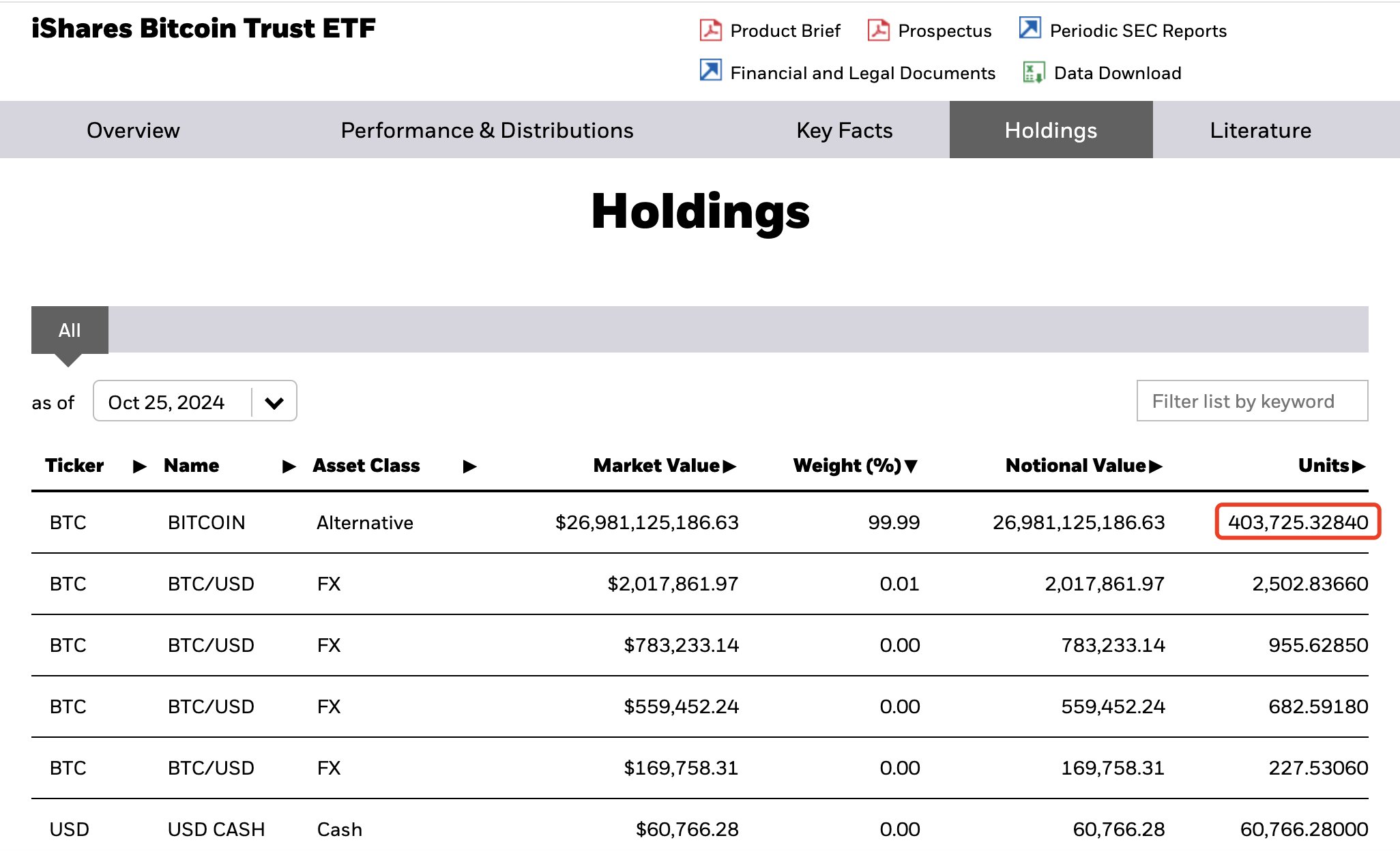

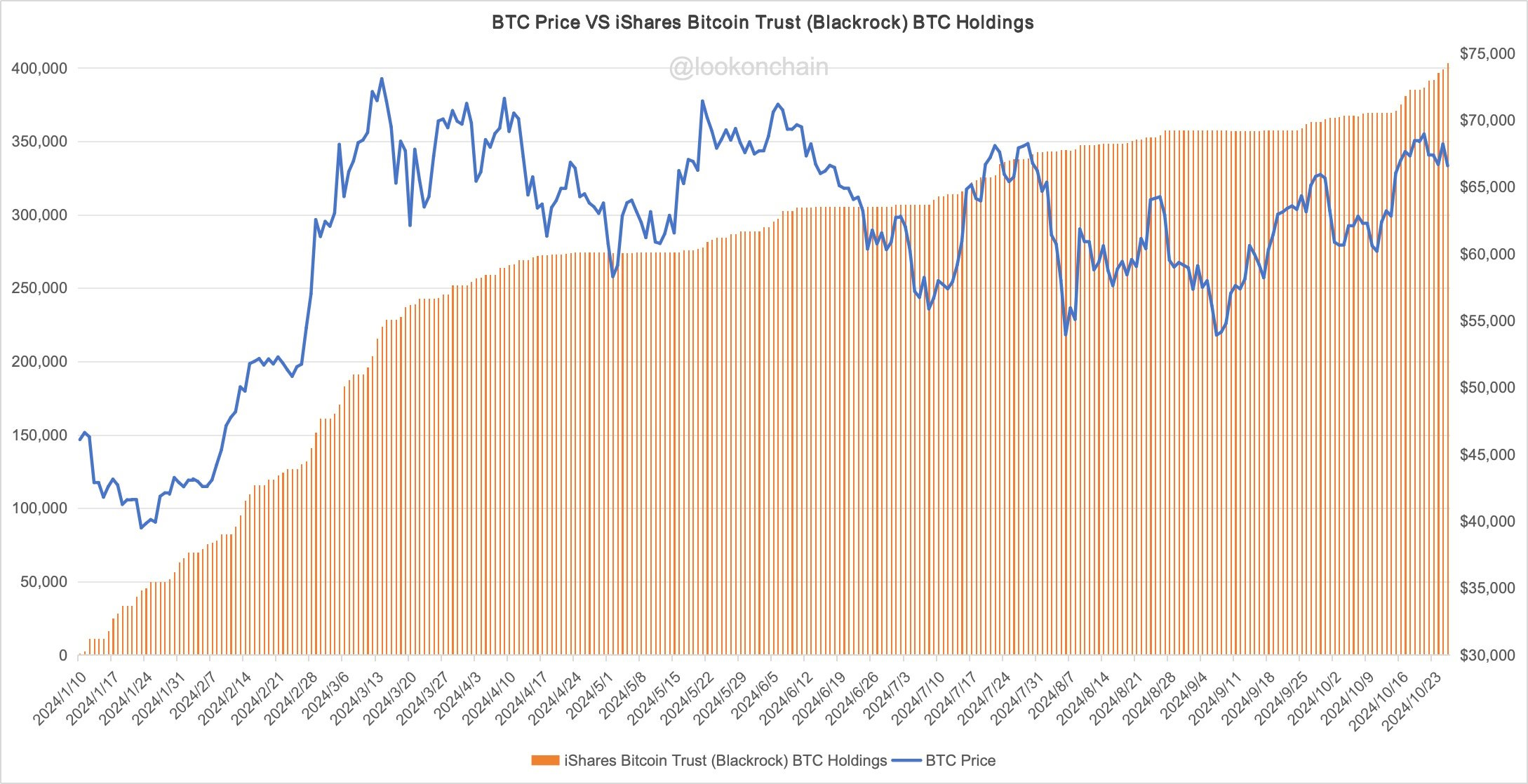

BlackRock has reached a new milestone in its Bitcoin holdings, totaling over 400,000 BTC. Currently, the hedge fund's holdings are valued at approximately $26.98 billion, with a total of 403,725 BTC. This big accumulation comes as the asset management giant purchased an additional 34,085 BTC in the past two weeks, with an estimated value of around $2.3 billion, Lookonchain reports.

With continued inflows into Bitcoin ETFs, BlackRock is increasing its presence in the crypto market, making it a dominant force. This shows that Bitcoin ETFs are becoming a great way for institutional investors to own BTC. As the company increases its holdings, some believe the future of Bitcoin may change.

Will BlackRock take over Bitcoin?

Many are already predicting a kind of Bitcoin war in the future, with BlackRock eventually pushing for a fork of the original BTC chain and using all of its vast resources to make its own fork chain authentic. They are making dystopian predictions that they will promote it. That doesn't sound impossible, but it seems like a conspiracy theory in the current realm.

With such a rapid accumulation of Bitcoin, people are wondering where BlackRock draws the line in its pursuit of dominance in the crypto market.

On the other hand, the financial behemoth relies on people like Michael Saylor, who owns MicroStrategy's Bitcoin, mining entities, early adopters, and millions of people forming a large, decentralized market presence. Bitcoin faces challenges to its influence from other important stakeholders in the Bitcoin space, such as retail investors. . However, whether they can present a solid countermeasure to BlackRock is another matter.