- Bullish excitement has returned to the market, with Base setting new highs for TVL and stablecoin market capitalization.

- Performance statistics confirm healthy improvements in reliability and network utility

The tide has shifted in favor of crypto bulls in September, and Base is one of the networks taking advantage of this shift. This is evident in the resurgence of robust network activity.

Base has established itself as one of the fastest growing Ethereum Layer 2. The network's recent performance indicates that it is likely to benefit greatly as the market continues to heat up. So it's worth taking a look at how it's fared recently in key areas.

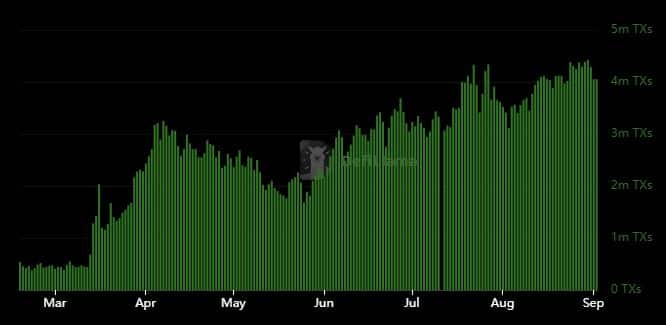

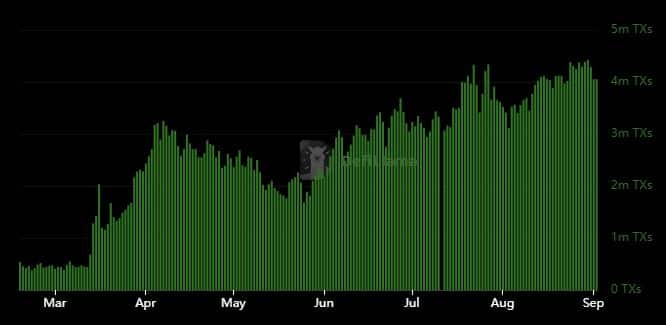

Network activity spikes in BASE

Basic transactions have been steadily increasing over the past few months, especially since March 2024. In fact, DeFiLlama revealed that until mid-March, the average number of transactions per day on the Ethereum Layer 2 network was less than 500,000.

However, things have changed and transactions have steadily increased since then. It recently reached a new high of over 5 million transactions per day.

Source: Defilama

The chart revealed that Base transactions are growing even during bearish periods. However, the resurgence of bullish activity has intensified its network activity. The impact of market fluctuations was more evident in volume and stablecoin data.

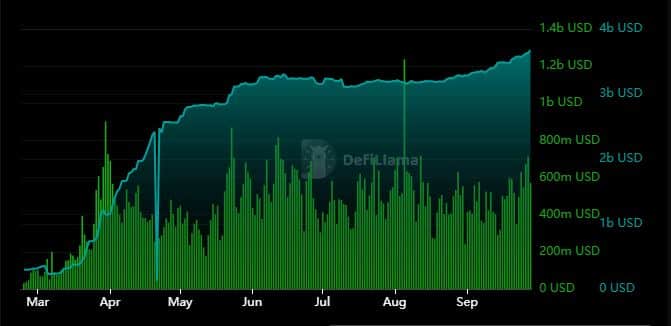

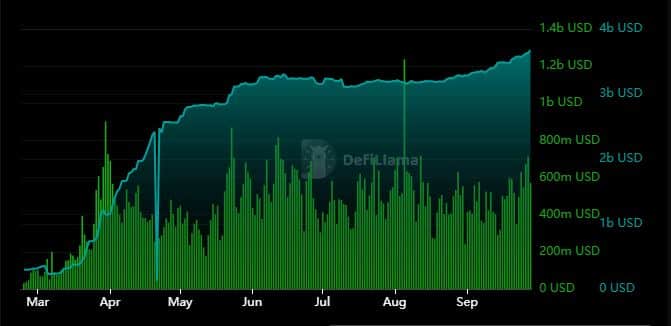

On-chain volume showed a significant correlation with stablecoin growth. For example, from March to April, trading volume and stablecoin market capitalization increased sharply. Currently, stablecoins were flat from May to August, but the pace of growth accelerated in September.

Source: Defilama

On-chain transaction volumes also decreased significantly from August to mid-September. On the contrary, as of September 27, daily trading volume had rebounded significantly, from less than $400 million to more than $700 million.

The network's stablecoin market capitalization also hit a new high of $3.67 billion. To put this growth into perspective, stablecoin market capitalization remained below $400 million until mid-March.

TVL's steady growth confirms user trust

While the aforementioned metrics highlighted increased network utility, there is one metric that highlights a significant increase in user trust.

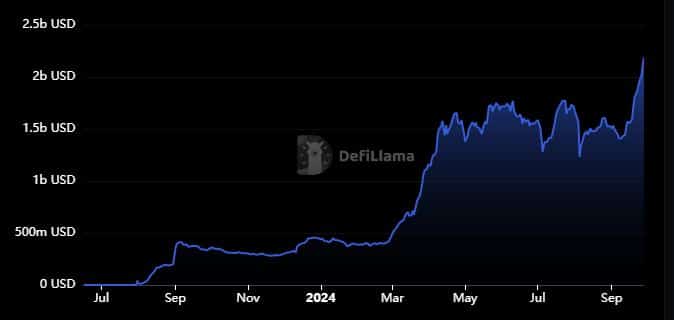

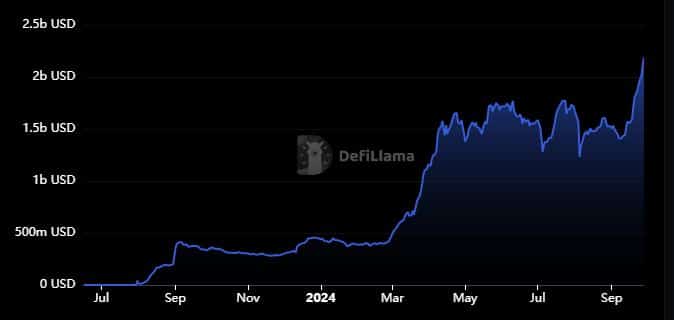

Base's TVL recently skyrocketed to $2.19 billion, its highest level ever.

Source: Defilama

Just 12 months ago, Base's TVL was $337 million. This means an increase of over 548%. This is a sign of healthy liquidity and indicates that investors are actively investing.

The network added $780 million to TVL in the past three weeks. This was around the same time the market changed in favor of the bulls. This result means Base is likely to see even more robust growth in the coming months. Especially if the market continues to heat up.