- Bitcoin's recent corrective price action is believed to be the cause of the decline in inflows.

- The liquidation of Genesis Global's bankruptcy assets resulted in an outflow of funds from GBTC.

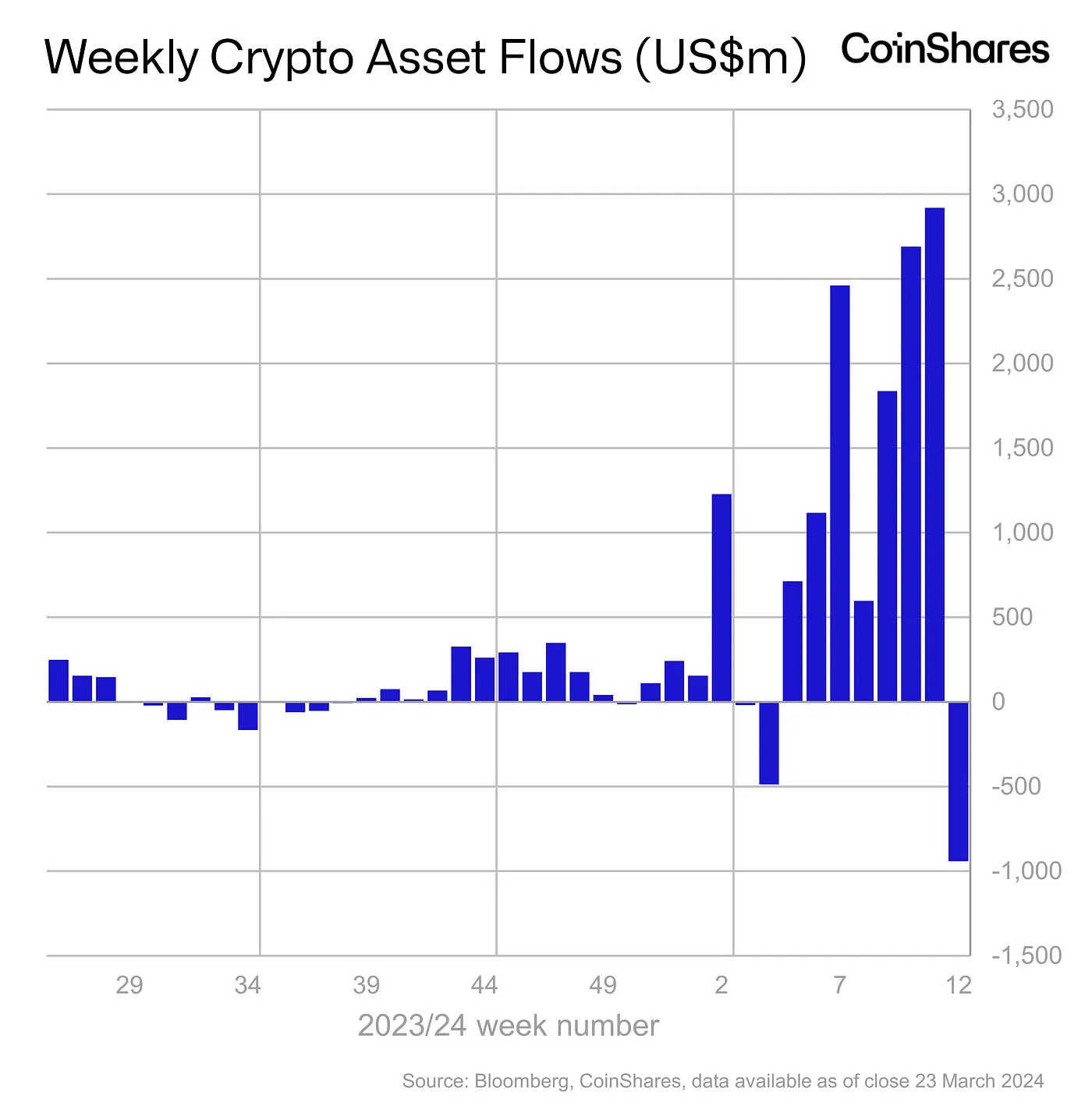

Investment funds tied to Bitcoin [BTC]The world's largest cryptocurrency recorded net outflows last week, ending a seven-week streak of inflows.

Investors become bearish on Bitcoin

Institutional investors sold more than $900 million in Bitcoin last week, according to a new report from digital asset management firm CoinShares.

Although recent outflows have impacted the year-to-date (year-to-date) numbers for Bitcoin-based funds, inflows remained impressive at nearly $12 billion.

Source: CoinShares

Furthermore, total assets under management (AuM) decreased significantly by 8.8% from the previous week to $68 billion.

Note that AuM is considered a key performance gradient for the fund. Typically, the higher the AuM, the more investment it attracts.

Explore all the “whys”

According to CoinShares, Bitcoin's recent price correction has seen it lose nearly 10% of its value, making investors cautious. As a result, inflows into newly launched spot ETFs in the U.S. have declined significantly.

In fact, approximately $1.1 billion in net Bitcoin was purchased by new issuers last week, nearly half of the total outflows from the existing Grayscale Bitcoin Fund (GBTC).

This represents the largest difference between the two cohorts since its listing in early January.

Bloomberg ETF analyst Eric Balchunas said last week that outflows from GBTC were primarily due to Genesis Global liquidating bankrupt assets.

He reiterated that Genesis was simply redeeming GBTC shares to reallocate to new spot ETFs, which he called a “net neutral event.”

read bitcoin [BTC] Price prediction for 2024-2025

Scorecard of other altcoins

Apart from Bitcoin, investment products linked to other top cryptocurrencies also experienced significant outflows.

While the funds are tied to Ethereum, [ETH] Solana sold for $34 million [SOL]Linked funds saw net outflows of 5.6 million. Interestingly, the rest of the cryptocurrency space fared relatively well, attracting $16 million in inflows.