Key takeout

- Bitcoin has dropped by 21% from its all-time high, warned Wolfe's research.

- Analysts suggest that if the $90,000 level doesn't play, Bitcoin could drop to $70,000.

Please share this article

Bitcoin hit a low of $79,500 in Binance on Thursday, a 26% drop from its January peak.

According to a Wolfe research, major digital assets could retreat to $70,000 (a level not seen since Election Day).

Wolfe analyst Reed Harvey warned that a drop into the medium range of $70,000 is possible, and said the break below the $91,000 main support marks a bearish turn, and that current price action is of concern.

“Over the past few months, $91,000 has served as a floor. With that level being decisively taken, another V-shaped sold response below sends a very bearish message. As reported by CNBC, Harvey said.

If bearish feelings get escalated, Harvey predicts that prices can be completely reversed to pre-election levels.

President Trump's decision to impose tariffs on major trading partners, including Mexico, Canada and China, sparked concerns about a slower economy despite prior optimism following election, inauguration and crypto executive orders.

According to Harvey, when investors feel uncertain about the economy, they tend to have consequences that span stocks, commodities and crypto assets.

“Uncertainty is at the forefront of investor concerns, and the willingness to take on risk is rapidly declining,” analysts said.

“The crypto market is feeling pressure, with both majors and altcoins experiencing key selling, and traders are responding to safety beyond profits. In particular, demand for downside protection is surged,” Nick Forster derived the founder of the protocol in a memo on Thursday.

According to Forster, The massive outflow from Spot Bitcoin ETFS will grow risk aversion among institutional investors. Exodus has increased sales pressure across the crypto market, raising concerns about a potential negative feedback loop that will further reduce prices.

“The fear is that this could create a negative feedback loop, where there will be more drives to sell on a continuous basis, and more drives to drive more,” he said.

Trust issues

According to Jack Lu, co-founder of Magic Eden, the Crypto industry continues to face challenges of trust despite regulatory advances and technology improvements.

In recent weeks, we have seen positive developments in crypto regulations, including Congress' efforts to establish an industry framework. However, amidst ongoing security incidents and fraudulent schemes, consumer trust remains elusive.

The Libra scandal has been eroded Trust among investors. Kelsier Ventures, led by CEO Hayden Davis, is now considered a key player in a network of fraudulent schemes. The company is said to be linked to multiple memecoin projects. Tokens like tokens Melania, etc.

Cybersecurity vulnerabilities remain a major concern, especially in light of recent times. Attacks targeting Bibit. Even with regulations, Regulations themselves Professor Hillary Allen, a law professor at the University of Washington in the United States, told Bloomberg.

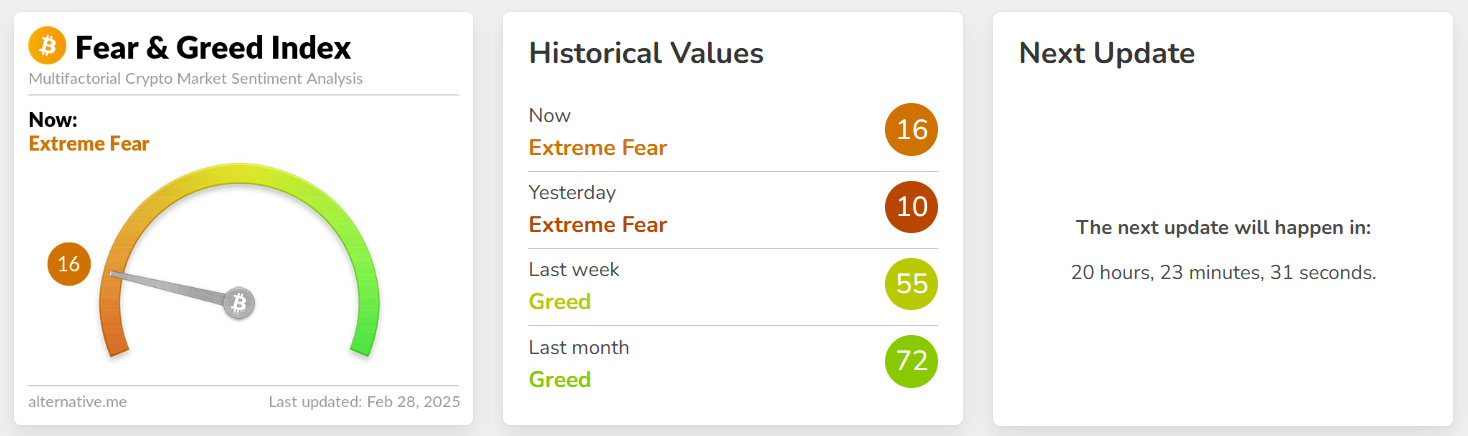

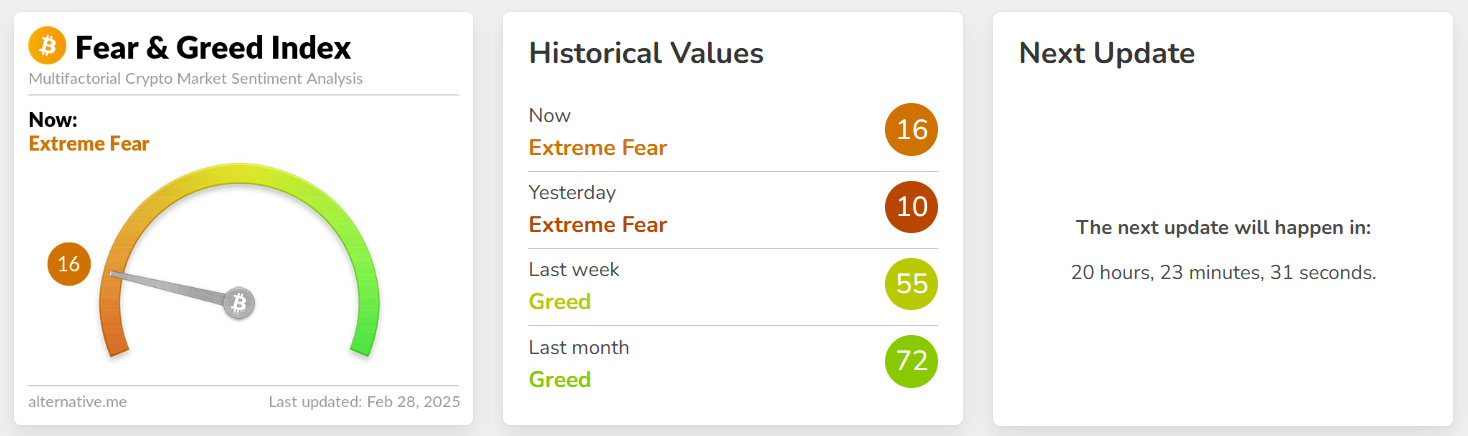

Crypto Market's total capital is below $3 trillion, a low that has not been seen since November, and market sentiment is still serious, as shown by terrifying and greedy indicators.

Please share this article