With Bitcoin breaking above $66,000, are we looking at the early stages of a long-term bull market, or is this just a temporary rally?

Bitcoin is back in action

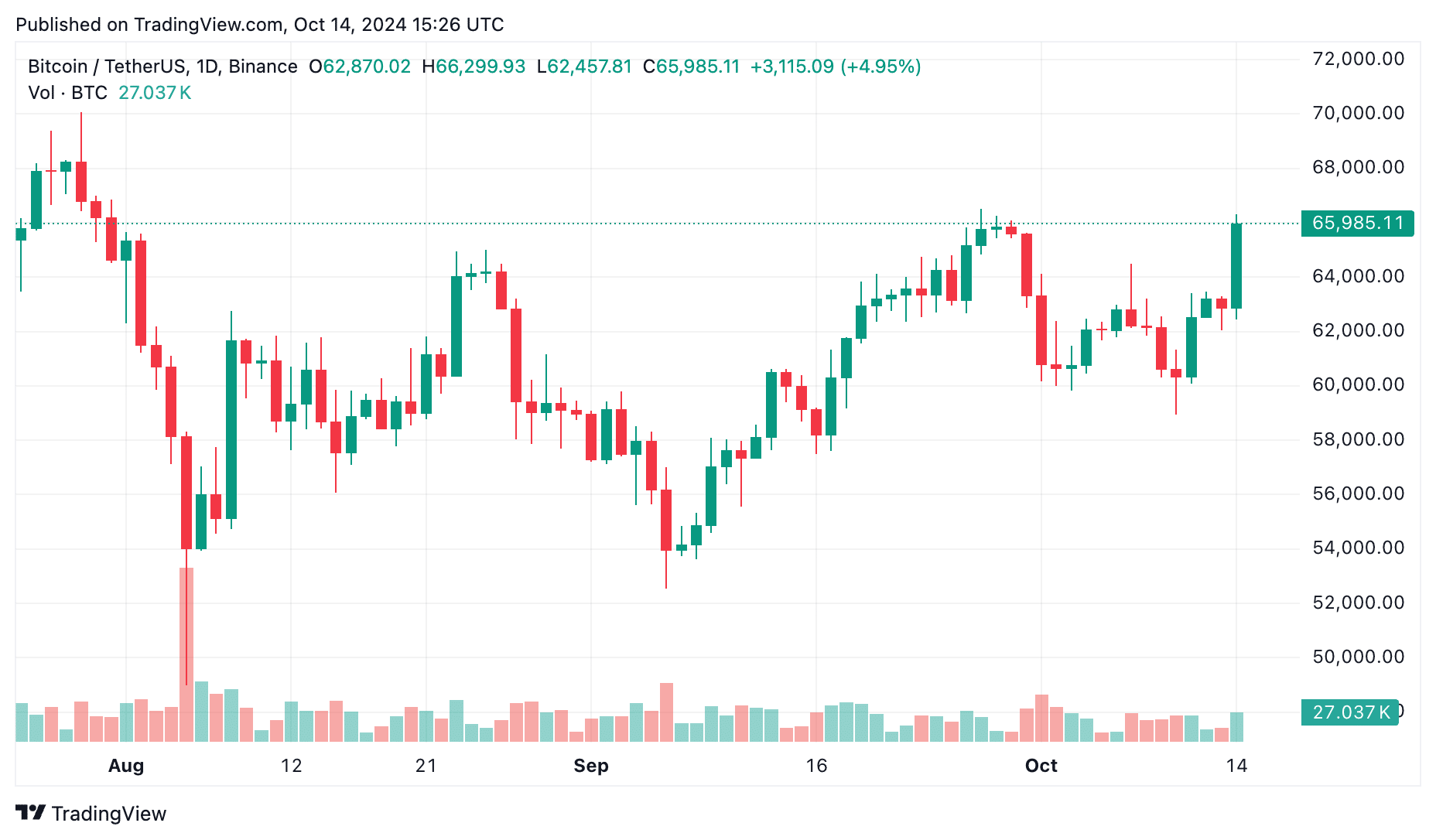

Bitcoin (BTC) is back in the spotlight, rising above the $64,000 resistance as the broader crypto market shows signs of recovery. As of October 14th, Bitcoin was trading at around $66,000 level, registering a solid 5.5% increase in the past 24 hours.

This surge followed weeks of volatility in the crypto industry, primarily caused by concerns about the global economy and rising geopolitical tensions, particularly in the Middle East.

The main driver of this new momentum is global markets reacting to China's latest economic developments. The country has been working to revive its economy, but the announcement of a long-awaited stimulus package has left many wondering if it is enough.

Economists have suggested that China's efforts to curb deflation are not enough, which has shifted attention to Bitcoin. According to Bloomberg, some speculators are capitalizing on Bitcoin's momentum by switching from Chinese stocks to cryptocurrencies.

Caroline Moron, co-founder of Orbit Markets, emphasized that “capital rotation from Bitcoin to Chinese stocks” had previously depressed crypto prices. Bitcoin now appears to be benefiting from this easing of rotation.

Adding to the positive momentum, last week's decision by bankrupt cryptocurrency exchange Mt.Gox to delay repayments to creditors by an additional year eased some of the market's fears. The exchange is owed about $2.7 billion worth of bitcoin, and the delay dampened fears of a large-scale selloff.

And perhaps the most exciting element? October, affectionately known as “Uptober” by the cryptocurrency community, has historically been Bitcoin's most profitable month. Since its inception, Bitcoin has recorded an average gain of more than 21% in October, despite setbacks in 2014 and 2018.

So, what does this leave for Bitcoin? Let's take a closer look at what's next for BTC and what our Bitcoin price predictions mean for the next few days.

Factors driving market momentum

Bitcoin has gained momentum recently due to several important factors.

One of the clearest signs of positive momentum is the inflow into spot Bitcoin exchange-traded funds. After a short period of outflows, the Spot BTC ETF saw a big move on October 11th, posting its largest inflow in two weeks of over $253 million.

This suggests that recent selling pressure on Bitcoin may be easing as investors regain confidence. ETF inflows often indicate interest from institutional investors and suggest brighter days are ahead for Bitcoin.

The US presidential election is also spurring Bitcoin's rise. Prediction markets have reversed and are now favoring pro-crypto Republican candidate Donald Trump over Democratic Vice President Kamala Harris.

As of Oct. 14, Mr. Trump's probability of victory in the polymarket is 54%, while Ms. Harris's probability of victory has fallen to 45%, the lowest since the start of the campaign. Trump's victory is seen as beneficial for the crypto industry and could lead to more crypto-friendly policies.

Meanwhile, Bitcoin's biggest corporate backer, MicroStrategy (MSTR), continues to outperform the market. Since adopting a Bitcoin-centric strategy in August 2020, MicroStrategy's stock price has risen 1,620%, significantly outperforming Bitcoin, the Magnificent 7 tech giants, and the S&P 500.

Executive Chairman Michael Saylor remains bullish, recently tweeting that “the only thing better than Bitcoin is more Bitcoin.”

However, recent results from Bitcoin mining have been mixed. This month, the BTC price increased by 5%, but the network's hashrate also increased by 11%, which slightly affected miners' profitability.

Jefferies analysts said miner revenue per exahash fell 2.6% in September and October could be even more difficult unless prices spike.

Bitcoin's momentum has been further fueled by recent moves by the Federal Reserve. On September 18, the Fed cut interest rates by 50 basis points, bringing the short-term benchmark interest rate to 4.75% to 5.00%.

The market is also pricing in further rate cuts, with an 86% probability of a 25 basis point cut in November and December. Low interest rates generally benefit risky assets such as Bitcoin, as lower borrowing costs drive investors toward higher-yielding alternative assets.

What do you expect next?

Looking at both macro and crypto-specific data, some important observations about the potential direction of the market are emerging. Let's look at some key insights.

Whale accumulation and minimal resistance

Bitcoin faces minimal resistance in the $55,000 to $64,000 range, according to IntoTheBlock's “Money In/Out Around Price” data.

Here, more than 4.3 million BTC is “in the money”, meaning that many holders are in profitable positions, highlighting the importance of this range. .

The key takeaway from this data is that whales, the large holders of Bitcoin, are steadily increasing their positions below $60,000.

“Whales have been accumulating significantly in the sub-$60,000 range,” said Slim Duddy, a cryptocurrency market observer. This pattern suggests that major investors believe Bitcoin is undervalued and poised for a breakout.

Historically, whale accumulations are often a sign of an upcoming bull market, as their purchasing power creates upward pressure on prices. From a technical perspective, this strengthens the possibility of a breakout, especially since Bitcoin is above $62,000.

Major resistance level is $64,000

Crypto analyst Michael Van de Poppe sees Bitcoin’s recent test of $62,000 as a harbinger of a bigger move. He predicts that a “massive rally” is underway and that “a test of $64,000 is likely to provide the big breakout the market is looking for.”

The $64,000 level is important for both psychological and technical reasons. Psychologically, it represents an important area where many traders set stop losses or take profits. Technically, this is a resistance zone where strong selling pressure may appear.

If Bitcoin decisively breaks above $64,000, it could pave the way for a sustained rally toward all-time highs. However, if you cannot break through this level, you may fall back.

Whale accumulation below $60,000 will provide some support, but failure at $64,000 could lead to temporary consolidation or short-term decline.

Bitcoin price prediction: 2024 and beyond

Bitcoin is currently gaining momentum and the big question on everyone's mind is where will it go next?

Analysts and market experts have provided several predictions, each based on different data models. Let's find out what they have to say about Bitcoin's future starting in 2024.

Bitcoin price prediction in 2024

One of the more conservative predictions comes from Coincodex, which predicts Bitcoin to reach an all-time high of $89,885 by November 2024. This is a 38% increase from current levels and above the March 2024 all-time high of $73,750.

DigitalCoinPrice's other model offers a wider range, with Bitcoin prices estimated at between $59,195 and $144,380. On average, they predict that Bitcoin will hover around $137,331 in 2024.

Bitcoin price prediction in 2025

According to Coincodex, Bitcoin is expected to trade between $65,494 and $102,794 in 2025. DigitalCoinPrice has a more bullish outlook, predicting a range of $141,620 to $169,264.

Titan of Crypto also predicts that Bitcoin could rise towards $105,000 in 2025 based on Fibonacci Yen analysis. He suggested that this is a conservative estimate and that there could be even greater gains depending on market conditions.

Bitcoin price prediction in 2030

Predictions for Bitcoin price in 2030 are even more dramatic. By then, Coincodex predicts that Bitcoin could trade between $118,333 and $305,028. DigitalCoinPrice sees Bitcoin reaching nearly $493,000, a significant increase from current levels.

It is not impossible to reach these high numbers by 2030 if Bitcoin continues to be institutionally adopted and supported as a mainstream financial asset. However, you need to be careful.

The road ahead

Although these predictions paint an exciting picture about Bitcoin's future, it is important to approach them with caution. Bitcoin's volatility means that large swings in either direction are always possible. These forecasts can change quickly due to market sentiment, global financial conditions and unforeseen events.

It's important for investors to stay informed and maintain a long-term perspective. Always consider your risk tolerance and the broader market before making any investment decisions. Don't invest more than you can afford to lose.

Disclosure: This article does not represent investment advice. The content and materials published on this page are for educational purposes only.