Ethereum has had a disappointing performance for investors in recent weeks, raising concerns that the second-largest cryptocurrency by market capitalization has lost its luster. The cryptocurrency continues to avoid the $3,100 level and fails to make significant gains. This indicates weak fundamentals that could cause the price to fall.

Ethereum fails to make meaningful moves

Markus Thielen, head of research at 10x Research, pointed out several worrying trends regarding the Ethereum price. In a new report shared with NewsBTC, he notes that Ethereum remains highly correlated with Bitcoin, with an R-squared rate of 95%, while Bitcoin has hit new all-time highs. The company says that performance continues to be weak.

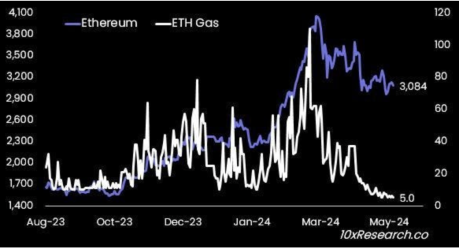

Looking back at ETH's performance during the last bull market, Thielen points out that it was closely tied to new sectors that have sprung up from the network, such as decentralized finance (DeFi) and non-fungible tokens (NFTs). This led to a surge in demand and prices as users gobbled up ETH due to the high gas fees required to trade on the blockchain.

However, Ethereum was unable to maintain this momentum, and this can be attributed to its inability to provide users with the upgrades they needed in time. Thielen explains that the Dencun upgrade that helped solve the problem of rising gas prices was three years late because users had migrated to Layer 2 networks by the time the upgrade arrived in 2024. . Other Layer 1 networks have also seen user growth during this time, including Solana.

Source: 10x Research

The researchers further explained that ETH's weak fundamentals are not only impacting its price, but are also having a knock-on effect on Bitcoin. “Ethereum’s weak fundamentals are a stumbling block for Bitcoin as it prevents widespread fiat inflows into the crypto ecosystem,” Thielen said.

Better to short ETH

Thielen’s analysis of Ethereum also extends to the declining use of stablecoins on the network. Back in 2021, Ethereum dominated stablecoin trading such as USDT and USDC. But like anything else, high fees seem to be driving users to other networks. Currently, blockchains such as Tron (TRX) dominate stablecoin trading, leaving ETH in the dust.

Additionally, there is the fact that ETH issuance is starting to become inflationary again. After the London Hard Fork, also known as EIP-1559, was completed in 2021, the network experienced deflation in its issuance for the first time as the amount of ETH burned rapidly exceeded the amount of ETH in circulation.

However, Thielen points out that this situation has changed in recent months, as more ETH has been minted than was incinerated. To put this in perspective, a total of 74,000 ETH was minted, while only 43,000 ETH was burned. This inflation, combined with the drop in staking rewards to 3% below the 5.1% yield on U.S. Treasuries, has meant that Ethereum has struggled to maintain bullish sentiment.

Given these developments, researchers believe it is better to be bearish on Ethereum for now. “At the moment, it is safer to hold a short ETH position than a long BTC position, as Ethereum fundamentals are fragile and have not yet been reflected in the ETH price,” Thielen concluded.

ETH price fails to hold $3,100 | Source: ETHUSD on Tradingview.com

Featured image from Watcher Guru, chart from Tradingview.com