On-chain data shows that Bitcoin’s “apparent demand” metric has flipped to positive. Here's what this means for the asset's price:

Bitcoin’s apparent demand is back in positive territory

Ki Young Ju, founder and CEO of on-chain analytics firm CryptoQuant, discussed the latest trends in Bitcoin's apparent demand metrics in a new post on X.

“Apparent demand is the difference between production and changes in inventory,” points out Young Ju. “In the case of Bitcoin, production refers to mining issuance, while inventory refers to supply that has been inactive for more than a year.”

Mining issuance here measures the total amount of BTC that miners generate by adding blocks to the network and receiving rewards. At the same time, the one-year inactive supply includes tokens that have not been transferred on the blockchain for more than one year.

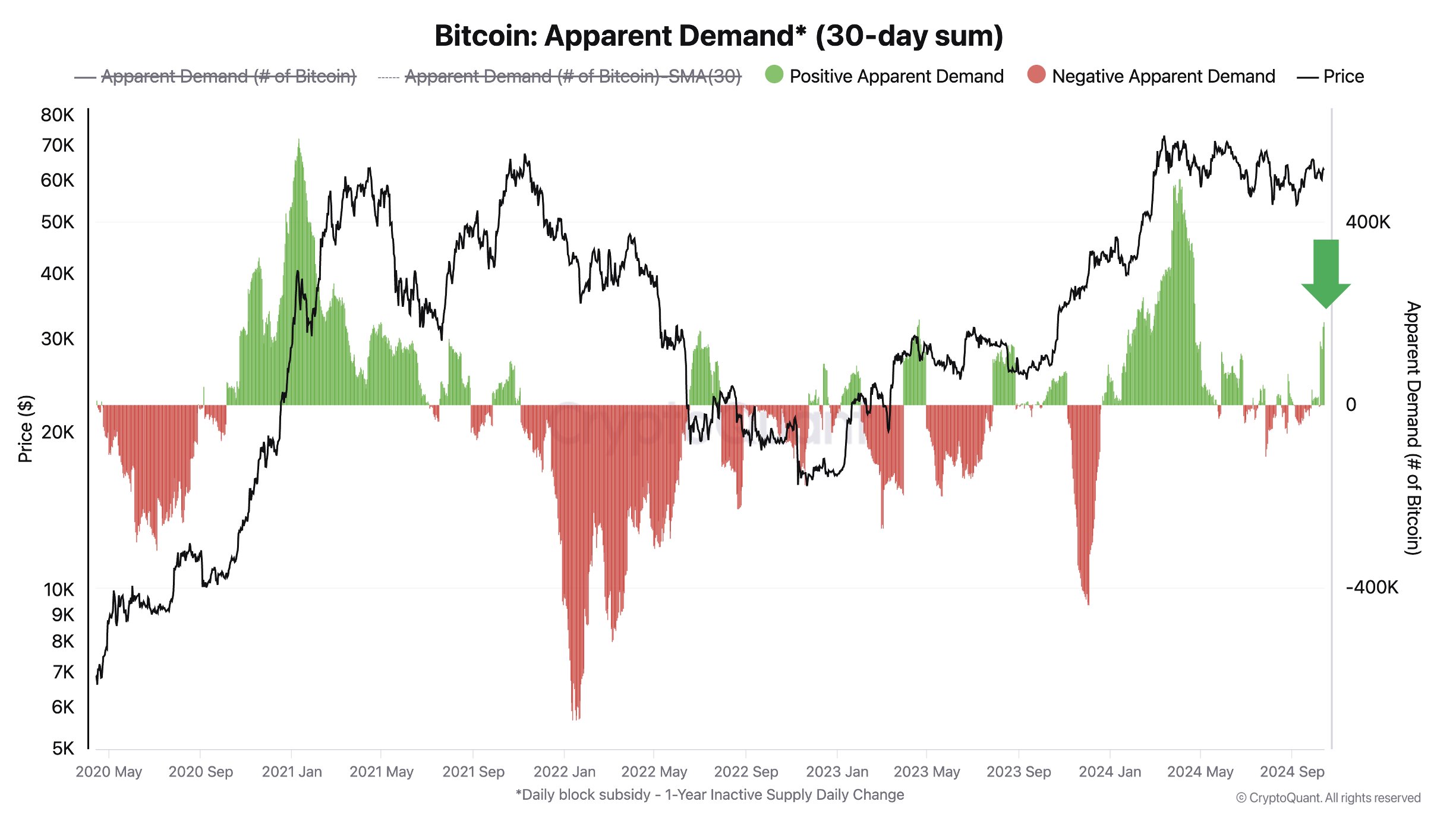

Below is a graph of Bitcoin's apparent demand shared by an analyst.

The trend in the 30-day sum of the metric over the last few years | Source: @ki_young_ju on X

As seen in the graph, Bitcoin's apparent demand rose to very positive levels during its rise to an all-time high (ATH) in the first quarter of this year.

A positive value indicates that the decrease in BTC stock is greater than production. “If inventory decline exceeds production, demand will increase and vice versa,” explains CryptoQuant's CEO.

However, the high demand for cryptocurrencies could not be sustained, as the indicator fell to a neutral value immediately after the asset price entered the consolidation phase.

However, this trend of plateauing around near-neutral levels seems to have finally broken recently, as the indicator has shown a positive spike.

So far, the apparent demand has not reached as high a level as around the ATH in March, but its current value is still very noteworthy and shows that demand for the coin is returning. Masu.

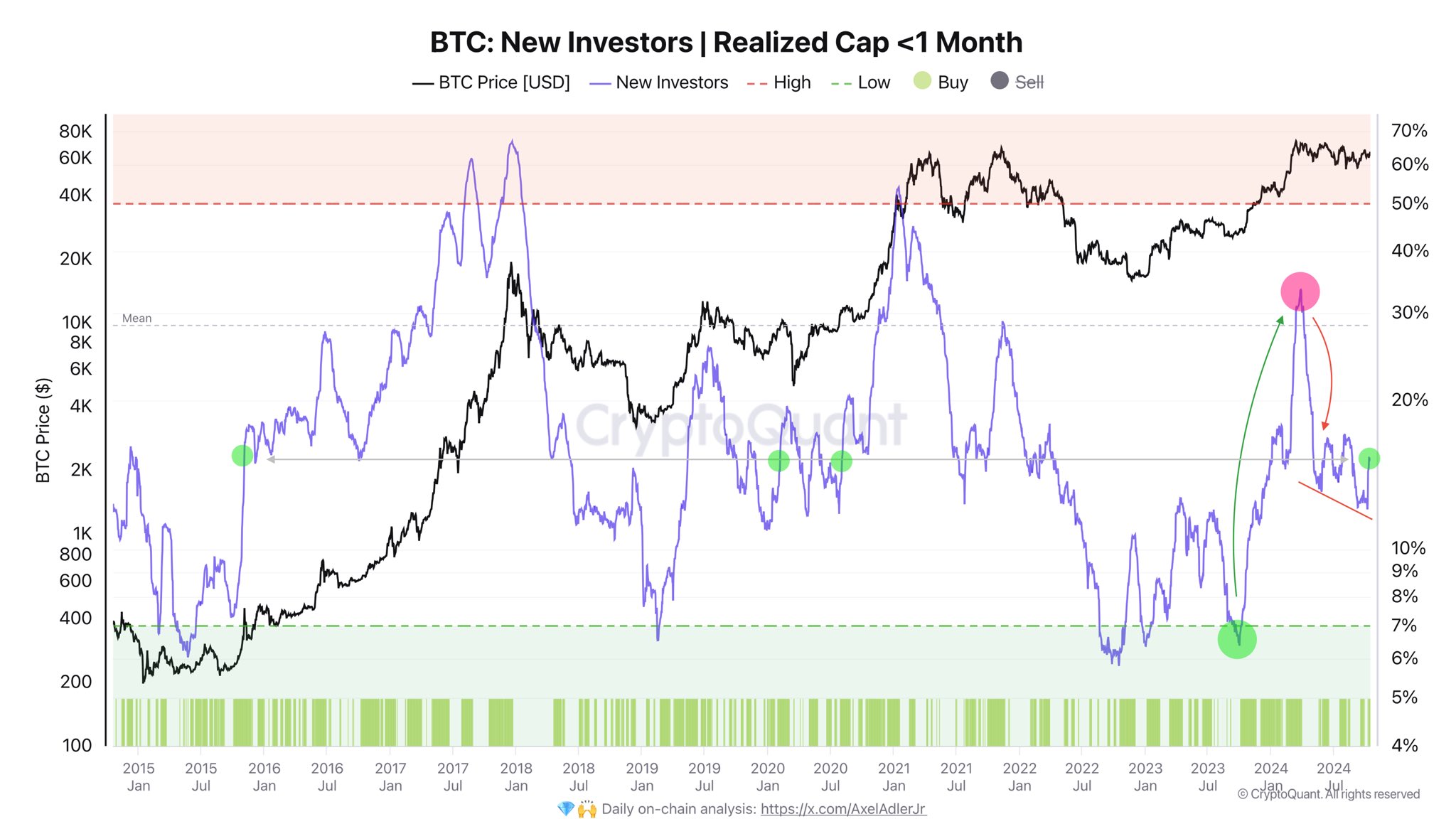

As CryptoQuant author Axel Adler Jr. points out in a new post on X, another indicator of the influx of new demand into Bitcoin is the realization cap for new investors.

The value of the metric appears to have seen a rise in recent days | Source: @AxelAdlerJr on X

Realized Cap is, in short, an indicator that tracks the total amount of capital invested in the cryptocurrency by all Bitcoin investors.

The chart displays realized cap data specifically for “new investors”, i.e. holders who purchased the coin within the past month. This indicator can represent new capital flowing into an asset.

“Demand for coin purchases from new investors has resumed, increasing by 3% in the past 10 days, which is a positive signal for the market,” the analyst notes.

BTC price

Bitcoin had approached the $68,000 level earlier in the day, but has now returned to $66,100, indicating a pullback.

Looks like the price of the coin has been on the rise recently | Source: BTCUSDT on TradingView

Dall-E, Featured Image from CryptoQuant.com, Chart from TradingView.com