Following today's release of the US labor market report, the price of Bitcoin has solidified above $60,000.

The rise in Bitcoin (BTC) came on the heels of the release of the US jobs report, which changed the Federal Reserve's (Fed) key interest rate cut forecast from November to September.

According to data from CoinMarketCap, Bitcoin rose more than 4% after the release of the statistics and continues to grow towards $62,000.

CryptoQuant CEO Ki Young Ju said that Bitcoin whales have accumulated 47,000 BTC in anticipation of the Fed report.

Macroeconomic data has led to revised expectations for the trajectory of the Fed's key interest rate in 2024. Markets are now factoring in not one but two rate cuts of 0.25% each, with the first rate cut expected in September rather than November before a decision is made. statistics.

Bloomberg analysts said the next important report for investors will be the May 15 report on consumer price trends.

“Overall, the labor market remains strong, and we need to see further evidence of an economic slowdown or an unexpected sharp decline in employment to be concerned about employment obligations after such a strong series of job gains.” Ultimately, the FOMC will be on hold until there is clarity on inflation.”

Ali Jaffery, CIBC Capital Markets Specialist

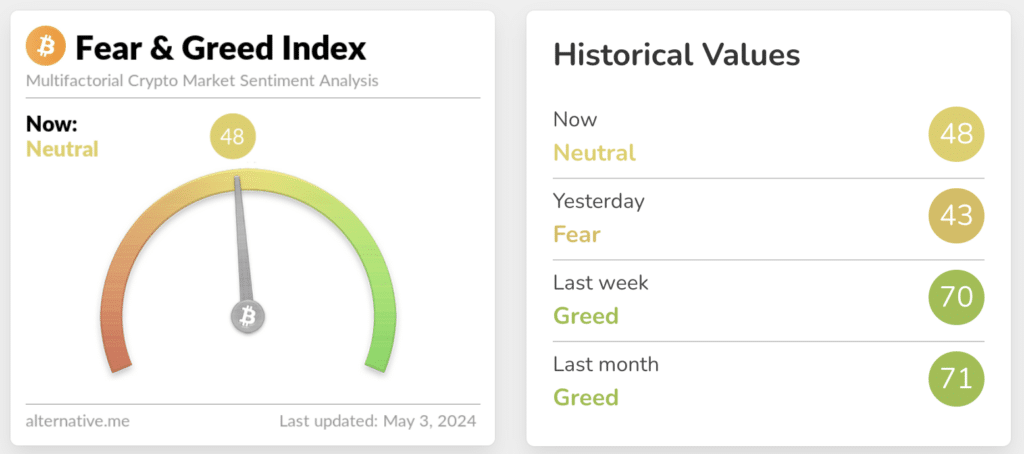

Risk appetite increased in global markets following the release of the US Labor Market Report. On this day, the S&P 500 stock index rose 1.2%, and the cryptocurrency fear and greed index rose 5 points, moving from the fear zone to the neutral zone.

Recently, the price of BTC fell below the $60,000 threshold. Against the backdrop of Bitcoin's decline, Santiment analysts said data released in the US led to a surge in discussions around the hashtag #buythedip and references to BTC.

Analysts say this increased sentiment signals a new polarization among traders. Some support the buying opportunity, while others are cautious.