The Bitcoin (BTC) Spot ETF, which was approved in the US in January, had net outflows of $94 million on March 21st, marking the fourth consecutive day of net outflows since March 18th. Cumulative outflows over the four-day period reached $836 million.

This is the first time since January 25 that the amount of outflows has exceeded four consecutive days. The majority of the outflows came from the Grayscale Bitcoin Trust ETF (GBTC), with the remaining nine ETFs seeing mostly net inflows.

iShares Bitcoin Trust leads inflows, while Grayscale Bitcoin Trust dominates outflows

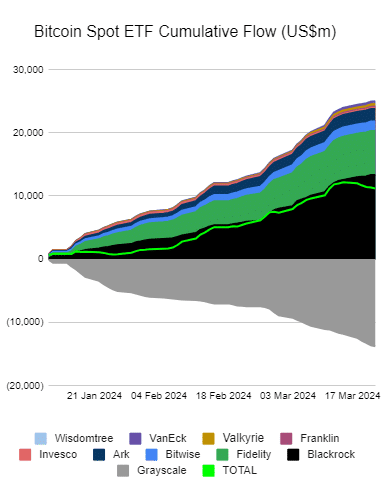

As of March 21, iShares Bitcoin Trust (IBIT) has attracted the most capital of the 10 Bitcoin spot ETFs, with cumulative inflows of approximately $13.3 billion. In contrast, outflows for the Grayscale Bitcoin Trust ETF (GBTC) exceeded IBIT's inflows, totaling approximately $13.8 billion out of the fund.

Despite large outflows from GBTC, net inflows for all 10 Bitcoin Spot ETFs have remained positive, totaling approximately $11.2 billion (approximately 1.7 trillion yen) as of March 21st. ).

Bloomberg analyst Eric Balchunas attributed the large outflows from the Grayscale Bitcoin Trust ETF (GBTC) to the recent collapse of crypto lender Genesis. Balciunas shared his own views on the issue and said:

Despite the 8% decline in Bitcoin prices, the nine Bitcoin spot ETFs other than GBTC have gained about $1.2 billion over the past five days.

Yes, there was an outflow from GBTC, but it was a net-neutral event because Genesis was the main culprit and was simply exchanging GBTC shares for physical Bitcoin.

Bloomberg analyst Eric Balchunas also said that large outflows from the Grayscale Bitcoin Trust ETF (GBTC) could subside once the failed cryptocurrency finance company Genesis sells its GBTC stake. expressed the opinion that it is high.

In February, a U.S. bankruptcy court approved Genesis' plan to sell about 35 million shares of GBTC, worth about $1.5 billion at the time. Genesis allows an investor to exchange his GBTC shares for fiat currency or Bitcoin.

In addition to the GBTC stock, Genesis also intended to sell more than 11 million shares of the Grayscale Ethereum Trust, worth approximately more than $230 million as of February.

The sale of these shares by Genesis is expected to have a significant impact on the market and may contribute to the recent capital outflow from GBTC.

However, Balciunas suggested that once this sale is completed, outflows from GBTC could stabilize and the market could return to more balanced inflows and outflows across the various Bitcoin spot ETFs. There is.