- Bitcoin's dominance and technical indicators suggested that it may be time for swing traders to turn their attention to altcoins.

- Relative strength to BTC is an important factor along with long-term support zones for evaluating underperforming altcoins.

Bitcoin [BTC] It was trading within a range. Short-term bearish bias has made Bitcoin and other crypto markets unattractive for long-term investors.

It could take weeks for the market to stabilize, especially considering the huge rally in the months leading up to the halving. This could be a buying opportunity for altcoins that have shown strength.

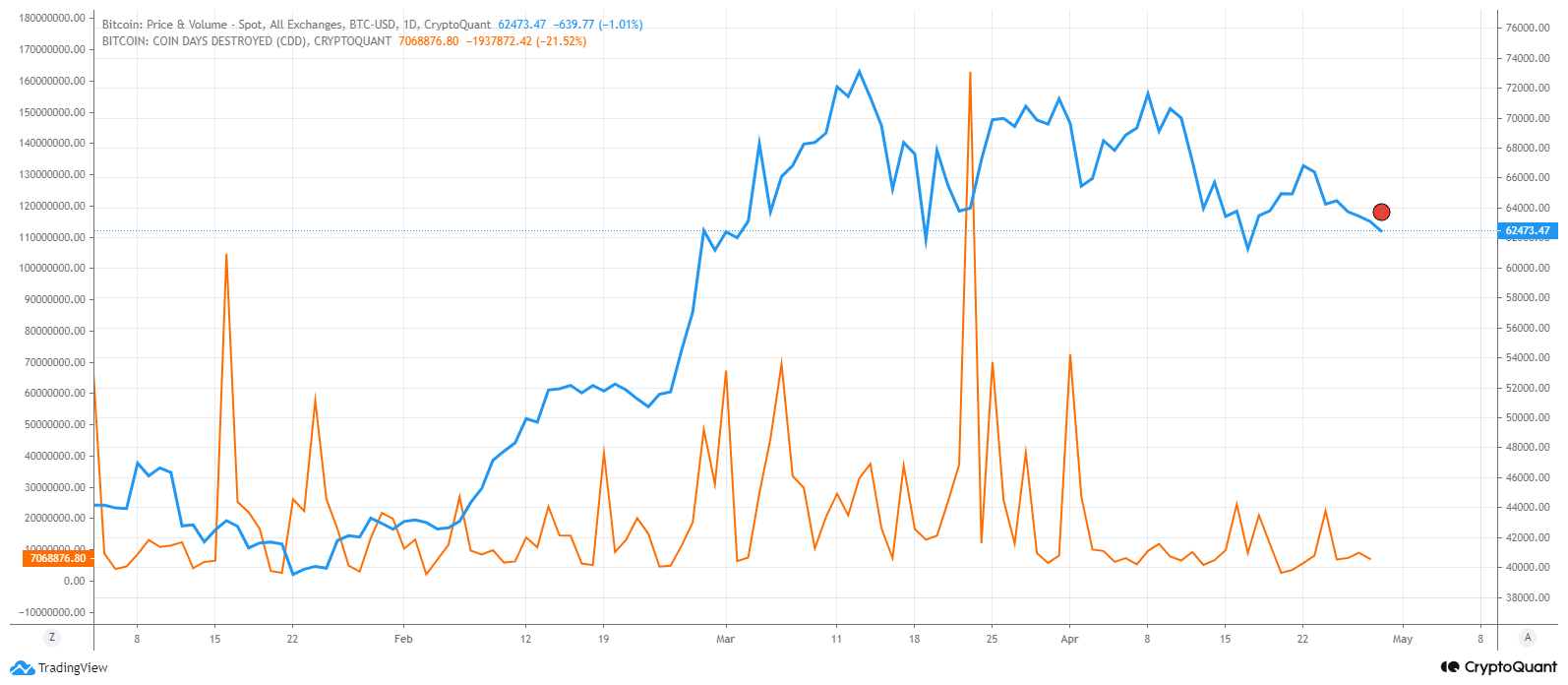

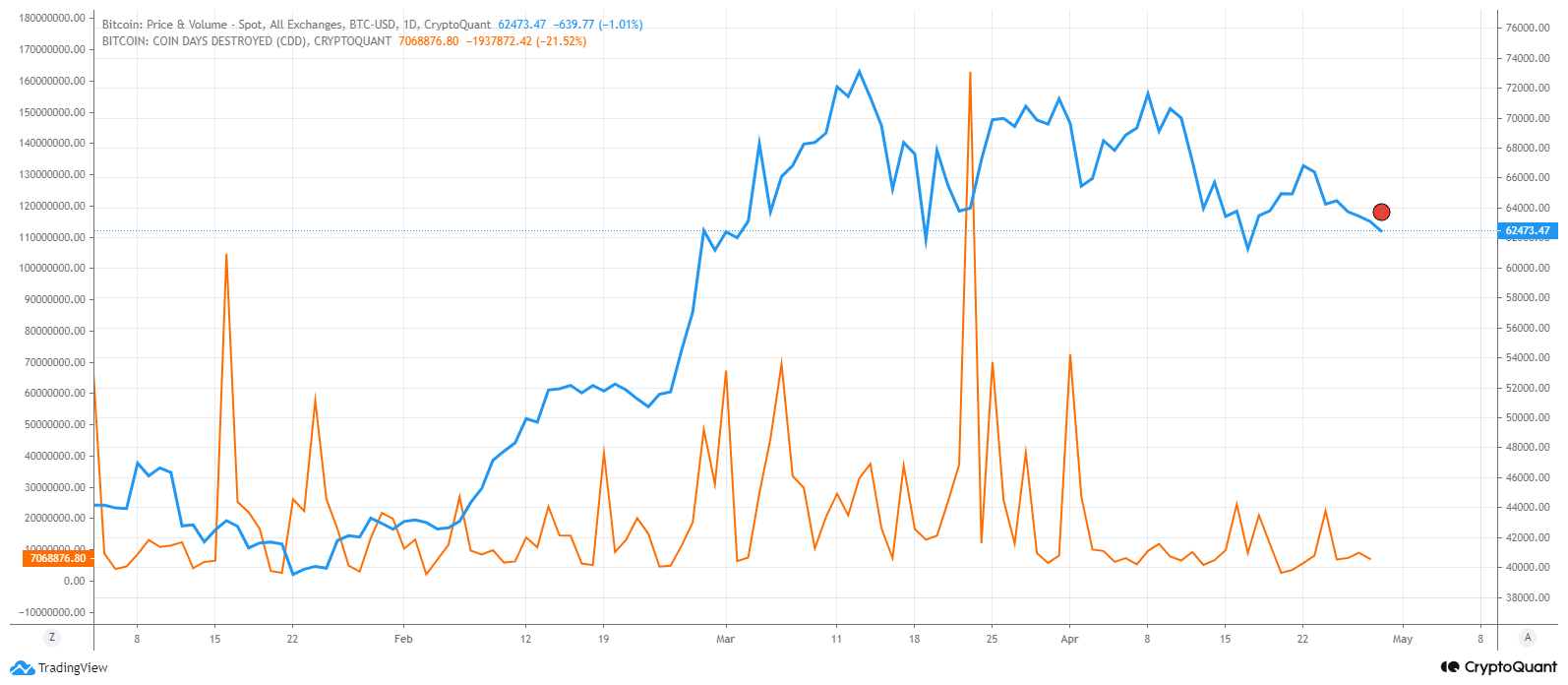

Check out recent BTC resets

Source: CryptoQuant

Coin Days destroy (CDD) is a metric that measures the elapsed time of coins moved during a transaction. This is calculated by multiplying the number of coins in the transaction by the number of days the coins have not moved.

Therefore, a huge spike in CDD means that long-dormant Bitcoins have been moved. Long-term holders may choose to lock in profits during a rally (like March 23rd) or after a particularly large pullback (April 1st).

This isn't a crystal ball, but it's a useful metric to gauge HODLer sentiment.

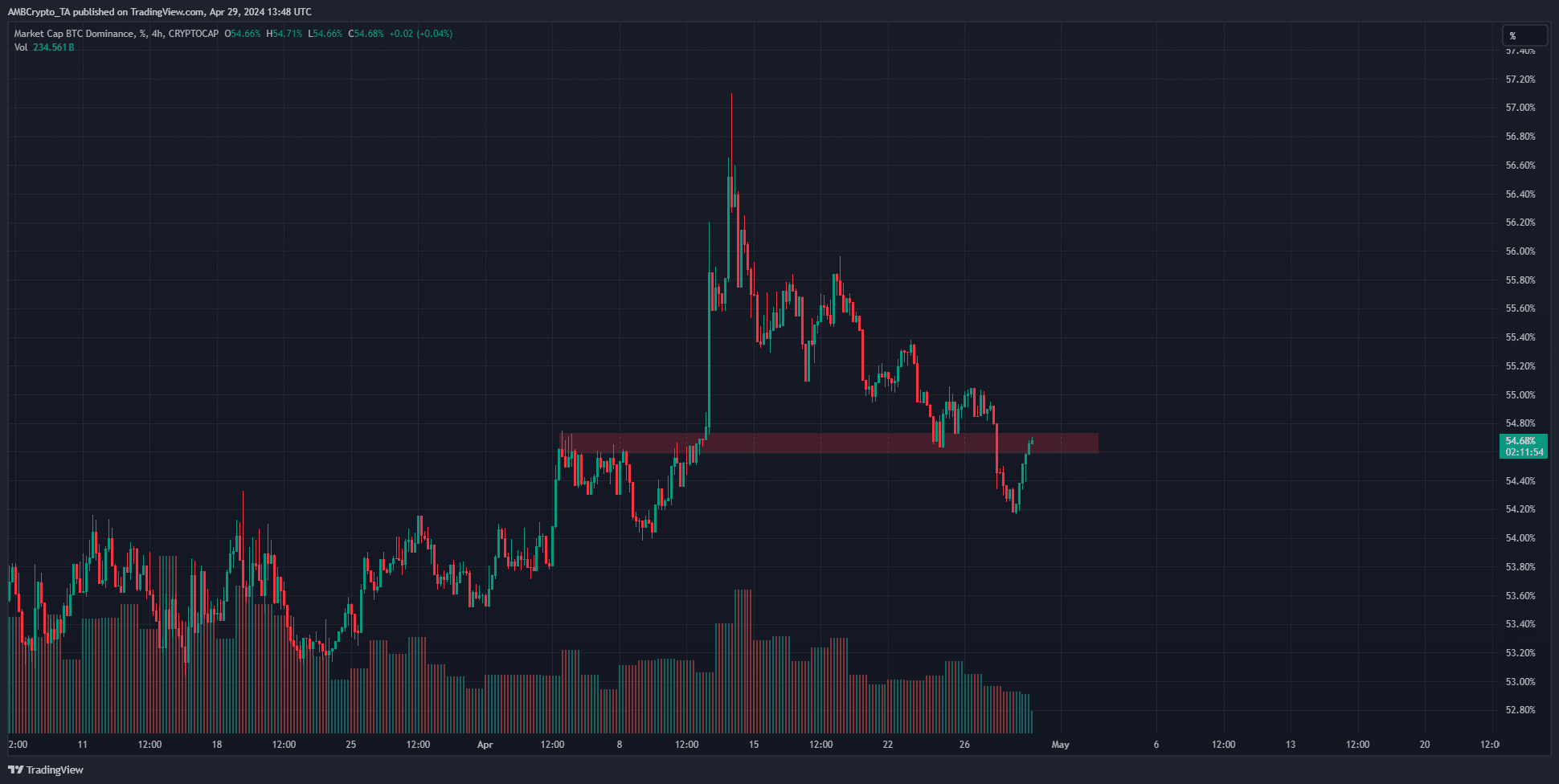

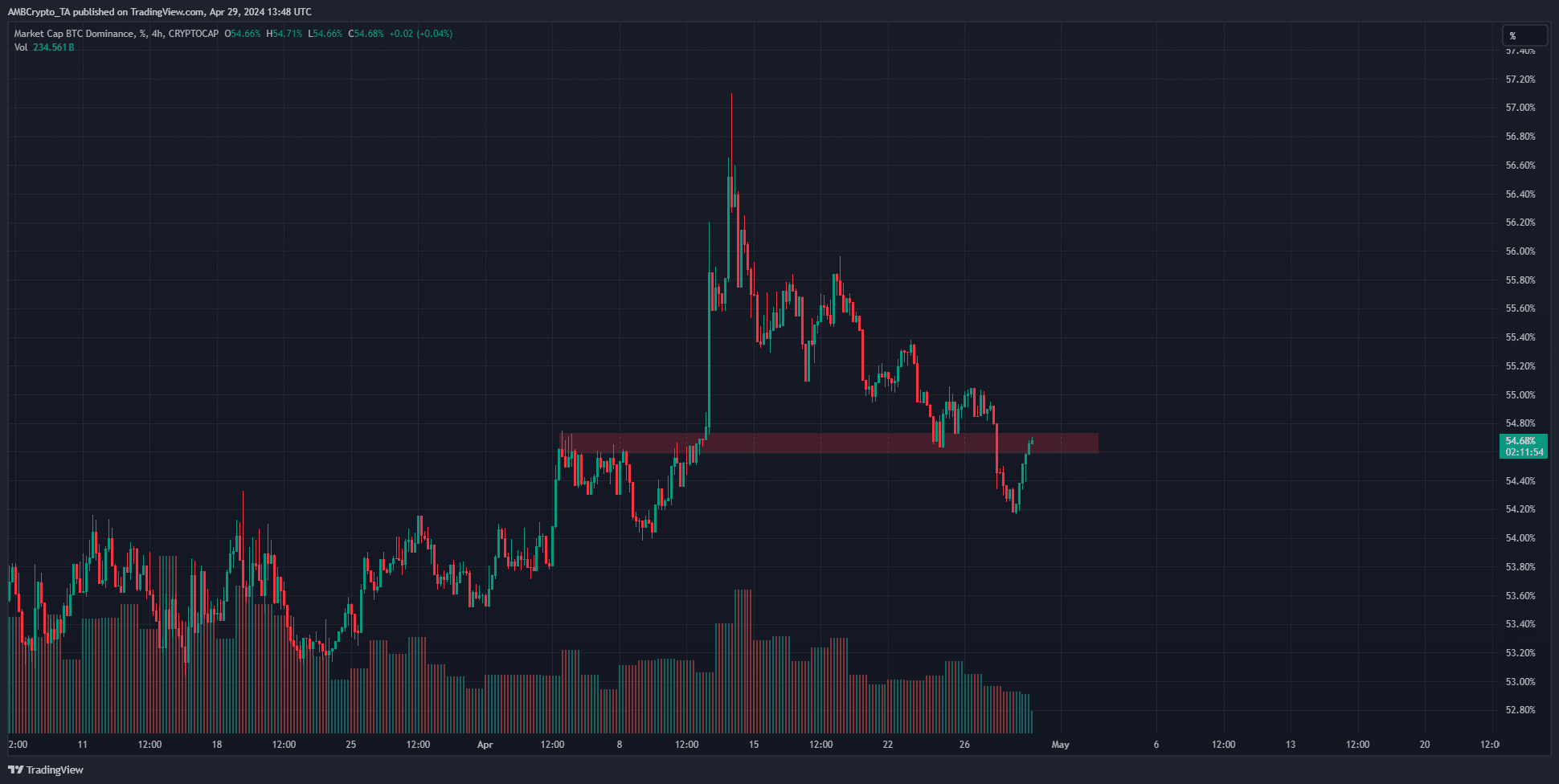

Source: BTC.D on TradingView

The Bitcoin Dominance Chart measures the ratio of BTC's market capitalization to the cryptocurrency's market capitalization. At the time of writing, it stands at 54.68%, below the previous support level.

This zone, highlighted in red, is expected to act as resistance. Therefore, if BTC dominance resumes its downward trend, altcoins may be given a chance to profit.

Which altcoins can you focus on?

In a recent post on X, Cryptocurrency Analyst Ali Martinez We noted that the TD Sequential Indicator flashed a buy signal on Chainlink [LINK] On the 12 hour chart. However, LINK has fallen nearly 33% since his March 26th.

Bitcoin fell by 12.2% during the same period. A sign of altcoin strength is when it can withstand BTC losses well. LINK has not shown any strength against Bitcoin over the past month.

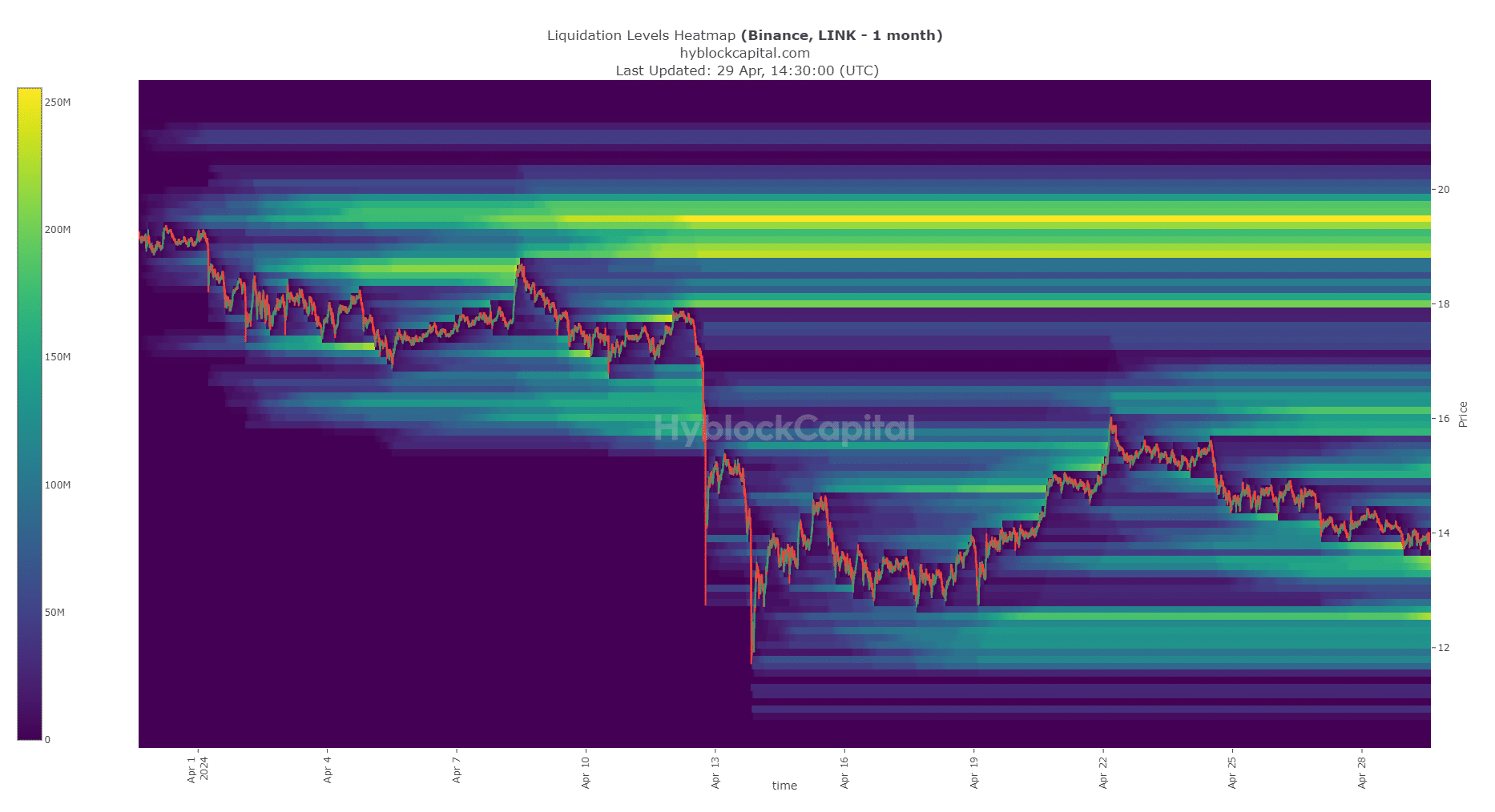

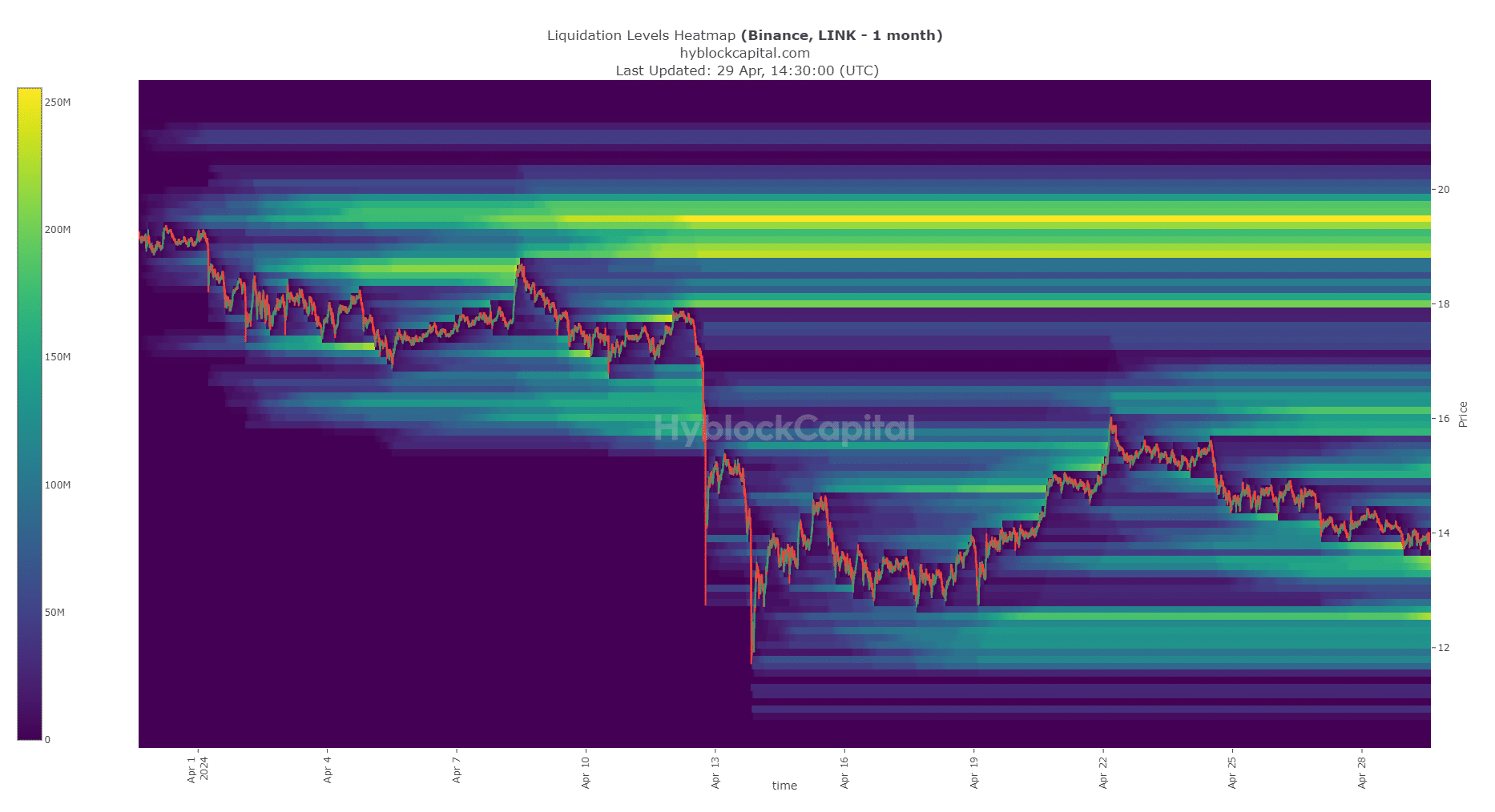

Source: High Block

According to the liquidation heatmap, the areas with the highest concentration of liquidation levels in the north were $16, $18, and $19.5. This marked them as bullish targets. However, the downward trend continued.

Is your portfolio green? Check out Chainlink's Profit Calculator

The liquidity at $13.5 and $12.5 is quite close, making it more likely that LINK price will reach it in the coming weeks.

Therefore, even though BTC dominance and TD sequential give swing traders a reason to go long, they should keep in mind the possibility of a drop to these support levels before entering a trade position.