- Solana is rapidly catching up with Ethereum in terms of fees.

- However, the Ethereum ecosystem still enjoys the confidence of investors.

of Solana [SOL] versus Ethereum [ETH] The debate has resurfaced on crypto Twitter following reports that the former may soon reverse the latter in terms of fees.

According to on-chain analyst Dan Smith, Solana was rapidly closing in on Ethereum in terms of transaction fees.Smith claimed that,

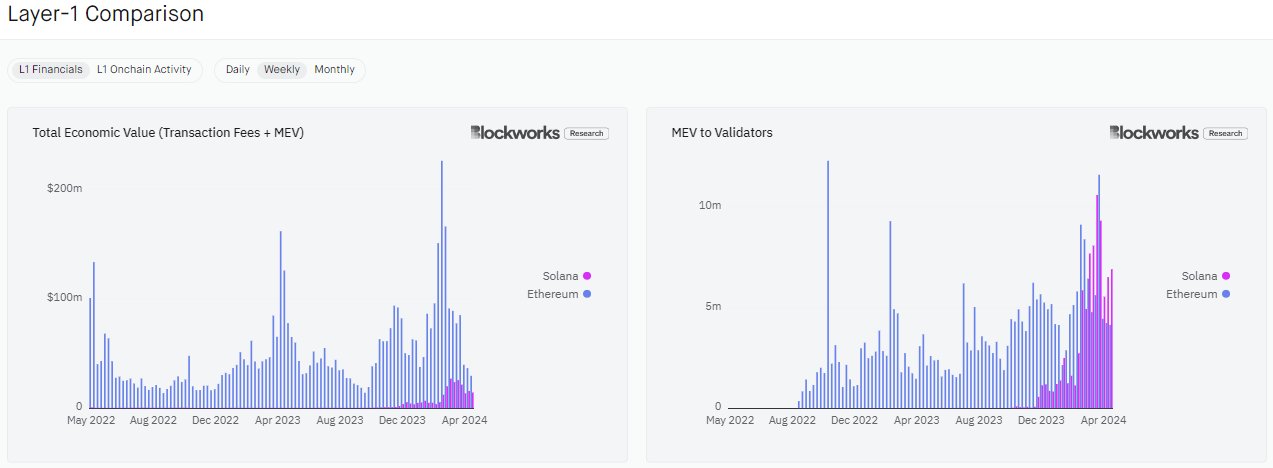

“Solana will flip Ethereum on transaction fees and acquired MEV this month, possibly as soon as this week.”

Transaction fees refer to fees associated with network activity, while MEV refers to the highest value a validator can earn by maximizing block generation or “confirmations.”

Solana vs. Ethereum: Fees and other aspects

Smith pointed out that there is a roughly $300,000 difference in fees between Solana and Ethereum, and backed up his claim with data.

Source: X/Dan Smith

The chart shows that Solana recorded a significant rally in 2024, closing most of the gap with Ethereum.

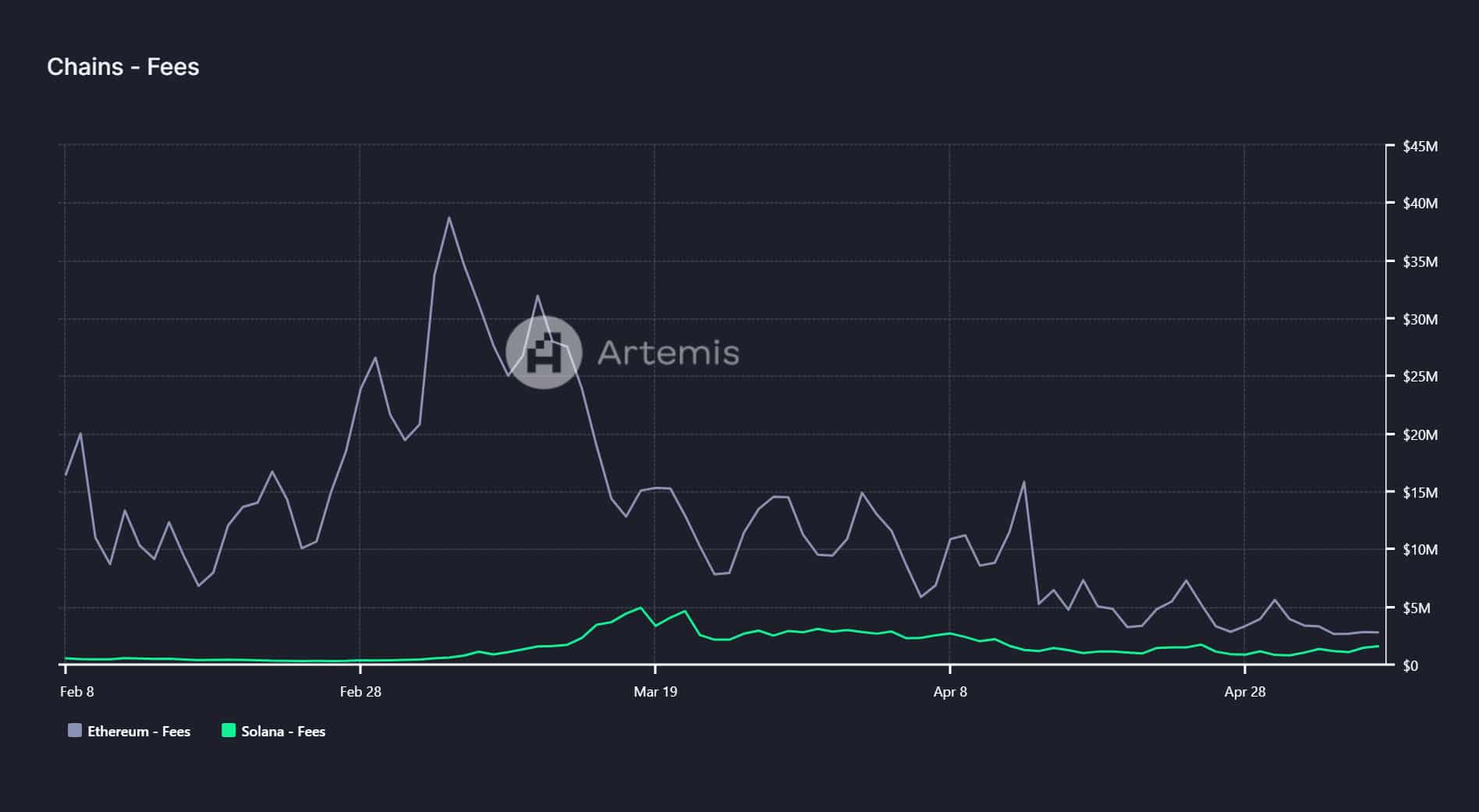

AMBCrypto's evaluation of Artemyz data confirms trends in fees. Data shows that Ethereum network fees have fallen significantly since the end of February.

On May 7, Ethereum's fees reached $2.8 million, while Solana's fees were $1.6 million.

Source: Artemis

However, other market watchers argued that Ethereum trading volume should include all L2 in order to capture Ethereum's “true value.” Dan Smith responded:

“The question is whether pushing activity into L2 where the asset ETH is used as currency will return enough value to L1 to compensate for the loss of L1 activity.”

Despite network challenges, Solana has lower transaction fees on average than Ethereum.

Crypto analyst Anthem reacts to Smith’s prediction that SOL will outperform ETH I wondered,

“And it's still 100x cheaper to trade for users. Think about this and elaborate on why ETH is still worth 5x more by market cap.”

After Solana’s Jupiter transaction, things are improving on the DEX (decentralized exchange) front as well. exceeded Uniswap for Ethereum in terms of Unique Active Wallet (UAW).

Similar to Anthem, most market participants emphasized that SOL is terrible. underratedespecially after last week's backlash.

Despite this, Ethereum held a commanding lead in TVL (Total Value Locked) and overall token value on the price chart.

Solana’s TVL was $4 billion, while Ethereum’s was measured at $53.3 billion at the time of writing, highlighting that Ethereum has more investor confidence.