D

futures.

(sauce)

In addition to the development of the market, Crypto has been bullish from regulatory news. Jerome Powell, chairman of the Federal Reserve, has recently indicated that banks are allowed to provide encrypted services.

This statement, which was held at a press conference, immediately lived the price of bitcoin.

Powell's comment suggests a potential change in how the bank interacts with the code, providing opportunities to maintain digital assets on behalf of clients. He emphasized that the Federal Reserve continues to monitor the risks related to encrypted and/bitcoin.

“Banks can fully provide services to encrypted customers,” said Jerome Powell.

After mentioning Bitcoin, it has now risen again at $ 104k. pic.twitter.com/iicnx51fyg

-Peg

(@Ivvvagiant) January 29, 2025

Before this statement, Powell explicitly stated that Bitcoin would compete with gold, not US dollar competition. He explains that bitcoin resembles digital gold. “It's like gold, virtual. It's digital.”

Bitcoin has a 21 million coin hard cap. A “Harving” event occurs every four years, the mining remuneration decreases in half, and the new supply of bitcoin entering the market is virtually decreasing. With this rarity, the price of bitcoin increases demand and pushes up. The last half of 2024 has further reduced the issuance rate and supported the nature of Bitcoin deflation.

Finished, but new money is mined every year, increasing about 1-2 % every year. There is no built -in mechanism like half of bitcoin to reduce the growth of this supply. Money comes from nature, it is difficult to predict its number, and it becomes more abstract as an investment.

Related: Bitcoin Harving Guide -How much is the Bulrun?

The market capitalization of bitcoin is ~ $ 2t. Approximately 11 % of the market capitalization of gold is ~ 18t.

Bitcoin is a better way. Bitcoin exists on a computer anywhere and anywhere. In the next 5 to 10 years, the market capitalization of bitcoin may exceed money.

6 reasons

Rare: Bitcoin … pic.twitter.com/edigqfwvyp

-₿ rianmaASS (@maasscfo) January 25, 2025

In the past 10 years, Bitcoin has been proved to be a very good investment compared to gold. From about $ 300 in 2014, Bitcoin has exceeded $ 100,000 by 2024, and has gained a tremendous return of about 33,000 %.

This means that if you have invested $ 1,000 in Bitcoin in the early 10 years, your investment is worth about $ 330,000. Gold, on the other hand, has increased to about $ 2,200 for about $ 1,200 per ounce, increasing to about $ 2,200, providing approximately 83 % of revenue.

In comparison, this is about $ 1,830 for $ 1,000 investment in gold growth over the same period.

Holding bitcoin would have been much more advantageous in the past decade. No, bitcoin does not stop immediately. It is a million dollar asset because institutions and smart money are participating in bitcoin.

MicroStrategy Bitcoin Bet: Impact on Michael Saylor's vision and Crypto Bull Run

In 1989, Michael Saylor jointly established Microstra Tegute with Sanju Bansal. Initially, the company, which focused on data mining, became the leader of business intelligence, mobile software and cloud -based services.

Saylor was CEO from 1989 to August 2022. With this decision, he can focus on bitcoin strategies.

Michael Saylor released MicroStrategy in June 1998. The stock was initially a price of $ 12 and doubled on the first day of the transaction. By the beginning of 2000, his net assets rose to $ 7 billion, and he became one of the most wealthy people in the world.

In 2020, MicroStrategy announced that Bitcoin will be used as a major Ministry of Finance protection assets. This led to purchasing more than 471,107 bitcoin by the beginning of 2025, and was evaluated as $ 30.4 billion.

Saylor is pleased with the criticism of Maxi to make Bitcoin “too big”.

Expand your capital to BTC and provide a cover to the institution that pumps the bag

Legend

-Mitchell

(@Mitchellhodl) October 21, 2024

Saylor has become a Bitcoin vocal advocacy, and has appeared in numerous podcasts and media to discuss the potential as a hedge for inflation. Under his guidance, MicroStrategy is investing a lot on bitcoin.

These actions have a micro strategy at the forefront of the future of financial changes. This encourages a question: If you haven't done the same, what are you waiting for?

Explore: 15 new and future coin base lists that can be viewed in 2025

For the latest market update, please participate in this 99 -bitcoins news.

Post CME has a secret plan to forcibly charge the execution of bitcoinble. What is Bitcoin BFF? First appeared in 99 Bitcoin.