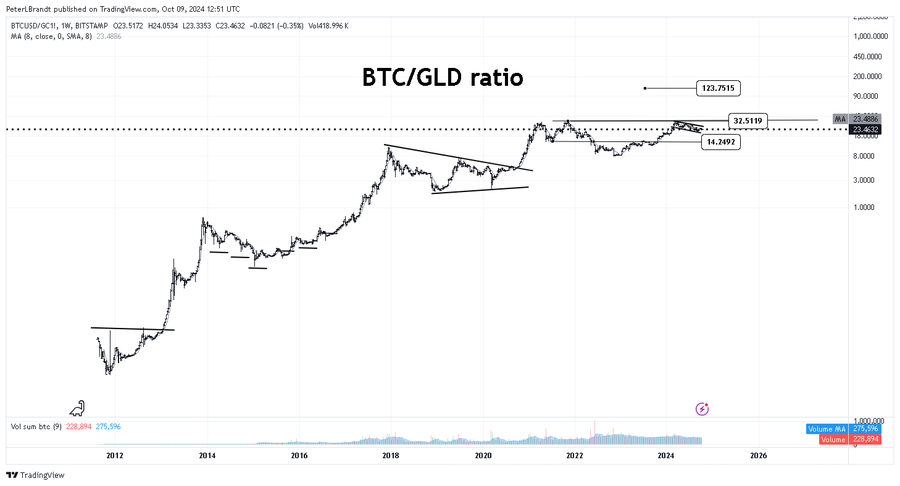

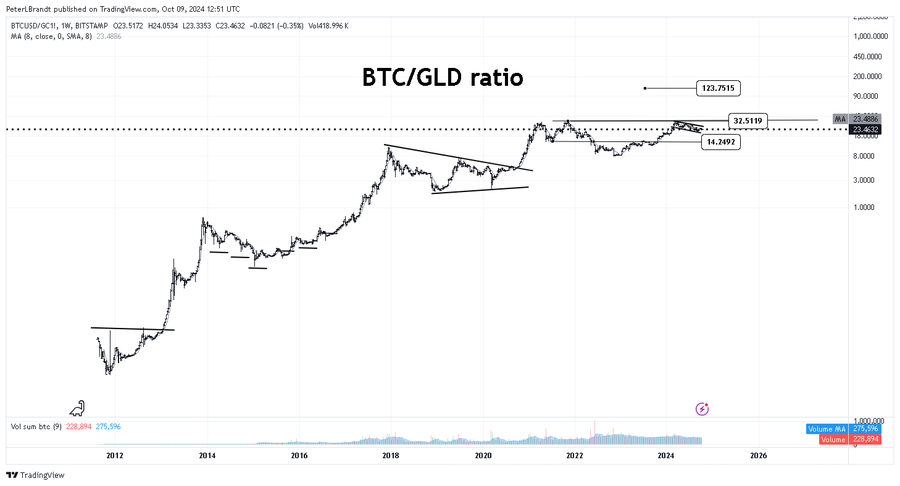

Veteran technical analyst Peter Brandt recently suggested that Bitcoin continues to outperform gold in the long-term store of value story.

He pointed this out in his latest book Analysis of BTC/GLD ratio. According to To market veterans, this premium crypto asset has been steadily “kicking gold’s butt” and could be on the verge of a monumental rally if it can break through key resistance levels.

Bitcoin vs Gold

In his chart, Brandt reveals a long-term upward trend in the BTC/GLD ratio, showing the increasing strength of Bitcoin relative to gold over the past few years. This ratio has previously been supported in the low teens, specifically around the 14oz mark, which is what triggered the current bull market.

Brandt identified 32 ounces of gold as a key resistance level. This level has previously capped Bitcoin's strength and has been a major point of contention between bulls and bears.

If Bitcoin can break through this hurdle, Brandt believes the target is more than 100 ounces of gold per Bitcoin, with long-term forecasts reaching up to 123.75 ounces of gold. Based on the current gold price (approximately $2,613 per ounce), this translates to a target price for Bitcoin of $323,358.

Additionally, this graph shows that Bitcoin price movement We have been following the rising wedge and breakout formation patterns. In particular, BTC has been on an upward trend since bottoming out in 2018. The current setup forms another ascending triangle, or bullish pattern.

Interestingly, Bitcoin has experienced similar parabolas in the past, and if it maintains its current upward trajectory, it will likely reach Brandt's goal.

Meanwhile, market veterans estimate there is a 30% chance the market will “reverse.” Advantages of Bitcoin You might flinch. However, Bayesian analysis shows that Bitcoin is still likely to outperform gold if the resistance is breached.

Short-term outlook for BTC/GLD

Meanwhile, the short-term outlook for BTCGLD recommends immediate caution. Notably, BTC is currently hovering around 23.27 ounces, trading below its 21-week simple moving average (SMA) of 25.59 ounces per BTC.

Bitcoin’s failure to break above this moving average indicates potential short-term weakness. Also, the relative strength index (RSI) was 45.49, indicating neutral to bearish sentiment.

The RSI has been trending lower in recent weeks, raising concerns about Bitcoin's immediate possibility of regaining bullish momentum. To begin a sustained rally, Bitcoin needs to break above the 21-week SMA and push the RSI into bullish territory.

The 21-week SMA has always served as an important axis for Bitcoin. The last major breakout above this moving average occurred in October 2023, when Bitcoin traded at around 16 ounces per BTC.

This breakout triggered a powerful 112% surge; Bitcoin If Bitcoin can regain this level of momentum and break above the 25.59 oz mark, it could lead to a new uptrend, potentially targeting Brandt’s prediction.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. We encourage our readers to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.