Ethereum (ETH) price recently fell by 10% after an attempt to establish $2,700 as a support level failed. Despite these setbacks, the altcoin has managed to stay above the uptrend line for the past two months, a feat largely supported by strategic whale activity.

With large amounts of capital leveraged, these high-net-worth investors may hold the key to a possible reversal.

Panic among Ethereum holders

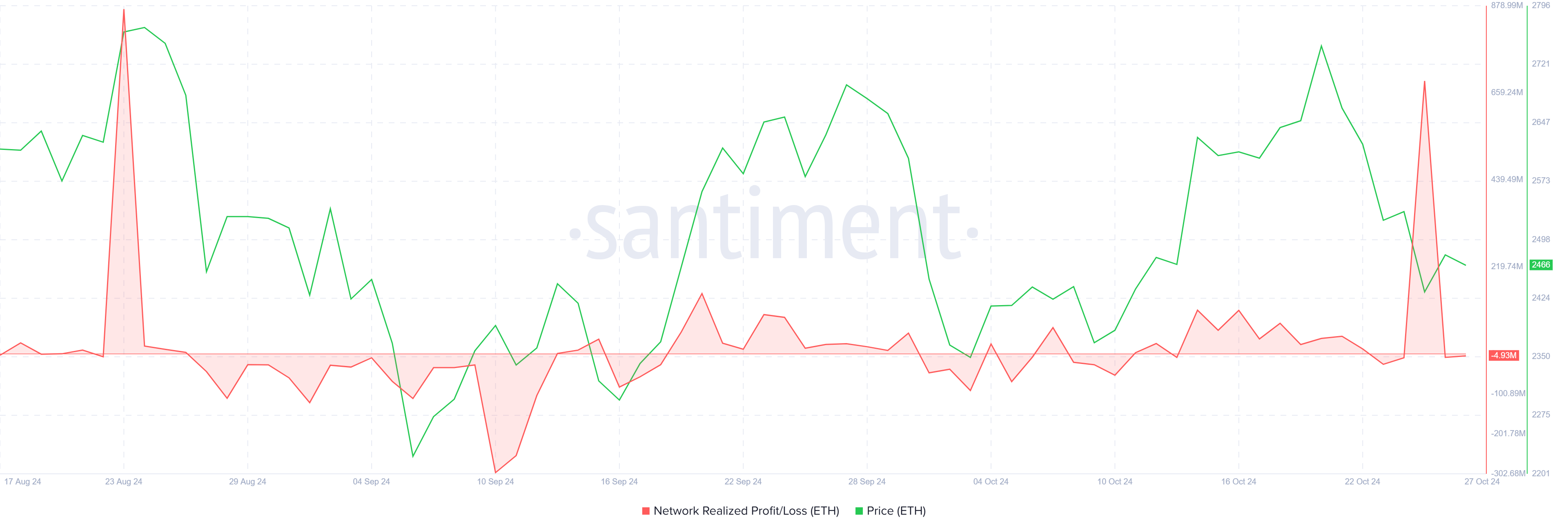

Ethereum has seen significant profit-taking recently, with realized profits hitting a two-month high. This spike indicates that many ETH holders have chosen to cash out their previous gains, contributing to the recent price movements. The surge in selling activity coincides with the broader market decline and reflects defensive moves by investors looking to lock in profits amid the economic downturn.

This trend could lead to a sharp drop in the value of ETH, raising concerns and causing panic selling. Such increases in realized gains often signal a decline in short-term market confidence among investors.

Read more: How can I invest in Ethereum ETFs?

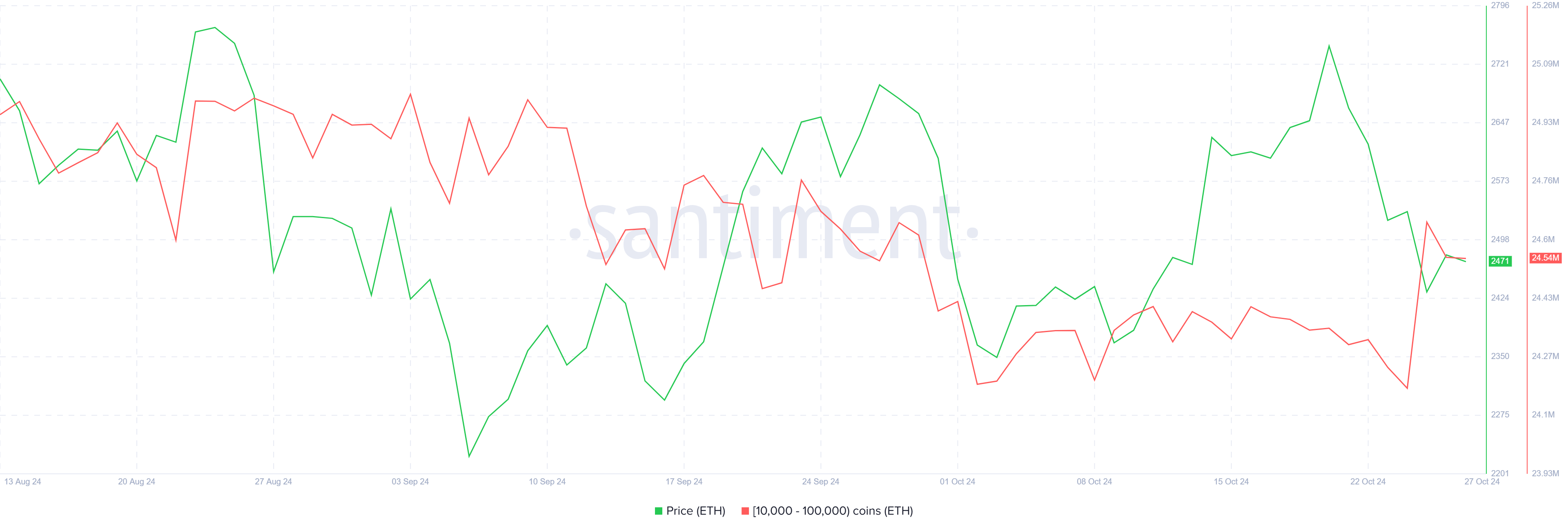

Amid the decline, whales are taking steps to counter drawdowns. This group of high-net-worth investors, especially those holding between 10,000 and 100,000 ETH, recently accumulated over 360,000 ETH, worth over $880 million.

Accumulation efforts by Whales highlight their strategic approach and strengthen broader market sentiment. Their actions signal a vote of confidence in Ethereum's long-term potential, even as the price continues to move through current volatility. More stable support levels are expected, at least temporarily, as whales take advantage of lower prices.

![]() ETH price prediction: history will not repeat itself

ETH price prediction: history will not repeat itself

Ethereum’s recent 10% drop has brought it perilously close to the uptrend line, and this level is being tested as support. This decline is due to a series of failed attempts to break above $2,700, and the altcoin’s current price is under significant pressure. Although this fourth failure has increased ETH's vulnerability, the uptrend line continues to show a semblance of stability.

Currently, the immediate goal for ETH is to turn the local resistance at $2,546 into support. Achieving this would provide Ethereum with a strong foundation for another attempt to break out of the $2,698 level, setting the stage for a move above $2,700. Retrieving this level as support would signal a significant change in sentiment and signal the possibility of further upside.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, a failure to break out of $2,546 or a new wave of selling could jeopardize ETH’s positions along the uptrend line. Losing this support could cause Ethereum price to fall to $2,344, invalidating the bullish-neutral outlook and creating more cautious sentiment across the market.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although BeInCrypto strives for accurate and unbiased reporting, market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.