Bitwise Chief Investment Officer Matt Hogan has revealed the catalyst he believes will propel Bitcoin (BTC) above $100,000.

Hogan said on social media platform X that macroeconomic conditions and on-chain data seem to suggest Bitcoin is poised to spark a massive rally.

Major central banks are adopting accommodative monetary policies as the supply of bitcoin dwindles after this year's halving event cut BTC miners' rewards in half, according to a Bitwise executive.

“We are heading towards six-digit Bitcoin.

*ETF flows re-accelerate

* Elections are coming

* Infinite deficit (bipartisan agreement!)

*China's economic stimulus measures

* Global interest rate cuts (FRB, ECB)

* Supply shocks are starting to halve

* The number of whales is increasing.

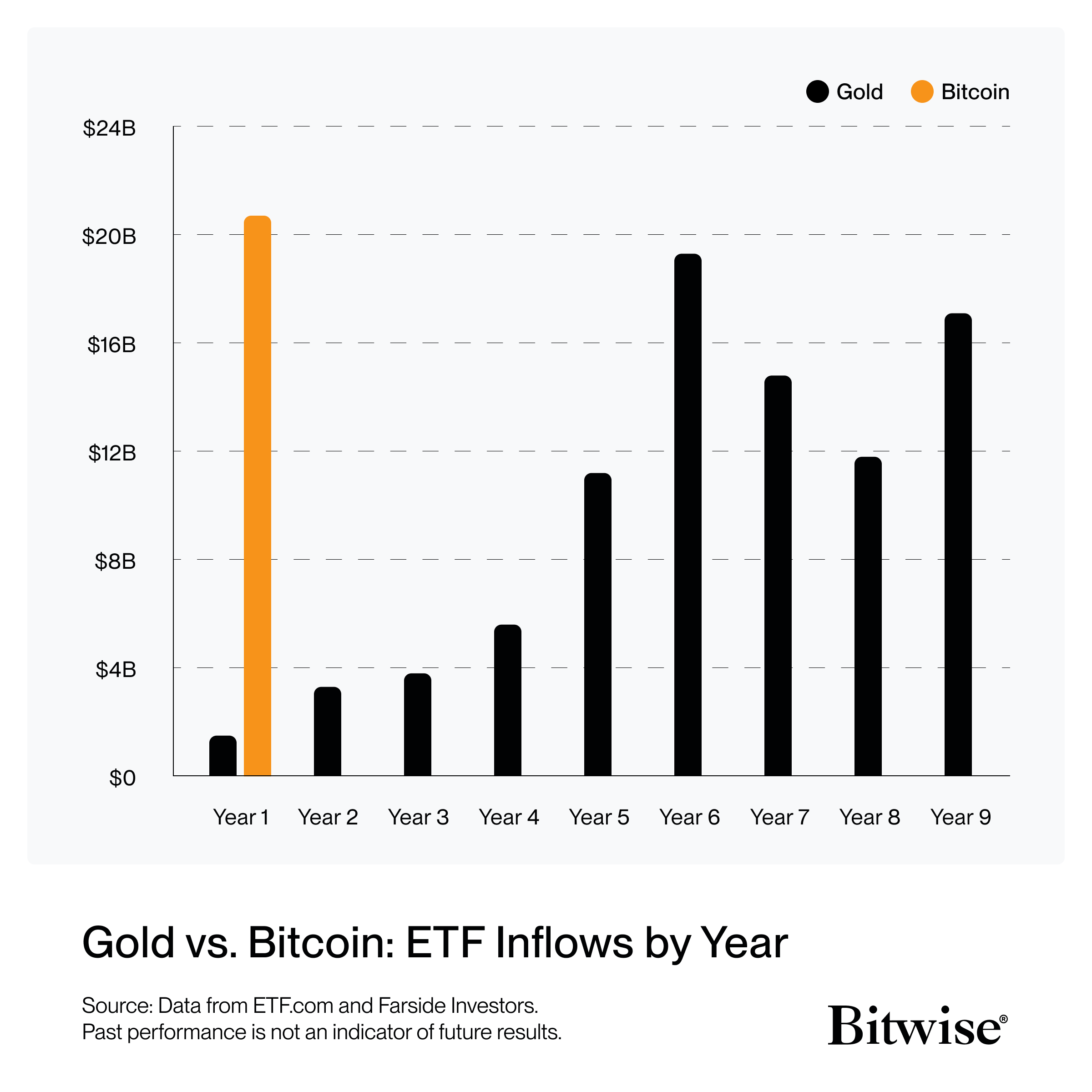

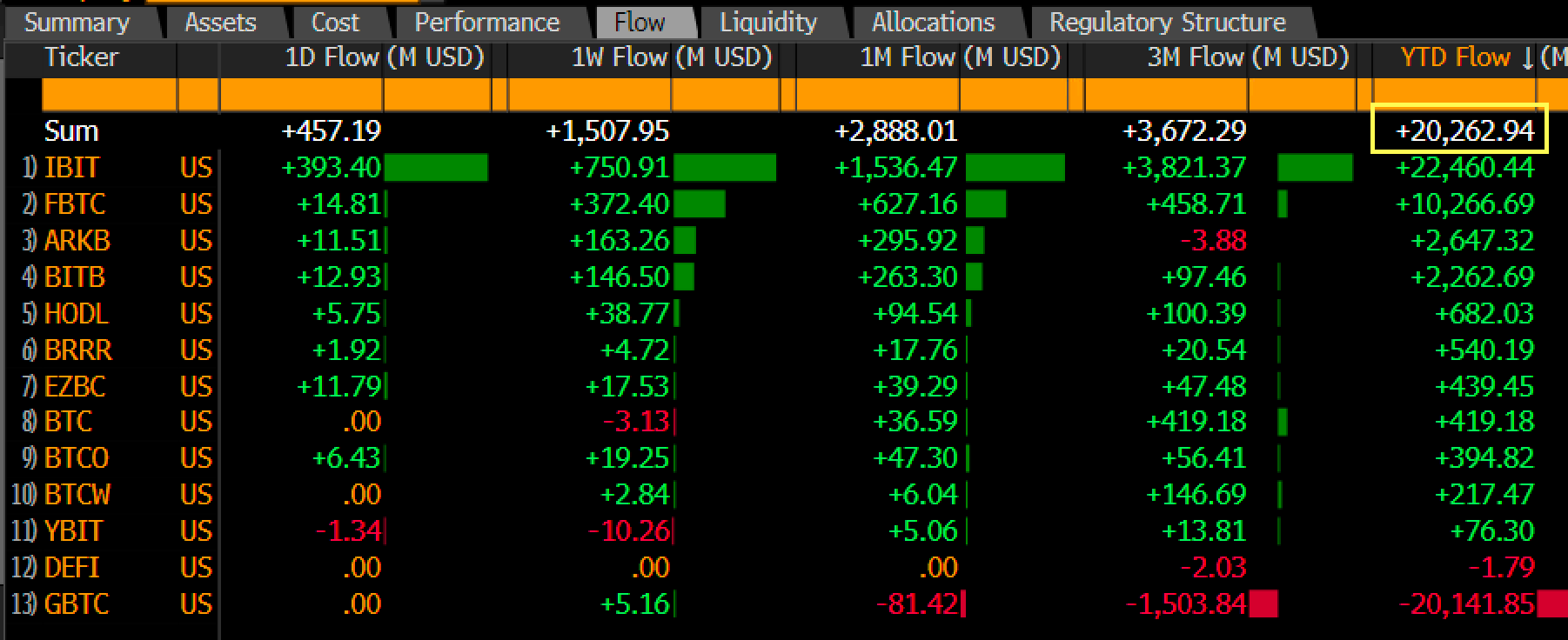

Hogan also highlighted data on Bitwise's Bitcoin exchange-traded fund (ETF), showing that it has received more than $20 billion in inflows this year alone. This chart shows that BTC ETFs significantly outperformed gold ETFs in terms of inflows in their first year of existence.

“this.”

Eric Balchunas, senior ETF analyst at Bloomberg, explains the significance of the large inflows that Bitcoin ETFs have seen this year. Balchunas said gold ETFs had to wait five years for comparable capital allocation.

“Bitcoin ETFs have surpassed $20 billion in total net flows (the most important number and most difficult metric in the ETF world) for the first time, after a huge week of $1.5 billion.

By comparison, it took about five years for gold ETFs to reach the same numbers. Total assets are currently $65 billion, which is also the highest level. ”

At the time of this writing, Bitcoin is trading at $68,172.

Never miss a beat – Subscribe to get email alerts delivered straight to your inbox

Check price action

follow me ×Facebook and Telegram

Surf the Daily Hoddle Mix

Disclaimer: The opinions expressed on The Daily Hodl do not constitute investment advice. Investors should perform due diligence before making high-risk investments in Bitcoin, cryptocurrencies, or digital assets. Please note that transfers and transactions are made at your own risk and you are responsible for any losses you may incur. The Daily Hodl does not recommend buying or selling any cryptocurrencies or digital assets. Additionally, The Daily Hodl is not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: Mid Journey