- The recent drop in ETH price appears to be a retracement.

- Market sentiment suggested a pullback was likely as buying pressure eased.

In the last 24 hours, Ethereum [ETH] The stock fell 2.70% during this period, entering a so-called retracement (a temporary decline that often precedes a bull market rally).

AMBCrypto reports that the economic downturn could widen further and reverse the 1.62% gain in ETH recorded over the past week.

ETH continues to face downturn

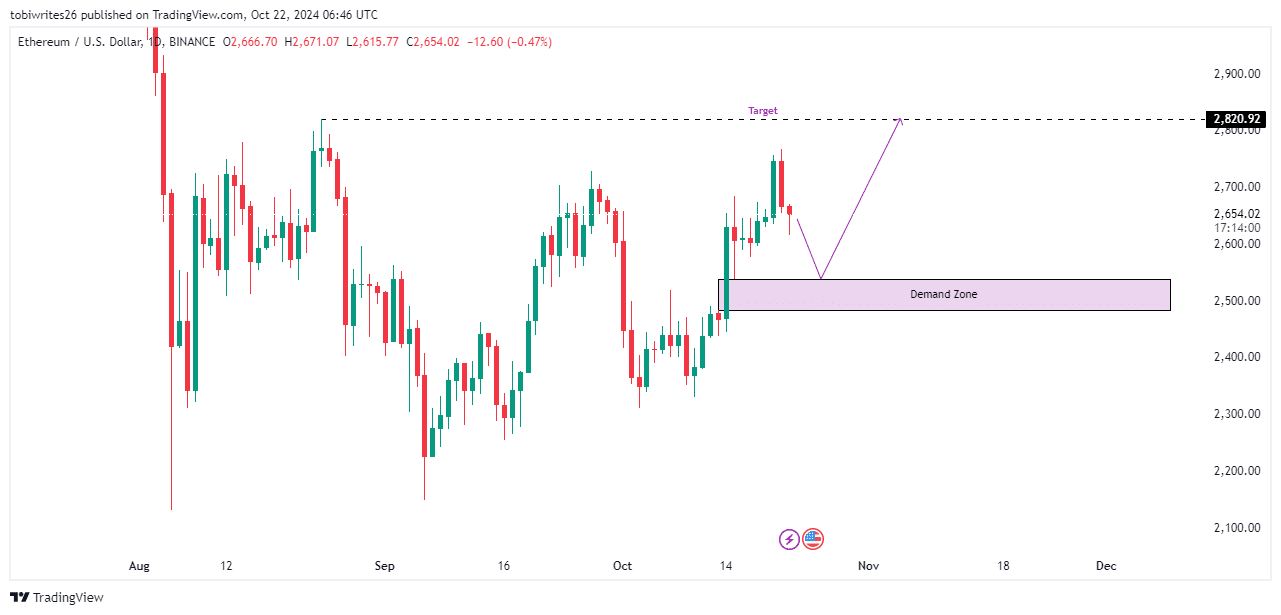

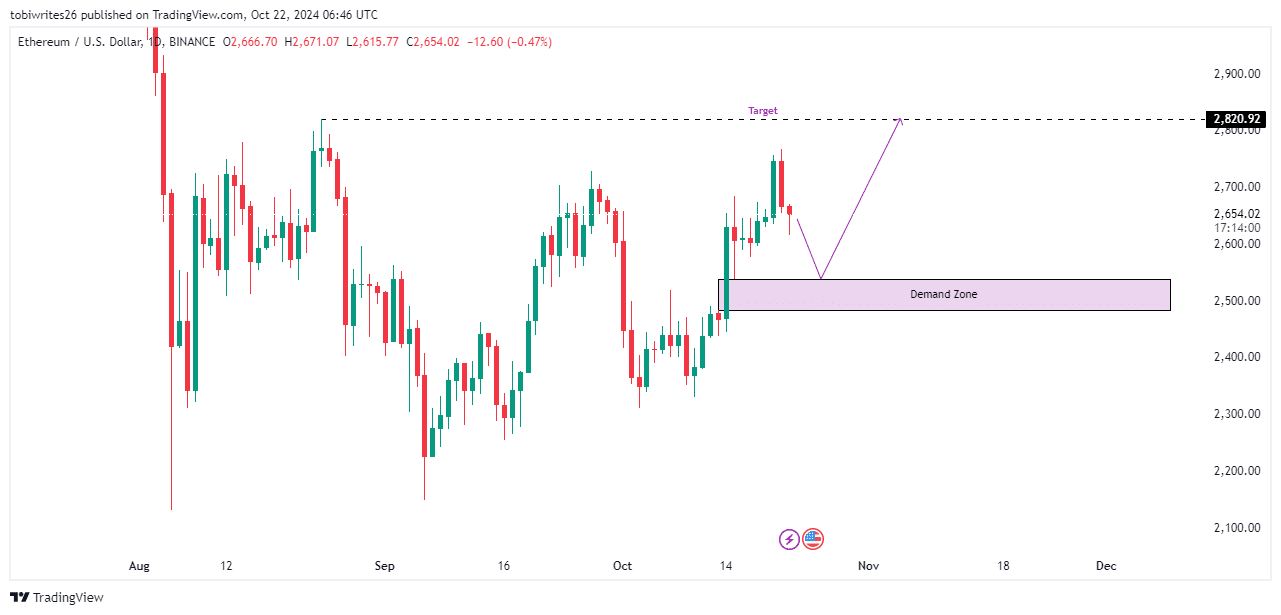

The ETH chart is currently lacking bullish signals, indicating the possibility of further decline as it searches for optimal liquidity levels to support price appreciation.

Currently, the closest liquidity zone is the demand area from $2,536.47 to $2,484.44. If the price enters this area, ETH could recover to the primary target of $2,820.92.

Source: TradingView

However, if ETH falls below this demand zone, it could trigger a stop hunt, a tactic where traders seek additional liquidity before making a final rally.

A prolonged decline suggests that ETH has entered a bearish trend.

Traders seek momentum in the ETH market

Recent trading activity indicates that the market is looking for momentum, suggesting a downside from the current price of $2,654.02.

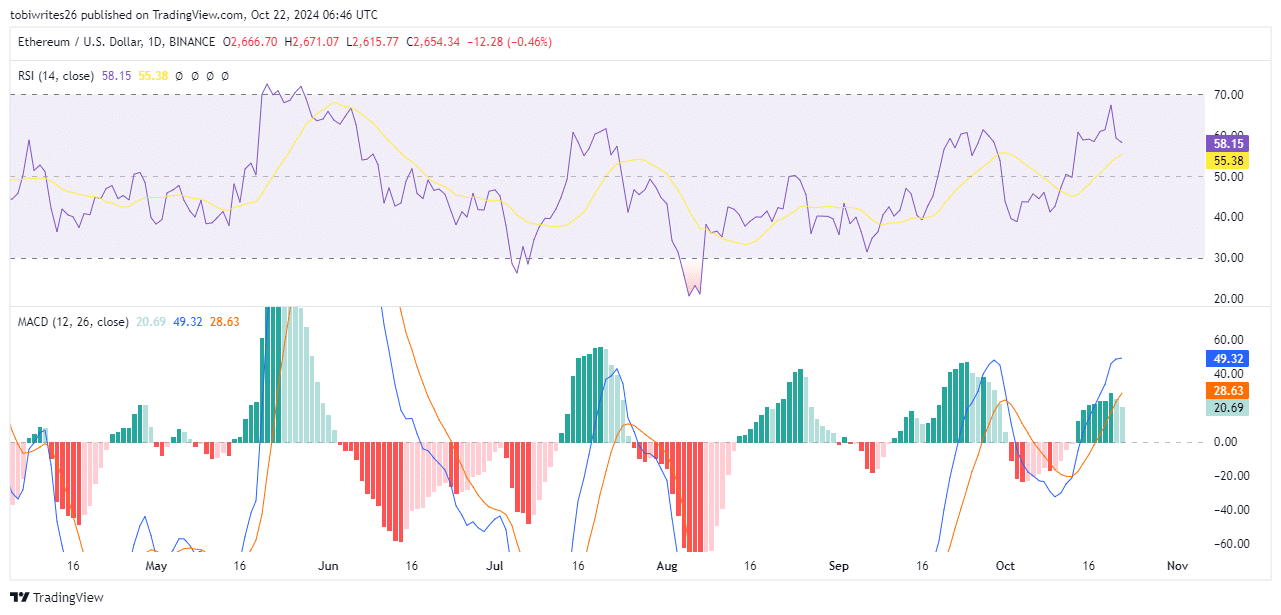

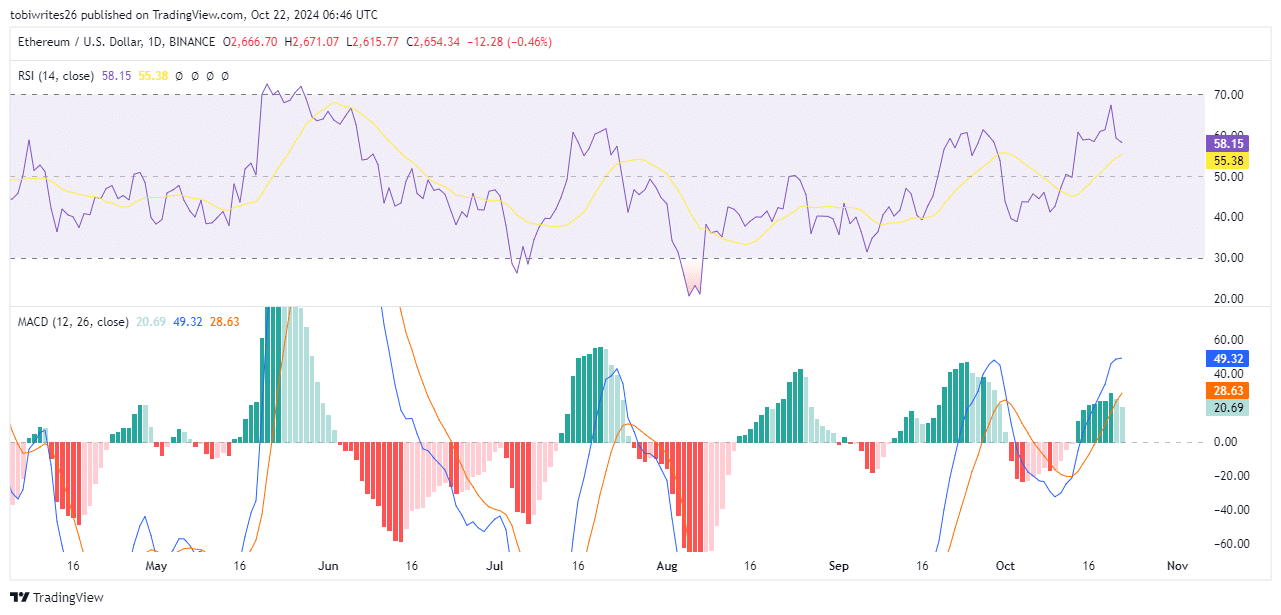

The relative strength index (RSI) is calculated on a scale of 0 to 100, with 50 representing the neutral point. Values above 50 indicate positive momentum, while values between 50 and 60 indicate moderate buying pressure.

Conversely, readings below 50 reflect selling pressure, while a range of 30 to 50 indicates moderate selling. Values above 70 indicate overbought conditions, and values below 30 indicate oversold conditions.

Currently, ETH has an RSI reading of 58.15, which is in a downtrend, indicating that despite remaining actively bullish, the price may seek a demand zone and move lower.

Source: Trading View

Similarly, the MACD, which remains in positive territory, also shows a noticeable drop in momentum, as indicated by the fading green bars on the chart.

This suggests that while the overall market health is good, buying pressure is gradually decreasing.

Temporary withdrawal from seller

Open interest, an indicator used to assess trader sentiment in the current market, reveals that traders are primarily in the position of shorting an asset.

read ethereum [ETH] Price prediction for 2024-2025

According to coin glassOpen interest decreased to $13.56 billion, reflecting a decrease of 2.89%.

If this trend continues, it would suggest that the asset could fall due to selling pressure, although it may still remain bullish.