On-chain data shows that the exodus of large Bitcoin holders has decreased significantly, with the flagship cryptocurrency still hovering above the $68,000 level.

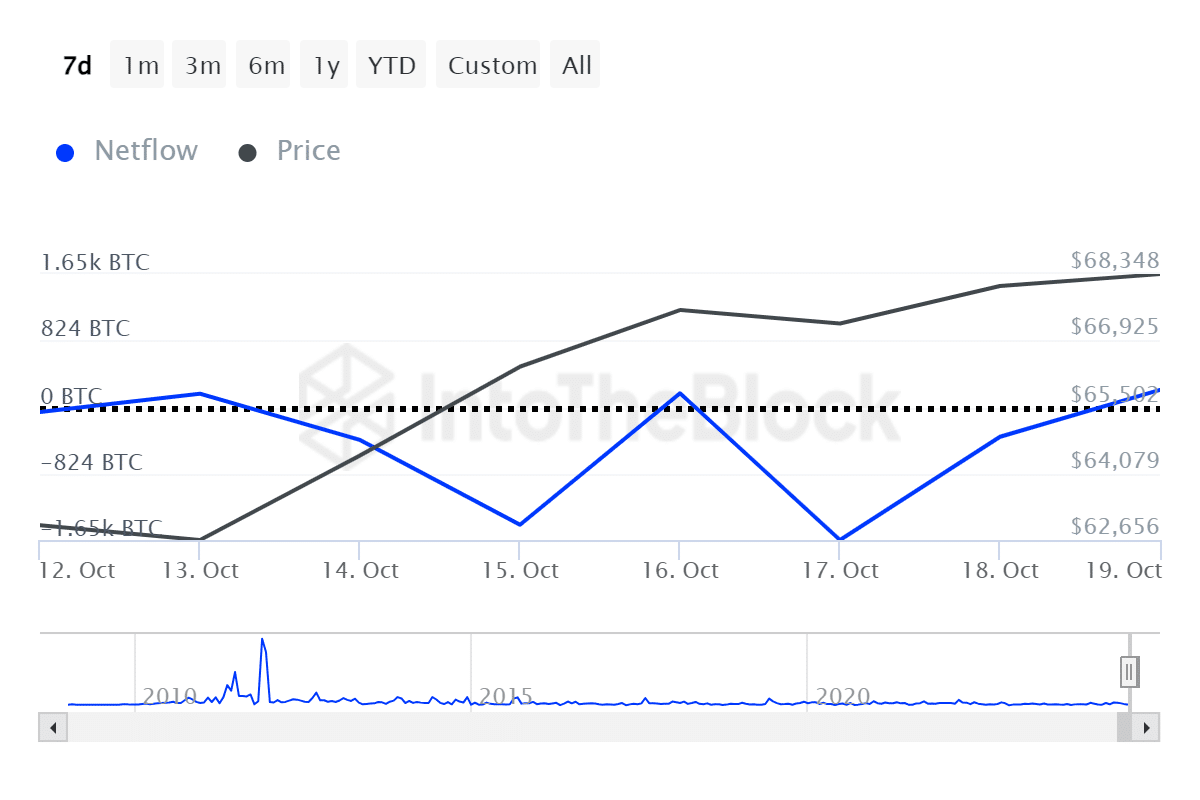

Bitcoin (BTC) net inflows went from an outflow of 1,650 BTC on October 17th to a net inflow of 211 BTC on October 19th, according to data provided by IntoTheBlock. This momentum indicates increased accumulation from large holders.

CryptoQuant CEO Ki Young Ju acknowledged the strengthening of the accumulation.

According to a report from crypto.news, at least 1,000 BTC new whale addresses held over 1.97 million coins yesterday, representing an 813% jump since the beginning of the year, according to data provided by Young Ju.

One of the main driving forces behind Bitcoin's bullish momentum is increased investor interest in the US-based Spot BTC exchange-traded fund.

According to the report, these investment products received $2.1 billion in inflows last week, bringing total net inflows to more than $21 billion.

Furthermore, according to ITB data, net outflows on Bitcoin exchanges have been in negative territory for three consecutive days, with net outflows of over 2,300 BTC (equivalent to $157 million) recorded on October 19th.

An increase in currency outflows usually signals a decrease in selling pressure. However, short-term profit taking is still expected as BTC price is close to its all-time high of $73,750.

Bitcoin has continued to consolidate between $68,000 and $68,600 over the past 24 hours. The company has a market capitalization of $1.35 trillion and daily trading volume of $13.8 billion, a decrease of 55%.

Reduced trading volumes may reduce price volatility of major assets.