- Bitcoin is experiencing a psychological surge and a correction is unlikely for now.

- But when fundamentals ultimately take precedence, panic can ensue.

Concerns about Bitcoin market overheating grow [BTC] Despite the steep decline in the RSI, the stock soared above the $68,000 threshold, breaking a four-month slump.

As a result, a trade just above this key level could signal a potential all-time high for BTC. If this range is confirmed as a resistance point, a price correction could be on the horizon, which could force a massive capitulation. but,

Bitcoin’s meteoric rise — psychology over fundamentals

First, it is important to consider that Bitcoin is highly influenced by macroeconomic factors.

Now, a combination of events such as the post-halving rally, nearing the end of the election cycle, the “Uptober” frenzy, and the Fed interest rate cut have all combined to push Bitcoin to $60,000 in just 10 days, with no solidity. It has risen to $8,000. Pull back.

This is important because these macro factors could strengthen large holders' belief that this is a prime buy zone, even though key technicals suggest a near-term reversal. .

In other words, large companies may still see this level as an opportunity, and as market sentiment heats up, this psychological momentum could attract more buyers as FOMO rises.

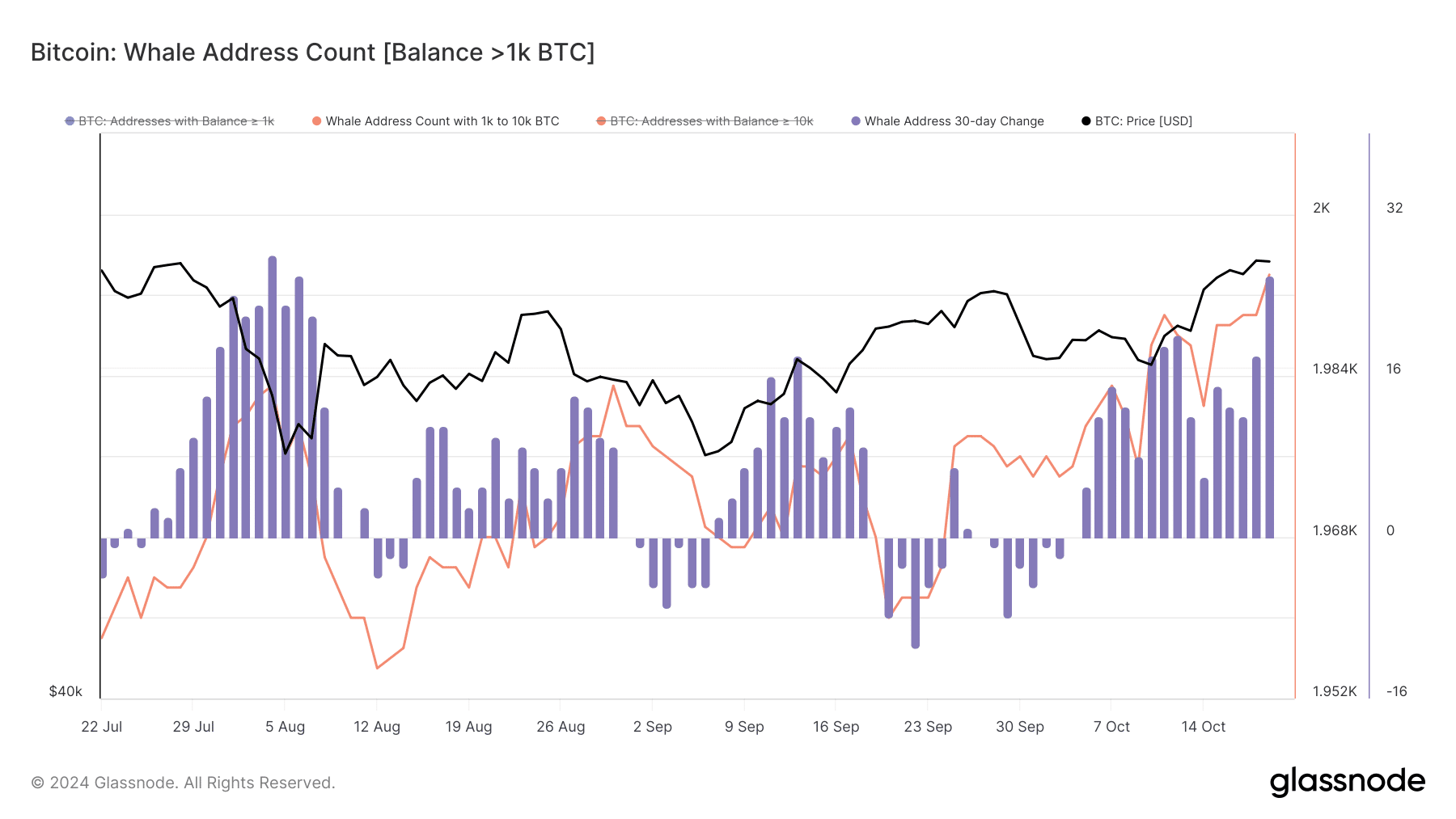

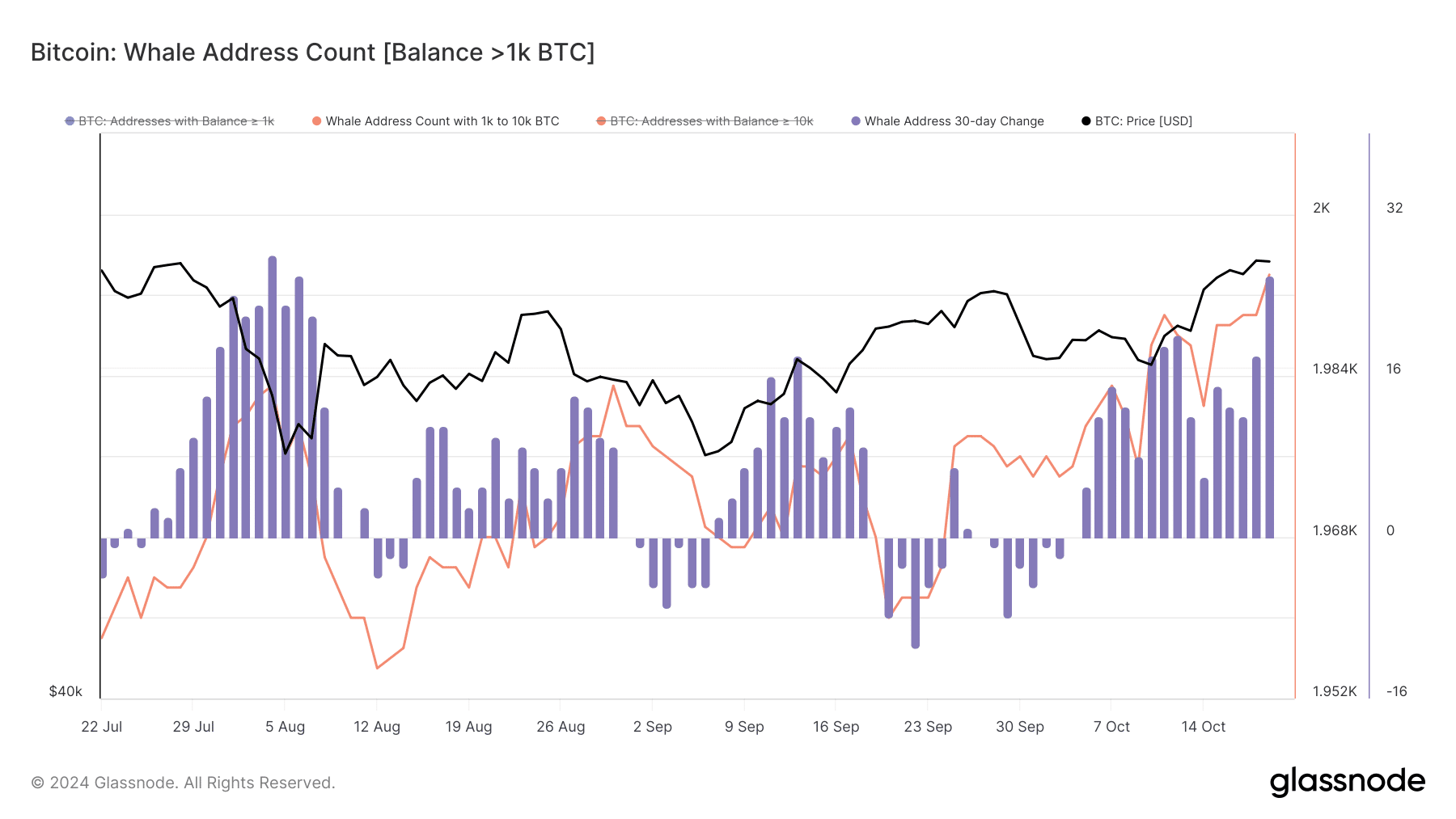

Source: Glassnode

This is evidenced by increased whale activity. Addresses holding 1,000 to 10,000 BTC are at a three-month high. The last big spike occurred with a 5% daily price spike, pushing BTC above $66,000.

Simply put, whales have played an important role in countering bearish pressure. Since early October, their activity has confirmed AMBCrypto's original hypothesis: macro factors are attracting large companies.

Overall, this cycle appears to be psychologically triggered. Therefore, despite bearish attempts to short Bitcoin, a significant correction seems unlikely for now.

Market buzz leads to $73,000

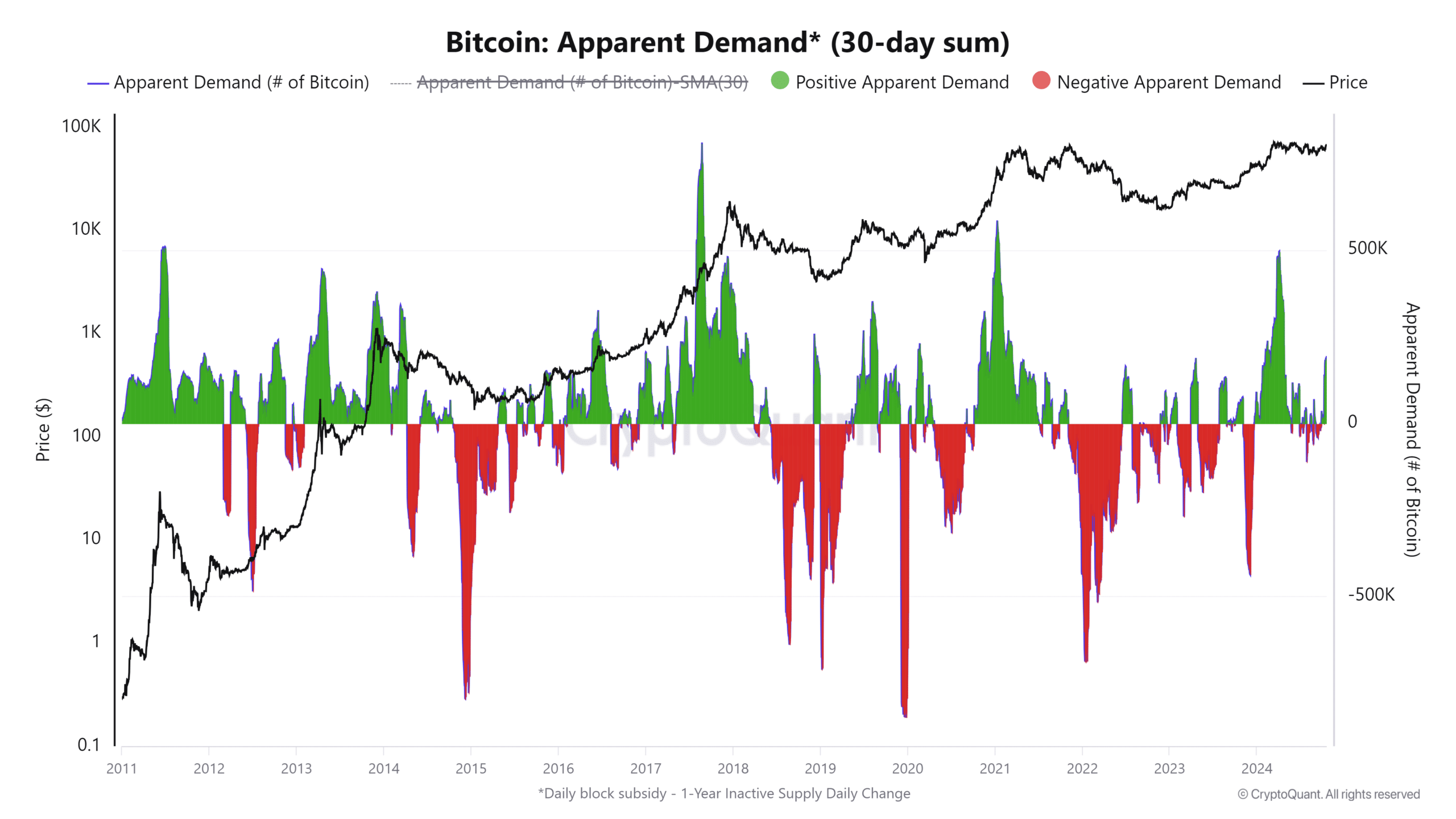

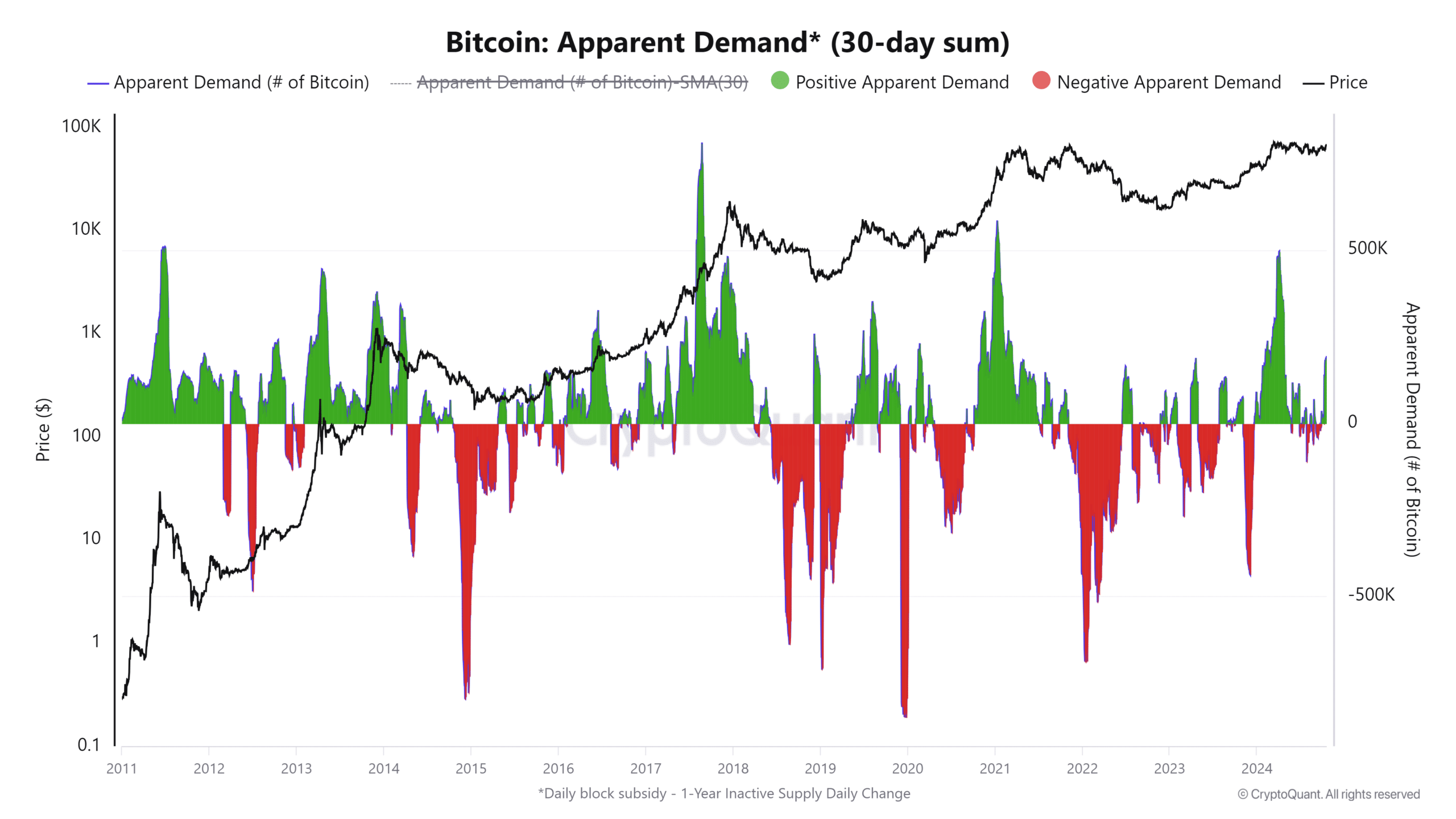

Historically, halvings have been a reliable indicator of when a bullish cycle will occur. The spike in the 30-day average demand (marked in green) always coincides with a reduction in Bitcoin's supply during a halving event.

These supply reductions typically result in long-term stock price appreciation, which provides significant benefits to stakeholders.

Source: CryptoQuant

Interestingly, just widespread expectations can cause a breakout, even if the fundamentals don't materialize right away.

Is your portfolio green? Check out our BTC Profit Calculator

This cycle is a classic example. The market was buzzing with hopes of a bull market following the halving, and as it turned out, Bitcoin soared to $68,000 in an incredibly short period of time.

That said, if whale activity continues this upward trend (which it likely will), Bitcoin could reach an all-time high of $73,000 before the end of the fourth quarter.