The price of Ethereum remains in the spotlight. Over the past 24 hours, ETH has risen by 1.4%, rising from the key support level at $2,300, bringing the price to $2,411. Because of this, many are wondering: Will Ethereum maintain this upward trend?

Current Ethereum price fluctuations

Ethereum (ETH) is showing signs of recovery and is trading within a triangle pattern. Recently, ETH price recovered from $2,332, an important level related to the Fibonacci extension. If ETH continues to sustain above this, it could reach $2,598, which is consistent with the daily Fibonacci extension of 0.618. Trading volumes have increased by 67%, indicating increased interest in the market.

On the downside, if Ethereum is unable to hold $2,300, it could drop 12% from its current price to $2,100.

Institutional Activity: How Whales and ETFs Impact Ethereum Price

Ethereum price is facing challenges due to low institutional demand. US Spot ETH ETFs reported $560 million in outflows, with the majority led by Grayscale's ETHE. This reflects the cautious behavior of large holders.

Additionally, large whale wallets, including those associated with the Chinese government, began selling $1.3 billion worth of ETH. This, like other ETH news, could increase selling pressure and impact ETH USD price.

Ethereum network growth and long-term outlook

Despite some concerns, Ethereum's fundamentals remain strong. The network has undergone major upgrades including Ethereum staking via the Beacon chain, with over 34.7 million ETH staked. This represents nearly 28.8% of the total ETH supply and strengthens Ethereum as the primary layer 1 blockchain. Similarly positive developments have also recently improved the outlook for Ripple (XRP), another major altcoin.

In the DeFi space, Ethereum has a TVL of $44 billion and a stablecoin market capitalization of $84 billion. Major projects such as Uniswap and OpenSea are increasing Ethereum's dominance and demonstrating continued growth.

Beyond ETH: Why Minotaur ($MTAUR) is attracting the attention of ETH holders

Many cryptocurrency enthusiasts are placing big bets on Ethereum as it has been recovering recently. While ETH is promising, diversifying your holdings may be a wise move. Buzz on social media highlights Minotaur ($MTAUR) as a favorite among ETH holders, making it an exciting option to consider.

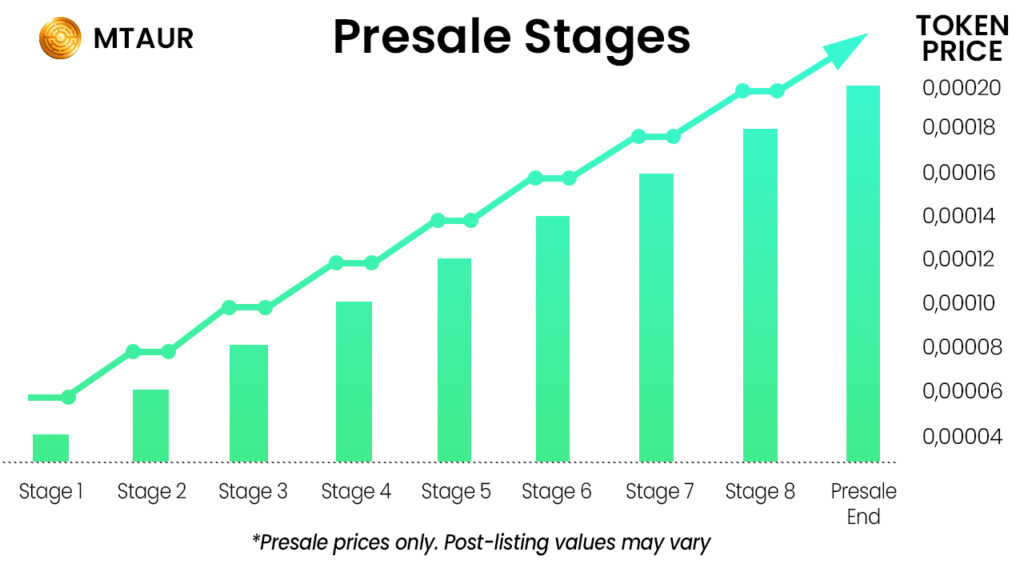

It has already reached the $100,000 mark in pre-sale, but still offers an affordable entry point for potential buyers. That means you can get your tokens for $0.00005964. This is 70% off the list price. Minotaur ($MTAUR) stands out from other ICOs with its actual in-game utility. Industry experts and thought leaders believe the Minotaur is more than just hype and is built to last.

On top of that, Minotaur recently announced a $100,000 giveaway to pre-sale purchasers. With 100 winners and a top prize of $50,000, the odds are looking pretty good. The referral and vesting program for holders also shows that Minotaur puts its community first.

So why wait? The benefits of buying early are clear, so it's best to explore Minotaur ($MTAUR) now while the presale is still ongoing.

conclusion

The Ethereum market has shown resilience despite significant capital outflows from institutional investors and whale activity. The $2,300 support level remains important, but the price's ability to rebound indicates strong underlying demand. If Ethereum maintains its current course and breaks above $2,598, the upward momentum could continue. However, holders should be aware of external factors.

If you want to ride the Ethereum wave with confidence, adding Minotaur ($MTAUR) to your asset lineup may be a smart choice. This token is packed with potential, offering a low cost of entry and a thrilling chance for serious upside. But hurry. The pre-sale token pool is decreasing by the minute.