Key takeout

- Amidst growing economic uncertainty, Bitcoin and altcoins are leaning towards it.

- Market responses are rather slow, as the strategic Bitcoin reserve does not currently include new government purchases.

Please share this article

The horrors of the looming recession, coupled with an escalating trade tension between the US and Canada, sparked a fall in Bitcoin prices and altcoin sales on Sunday night.

Speaking about the future of Fox News' Sunday morning, Trump said he avoided dealing directly with the possibility of a recession in 2025 and disliked predicting “that thing.” He emphasized that although the transition may take time, his economic policies aim to bring wealth back to America.

Trump's tariffs on imports from countries such as Canada, Mexico and China have become a source of market volatility. Nevertheless, the US President defended the necessary approach to achieving his economic goals.

Also, on March 9th, former Bank of Canada governor Mark Carney won the liberal leadership election, replacing Justin Trudeau as Canada's prime minister.

The new Prime Minister-Elect went out to Trump in his first speech saying that Trump would not succeed in the trade war with Canada.

“The United States is not Canada, and Canada will never, in any way become part of America in any form or form,” Carney said. Trump has repeatedly called Trudeau the “governor” of Canada, suggesting that Canada will become the better state as the 51st US state.

“My government will maintain tariffs until Americans show respect for us,” he said. Canada is leviing a 25% tariff on US consumer goods in retaliation against Trump's tariffs.

Bitcoin fell below $81,000 following Carney's victory, according to Coingecko data. At the time of press, BTC was just above $82,000, down 4% over the past 24 hours.

As Bitcoin declined, market turmoil deepened. Ether and XRP each dropped by more than 6%, while Dogecoin fell by more than 10%.

Other top coins like BNB, Solana, Cardano and Tron also found major losses, but Injective, Maker and Render experienced double-digit drops.

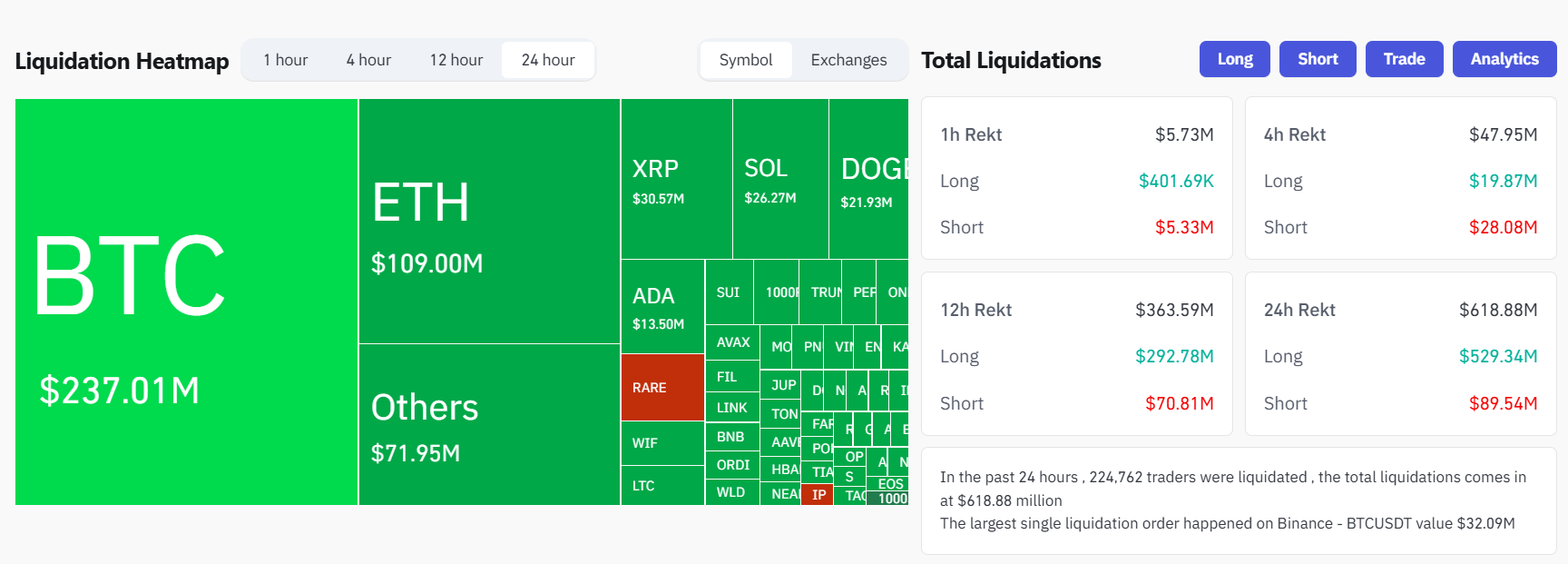

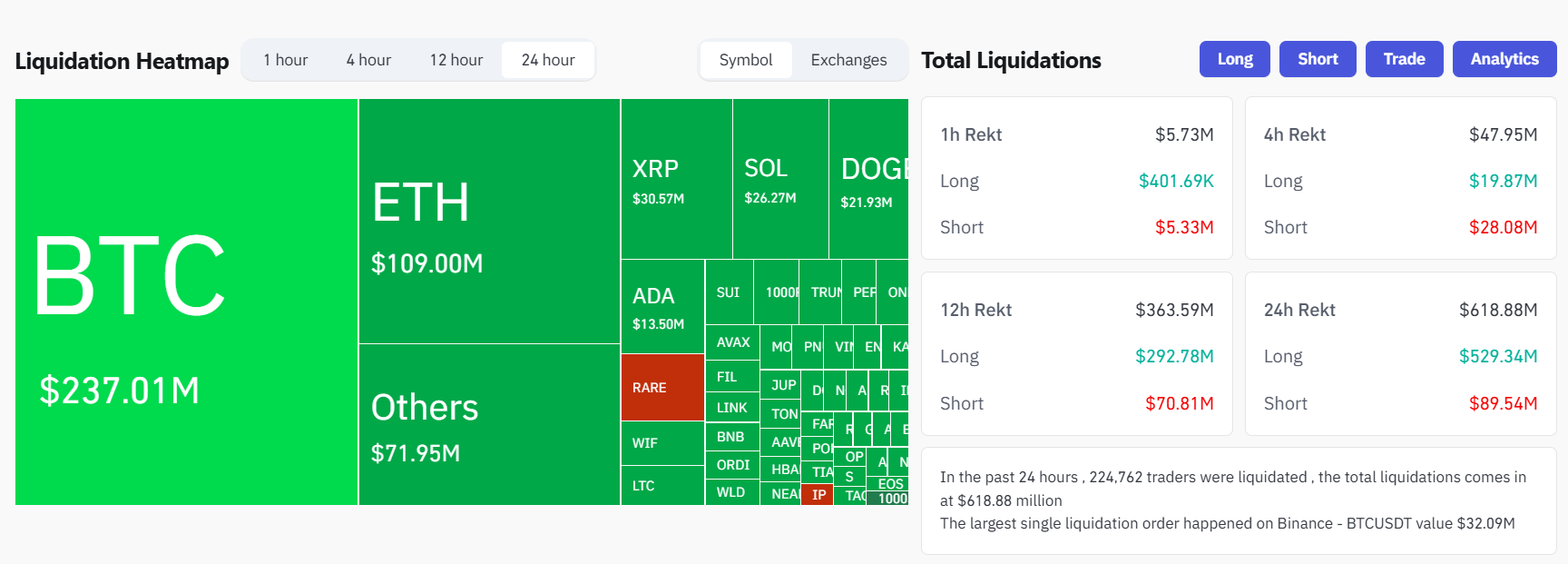

Crypto's total market capitalization fell 6% within a day to $2.8 trillion. Leveraged liquidation reached $600 million, eliminating a long position of about $530 million, according to Coinglass data.

The Atlanta Federal Reserve GDPNOW model revised its forecast for the first quarter 2025, predicting a 2.4% GDP contraction. This downward revision reflects weaker consumer spending and an increased trade deficit than expected, raising concerns about the possibility of a recession.

Market response to Trump's Bitcoin Reserve: Mixed Bags

The turbulence in the market continued after Trump's executive order on Thursday established a strategic Bitcoin reserve. This caused initial sales pressure due to limited details about funds beyond existing US-held Bitcoin.

U.S. Treasury Secretary Scott Bescent said on Friday that discussions are ongoing over the additional BTC acquisition, but said the first step is to stop the sale of seized Bitcoin.

He also said that while the current focus is on Bitcoin, the broader strategy is to establish a comprehensive crypto sanctuary.

Some analysts view the creation of reserves as a formal recognition of Bitcoin's role as a strategic asset and place them together with traditional reserves like gold, but this recognition has not led to immediate market trust.

Members of the crypto community also received mixed reactions to the Whitehau Script Summit, which took place after the executive order.

Speaking at the event, Chainlink co-founder Sergey Nazarov expressed optimism that US officials are currently actively involved in the blockchain and crypto industry.

“Me and others in the room believe that crypto, blockchain and Web3 infrastructure are the next iteration of the financial system,” Nazarov said. “And I think the US should continue its leadership position in its new financial system.”

Multicoin Capital Managing Partner Kyle Samani also actively looked at the event and labeled it a “historic moment” of code.

In contrast, Coin Bureau CEOs Nic Puckrin and Bitcoin Maximalist Justin Bechler expressed disappointment, questioning the impact of the summit and criticising its approach.

Please share this article